UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported):

June 27, 2014

bebe stores, inc.

(Exact name of registrant as specified in its charter)

|

| | |

California | 0-24395 | 94-2450490 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

400 Valley Drive

Brisbane, CA 94005

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(415) 715-3900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05 Costs Associated with Exit or Disposal Activities

On June 27, 2014 bebe stores, inc. (the Company) issued a press release announcing the exit of its 2b business. The Company estimates the pre-tax cost associated with closing its remaining 16 2b stores including e-commerce business will be approximately $5-6 million. This includes an estimated $0.8 million related to the write-off of the net book value of assets and between $0.8-1.3 million for inventory liquidation write downs; both of these non-cash charges will be recorded in the fourth quarter of fiscal 2014. The $5-6 million also includes an estimated $3.4-3.9 million related to lease termination and employee termination costs, both of which are cash charges that the Company expects to incur as the stores close. The Company plans to close all remaining 2b stores in fiscal 2014. The Company's decision to close the 2b business will enable it to increase its focus on the core bebe brand’s retail and outlet stores, e-commerce and international licensing business.

The press release relating to the planned closure of the 2b business is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| |

99.1. | Press Release dated June 27, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 27, 2014.

|

|

bebe stores, inc. |

|

/s/ Liyuan Woo |

Liyuan Woo, Chief Financial Officer |

Exhibit 99.1

Plans to Exit 2b Concept to Focus on the bebe Brand

Initiate Cost Reduction Program

Expects approximately $9-10 Million in Pre-Tax Annualized Cost Savings

Updates Fiscal 4th quarter 2014 Guidance

BRISBANE, CALIF. - June 27, 2014 - bebe stores, inc. (NASDAQ:BEBE) today announced the exit of its 2b business and a comprehensive cost reduction program as part of the Company's on-going turnaround plan. Following a strategic business review, the Company has identified key initiatives it estimates will generate approximately $9-10 million in annualized pre-tax savings, beginning in fiscal 2015.

Following careful evaluation, the Company has made the determination to exit the 2b business by the end of fiscal 2014, July 5, 2014, enabling it to increase its focus on the core bebe brand’s retail and outlet stores, e-commerce and international licensing business. The 16 2b mall-based stores including e-commerce business are expected to generate pre-tax losses of approximately $5-6 million in fiscal 2014, excluding impairment charges. The Company estimates that it will record pre-tax restructuring charges of approximately $5-6 million in relation to lease termination, asset write-off, inventory liquidation write downs and employee termination costs to close the remaining 16 2b mall stores including the e-commerce business.

The Company has also begun the implementation of a cost reduction program following a thorough review of the Company’s current cost structure that will target both direct and indirect spending across the organization. This includes the Company's plans to reduce corporate and field management positions to align with current business strategies, in addition to the workforce reductions from the Company's store closure program. The workforce reduction impacted approximately 9% of the Company's non-store employees, excluding the distribution center, and less than 1% of its store operations team. Employees affected by the workforce reduction have been provided financial assistance in the form of severance. As part of this cost reduction program, the Company expects to achieve approximately $4 million in cost savings in fiscal 2015. Pre-tax severance costs are approximately $3 million during fiscal 2014. Additional details regarding the impact of these decisions will be provided as part of the Company's earnings call scheduled for August 28, 2014.

"The steps we are announcing today build on our turnaround efforts from the past year," said Jim Wiggett, Interim Chief Executive Officer. "Through the closing of our unprofitable 2b brand, and the cost reduction program, we will be better positioned financially and structurally to focus on our core bebe brand. Our objective is to drive long term growth and sustainable profitability. We will also continue to focus on our merchandising, marketing and operational strategies designed to reposition the bebe brand. We thank the affected employees for their efforts and dedication. This is a difficult step, but important to the long term success of our brand.

As we prepare for the next fiscal year, we continue to evaluate our cost structure, capital expenditure requirements and dividend payments, and we will remain focused on carefully managing expenses and inventories, as well as preserving our cash."

For the fourth quarter of fiscal 2014, the Company now expects comparable store sales to be in the negative low single digit range. Despite the slightly lower than expected comparable store sales performance, the Company continues to expect loss per share to be in the mid-teen range prior to any non-recurring expenses. Finished goods inventory per square foot as of the end of fiscal fourth quarter 2014 is anticipated to increase in the mid to high-single digit range as compared to the same period last year.

About bebe stores, Inc.:

bebe stores, inc. is a global specialty retailer, which designs, develops and produces a distinctive line of contemporary women’s apparel and accessories under the bebe, BEBE SPORT, bbsp and 2b bebe brand names. bebe currently operates 224 stores, of which 174 are bebe stores, including the on-line store bebe.com, 34 bebe outlet stores, and 16 2b bebe stores including the on-line store 2bstores.com scheduled to be closed on July 5, 2014. These stores are located in the United States, U.S. Virgin Islands, Puerto Rico and Canada. bebe also distributes and sells bebe branded product through its licensees in approximately 26 countries.

Contact:

bebe Stores, Inc.

Liyuan Woo, Chief Financial Officer

415-715-3900

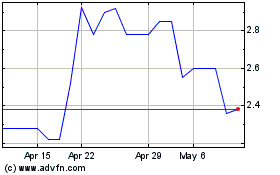

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jun 2024 to Jul 2024

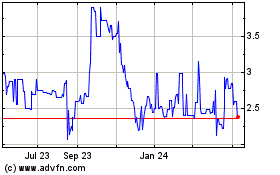

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jul 2023 to Jul 2024