UPDATE: Tesco CEO To Take On UK Role As Brasher Steps Down

March 15 2012 - 11:05AM

Dow Jones News

Tesco PLC (TSCO.LN) Thursday said Chief Executive Philip Clarke

will assume responsibility for its struggling U.K. operations as

well as his other duties, replacing Richard Brasher after barely a

year into the job following the retailer's first profit warning in

20 years.

Several years of falling sales in the U.K. and a particularly

dire Christmas period prompted the company to warn in January that

it will make minimal profit in 2013 despite investing millions of

pounds to improve service and lower prices to lure back customers

who have deserted the U.K.'s largest supermarket chain for its

nimbler rivals.

"I have decided to assume responsibility as the CEO of our U.K.

business at this very important time," Mr. Clarke said. "This

greater focus will allow me to oversee the improvements that are so

important for customers."

"The depth of management at Tesco and the strong leadership team

across the Group allow me to take a more active role in the U.K.

whilst our other businesses continue to grow," he added.

Mr. Brasher, 49, a long-time executive who joined Tesco in 1986,

was appointed U.K. and Republic of Ireland chief executive in March

2011 when Mr. Clarke took over from Terry Leahy.

Mr. Brasher wasn't immediately available for comment.

The U.K. makes up around two-thirds of Tesco's sales and

profits, and Mr. Brasher was a key architect of Tesco's Big Price

Drop, a GBP500 million price-cutting campaign launched in October

2011 to reinvigorate U.K. sales. The move prompted widescale price

cuts across the grocery industry but has so far failed to reverse

the decline at Tesco.

Its market share in the 12 weeks ended Feb. 19 fell to its

lowest level since May 2005, dropping to 29.7% from 30.3% in the 12

weeks ended Feb. 20, 2011, according to the latest data from Kantar

which monitors grocery purchasing habits in U.K. households.

The Big Price Drop investment will be augmented by several more

millions spent on improving service at the stores.

Mr. Clarke has previously said its U.K. stores have focused too

much on efficiency and cost-cutting, with less emphasis on customer

service. To this end, the company announced last week that it will

create 20,000 new jobs over the next few years to improve service

in its stores.

The company has also committed to scaling back on its

hypermarket formats that concentrate more on non-food lines and Mr.

Clarke is likely to continue to pursue the strategy outlined in

January which also aims to keep prices low and improve service,

said Rahul Sharma, managing director of investment firm Neev

Capital.

Planet Retail U.K. analyst David Gray said the Mr. Clarke was

behind the strategy and was likely to continue to push it through

the company.

"The store improvement program came from senior management

levels and is unlikely to change [now that Clarke is in charge],"

Still, Mr. Clarke face the task of keeping his eye on international

operations, turning a profit in the U.S. by next year, selling off

its operations in Japan and managing difficult eastern European

markets.

Tesco isn't the only ailing grocer to foist its home market

troubles on a busy chief executive. Outgoing Carrefour SA (CA.FR)

Chief Executive Lars Olofsson assumed control of the retailer's

ailing French business, which accounts for over 40% of sales, after

firing French chief James McCann in May 2011, just over a year

after he was brought in from Tesco to turn around the business.

In addition to dealing with problems at its international

businesses, Carrefour has zigzagged on many policies in its home

market, massively increased price promotions in France before

switching tack last year to focus on everyday low prices, costing

it sales and market share.

Like Tesco it is also stuck with a legacy of large-format

hypermarket stores which it aimed to revamp, plans which are now on

hold after disappointing results from the first converted

stores.

Georges Plassat will replace Mr. Olofsson as CEO in June, the

company's third boss in four years.

At 1406 GMT, Tesco shares were down 4 pence, or 1.2%, at 321

pence.

By Kathy Gordon, Dow Jones Newswires; 44-207-842-9293;

kathy.gordon@dowjones.com

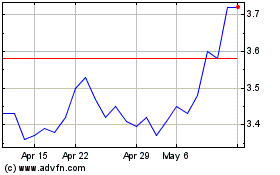

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Jun 2024 to Jul 2024

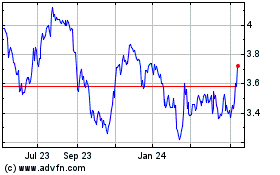

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Jul 2023 to Jul 2024