BNP Paribas and Peter Thiel-Backed Company Team Up to Sell Unicorn Shares

April 03 2019 - 9:14AM

Dow Jones News

By Justin Baer

A financial-technology firm backed by billionaire Peter Thiel

and a giant European bank are teaming up to sell shares in pre-IPO

companies, giving employees of valuable startups another chance to

cash out early.

Forge Global Inc., a five-year-old company that matches private

companies and their employees with investors, plans to raise as

much as $1 billion in the next year through the sale of a series of

structured notes linked to the shares of startups. French bank BNP

Paribas SA will offer the derivatives to both institutions and

wealthy individuals in Europe and Asia, the companies said.

Forge and BNP Paribas aim to tap demand for shares for Silicon

Valley's most promising startups before they go public. Those

investors are finding willing sellers. Companies such as

ride-hailing giant Uber Technologies Inc. are staying private

longer, delaying the potential windfall awaiting employees and

other insiders. A 2018 selloff in publicly traded tech stocks has

added a note of urgency to cash out before the cycle turns.

BNP Paribas's clients outside the U.S. have long sought to

invest more heavily in emerging Silicon Valley companies but may

not have the resources to research individual companies or access

the venture-capital funds that own them. "For them it was really

about accessing private tech as an asset class as opposed to

picking individual names," said Benjamin Kieffer, BNP Paribas's

head of equity-derivatives structuring.

Private tech stocks will invariably go through downturns, but

they will endure as a viable investment option in part because

these companies are no longer racing to go public as once were, Mr.

Kieffer said. Today's privately held companies are bigger and the

pool of available cash to fund them is much greater, he added.

The bank will select the shares included in the basket based on

a set of criteria, including minimums on disclosures, valuations

and the number of funding rounds the company has raised.

The initial structured note, which is slated to close in June,

will draw from the 300 or so private companies valued at more than

$1 billion. private companies valued above $1 billion are known in

the industry as unicorns.

Nearly $2 billion -- and the private shares of tech stalwarts

ranging from music-streaming company Spotify Technology SA to Uber

rival Lyft Inc. -- changed hands since Forge launched its exchange

in 2014. The company expects to hit $3 billion in total trading

volume by the end of this year.

Forge's backers include German insurer Munich Re and Mr. Thiel,

a venture capitalist. It raised $85 million from BNP Paribas and

other investors in its latest funding round earlier this year.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

April 03, 2019 08:59 ET (12:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

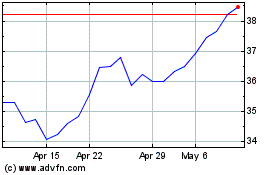

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Mar 2024 to Apr 2024

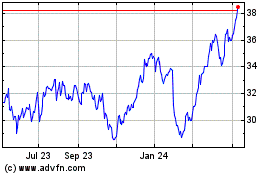

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Apr 2023 to Apr 2024