BNP Cuts 2020 Revenue, Profitability Targets -- Earnings Review

February 06 2019 - 5:35AM

Dow Jones News

By Pietro Lombardi

BNP Paribas SA (BNP.FR) reported its fourth-quarter and

full-year results and updated its 2020 targets on Wednesday. Here's

what you need to know:

NET PROFIT: Net profit rose 1.1% on year to EUR1.44 billion

($1.64 billion) in the fourth quarter. This compares with analysts'

expectations of a net profit of EUR1.45 billion, according to a

consensus forecast provided by FactSet. Net profit for the year

declined 3% to EUR7.53 billion.

REVENUE: Fourth-quarter revenue fell 3.5% to EUR10.16 billion.

Analysts had expected revenue of EUR10.37 billion, according to the

consensus.

WHAT WE WATCHED:

-STRATEGIC UPDATE: BNP cut its 2020 revenue growth and

profitability targets and vowed to increase cost savings. It now

sees revenue growth of 1.5% a year between 2016 and 2020, down from

a previous guidance of 2.5%. It also lowered the guidance for 2020

return on equity--a key measure of profitability--to 9.5% from 10%.

The bank increased its recurring cost-savings target to EUR3.3

billion from 2020, up from a previous target of EUR2.7 billion. Of

the additional EUR600 million, roughly EUR350 million will come

from its corporate and institutional banking unit.

-CORPORATE AND INSTITUTIONAL BANKING: The performance of its

domestic markets and international financial-services divisions are

in line with the bank's plan, it said. However, "the unfavorable

environment requires to intensify the transformation" of the

corporate and institutional banking unit, BNP said. The CIB unit's

revenue fell 7.5% last year and 9.4% in the fourth quarter compared

with a year earlier. Global markets revenue fell 40% in the

quarter, with equity revenue down 70% on year while fixed-income,

currencies and commodities revenue were down 15%.

-CAPITAL: BNP's core Tier 1 capital ratio--a key measure of

capital strength--rose to 11.8% in December from 11.7% in

September. It now targets a ratio of at least 12% in 2020, compared

with a previous guidance of 12%.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2019 05:20 ET (10:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

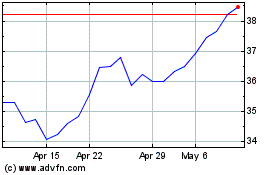

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Apr 2024 to May 2024

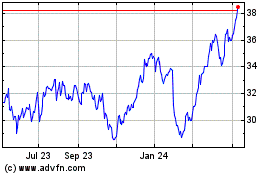

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From May 2023 to May 2024