Business Watch -- WSJ

September 29 2016 - 3:03AM

Dow Jones News

HANJIN SHIPPING

U.S. Bans Crews From Coming Ashore

Crews aboard Hanjin Shipping Co. vessels docked at American

ports are being barred by U.S. immigration officials from coming

ashore, a decision labor groups say goes against international

seafarers' conventions.

Sailors on several Hanjin ships were denied shore leave out of

concern they night not return to their ships, U.S. Customs and

Border Protection said. The concerns arose after the shipowner

filed for bankruptcy protection late last month.

For the crews, "the uncertainty of the situation was weighing on

them," said Jeff Engels, U.S. West Coast coordinator for the

International Transport Workers' Federation.

On Monday, dockworkers at the Port of Seattle staged a brief

work stoppage in solidarity after crew members of the Hanjin Marine

dropped a banner off the side of that ship that read, "We deserve

shore leave."

On shore, "you take for granted that you can smell flowers, hear

birds or check what movie's playing," Mr. Engels said. "When that's

denied, it's like a gut punch."

--Erica E. Phillips

SOLARCITY

New CFO Is Named; Deal With Citi Is Set

SolarCity Corp. named a new chief financial officer and said it

was teaming up with Citi on a program to finance more than $347

million in solar projects in the U.S.

The San Mateo, Calif., company promoted global capital markets

executive Radford Small to finance chief.

SolarCity and Citi plan to form two funds, including one to fund

$284 million of residential projects nationwide and another fund to

finance $63 million of projects for small and midsize businesses in

California.

The moves come as the cash-strapped company has been striving to

survive as a stand-alone company until its planned merger with

Tesla Motors Inc.

SolarCity said President Tanguy Serra, who previously oversaw

finance as part of his responsibilities, will leave the company at

year's end after the Tesla deal is expected to close.

--Tess Stynes

COSI

Sandwich Chain Files for Chapter 11

Cash-strapped soup and sandwich chain Cosi Inc. has filed for

chapter 11 protection with plans of selling itself to lenders.

The chain, which filed in the U.S. Bankruptcy Court in Boston,

and listed assets of $31.2 million and debts of $19.8 million,

blamed economic conditions in its industry that have "negatively

impacted sales and restaurant-level profits," according to court

papers.

--Lillian Rizzo

(END) Dow Jones Newswires

September 29, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

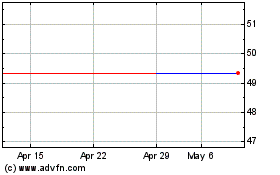

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From May 2024 to Jun 2024

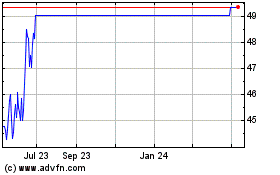

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Jun 2023 to Jun 2024