UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14N/A

Amendment No. 1

(Rule 240.14n-1)

Under the Securities Exchange Act of 1934

Destiny Media Technologies, Inc.

(Name of Issuer)

Common stock, $0.001 per share

(Title of Class of Securities)

_____________25063G 303_____________

(CUSIP Number)

[ ] Solicitation pursuant

to §240.14a-2(b)(7)

[ ] Solicitation pursuant

to §240.14a-2(b)(8)

[ ] Notice of Submission

of a Nominee or Nominees in Accordance with §240.14a-11

[X] Notice of Submission of a Nominee or Nominees

in Accordance with Procedures Set Forth Under Applicable State or Foreign Law, or the Registrant's Governing Documents

The information required in the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act.

|

1. Names of Reporting Persons:

Steven Erik Vestergaard

|

|

2. Mailing address and phone number of each reporting person

(or, where applicable, the authorized representative):

695-350 Centre Road

Lions Bay BC V0N 2E0

Canada

(604) 328-3893

|

|

|

|

3. Amount of securities held that are entitled to

be voted on the election of directors held by each reporting person (and, where applicable, amount of securities held in the aggregate

by the nominating shareholder group), but including loaned securities and net of securities sold short or borrowed for purposes

other than a short sale:

947,899 shares of common stock.

|

|

|

|

4. Number of votes attributable to the securities entitled to

be voted on the election of directors represented by amount in Row (3) (and, where applicable, aggregate number of votes attributable

to the securities entitled to be voted on the election of directors held by group):

947,899 votes

|

Item 1(a). Name of Registrant

Destiny Media Technologies, Inc.

Item 1(b). Address of Registrant’s

Principal Executive Offices

1110 - 885 West Georgia

Vancouver, BC V6C 3E8

Canada

Item 2(a). Name of Person Filing

Steven Erik Vestergaard

Item 2(b). Address or Principal Business

Office or, If None, Residence

695-350 Centre Road

Lions Bay BC V0N 2E0

Canada

Item 2(c). Title of Class of Securities

Common stock, par value $0.001 per share

Item 2(d). CUSIP No.

25063G 303

Item 3. Ownership

(a) The Amount of securities held and entitled

to be voted on the election of directors is as follows:

947,899 shares of common stock

(b) All of the foregoing securities disclosed

by the Reporting Person in (a) of this Item 3 are voting securities. Pursuant to the Issuer’s governing documents, each share

of Common Stock is entitled to one vote and therefore the number of shares of Common Stock disclosed in (a) of this Item 3 represents

the number of votes attributable to such securities.

(c)-(d) None of the securities disclosed in

this Schedule 14N have been loaned or sold in a short sale that is not closed out, or that have been borrowed for purposes other

than a short sale.

(e) The aggregate voting stock owned by the

Reporting Persons as set forth in this Item 3 is 947,899 shares, which constitutes approximately 9.07% of the outstanding Common

Stock of the Issuer, based on 10,450,656 shares issued and outstanding July 10, 2020, as reported in the Issuer’s Quarterly

Report on Form 10-Q filed July 15, 2020.

Item 4. Statement of Ownership From a Nominating

Shareholder or Each Member of a Nominating Shareholder Group Submitting this Notice Pursuant to § 240.14a-11

Not applicable.

Item 5. Disclosure Required for Shareholder

Nominations Submitted Pursuant to § 240.14a-11

Not applicable.

Item 6. Disclosure Required by § 240.14a-18

(a) The

Reporting Person has nominated Steven Erik Vestergaard, Robert Chaplin, David Kaland, and Abhijit Bhattacharjee, (collectively,

the “Nominees”) for election at the Issuer’s next annual general meeting to serve on the Issuer’s Board

of Directors (the “Board”) pursuant to the provisions of Section 5 of the Issuer’s Bylaws and Rule 14a-18 under

the Exchange Act. Each of the Nominees has consented to being named in the Issuer’s proxy statement and form of proxy and,

if elected, to serve on the Issuer’s Board. The Nominees have executed written consents, copies of which are furnished herewith

as Exhibits. 99.1 – 99.4.

(b) – (c)

Steven Erik Vestergaard (age 54)

Home and Business Address: 695-350 Center

Road, Lions Bay, BC V0N 2E0

Principal Occupation or Employment: Broughton

and Broughton, an investment Company

Mr. Vestergaard was a director of Destiny Media

Technologies Inc. from 1999 to 2019. Mr. Vestergaard obtained a B.Sc. from the University of British Columbia in 1989 and was previously

the Company’s Chief Executive Officer. Currently Mr. Vestergaard is working for Broughton and Broughton, an Investment Company

based in Canada.

Beneficial Ownership of the Issuer’s

Securities: 947,899 shares of common stock, constituting approximately 9.07% of all issued and outstanding common stock.

Robert Chaplin (Age 52)

Home and Business Address: 7-1616 West

Broadway, Vancouver, BC V6J 1X6

Principal Occupation or Employment: Publisher

and Artist

Mr. Chaplin was the first employee at Destiny

Software. He went on to pioneer digital book design and animate for PBS and Disney. For the past 5 years Mr. Chaplin has been self-employed

as an artist and publisher. A master of synergistic marketing, Chaplin published ‘The Elves & The Shoemaker-with Shoes

by Fluevog’ and was simultaneously awarded ‘Most Interesting Vancouver’, in 2016.

Beneficial Ownership of the Issuer’s

Securities: None.

David Kaland (Age 61)

Home and Business Address: 10255 Michel

Place Surrey BC Canada V3T3R1

Principal Occupation or Employment: Investor,

Entrepreneur

Mr. Kaland has had forty years’ experience

as a successful entrepreneur and investor. Mr. Kaland served as Operations Manager for Destiny Media Technologies from January

2012 until June 2017, where he worked on Development of version 5 of the Play MPE Player, managed hiring of software developers

and was a key member of Destiny's management team building out Clipstream for launch and managing sales. Prior to Destiny Media,

Mr. Kaland was with ADT Security Services from November 1980 to July 2010, serving as an electronics tech for 24 years and a sales

manager for 6 years. Mr. Kaland graduated from the Pacific Vocational Institution for Electronic Tech May 1980. He completed 12

sales management courses from ADT Security University from 2006 to 2009. Since leaving Destiny Media in 2017, Mr. Kaland has been

a private, self-employed investor.

Beneficial Ownership of the Issuer’s

Securities: 494,694 shares of common stock, constituting approximately 4.73% of all issued and outstanding common stock based on

10,450,656 shares issued and outstanding July 10, 2020, as reported in the Issuer’s Quarterly Report on Form 10-Q filed July

15, 2020.

Abhijit Bhattacharjee (Age 50)

Home and Business Address: #11, JSS Science and

Technology Entrepreneurs Park C-20/1, Sector 62, NOIDA Uttar Pradesh, 201301 India

Principal Occupation or Employment: Founder of Luna

Ergonomics Pvt. Ltd.

Major (Ret.) Abhijit Bhattacharjee (49) served in

the Signals of the Indian Army for 12 years. He is also a gifted computer programmer. Subsequently Mr. Bhattacharjee set up his

own company in New Delhi in the field of unicode languages on mobile phones. His work in this sector has won him many awards worldwide

as well as patents in the US and South Korea. Operating Luna Ergonomics Pvt. Ltd. has been his primary employment for the past

5 years.

Beneficial Ownership of the Issuer’s

Securities: None.

The Reporting Person believes that each Nominee

would be an “independent director” of the Issuer pursuant to the rules of the NASDAQ Stock Market.

With regard to each nominee and the Reporting

Person (collectively, the “Participants”):

(i) during the past 10 years, no Participant

has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors);

(ii) no Participant directly or indirectly

beneficially owns any securities of the Issuer, except as set forth above;

(iii) no Participant owns any securities of

the Issuer which are owned of record but not beneficially;

(iv) no Participant has purchased or sold any

securities of the Issuer during the past two years, except as set forth below:

During the preceding two (2) years Mr.

Vestergaard has sold 1,253,323 shares of common stock at prevailing market prices. Please see Exhibit 99.6 for a complete summary

of Mr. Vestergaard’s stock sales during the preceding two (2) years.

(v) no part of the purchase price or market

value of the securities of the Issuer owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose

of acquiring or holding such securities;

(vi) no Participant is, or within the past

year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Issuer,

including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees

of profit, division of losses or profits, or the giving or withholding of proxies;

(vii) no associate of any Participant owns

beneficially, directly or indirectly, any securities of the Issuer;

(viii) no Participant owns beneficially, directly

or indirectly, any securities of any parent or subsidiary of the Issuer;

(ix) no Participant or any of his associates

was a party to any transaction, or series of similar transactions, since the beginning of the Issuer’s last fiscal year,

or is a party to any currently proposed transaction, or series of similar transactions, to which the Issuer or any of its subsidiaries

was or is to be a party, in which the amount involved exceeds $120,000;

(x) no Participant or any of his associates

has any arrangement or understanding with any person with respect to any future employment by the Issuer or its affiliates, or

with respect to any future transactions to which the Issuer or any of its affiliates will or may be a party;

(xi) no Participant has a substantial interest,

direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Issuer’s next annual meeting;

(xii) no Participant holds any positions or

offices with the Issuer;

(xiii) Mr. Vestergaard and Mr. Kaland are

first cousins. No other Participant has a family relationship with any other Participant or any director, executive officer, or

person nominated or chosen by the Issuer to become a director or executive officer; and

(xiv) no companies or organizations, with which

any of the Participants has been employed in the past five years, is a parent, subsidiary or other affiliate of the Issuer.

(xv) Except as set forth below, there are no

material proceedings to which any Participant or any of his or its associates is a party adverse to the Issuer or any of its subsidiaries

or has a material interest adverse to the Issuer or any of its subsidiaries:

Mr. Vestergaard is currently in litigation

with the Issuer which is pending as follows:

Steven Erik Vestergaard v. Destiny Media

Technologies, Inc., Case No. A-20-810192-C (Eighth Judicial District Court for Clark County, Nevada).

Mr. Vestergaard has filed suit against the

Issuer for breach of contact, breach of the covenant of good faith and fair dealing, and declaratory relief arising out of the

Issuer’s improper refusal to place Mr. Vestergaard’s nominees for director on the agenda for the Issuer’s 2020

general meeting of shareholders and other alleged improprieties related to the 2020 shareholder meeting. The action is pending.

Steven Erik Vestergaard v. Destiny Media

Technologies, Inc.; Destiny Software Productions Inc.; Sonox Digital, Inc.; MPE Distribution, Inc.; Hyonmyong, Cho; S. Jay Graber;

and Frederick Vandenberg, Case No. S178293 (Supreme Court of British Columbia).

Mr. Vestergaard has filed suit against the

Issuer and others for conspiracy, defamation, and declaratory and injunctive relief based on his alleged wrongful termination from

his former positions at the Issuer and related facts and circumstances. The action is pending.

(xvi) there are no arrangements or understandings

between the Reporting Person and any of the nominees or any other person or persons pursuant to which the nominations were to be

made by the Reporting Person.

(d)

With respect to each of the Nominees and the

Reporting Person, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the

past ten years.

(e)

Except as set forth above, there are no (1)

direct or indirect material interests in any contract or agreement between any of the Participants and/or the Issuer or any affiliate

of the Issuer (including any employment agreement, collective bargaining agreement, or consulting agreement), (2) material pending

or threatened legal proceedings in which any of the Participants is a party, involving the Issuer, any of its executive officers

or directors, or any affiliate of the Issuer; and (3) other material relationships between any of the Participants and/or the Issuer

or any affiliate of the Issuer not otherwise disclosed herein.

Certain Information Under Rule 14a-101

Methods to be

employed to solicit security holders: In the event that the Nominees are not included in the Issuer’s proxy statement

as provided in the Issuer’s Bylaws, the Reporting Person intends to solicit security holders primarily by mail. In addition,

the Reporting person intends to solicit security holders personally by telephone following the mailing of an appropriate proxy

statement.

Employees, representatives,

or other persons: The Reporting Person intends to carry out any and all such solicitation activity personally and, at this

time, the Reporting Person is the sole Participant contemplated to be involved in the solicitation. At this time, the Participant

does not intend to task his regular employees with soliciting security holders, nor does he currently intend to specially engage

employees, representatives, or other persons to solicit security holders.

Costs of solicitation:

To date the Reporting Person has spent approximately $5,000 in connection with the solicitation of security holders. These costs

have consisted of legal fees, edgar preparation fees, and mailing and delivery fees for notice materials sent to the Issuer. If

the Nominees are included in the Issuer’s proxy statement as provided in the Issuer’s Bylaws, the Reporting Person

anticipates that his additional solicitation expenses will be nominal, and no more that $1,000. In the event that the Nominees

are not included in the Issuer’s proxy statement as provided in the Issuer’s Bylaws, the Reporting Person anticipates

his additional solicitation expenses will be approximately $10,000 to $15,000, to consist of the purchase of beneficial ownership

lists, printing, mailing, edgar preparation, and other expenses. The Reporting Person will initially bear the costs of the solicitation

and does not currently intend to seek reimbursement from the Company.

Security Ownership of Certain Beneficial

Owners and Management

The Reporting Person does not have access

to information sufficient to provide current figures on the beneficial ownership of management and other holders. The latest information

available to the Reporting Person is contained in the Issuer’s Schedule 14A filed February 4, 2020. This information is

publicly available at:

https://www.sec.gov/Archives/edgar/data/1099369/000106299320000424/formdef14a.htm#page_27

Item 7. Notice of Dissolution of Group or

Termination of Shareholder Nomination

Not applicable.

Item 8. Signatures

After reasonable inquiry and to the best

of my knowledge and belief, each of the undersigned certifies that the information set forth in this notice on Amendment No. 1

to Schedule 14N is true, complete and correct.

November 2, 2020

Date

/s/ Steven Erik Vestergaard

Steven Erik Vestergaard

* Incorporated by reference to Schedule

14N filed September 30, 2020

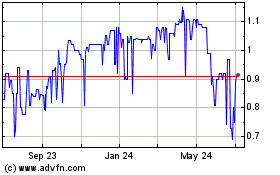

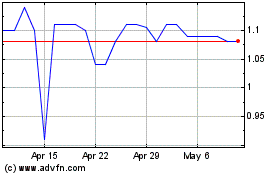

Destiny Media Technologies (QB) (USOTC:DSNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Destiny Media Technologies (QB) (USOTC:DSNY)

Historical Stock Chart

From Apr 2023 to Apr 2024