0000867028

false

0000867028

2023-10-02

2023-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 2, 2023

FOMO

WORLDWIDE, INC.

(Exact

name of Registrant as specified in its Charter)

| california |

|

001-13126 |

|

83-3889101 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

831

W North Ave., Pittsburgh, PA 15233

(Address

of principal executive offices)

(630)

708-0750

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

FOMC |

|

OTC

Pink Current |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

FOMO

WORLDWIDE, INC. is referred to in this Current Report on Form 8-K as “FOMO,” the “Company,” “we,”

or “us.”

Item

8.01 Other Events.

On

October 2, 2023, we issued a press release updating investors on five corporate actions filed with FINRA over the past four months, including

Rule 15c2-11 response, ticker change, name change, redomicile, and a 1-100 reverse split. The press release is included herein as Exhibit

99.1.

Item

9.01. Exhibits

(a)

Exhibits. The following exhibit is filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FOMO

WORLDWIDE, INC. |

| |

|

|

| Date:

October 2, 2023 |

By:

|

/s/

Vikram Grover |

| |

|

Vikram

Grover |

Exhibit

99.1

FOMO

WORLDWIDE SUBMITS 15c2-11 RESPONSE TO FINRA; NEARS COMPLETION OF CORPORATE ACTIONS TO REGAIN MARKET MAKERS to improve LIQUIDITY AND TRANSPARENCY

FOR INVESTORS

Pittsburgh,

PA, October 2, 2023 – FOMO WORLDWIDE, INC. (OTC: FOMC) reports that after nearly four months, through a FINRA brokerage firm, the

Company has responded to FINRA’s Compliance Unit comments regarding its Rule 15c2-11 process. SEC Rule 15c2-11 requires market

makers to review basic issuer information prior to publishing quotations for that issuer’s securities. Market makers must have

a reasonable basis for believing that the information is accurate and from reliable sources. Because of the Company’s SEC reporting

delinquency from June 30, 2022 through mid-January 2023, the Company lost solicited quotes for its common shares making them untradeable

for many investors. FOMO WORLDWIDE thereafter underwent a rigorous review of the accuracy of its SEC filings, had to prove the accuracy

and transparency of its share issuances, provide backup and documentation to corporate actions, and confirm the accuracy of Company statements

to investors, the media, and regulators including documenting statements in presentation materials. With the Rule 15c2-11 response submission

to FINRA, management believes FOMO WORLDWIDE is in the final stages of restoring solicited quotations for the Company’s common

stock and regaining market makers.

Further,

following an April 30, 2023 majority shareholder vote, FOMO WORLDWIDE filed four corporate actions with FINRA’s Corporate Actions

group, including finalizing its name change already completed in the State of California, redomiciling to Wyoming from California to

reduce expenses and costs, changing its ticker to a proposed “IGOT” to reduce investor confusion, and completing a reverse

split of common shares on a 1-100 basis. An information notification 14C filing was mailed to shareholders as per SEC requirements on

July 24, 2023 and has since far surpassed the 20-day waiting period. The Company submitted extensive documentation to FINRA in response

to roughly two dozen comments, including notarized proof of shareholder and Board resolutions, vote count accuracy by FOMO WORLDWIDE’s

majority shareholder, explanation of share issuances and warrant/stock option positions, CUSIP change and CUSIP domicile change preparation,

Amended Articles filed for FOMO CORP. (Wyoming) changing its name to FOMO WORLDWIDE, INC. in preparation for a short-form merger with

FOMO WORLDWIDE, INC. (California), and other supporting documents.

Upon

completion of the above corporate actions and subject to any required trading periods above threshold levels, management intends to apply

to uplist the Company’s common shares to the OTC QB market, which typically improves trading liquidity and provides issuers access

to a broader array of investors unable to purchase shares on the OTC Pink market. None of the above corporate actions have been approved

by FINRA and there is no assurance that FINRA will approve them at any time. FINRA has no deadline to its review process and may request

additional information from the Company, thereby potentially delaying completion of any or all of the corporate actions.

The

FINRA review process(es) follow(s) on the heels of FOMO WORLDWIDE regaining SEC reporting current status with a PCAOB audited Form 10-K

filed on or around April 17, 2023, followed by filed Forms 10-Q for the three month periods ended March 31, 2023 and June 30, 2023. To

provide further transparency to investors, management intends to provide an operational update for FOMO WORLDWIDE and its subsidiaries

over the next several business days.

About

FOMO WORLDWIDE, INC.

FOMO

WORLDWIDE, INC. (US OTC: FOMC) (www.fomoworldwide.com) is a publicly traded company focused on business incubation and acceleration.

The Company invests in and advises emerging companies aligned with a growth mandate. FOMO is developing direct investment and affiliations

- majority- and minority-owned as well as in joint venture formats - that afford targets access to the public markets for expansion capital

as well as spin-out options to become their own stand-alone public companies.

Forward

Looking Statements

Statements

in this press release about our future expectations, including without limitation, the likelihood that FOMO WORLDWIDE, INC. will be able

to meet minimum sales expectations, be successful and profitable in the market, bring significant value to FOMO’s stockholders,

and leverage capital markets to execute its growth strategy, constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and as that term is defined in the Private

Litigation Reform Act of 1995. Such forward-looking statements involve risks and uncertainties and are subject to change at any time,

and our actual results could differ materially from expected results. The Company undertakes no obligation to update or release any revisions

to these forward-looking statements to reflect events or circumstances after the date of this statement or to reflect the occurrence

of unanticipated events, except as required by law. FOMO’s business strategy described in this press release is subject to innumerable

risks, most significantly, whether the Company is successful in securing adequate financing. Additionally, although the Company has announced

letters of intent to acquire additional companies, there is absolutely no assurances that any such transactions will result in a completed

acquisition. No information in this press release should be construed in any form, shape, or manner as an indication of the Company’s

future revenues, financial condition, or stock price.

Investor

Contact

Investor

Relations

(630)

708-0750

IR@fomoworldwide.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

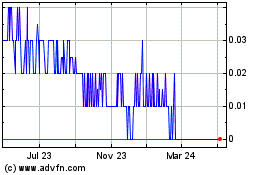

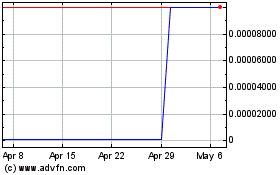

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Jul 2023 to Jul 2024