AQUILA TAX-FREE FUND OF COLORADO

SUMMARY PROSPECTUS

September 30, 2013

As Revised As Of October 11, 2013

|

|

Tickers:

|

Class A – COTFX

|

Class C – COTCX

|

|

|

|

Class I – COTIX

|

Class Y – COTYX

|

This summary prospectus is designed to provide investors with key Fund information in a clear and concise format. Before you invest, you may want to review the Fund’s complete Prospectus, which contains more information about the Fund and its risks. You can find the Fund's Prospectus and other information about the Fund online at

www.aquilafunds.com/literature.html

. You can also get this information at no cost by calling 800-437-1020 (toll-free) or by sending an e-mail request to

info@

aquilafunds.com

. If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Prospectus and other information will also be available from your financial intermediary. The Fund's Prospectus and Statement of Additional Information, both dated September 30, 2013, as revised as of

October 11, 2013,

are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment Objective

The Fund’s objective is to provide you as high a level of current income exempt from Colorado state and regular Federal income taxes as is consistent with preservation of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $25,000 in the Fund or in other funds in the Aquila Group of Funds. More information about these and other discounts, as well as eligibility requirements for each share class, is available from your financial advisor and in "Alternative Purchase Plans” on page 47 of the Fund's Prospectus, "What are the sales charges for purchases of Class A Shares” on page 48 of the Prospectus, "Reduced Sales Charges for Certain Purchases of Class A Shares” on page 50 of the Prospectus and “Purchase, Redemption, and Pricing of Shares” on page 72 of the Statement of Additional Information (the “SAI”). No Class I Shares are currently outstanding.

|

|

Class A

Shares

|

Class C

Shares

|

Class I

Shares

|

Class Y

Shares

|

|

|

|

|

|

|

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

4.00%

|

None

|

None

|

None

|

|

|

|

|

|

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of redemption value or purchase price)

|

None

(1

)

|

1.00%

|

None

|

None

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

Management Fee

(3)

|

0.50%

|

0.50%

|

0.50%

|

0.50%

|

|

|

|

|

|

|

|

Distribution (12b-1) Fee

|

0.05%

|

0.75%

|

0.15%

|

None

|

|

|

|

|

|

|

|

Other Expenses

|

0.17%

|

0.42%

|

0.40%

(2)

|

0.17%

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

0.72%

|

1.67%

|

1.05%

|

0.67%

|

|

|

|

|

|

|

|

Total Fee Waivers

(3)

|

0.02%

|

0.02%

|

0.02%

|

0.02%

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

After Waivers and Reimbursements

(3)

|

0.70%

|

1.65%

|

1.03%

|

0.65%

|

|

|

|

|

|

|

|

(1)

|

Purchases of $1 million or more have no sales charge but a contingent deferred sales charge of up to 1% for redemptions within two years of purchase and up to 0.50 of 1% for redemptions during the third and fourth years after purchase.

|

|

(2)

|

Other Expenses of Class I Shares are based on estimated amounts for the current fiscal year.

|

|

(3)

|

The Manager has contractually undertaken to waive its fees so that management fees are equivalent to 0.48 of 1% of net assets of the Fund up to $400,000,000; 0.46 of 1% of net assets above $400,000,000 up to $1,000,000,000; and 0.44 of 1% of net assets above $1,000,000,000. This contractual undertaking is in effect until September 30, 2014. Prior to September 30, 2014, the Manager may not terminate the arrangement without the approval of the Board of Trustees.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Six years after the date of purchase, Class C Shares automatically convert to Class A Shares. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A Shares

|

$469

|

$619

|

$783

|

$1,257

|

|

Class C Shares

|

$268

|

$525

|

$905

|

$1,487

|

|

Class I Shares

|

$105

|

$332

|

$577

|

$1,281

|

|

Class Y Shares

|

$66

|

$212

|

$371

|

$833

|

You would pay the following expenses if you did not redeem your Class C Shares:

|

Class C Shares

|

$168

|

$525

|

$905

|

$1,487

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended December 31, 2012 and during the fiscal period ended March 31, 2013, the Fund's portfolio turnover rate was 15% and 2%, respectively, of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, at least 80% of the Fund’s net assets will be invested in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Colorado state and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. In general, almost all of these obligations are issued by the State of Colorado, its counties and various other local authorities. We call these “Colorado Obligations.” These securities may include participation or other interests in municipal securities and variable rate demand notes. A significant portion of the Colorado Obligations in which the Fund invests are revenue bonds, which are backed only by revenues from certain facilities or other sources and not by the issuer itself. These obligations can be of any maturity, but the Fund’s average portfolio maturity has traditionally been between 6 and 12 years.

At the time of purchase, the Fund’s Colorado Obligations must be of investment grade quality. This means that they must either

|

·

|

be rated within the four highest credit ratings assigned by nationally recognized statistical rating organizations or,

|

|

·

|

if unrated, be determined to be of comparable quality by the Fund’s Sub-Adviser, Davidson Fixed Income Management, Inc. doing business as Kirkpatrick Pettis Capital Management (the “Sub-Adviser”).

|

The Sub-Adviser selects obligations for the Fund’s portfolio to best achieve the Fund’s objective by considering various characteristics including quality, maturity and coupon rate.

Principal Risks

Market Risk

. The market prices of the Fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment may go down.

Interest Rate Risk.

The value of your investment may go down when interest rates rise. A rise in rates tends to have a greater impact on the prices of longer term securities.

Credit Risk

. If an issuer or obligor of a security held by the Fund or a counterparty to a financial contract with the Fund defaults or is downgraded, or if the value of the assets underlying a security declines, the value of your investment will typically decline. Securities in the lowest category of investment grade (i.e., BBB/Baa) may be considered to have speculative characteristics.

Rating Agency Risk.

Investment grade debt securities may be downgraded by a major rating agency to below investment grade status, which would increase the risk of holding these securities. In addition, a rating may become stale in that it fails to reflect changes to an issuer’s financial condition. Ratings represent the rating agency’s opinion regarding the quality of the security and are not a guarantee of quality. Rating agencies may fail to make timely changes to credit ratings in response to subsequent events. In addition, rating agencies are subject to an inherent conflict of interest because they are often compensated by the same issuers whose securities they grade.

Risks Associated with Investments in Colorado and Other Municipal Obligations

. The Fund may be affected significantly by adverse economic, political or other events affecting Colorado and other municipal issuers. Continued economic recovery

2/ Aquila Tax-Free Fund of Colorado

in Colorado will be affected by concerns about the global economy, federal fiscal policy, tax increases and spending cuts, and business and consumer uncertainty related to these issues. Colorado revenue receipts may struggle to return to healthy growth rates until personal income and employment show sustained improvement. The Taxpayer Bill of Rights (TABOR), passed in 1992, is a constitutional provision that limits increases in spending, as well as the amount of revenue that can be raised, in a given year. Any excess revenue must be refunded to taxpayers. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities. Issuers often depend on revenues from these projects to make principal and interest payments. The value of municipal securities also can be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory developments, legislative actions, and by uncertainties and public perceptions concerning these and other factors. In recent periods an increasing number of municipal issuers in the United States have defaulted on obligations and commenced insolvency proceedings. Financial difficulties of municipal issuers may continue or get worse.

Tax Risk

. The income on the Fund’s Colorado Obligations and other municipal obligations could become subject to Federal and/or state income taxes due to noncompliant conduct by issuers, unfavorable legislation or litigation or adverse interpretations by regulatory authorities.

Liquidity Risk

. Some securities held by the Fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the Fund is forced to sell an illiquid security to meet redemption requests or other cash needs, the Fund may be forced to sell the security at a loss.

Prepayment or Call Risk

. Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right, and the Fund could be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security. The Fund may also lose any premium it paid on the security.

Portfolio Selection Risk

. The value of your investment may decrease if the Sub-adviser’s judgment about the quality, relative yield, value or market trends affecting a particular security, industry, sector or region, or about interest rates, is incorrect.

The Fund is classified as a “non-diversified” investment company under the Investment Company Act of 1940 (the “1940 Act”). Thus, compared with “diversified” funds, it may invest a greater percentage of its assets in obligations of a small number of issuers. In general, the more the Fund invests in the securities of specific issuers or issues of a similar project type, the more the Fund is exposed to risks associated with investments in those issuers or types of projects. Also, the Fund may be more volatile than a more geographically diverse fund.

Loss of money is a risk of investing in the Fund.

These risks are discussed in more detail later in the Prospectus or in the SAI.

Fund Performance

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the designated periods compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at

www.aquilafunds.com

or by calling

800-437-1020 (toll-free).

The Fund acquired the assets and liabilities of Tax-Free Fund of Colorado (the Predecessor Fund) on October 11, 2013. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance shown for periods prior to October 11, 2013 is the performance of the Predecessor Fund.

ANNUAL TOTAL RETURNS

As of December 31

Class Y Shares

2003-2012

12%

10%

9.47

8% XXXX 8.96

XXXX XXXX

6% XXXX XXXX

4.37 XXXX XXXX 5.89

4% XXXX XXXX XXXX XXXX

XXXX 2.73 3.26 3.17 XXXX XXXX XXXX

2% XXXX XXXX XXXX XXXX XXXX XXXX XXXX

XXXX XXXX 1.49 XXXX XXXX 0.63 XXXX 1.44 XXXX XXXX

0% XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Calendar Years

During the 10-year period shown in the bar chart, the highest return for a quarter was 4.37% (quarter ended September 30, 2009) and the lowest return for a quarter was –2.39% (quarter ended June 30, 2004).

The year-to-date (from January 1, 2013 to June 30, 2013) total return for Class Y Shares was –3.13%.

3/ Aquila Tax-Free Fund of Colorado

|

|

Average Annual Total Returns for

the Periods Ended December 31, 2012

|

|

|

1 Year

|

5 Years

|

10 Years

|

|

Class Returns Before Taxes:

|

|

|

|

|

Class A

|

1.64%

|

4.28%

|

3.61%

|

|

Class C

|

3.83%

|

4.15%

|

3.05%

|

|

Class Y

|

5.89%

|

5.21%

|

4.10%

|

|

Class Y Returns After Taxes:

|

|

|

|

|

On Distributions

|

5.89%

|

5.20%

|

4.05%

|

|

On Distributions and Redemption

|

5.03%

|

5.02%

|

4.02%

|

|

Barclays Capital Quality Intermediate Municipal Bond Index. (This index of municipal bonds of issuers throughout the U.S. is unmanaged and does not reflect deductions for fund operating expenses, taxes or sales charges.)

|

3.84%

|

5.47%

|

4.53%

|

After-tax returns are calculated using the highest individual Federal marginal income and capital gains tax rates in effect at the time of each distribution and redemption, but do not reflect state and local taxes. Actual after-tax returns will depend on your specific situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. The total returns reflect reinvestment of dividends and distributions. After-tax returns are shown only for Class Y Shares. After-tax returns for other classes of shares will vary.

Management

Investment Adviser -

Aquila Investment Management LLC

(the “Manager”)

Sub-Adviser -

Davidson Fixed Income Management, Inc. doing business as Kirkpatrick Pettis Capital Management

Portfolio Manager

-- Mr. Christopher Johns is a Senior Vice President of the Sub-Adviser; he has served as the portfolio manager of the Fund and the Predecessor Fund since the Predecessor Fund’s inception in 1987.

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange shares of the Fund on any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Class A Shares or Class C Shares either through a financial advisor or directly from the Fund. The minimum initial purchase amount for Class A or Class C Shares is $1,000, and $50 if an automatic investment program is established. There is no minimum for subsequent investments. Class I Shares and Class Y Shares may be purchased only through a financial intermediary, which may impose separate investment minimums.

Tax Information

The Fund intends to distribute income that is exempt from regular Federal income tax and Colorado state income tax. Portions of the Fund's distributions may be subject to such taxes and/or to the Federal alternative minimum tax.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and Aquila Distributors, Inc. (the “Distributor”) or the Manager may pay the intermediary for the sale of Fund shares and related shareholder servicing activities. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

4/ Aquila Tax-Free Fund of Colorado

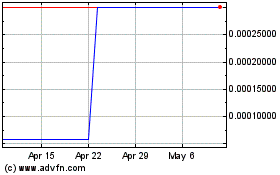

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From May 2024 to Jun 2024

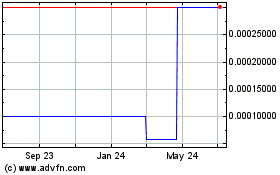

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From Jun 2023 to Jun 2024