Bebe Beats Estimate, Declines Y/Y - Analyst Blog

August 24 2012 - 4:30AM

Zacks

Bebe Stores, Inc.

(BEBE) recently reported earnings of 4 cents per share for the

fourth-quarter ended June 30, 2012, surpassing the Zacks Consensus

Estimate by a penny. However, quarterly earnings reflected a

year-over-year decline of 33.3% from 6 cents per share reported in

the prior-year quarter.

Quarter in

Detail

Net sales from continuing

operations for the quarter were $131.5 million, beating the Zacks

Consensus Estimate of $128.0 million. However, net sales inched

down 0.6% from $132.3 million in the prior-year quarter reflecting

a decline of 2.5% in comparable-store-sales.

Gross profit in dollar terms crept

down 2.9% to $52.9 million from $54.4 million in the year-ago

quarter and consequently, gross profit margin contracted 90 basis

points year over year at 40.2% from 41.1% in the year-ago quarter.

The decrease in gross profit and margin was primarily due to higher

cost of goods sold as a percentage of sales because of rise in

other costs inclusive of in-house production.

Lower gross profit and a decline in

comparable-store-sales led to a year-over-year fall of 31.8% in

operating income to $5.4 million compared with $7.8 million in the

fourth-quarter of 2011, resulting in contraction of 180 basis

points in operating margin to 4.1%.

Fiscal 2012

Review

Bebe reported earnings of 14 cents

per share for the fiscal year 2012, which came in line with the

Zacks Consensus Estimate and surged 180% from 5 cents reported in

the prior year. Net sales for the fiscal were $530.8 million

compared with $493.3 million in the prior year, reflecting an

increase of 7.6% and also beating the Zacks Consensus Estimate of

$528.0 million. Comparable-store-sales for the fiscal showed an

improvement of 5.3% compared with 0.6% in fiscal 2011.

Stores

Update

The company markets its products

under the bebe, BEBE SPORT, bbsp, and 2b bebe brand names,

targeting women belonging to the age-group 21–34 years. During the

fourth-quarter, the company opened three 2b bebe stores and shut

down two bebe stores. For the fiscal 2012, the company opened five

bebe stores, eight 2b stores and shut 13 bebe stores (comprising

one conversion of bebe to 2B store).

As of June 30, 2012, it operated

247 retail stores including 200 bebe stores and 47 2b bebe

stores.

Other Financial

Aspects

Bebe, which competes with upper

segment apparel retailers, such as Nordstrom Inc.

(JWN) and Guess’ Inc. (GES), has a debt-free

balance sheet. The company ended the fiscal 2012 with cash and

equivalents of $104.9 million compared to $95.2 million a year ago.

Inventories for the fiscal were $33.3 million. As of June 30, 2012,

the company registered a 2% growth in average inventory per square

foot compared with 1% increase in fiscal 2011.

Strolling through

Guidance

Bebe generated outlook for first

quarter of 2013. The company forecasts comparable-store-sales to

decrease in the mid to high-single digit, following the weak comps

for the fourth quarter 2012. The company anticipates net loss to

fall in the range of 1 - 4 cents for the first quarter 2013

compared with earnings of 3 cents in the prior-year quarter.

Selling, general and administrative expenses are expected to

increase mainly due to increased compensation and promotional

expenses.

For the upcoming quarter, the

company anticipates inventories per square foot to fall in low to

mid-teens, mainly due to expected rise in average per unit costs,

investments in wear-to-work and rise in inventory resulting from

our localization strategy.

Bebe expects to spend $27 million

as capital expenditures for the full fiscal year 2013, which will

help in opening new stores, renovations of old ones, store

expansions, IT system and office developments.

During the fiscal 2013, Bebe

forecasts to open five bebe stores and six 2b stores and expects to

shut down 12 bebe stores and one 2b pop-up store. The company

further anticipates that such openings and closures will not alter

the total square footage compared with the prior-fiscal year.

Conclusion

Bebe’s products include a wide

range of separates, tops, dresses, active wear, and accessories in

career, evening, casual, and active lifestyle categories. The

company is aggressively focusing on developing multi-channel retail

format by enhancing its e-commerce capabilities.

Further, in a drive to expand its

international business, Bebe is aggressively increasing its sales

points in different countries and forecasts that the company’s

international licensees will increase 25 points of sales in the

fiscal 2013.

Following the year over year

decline in the fourth-quarter revenue and profitability, Bebe

carries a Zacks #4 Rank for the next 1-3 months implying short-term

Sell rating. However, we maintain our long-term ‘Neutral’

recommendation on the stock.

BEBE STORES INC (BEBE): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

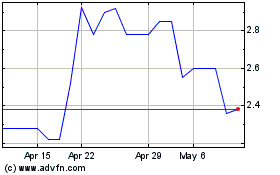

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jun 2024 to Jul 2024

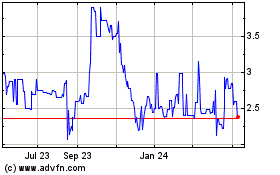

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jul 2023 to Jul 2024