|

As

filed with the Securities and Exchange Commission on April __,

2009

|

Registration

No. 333-152660

|

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

ARNO THERAPEUTICS,

INC

.

(

Exact name of registrant as specified

in its charter)

|

Delaware

|

2834

|

52-2286452

|

|

(State

or other jurisdiction of incorporation

or

organization)

|

(Primary

Standard Industrial Classification

Code

Number)

|

(I.R.S.

Employer

Identification

No.)

|

4

Campus Drive, 2

nd

Floor

Parsippany,

New Jersey 07054

(862)

703-7170

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive offices)

|

BRIAN

LENZ

CHIEF

FINANCIAL OFFICER

ARNO

THERAPEUTICS, INC.

4

CAMPUS DRIVE, 2

ND

FLOOR

PARSIPPANY,

NJ 07054

(862)

703-7170

(NAME, ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE

NUMBER,

INCLUDING AREA CODE, OF AGENT FOR SERVICE)

|

|

COPIES TO:

CHRISTOPHER J. MELSHA, ESQ.

SEAN M. NAGLE, ESQ.

FREDRIKSON & BYRON, P.A.

200 SOUTH SIXTH STREET, SUITE 4000

MINNEAPOLIS, MN 55402-1425

TELEPHONE: (612) 492-7000

FACSIMILE: (612) 492-7077

|

Approximate date of commencement of

proposed sale to the public:

From time to time after the

effective date of this registration statement, as shall be determined by the

selling stockholders identified herein.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, as

amended, check the following box.

þ

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration number of the earlier effective registration statement for the

same offering.

¨

If this

Form is a post effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

¨

If this

Form is a post effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

o

|

|

Accelerated

filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

þ

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS

MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A

FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF

THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME

EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH

SECTION 8(A), MAY DETERMINE.

A

registration statement relating to these securities has been filed with the

Securities and Exchange Commission. These securities may not be sold

nor may offers to buy be accepted prior to the time the registration statement

becomes effective. This prospectus shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any sale of these

securities in any state in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any

such state.

Subject

to completion, dated April __, 2009

OFFERING

PROSPECTUS

10,562,921

Shares

Common

Stock

The selling stockholders identified on

pages 17-23 of this prospectus are offering on a resale basis a total of

10,562,921

shares of our

common stock, including 196,189 shares issuable upon the exercise of outstanding

warrants. We will not receive any proceeds from the sale of these

shares by the selling stockholders.

Our common stock is quoted on the OTC

Bulletin Board under the symbol “ARNI.OB.” On _____________, 2009,

the last sale price of our common stock as reported on the OTC Bulletin Board

was $______.

The

securities offered by this prospectus involve a high degree of

risk.

See

“Risk Factors” beginning on page 5.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined that this prospectus

is truthful or complete. A representation to the contrary is a

criminal offense.

The

date of this prospectus is ______________, 2009.

TABLE

OF CONTENTS

|

PROSPECTUS

SUMMARY

|

|

|

4

|

|

|

RISK

FACTORS

|

|

|

6

|

|

|

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

16

|

|

|

USE

OF PROCEEDS

|

|

|

17

|

|

|

SELLING

STOCKHOLDERS

|

|

|

17

|

|

|

PLAN

OF DISTRIBUTION

|

|

|

24

|

|

|

DESCRIPTION

OF CAPITAL STOCK

|

|

|

26

|

|

|

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

|

|

27

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

|

|

28

|

|

|

DESCRIPTION

OF BUSINESS

|

|

|

35

|

|

|

MANAGEMENT

AND BOARD OF DIRECTORS

|

|

|

46

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

|

58

|

|

|

TRANSACTIONS

WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL

PERSONS

|

|

|

60

|

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

|

|

60

|

|

|

VALIDITY

OF COMMON STOCK

|

|

|

60

|

|

|

EXPERTS

|

|

|

60

|

|

|

TRANSFER

AGENT

|

|

|

60

|

|

|

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

|

|

|

60

|

|

|

FINANCIAL

STATEMENTS

|

|

|

F-1

|

|

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this

prospectus. Because it is a summary, it may not contain all of the

information that is important to you. Accordingly, you are urged to

carefully review this prospectus in its entirety, including the risks of

investing in our securities discussed under the caption “Risk Factors” and the

financial statements and other information that is contained in or incorporated

by reference into this prospectus or the registration statement of

which this prospectus is a part before making an investment

decision. Unless the context otherwise requires, hereafter in this

prospectus the terms the “Company,” the “Registrant,” “we,” “us,” or “our” refer

to Arno Therapeutics, Inc., a Delaware corporation, and its consolidated

subsidiaries, together taken as a whole.

Company

Overview

We are a development stage company

focused on developing innovative products for the treatment of cancer. We seek

to acquire rights to novel, pre-clinical or early stage clinical oncology

product candidates, primarily from academic and research institutions, and then

develop those drug candidates for commercial use. We currently have the

exclusive worldwide rights to commercially develop our three oncology product

candidates:

|

|

·

|

AR-67

– Our lead clinical product candidate is a novel, third-generation

campothecin analogue. We have completed patient enrollment of a

multi-center, ascending dose Phase I clinical trial of AR-67 in patients

with advanced solid tumors. During the first half of 2009, we

anticipate initiating a Phase II clinical trial of AR-67 in patients with

glioblastoma multiforme, or GBM, a highly aggressive form of brain

cancer. We also anticipate initiating a Phase II study in

patients with myelodysplastic syndrome, or MDS, a group of diseases marked

by abnormal production of blood cells by the bone marrow. In light of

current economic circumstances, we no longer plan to conduct these studies

ourselves, but rather we plan to pursue collaborations with oncology

cooperative groups and/or identify other researchers to conduct

investigator-initiated studies. We believe this action will

preserve our available cash resources, while continuing to advance the

development of this product

candidate.

|

|

|

·

|

AR-12

– We are also developing AR-12, an orally available pre-clinical

compound for the treatment of cancer. AR-12 is a novel

inhibitor of phosphoinositide dependent protein kinase-1, or PDK-1, that

targets the PI3K/Akt pathway while also possessing activity in the

endoplasmic reticulum stress and other pathways targeting apoptosis.

Pre-clinical studies suggest that AR-12 may provide therapeutic benefit

either alone or in combination with other therapeutic agents. We are

currently conducting pre-clinical toxicology and manufacturing studies

that we anticipate will provide the basis for the filing of an

investigational new drug application, or IND, in the first half of

2009. We anticipate commencing a Phase I clinical study of

AR-12 in the United States and the United Kingdom during

2009.

|

|

|

·

|

AR-42

– Our third product candidate in development is AR-42, an orally available

pre-clinical compound for the treatment of cancer. AR-42 is a

broad spectrum inhibitor of deacetylase targets, or Pan-DAC, as well as an

inhibitor of Akt. In pre-clinical models, AR-42 has demonstrated greater

potency and a competitive profile in tumors when compared with vorinostat

(also known as SAHA and marketed as Zolinza

®

by

Merck), the leading marketed histone deacetylase inhibitor. In March 2009,

the FDA accepted our IND for AR-42. We plan to pursue collaborations with

oncology cooperative groups, explore strategic partnerships and/or

identify other researchers to conduct a Phase I study of AR-42 and

otherwise further its development.

|

On June 2, 2008, we were acquired by

Laurier International, Inc., a Delaware corporation, in a “reverse” merger

whereby a wholly-owned subsidiary of Laurier merged with and into Arno

Therapeutics, with Arno Therapeutics remaining as the surviving corporation and

a wholly-owned subsidiary of Laurier. In accordance with the terms of this

merger, stockholders of Arno Therapeutics exchanged all of their shares of

common stock of Arno Therapeutics for shares of Laurier common stock at a rate

of 1.99377 shares of Laurier common stock for each share of Arno Therapeutics

common stock. As a result of the issuance of the shares of Laurier common stock

to the former Arno Therapeutics stockholders, following the merger the former

stockholders of Arno Therapeutics held 95 percent of the outstanding common

stock of Laurier, assuming the issuance of all shares underlying outstanding

options and warrants. Upon completion of the merger, all of the

former officers and directors of Laurier resigned and were replaced by the

officers and directors of Arno Therapeutics. Additionally, following the merger

Laurier changed its name to Arno Therapeutics, Inc.

Our executive offices are located at 4

Campus Drive, 2

nd

Floor,

Parsippany, New Jersey 07054. Our telephone number is (862)

703-7170. Our website is

www.arnothera.com

. Information

contained in, or accessible through, our website does not constitute a part of

this prospectus.

Risk

Factors

As with most pharmaceutical product

candidates, the development of our product candidates is subject to

numerous risks, including the risk of delays in or discontinuation of

development from lack of financing, inability to obtain necessary regulatory

approvals to market the products, unforeseen safety issues relating to the

products and dependence on third party collaborators to conduct research and

development of the products. Because we are a development stage

company with a very limited history of operations, we are also subject to many

risks associated with early-stage companies. For a more detailed

discussion of some of the risks you should consider before purchasing shares of

our common stock, you are urged to carefully review and consider the section

entitled “Risk Factors” beginning on page 6 of this

prospectus.

The

Offering

The selling stockholders identified on

pages 17-23 of this prospectus are offering on a resale basis a total of

10,562,921 shares of our common stock, including 196,189 shares issuable upon

the exercise of outstanding warrants.

|

Common

stock offered

|

|

10,562,921

shares

|

|

|

|

|

|

Common

stock outstanding before the offering

(1)

|

|

20,392,024

shares

|

|

|

|

|

|

Common

stock outstanding after the offering

(2)

|

|

20,588,213

shares

|

|

|

|

|

|

Use

of Proceeds

|

|

We

will receive none of the proceeds from the sale of the shares by the

selling stockholders, except for the warrant exercise price upon exercise

of the warrants, which would be used for working capital and other general

corporate purposes

|

|

|

|

|

|

OTC

Bulletin Board Symbol

|

|

ARNI.OB

|

|

(1)

|

Based

on the number of shares outstanding as of March 31, 2009, not including

2,931,763 shares issuable upon exercise of various warrants and options to

purchase our common stock.

|

|

(2)

|

Assumes

the issuance of all shares offered hereby that are issuable upon exercise

of warrants.

|

RISK

FACTORS

Investment

in our common stock involves significant risk. You should carefully consider the

information described in the following risk factors, together with the other

information appearing elsewhere in this prospectus, before making an investment

decision regarding our common stock. If any of these risks actually occur, our

business, financial condition, results of operations and future growth prospects

would likely be materially and adversely affected. In these circumstances, the

market price of our common stock could decline, and you may lose all or a part

of your investment in our common stock. Moreover, the risks described below are

not the only ones that we face. Additional risks not presently known to us or

that we currently deem immaterial may also affect our business, operating

results, prospects or financial condition.

Risks Relating to Our

Business

We currently have

no product revenues and will need to raise substantial additional capital to

operate our business.

To date,

we have generated no product revenues

.

Until, and unless, we

receive approval from the FDA and other regulatory authorities for our product

candidates, we cannot sell our drugs and will not have product revenues.

Currently, our only product candidates are AR-67, AR-12 and AR-42, and none of

these products are approved for sale by the FDA. Therefore, for the foreseeable

future, we will have to fund all of our operations and capital expenditures from

cash on hand and, potentially, future offerings. Currently, we believe we have

cash on hand to fund our operations into the first quarter of 2010. However,

changes may occur that would consume our available capital before that time,

including changes in and progress of our development activities, acquisitions of

additional product candidates and changes in regulation. Accordingly, we will

need additional capital to fund our continuing operations. Since we do not

generate any recurring revenue, the most likely sources of such additional

capital include private placements of our equity securities, including our

common stock, debt financing or funds from a potential strategic licensing or

collaboration transaction involving the rights to one or more of our product

candidates. To the extent that we raise additional capital by issuing equity

securities, our stockholders will likely experience dilution, which may be

significant depending on the number of shares we may issue and the price per

share. If we raise additional funds through collaborations and licensing

arrangements, it may be necessary to relinquish some rights to our technologies,

product candidates or products, or grant licenses on terms that are not

favorable to us. If we raise additional funds by incurring debt, we could incur

significant interest expense and become subject to covenants in the related

transaction documentation that could affect the manner in which we conduct our

business.

However,

we currently have no committed sources of additional capital and our access to

capital funding is always uncertain. This uncertainty is exacerbated due to the

current global economic turmoil, which has severely restricted access to the

U.S. and international capital markets, particularly for small biopharmaceutical

and biotechnology companies. Accordingly, despite our ability to secure adequate

capital in the past, there is no assurance that additional equity or debt

financing will be available to us when needed, on acceptable terms or even at

all. If we fail to obtain the necessary additional capital when needed, we may

be forced to significantly curtail our planned research and development

activities, which will cause a delay in our drug development programs and may

severely harm our business.

We are a

development stage

company.

We have

not received any operating revenues to date and are in the development stage.

You should be aware of the problems, delays, expenses and difficulties

encountered by an enterprise in our stage of development, and particularly for

companies engaged in the development of new biotechnology or biopharmaceutical

product candidates, many of which may be beyond our control. These include, but

are not limited to, problems relating to product development, testing,

regulatory compliance, manufacturing, marketing, costs and expenses that may

exceed current estimates and competition. No assurance can be given that our

existing product candidates, or any technologies or products that we may acquire

in the future will be successfully developed, commercialized and accepted by the

marketplace or that sufficient funds will be available to support operations or

future research and development programs.

We

are not currently profitable and may never become profitable.

We expect

to incur substantial losses and negative operating cash flows for the

foreseeable future, and we may never achieve or maintain profitability. For the

years ended December 31, 2008 and 2007, we had a net loss of $12,913,566 and

$3,359,697, respectively, and for the period from our inception on August 1,

2005 through December 31, 2008, we had a net loss of

$16,644,156. Even if we succeed in developing and commercializing one

or more of our product candidates, we expect to incur substantial losses for the

foreseeable future, as we:

|

|

·

|

continue

to undertake pre-clinical development and clinical trials for our product

candidates;

|

|

|

·

|

seek

regulatory approvals for our product

candidates;

|

|

|

·

|

in-license

or otherwise acquire additional products or product

candidates;

|

|

|

·

|

implement

additional internal systems and infrastructure;

and

|

|

|

·

|

hire

additional personnel.

|

Further,

for the years ended December 31, 2008 and 2007, we had negative cash flows from

operating activities of $8,884,214 and $1,824,115, respectively, and since

inception through December 31, 2008, we have had negative cash flows from

operating activities of $11,060,003. We expect to continue to

experience negative cash flows for the foreseeable future as we fund our

operating losses and capital expenditures. As a result, we will need to generate

significant revenues in order to achieve and maintain profitability. We may not

be able to generate these revenues or achieve profitability in the future. Our

failure to achieve or maintain profitability could negatively impact the value

of our common stock.

We

have a limited operating history upon which to base an investment

decision.

We are a

development stage company and have not demonstrated our ability to perform the

functions necessary for the successful commercialization of any of our product

candidates. The successful commercialization of our product candidates will

require us to perform a variety of functions, including:

|

|

·

|

continuing

to undertake pre-clinical development and clinical trials for our product

candidates;

|

|

|

·

|

participating

in regulatory approval processes;

|

|

|

·

|

formulating

and manufacturing products; and

|

|

|

·

|

conducting

sales and marketing activities.

|

Our

operations have been limited to organizing our company, acquiring, developing

and securing our proprietary technologies and preparing for pre-clinical and

clinical trials of our product candidates. These operations provide a limited

basis for you to assess our ability to commercialize our product candidates and

the advisability of investing in our securities.

We

may not successfully manage our growth.

Our

success will depend upon the expansion of our operations and the effective

management of our growth, which will place a significant strain on our

management and on our administrative, operational and financial resources. To

manage this growth, we may need to expand our facilities, augment our

operational, financial and management systems and hire and train additional

qualified personnel. If we are unable to manage our growth effectively, our

business would be harmed.

We rely on

key

employees and

scientific and medical advisors, whose knowledge of our business and technical

expertise would be difficult to replace.

We

currently rely on certain key employees, the loss of any one or more of whom

could delay our development program. We are and will be highly dependent on our

principal scientific, regulatory and medical advisors. Although we have “key

person” life insurance policies for our Chief Executive Officer and President

and Chief Medical Officer, the loss of technical knowledge and management and

industry expertise of any of our key personnel could result in delays in product

development, loss of customers and sales and diversion of management resources,

which could adversely affect our operating results.

In

February 2009, our current President and Chief Medical Officer informed us that

he would not be continuing his employment with us when the term of his

employment agreement expires on May 31, 2009. We are actively

recruiting candidates to this position, including persons who may serve on a

part-time consulting basis. However, there is no assurance we will be

able to secure an adequate replacement in a timely fashion. If we are

not able to timely find a replacement, the pace of our development activities

may be delayed.

If

we are unable to hire additional qualified personnel, our ability to grow our

business may be harmed.

Attracting

and retaining qualified personnel will be critical to our success. Our success

is highly dependent on the hiring and retention of key personnel and scientific

staff. While we are actively recruiting additional experienced members for the

management team, there is intense competition and demand for qualified personnel

in our area of business and no assurances can be made that we will be able to

retain the personnel necessary for the development of our business on

commercially reasonable terms, if at all. Certain of our current officers,

directors, scientific advisors and/or consultants or certain of the officers,

directors, scientific advisors and/or consultants hereafter appointed may from

time to time serve as officers, directors, scientific advisors and/or

consultants of other biopharmaceutical or biotechnology companies. We rely, in

substantial part, and for the foreseeable future will rely, on certain

independent organizations, advisors and consultants to provide certain services,

including substantially all aspects of regulatory approval, clinical management,

and manufacturing. There can be no assurance that the services of independent

organizations, advisors and consultants will continue to be available to us on a

timely basis when needed, or that we can find qualified

replacements.

We

may incur substantial liabilities and may be required to limit commercialization

of our products in response to product liability lawsuits.

The

testing and marketing of medical products entail an inherent risk of product

liability. If we cannot successfully defend ourselves against product liability

claims, we may incur substantial liabilities or be required to limit

commercialization of our products. Our inability to obtain sufficient product

liability insurance at an acceptable cost to protect against potential product

liability claims could prevent or inhibit the commercialization of the

pharmaceutical products we develop, alone or with corporate collaborators. We

currently do not have product liability insurance, but do maintain clinical

trial insurance coverage with respect to AR-67. Even if our agreements with any

future corporate collaborators entitle us to indemnification against losses,

such indemnification may not be available or adequate should any claim

arise.

There

are certain interlocking relationships among us and certain affiliates of Two

River Group Holdings, LLC, which may present potential conflicts of

interest.

Dr. Arie

S. Belldegrun, Peter M. Kash, Joshua A. Kazam and David M. Tanen, each a

director and stockholder of Arno, are the sole members of Two River Group

Management, LLC, which serves as the managing member of Two River Group

Holdings, LLC, or Two River, a venture capital firm specializing in the

formation of biotechnology companies. Messrs. Kash, Kazam and Tanen are officers

and directors of Riverbank Capital Securities, Inc., or Riverbank, a broker

dealer registered with the Financial Industry Regulatory Authority, or FINRA.

Mr. Tanen also serves as our Secretary and Scott L. Navins, the Vice President

of Finance for Two River and Financial and Operations Principal for Riverbank,

serves as our Treasurer. Additionally, certain employees of Two River, who are

also our stockholders, perform substantial operational activity for us,

including without limitation financial, clinical and regulatory activities.

Generally, Delaware corporate law requires that any transactions between us and

any of our affiliates be on terms that, when taken as a whole, are substantially

as favorable to us as those then reasonably obtainable from a person who is not

an affiliate in an arms-length transaction. Nevertheless, none of our affiliates

or Two River is obligated pursuant to any agreement or understanding with us to

make any additional products or technologies available to us, nor can there be

any assurance, and the investors should not expect, that any biomedical or

pharmaceutical product or technology identified by such affiliates or Two River

in the future will be made available to us. In addition, certain of our current

officers and directors or certain of any officers or directors hereafter

appointed may from time to time serve as officers or directors of other

biopharmaceutical or biotechnology companies. There can be no assurance that

such other companies will not have interests in conflict with our

own.

We are controlled

by current directors and principal stockholders.

Our

executive officers, directors and principal stockholders, which include the

persons affiliated with Two River discussed above, beneficially own

approximately 44% of our outstanding voting securities. Accordingly, our

executive officers, directors, principal stockholders and certain of their

affiliates will have the ability to exert substantial influence over the

election of our board of directors and the outcome of issues submitted to our

stockholders.

We

will be required to implement additional finance and accounting systems,

procedures and controls in order to satisfy requirements under the securities

laws, including the Sarbanes-Oxley Act of 2002, which will increase our costs

and divert management’s time and attention.

We are in

a continuing process of further establishing and documenting controls and

procedures that will allow our management to report on, and our independent

registered public accounting firm to attest to, our internal controls over

financial reporting when required to do so under Section 404 of the

Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. As a company with limited

capital and human resources, we anticipate that more of management’s time and

attention will be diverted from our business to ensure compliance with these

regulatory requirements than would be the case with a company that has well

established controls and procedures. This diversion of management’s time and

attention may have a material adverse effect on our business, financial

condition and results of operations.

In the

event we identify significant deficiencies or material weaknesses in our

internal controls over financial reporting that we cannot remediate in a timely

manner, or if we are unable to receive a positive attestation from our

independent registered public accounting firm with respect to our internal

controls over financial reporting when we are required to do so, investors and

others may lose confidence in the reliability of our financial statements. If

this occurs, the trading price of our common stock, if any, and our ability to

obtain any necessary financing could suffer. In addition, in the event that our

independent registered public accounting firm is unable to rely on our internal

controls over financial reporting in connection with its audit of our financial

statements, and in the further event that it is unable to devise alternative

procedures in order to satisfy itself as to the material accuracy of our

financial statements and related disclosures, we may be unable to file our

Annual Reports on Form 10-K with the SEC. This would likely have an adverse

affect on the trading price of our common stock, if any, and our ability to

secure any necessary additional financing, and could result in the delisting of

our common stock if we are listed on an exchange in the future. In such event,

the liquidity of our common stock would be severely limited and the market price

of our common stock would likely decline significantly.

We

will experience increased costs as a result of becoming subject to the reporting

requirements of federal securities laws.

Since our

merger with Laurier International, Inc. in June 2008, we are subject to the

reporting requirements of the Exchange Act, including the requirements of the

Sarbanes-Oxley Act of 2002. These requirements may place a strain on our systems

and resources. The Securities Exchange Act of 1934 requires that we file annual,

quarterly and current reports with respect to our business and financial

condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure

controls and procedures and internal controls over financial reporting, which is

discussed above. In order to maintain and improve the effectiveness of our

disclosure controls and procedures, significant resources and management

oversight will be required. We will continue to be implementing additional

procedures and processes for the purpose of addressing the standards and

requirements applicable to public companies. In addition, sustaining our growth

will also require us to commit additional management, operational and financial

resources to identify new professionals to join our firm and to maintain

appropriate operational and financial systems to adequately support expansion.

These activities may divert management's attention from other business concerns,

which could have a material adverse effect on our business, financial condition,

results of operations and cash flows. We expect to incur significant additional

annual expenses related to these steps and, among other things, additional

directors and officers liability insurance, director fees, reporting

requirements of the SEC, transfer agent fees, hiring additional accounting,

legal and administrative personnel, increased auditing and legal fees and

similar expenses.

Risks Relating to the

Clinical Testing, Regulatory Approval, Manufacturing

and Commercialization of Our

Product Candidates

We

may not obtain the necessary U.S. or worldwide regulatory approvals to

commercialize our product candidates.

We will

need FDA approval to commercialize our product candidates in the U.S. and

approvals from the FDA equivalent regulatory authorities in foreign

jurisdictions to commercialize our product candidates in those jurisdictions. In

order to obtain FDA approval of any of our product candidates, we must submit to

the FDA a new drug application, or NDA, demonstrating that the product candidate

is safe for humans and effective for its intended use. This demonstration

requires significant research and animal tests, which are referred to as

pre-clinical studies, as well as human tests, which are referred to as clinical

trials. Satisfaction of the FDA’s regulatory requirements typically takes many

years, depends upon the type, complexity and novelty of the product candidate

and requires substantial resources for research, development and testing. We

cannot predict whether our research and clinical approaches will result in drugs

that the FDA considers safe for humans and effective for indicated uses. The FDA

has substantial discretion in the drug approval process and may require us to

conduct additional pre-clinical and clinical testing or to perform

post-marketing studies. The approval process may also be delayed by changes in

government regulation, future legislation or administrative action or changes in

FDA policy that occur prior to or during our regulatory review. Delays in

obtaining regulatory approvals may:

|

|

·

|

delay

commercialization of, and our ability to derive product revenues from, our

product candidates;

|

|

|

·

|

impose

costly procedures on us; or

|

|

|

·

|

diminish

any competitive advantages that we may otherwise

enjoy.

|

Even if

we comply with all FDA requests, the FDA may ultimately reject one or more of

our NDAs. We cannot be sure that we will ever obtain regulatory clearance for

our product candidates. Failure to obtain FDA approval of any of our product

candidates will severely undermine our business by reducing our number of

salable products and, therefore, corresponding product

revenues.

In

foreign jurisdictions, we must receive approval from the appropriate regulatory

authorities before we can commercialize our drugs. Foreign regulatory approval

processes generally include all of the risks associated with the FDA approval

procedures described above. We cannot assure that we will receive the approvals

necessary to commercialize our product candidate for sale outside the

U.S.

All of our

product candidates are in early stages of clinical trials, which are very

expensive and time-consuming. Any failure or delay in completing clinical trials

for our product candidates could harm our business.

All three

of our current product candidates are in early stages of development and will

require extensive clinical and other testing and analysis before we will be in a

position to consider seeking regulatory approval to sell such product

candidates. To date, we have only filed INDs for AR-67 and AR-42, which is

required in order to conduct clinical studies of a drug candidate. We do not

intend to file an IND for AR-12 until the first half of 2009.

Conducting

clinical trials is a lengthy, time consuming and very expensive process and the

results are inherently uncertain. The duration of clinical trials can vary

substantially according to the type, complexity, novelty and intended use of the

product candidate. We estimate that clinical trials of our product candidates

will take at least several years to complete. The completion of clinical trials

for our product candidates may be delayed or prevented by many factors,

including:

|

|

·

|

delays

in patient enrollment, and variability in the number and types of patients

available for clinical trials;

|

|

|

·

|

difficulty

in maintaining contact with patients after treatment, resulting in

incomplete data;

|

|

|

·

|

poor

effectiveness of product candidates during clinical

trials;

|

|

|

·

|

safety

issues, side effects, or other adverse

events;

|

|

|

·

|

results

that do not demonstrate the safety or effectiveness of the product

candidates;

|

|

|

·

|

governmental

or regulatory delays and changes in regulatory requirements, policy and

guidelines; and

|

|

|

·

|

varying

interpretation of data by the FDA.

|

In

conducting clinical trials, we may fail to establish the effectiveness of a

compound for the targeted indication or discover that it is unsafe due to

unforeseen side effects or other reasons. Even if our clinical trials are

commenced and completed as planned, their results may not support our product

candidate claims. Further, failure of product candidate development can occur at

any stage of the clinical trials, or even thereafter, and we could encounter

problems that cause us to abandon or repeat clinical trials. These problems

could interrupt, delay or halt clinical trials for our product candidates and

could result in FDA, or other regulatory authorities, delaying approval of our

product candidates for any or all indications. The results from pre-clinical

testing and prior clinical trials may not be predictive of results obtained in

later or other larger clinical trials. A number of companies in the

pharmaceutical industry have suffered significant setbacks in clinical trials,

even in advanced clinical trials after showing promising results in earlier

clinical trials. Our failure to adequately demonstrate the safety and

effectiveness of any of our product candidates will prevent us from receiving

regulatory approval to market these product candidates and will negatively

impact our business. In addition, we or the FDA may suspend or curtail our

clinical trials at any time if it appears that we are exposing participants to

unacceptable health risks or if the FDA finds deficiencies in the conduct of

these clinical trials or in the composition, manufacture or administration of

the product candidates. Accordingly, we cannot predict with any certainty when

or if we will ever be in a position to submit a new drug application, or NDA,

for any of our product candidates, or whether any such NDA would ever be

approved.

Our

products use novel alternative technologies and therapeutic approaches, which

have not been widely studied.

Our

product development efforts focus on novel therapeutic approaches and

technologies that have not been widely studied. These approaches and

technologies may not be successful. We are applying these approaches and

technologies in our attempt to discover new treatments for conditions that are

also the subject of research and development efforts of many other

companies.

Physicians

and patients may not accept and use our drugs.

Even if

the FDA approves our product candidates, physicians and patients may not accept

and use them. Acceptance and use of our product will depend upon a number of

factors including:

|

|

·

|

perceptions

by members of the health care community, including physicians, about the

safety and effectiveness of our

drugs;

|

|

|

·

|

cost-effectiveness

of our products relative to competing

products;

|

|

|

·

|

availability

of reimbursement for our products from government or other healthcare

payers; and

|

|

|

·

|

effectiveness

of marketing and distribution efforts by us and our licensees and

distributors, if any.

|

Because

we expect sales of our current product candidates, if approved, to generate

substantially all of our product revenues for the foreseeable future, the

failure of any of these drugs to find market acceptance would harm our business

and could require us to seek additional financing.

Because we are

dependent on clinical research institutions and other contractors for clinical

testing and for research and development activities, the results of our clinical

trials and such research activities are, to a certain extent, beyond our

control.

We depend

upon independent investigators and collaborators, such as universities and

medical institutions, to conduct our pre-clinical and clinical trials under

agreements with us. These parties are not our employees and we cannot control

the amount or timing of resources that they devote to our programs. These

investigators may not assign as great a priority to our programs or pursue them

as diligently as we would if we were undertaking such programs ourselves. If

outside collaborators fail to devote sufficient time and resources to our drug

development programs, or if their performance is substandard, the approval of

our FDA applications, if any, and our introduction of new drugs, if any, will be

delayed. These collaborators may also have relationships with other commercial

entities, some of whom may compete with us. If our collaborators assist our

competitors at our expense, our competitive position would be

harmed.

Our reliance on

third parties to formulate and manufacture our product candidates exposes us to

a number of risks that may delay the development, regulatory approval and

commercialization of our products or result in higher product

costs.

We have

no experience in drug formulation or manufacturing and do not intend to

establish our own manufacturing facilities. We lack the resources and expertise

to formulate or manufacture our own product candidates. Instead, we will

contract with one or more manufacturers to manufacture, supply, store and

distribute drug supplies for our clinical trials. If any of our product

candidates receive FDA approval, we will rely on one or more third-party

contractors to manufacture our drugs. Our anticipated future reliance on a

limited number of third-party manufacturers exposes us to the following

risks:

|

|

·

|

We

may be unable to identify manufacturers on acceptable terms or at all

because the number of potential manufacturers is limited and the FDA must

approve any replacement contractor. This approval would require new

testing and compliance inspections. In addition, a new manufacturer would

have to be educated in, or develop substantially equivalent processes for,

production of our products after receipt of FDA approval, if

any.

|

|

|

·

|

Our

third-party manufacturers might be unable to formulate and manufacture our

drugs in the volume and of the quality required to meet our clinical

and/or commercial needs, if any.

|

|

|

·

|

Our

future contract manufacturers may not perform as agreed or may not remain

in the contract manufacturing business for the time required to supply our

clinical trials or to successfully produce, store and distribute our

products.

|

|

|

·

|

Drug

manufacturers are subject to ongoing periodic unannounced inspection by

the FDA and corresponding state agencies to ensure strict compliance with

good manufacturing practice and other government regulations and

corresponding foreign standards. We do not have control over third-party

manufacturers’ compliance with these regulations and standards, but we

will be ultimately responsible for any of their

failures.

|

|

|

·

|

If

any third-party manufacturer makes improvements in the manufacturing

process for our products, we may not own, or may have to share, the

intellectual property rights to the innovation. This may prohibit us from

seeking alternative or additional manufacturers for our

products.

|

Each of

these risks could delay our clinical trials, the approval, if any, of our

product candidates by the FDA, or the commercialization of our product

candidates or result in higher costs or deprive us of potential product

revenues.

We

have no experience selling, marketing or distributing products and no internal

capability to do so.

We

currently have no sales, marketing or distribution capabilities. We do not

anticipate having resources in the foreseeable future to allocate to the sales

and marketing of our proposed products. Our future success depends, in part, on

our ability to enter into and maintain sales and marketing collaborative

relationships, the collaborator’s strategic interest in the products under

development and such collaborator’s ability to successfully market and sell any

such products. We intend to pursue collaborative arrangements regarding the

sales and marketing of our products, however, there can be no assurance that we

will be able to establish or maintain such collaborative arrangements, or if

able to do so, that they will have effective sales forces. To the extent that we

decide not to, or are unable to, enter into collaborative arrangements with

respect to the sales and marketing of our proposed products, significant capital

expenditures, management resources and time will be required to establish and

develop an in-house marketing and sales force with technical expertise. There

can also be no assurance that we will be able to establish or maintain

relationships with third-party collaborators or develop in-house sales and

distribution capabilities. To the extent that we depend on third parties for

marketing and distribution, any revenues we receive will depend upon the efforts

of such third parties, and there can be no assurance that such efforts will be

successful. In addition, there can also be no assurance that we will be able to

market and sell our products in the U.S. or overseas.

If

we cannot compete successfully for market share against other drug companies, we

may not achieve sufficient product revenues and our business will

suffer.

The

market for our product candidates is characterized by intense competition and

rapid technological advances. If our product candidates receive FDA approval,

they will compete with a number of existing and future drugs and therapies

developed, manufactured and marketed by others. Existing or future competing

products may provide greater therapeutic convenience or clinical or other

benefits for a specific indication than our products, or may offer comparable

performance at a lower cost. If our products fail to capture and maintain market

share, we may not achieve sufficient product revenues and our business will

suffer.

We will

compete against fully integrated pharmaceutical companies and smaller companies

that are collaborating with larger pharmaceutical companies, academic

institutions, government agencies and other public and private research

organizations. Many of these competitors have technologies already approved or

in development. In addition, many of these competitors, either alone or together

with their collaborative partners, operate larger research and development

programs and have substantially greater financial resources than we do, as well

as significantly greater experience in:

|

|

·

|

undertaking

pre-clinical testing and human clinical

trials;

|

|

|

·

|

obtaining

FDA and other regulatory approvals of

drugs;

|

|

|

·

|

formulating

and manufacturing drugs; and

|

|

|

·

|

launching,

marketing and selling drugs.

|

Developments by

competitors may render our products or technologies obsolete or

non-competitive

.

The

biotechnology and pharmaceutical industries are intensely competitive and

subject to rapid and significant technological change. The drugs that we are

attempting to develop will have to compete with existing therapies. In addition,

a large number of companies are pursuing the development of pharmaceuticals that

target the same diseases and conditions that we are targeting. We face

competition from pharmaceutical and biotechnology companies in the U.S. and

abroad. In addition, companies pursuing different but related fields represent

substantial competition. Many of these organizations competing with us have

substantially greater capital resources, larger research and development staffs

and facilities, longer drug development history in obtaining regulatory

approvals and greater manufacturing and marketing capabilities than we do. These

organizations also compete with us to attract qualified personnel and parties

for acquisitions, joint ventures or other collaborations.

Our

ability to generate product revenues will be diminished if our drugs sell for

inadequate prices or patients are unable to obtain adequate levels of

reimbursement.

Our

ability to commercialize our drugs, alone or with collaborators, will depend in

part on the extent to which reimbursement will be available from:

|

|

·

|

government

and health administration

authorities;

|

|

|

·

|

private

health maintenance organizations and health insurers;

and

|

|

|

·

|

other

healthcare payers.

|

Significant

uncertainty exists as to the reimbursement status of newly approved healthcare

products. Healthcare payers, including Medicare, are challenging the prices

charged for medical products and services. Government and other healthcare

payers increasingly attempt to contain healthcare costs by limiting both

coverage and the level of reimbursement for drugs. Even if our product

candidates are approved by the FDA, insurance coverage may not be available, and

reimbursement levels may be inadequate, to cover our drugs. If government and

other healthcare payers do not provide adequate coverage and reimbursement

levels for any of our products, once approved, market acceptance of our products

could be reduced.

We

may be exposed to liability claims associated with the use of hazardous

materials and chemicals.

Our

research and development activities may involve the controlled use of hazardous

materials and chemicals. Although we believe that our safety procedures for

using, storing, handling and disposing of these materials comply with federal,

state and local laws and regulations, we cannot completely eliminate the risk of

accidental injury or contamination from these materials. In the event of such an

accident, we could be held liable for any resulting damages and any liability

could materially adversely effect our business, financial condition and results

of operations. In addition, the federal, state and local laws and regulations

governing the use, manufacture, storage, handling and disposal of hazardous or

radioactive materials and waste products may require us to incur substantial

compliance costs that could materially adversely affect our business, financial

condition and results of operations.

Risks Relating to Our

Intellectual Property

If

we fail to protect or enforce our intellectual property rights adequately or

secure rights to patents of others, the value of our intellectual property

rights would diminish.

Our

success, competitive position and future revenues will depend in part on our

ability and the abilities of our licensors to obtain and maintain patent

protection for our products, methods, processes and other technologies, to

preserve our trade secrets, to prevent third parties from infringing on our

proprietary rights and to operate without infringing upon the proprietary rights

of third parties. Additionally, if any third-party manufacturer makes

improvements in the manufacturing process for our products, we may not own, or

may have to share, the intellectual property rights to the

innovation.

To date,

we hold certain exclusive rights under U.S. patents and patent applications as

well as rights under foreign patent applications. We anticipate filing

additional patent applications both in the U.S. and in other countries, as

appropriate. However, we cannot predict:

|

|

·

|

the

degree and range of protection any patents will afford us against

competitors including whether third parties will find ways to invalidate

or otherwise circumvent our

patents;

|

|

|

·

|

if

and when patents will issue;

|

|

|

·

|

whether

or not others will obtain patents claiming aspects similar to those

covered by our patents and patent applications;

or

|

|

|

·

|

whether

we will need to initiate litigation or administrative proceedings which

may be costly whether we win or

lose.

|

If

any of our trade secrets, know-how or other proprietary information is

disclosed, the value of our trade secrets, know-how and other proprietary rights

would be significantly impaired and our business and competitive position would

suffer.

Our

success also depends upon the skills, knowledge and experience of our scientific

and technical personnel, our consultants and advisors as well as our licensors

and contractors. To help protect our proprietary know-how and our inventions for

which patents may be unobtainable or difficult to obtain, we rely on trade

secret protection and confidentiality agreements. To this end, we require all of

our employees, consultants, advisors and contractors to enter into agreements

which prohibit the disclosure of confidential information and, where applicable,

require disclosure and assignment to us of the ideas, developments, discoveries

and inventions important to our business. These agreements may not provide

adequate protection for our trade secrets, know-how or other proprietary

information in the event of any unauthorized use or disclosure or the lawful

development by others of such information. If any of our trade secrets, know-how

or other proprietary information is disclosed, the value of our trade secrets,

know-how and other proprietary rights would be significantly impaired and our

business and competitive position would suffer.

If

we infringe upon the rights of third parties we could be prevented from selling

products, forced to pay damages, and defend against litigation.

If our

products, methods, processes and other technologies infringe upon the

proprietary rights of other parties, we could incur substantial costs and we may

have to:

|

|

·

|

obtain

licenses, which may not be available on commercially reasonable terms, if

at all;

|

|

|

·

|

redesign

our products or processes to avoid

infringement;

|

|

|

·

|

stop

using the subject matter claimed in the patents held by

others;

|

|

|

·

|

defend

litigation or administrative proceedings which may be costly whether we

win or lose, and which could result in a substantial diversion of our

valuable management resources.

|

If

requirements under our license agreements are not met, we could suffer

significant harm, including losing rights to our products.

We depend

on licensing agreements with third parties to maintain the intellectual property

rights to our products under development. Presently, we have licensed rights

from the University of Pittsburgh and The Ohio State University Research

Foundation. These agreements require us and our licensors to perform certain

obligations that affect our rights under these licensing agreements. All of

these agreements last either throughout the life of the patents, or with respect

to other licensed technology, for a number of years after the first commercial

sale of the relevant product.

In

addition, we are responsible for the cost of filing and prosecuting certain

patent applications and maintaining certain issued patents licensed to us. If we

do not meet our obligations under our license agreements in a timely manner, we

could lose the rights to our proprietary technology.

Finally,

we may be required to obtain licenses to patents or other proprietary rights of

third parties in connection with the development and use of our products and

technologies. Licenses required under any such patents or proprietary rights

might not be made available on terms acceptable to us, if at all.

Risks Relating to Our

Securities

We

cannot assure you that our common stock will ever be listed on NASDAQ or any

other securities exchange.

Our

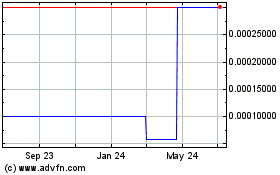

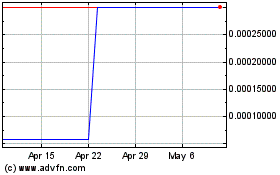

common stock trades on the OTC Bulletin Board. Stocks traded on the OTC Bulletin

Board and other electronic over-the-counter markets are often less liquid than

stocks traded on national securities exchanges. In fact, the historical trading

of our common stock has been extremely limited and sporadic. We plan to seek

listing on NASDAQ or the American Stock Exchange in the future, but we cannot

assure you that we will be able to meet the initial listing standards of either

of those or any other stock exchange, or that we will be able to maintain a

listing of our common stock on either of those or any other stock exchange. To

the extent that our common stock is not traded on a national securities

exchange, such as NASDAQ, the decreased liquidity of our common stock may make

it more difficult to sell your shares at desirable times and at

prices.

Our

common stock is considered a “ penny stock.”

The SEC

has adopted regulations which generally define a “penny stock” to be an equity

security that has a market price of less than $5.00 per share, subject to

specific exemptions. Since trading of our common stock commenced on the OTC

Bulletin Board, the market price has been below $5.00 per share. Therefore, our

common stock is deemed a “penny stock” according to SEC rules. This designation

requires any broker or dealer selling these securities to disclose certain

information concerning the transaction, obtain a written agreement from the

purchaser and determine that the purchaser is reasonably suitable to purchase

the securities. These rules may restrict the ability of brokers or dealers to

sell shares of our common stock.

Because

we became public by means of a reverse merger, we may not be able to attract the

attention of major brokerage firms.

Additional

risks may exist since we became public through a “reverse merger.” Security

analysts of major brokerage firms may not provide coverage of us since there is

no incentive to brokerage firms to recommend the purchase of our common stock.

No assurance can be given that brokerage firms will want to conduct any

secondary offerings on behalf of our company in the future. The lack of such

analyst coverage may decrease the public demand for our common stock, making it

more difficult for you to resell your shares when you deem

appropriate.

Because

we do not expect to pay dividends, you will not realize any income from an

investment in our common stock unless and until you sell your shares at

profit.

We have

never paid dividends on our common stock and do not anticipate paying any

dividends for the foreseeable future. You should not rely on an investment in

our common stock if you require dividend income. Further, you will only realize

income on an investment in our shares in the event you sell or otherwise dispose

of your shares at a price higher than the price you paid for your shares. Such a

gain would result only from an increase in the market price of our common stock,

which is uncertain and unpredictable.

There

may be issuances of shares of blank check preferred stock in the

future.

Our

certificate of incorporation authorizes the issuance of up to 20,000,000 shares

of preferred stock, none of which are issued or currently outstanding. Our board

of directors will have the authority to fix and determine the relative rights

and preferences of preferred shares, as well as the authority to issue such

shares, without further stockholder approval. As a result, our board of

directors could authorize the issuance of a series of preferred stock that is

senior to our common stock and that would grant to holders preferred rights to

our assets upon liquidation, the right to receive dividends, additional

registration rights, anti-dilution protection, the right to the redemption to

such shares, together with other rights, none of which will be afforded holders

of our common stock.

If our results do

not meet analysts’ forecasts and expectations, our stock price could

decline.

In the

future, analysts who cover our business and operations may provide valuations

regarding our stock price and make recommendations whether to buy, hold or sell

our stock. Our stock price may be dependent upon such valuations and

recommendations. Analysts’ valuations and recommendations are based primarily on

our reported results and their forecasts and expectations concerning our future

results regarding, for example, expenses, revenues, clinical trials, regulatory

marketing approvals and competition. Our future results are subject to

substantial uncertainty, and we may fail to meet or exceed analysts’ forecasts

and expectations as a result of a number of factors, including those discussed

above under the sections “

Risks Relating to Our

Business

” and “

Risks

Relating to the Clinical Testing, Regulatory Approval, Manufacturing and

Commercialization of Our Product Candidates.

” If our results do not meet

analysts’ forecasts and expectations, our stock price could decline as a result

of analysts lowering their valuations and recommendations or

otherwise.

We

are at risk of securities class action litigation.

In the

past, securities class action litigation has often been brought against a

company following a decline in the market price of its securities. This risk is

especially relevant for us because biotechnology companies have experienced

greater than average stock price volatility in recent years. If we faced such

litigation, it could result in substantial costs and a diversion of our

management’s attention and resources, which could harm our

business.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, or the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or

the Exchange Act. The forward-looking statements are only predictions and

provide our current expectations or forecasts of future events and financial

performance and may be identified by the use of forward-looking terminology,

including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,”

“intends,” “may,” “will” or “should” or, in each case, their negative, or other

variations or comparable terminology, though the absence of these words does not

necessarily mean that a statement is not forward-looking. Forward-looking

statements include all matters that are not historical facts and include,

without limitation, statements concerning our business strategy, outlook,

objectives, future milestones, plans, intentions, goals, future financial

conditions, our research and development programs and planning for and timing of

any clinical trials, the possibility, timing and outcome of submitting

regulatory filings for our product candidates under development, research and

development of particular drug products, the development of financial, clinical,

manufacturing and marketing plans related to the potential approval and

commercialization of our drug products, and the period of time for which our

existing resources will enable us to fund our operations.

Forward-looking

statements are subject to many risks and uncertainties that could cause our

actual results to differ materially from any future results expressed or implied

by the forward-looking statements. Examples of the risks and

uncertainties include, but are not limited to:

|

|

·

|

the

risk that recurring losses, negative cash flows and the inability to raise

additional capital could threaten our ability to continue as a going

concern;

|

|

|

·

|

the

risk that we may not successfully develop and market our product

candidates, and even if we do, we may not become

profitable;

|

|

|

·

|

risks

relating to the progress of our research and

development;

|

|

|

·

|

risks

relating to significant, time-consuming and costly research and

development efforts, including pre-clinical studies, clinical trials and

testing, and the risk that clinical trials of our product candidates may

be delayed, halted or fail;

|

|

|

·

|

risks

relating to the rigorous regulatory approval process required for any

products that we may develop independently, with our development partners

or in connection with any collaboration

arrangements;

|

|

|

·

|

the

risk that changes in the national or international political and

regulatory environment may make it more difficult to gain FDA or other

regulatory approval of our drug product

candidates;

|

|

|

·

|

risks

that the FDA or other regulatory authorities may not accept any

applications we file;

|

|

|

·

|

risks

that the FDA or other regulatory authorities may withhold or delay

consideration of any applications that we file or limit such applications

to particular indications or apply other label

limitations;

|

|

|

·

|

risks

that, after acceptance and review of applications that we file, the FDA or

other regulatory authorities will not approve the marketing and sale of

our drug product candidates;

|

|

|

·

|

risks

relating to our drug manufacturing operations, including those of our

third-party suppliers and contract

manufacturers;

|

|

|

·

|

risks

relating to the ability of our development partners and third-party

suppliers of materials, drug substance and related components to provide

us with adequate supplies and expertise to support manufacture of drug

product for initiation and completion of our clinical

studies;

|

|

|

·

|

risks

relating to the transfer of our manufacturing technology to third-party

contract manufacturers; and

|

|

|

·

|

other

risks and uncertainties detailed in “

Risk

Factors

.”

|

Pharmaceutical

and biotechnology companies have suffered significant setbacks in advanced

clinical trials, even after obtaining promising earlier trial

results. Data obtained from such clinical trials are susceptible to

varying interpretations, which could delay, limit or prevent regulatory

approval. Except to the extent required by applicable laws or rules,

we do not undertake to update any forward-looking statements or to publicly

announce revisions to any of our forward-looking statements, whether resulting

from new information, future events or otherwise.

USE

OF PROCEEDS

We will

receive none of the proceeds from the sale of the shares by the selling

stockholders, except for the warrant exercise price upon exercise of the

warrants, which would be used for working capital and other general corporate

purposes.

SELLING

STOCKHOLDERS

This

prospectus covers the resale by the selling stockholders identified below of

10,562,921 shares of common stock, including 196,189 shares issuable upon the

exercise of outstanding warrants. Of the total number of shares offered hereby,

7,360,689 shares were issued to the investors in our June 2008 private

placement, and 2,158,527 shares (including the shares issuable upon the

exercise of outstanding warrants) were issued to the former holders of our 6%

convertible promissory notes, which converted into shares of our common stock

and warrants upon the completion of our June 2008 private placement. The

following table sets forth the number of shares of our common stock beneficially

owned by the selling stockholders as of March 31, 2009 and after giving effect

to this offering, except as otherwise referenced below.

|

Selling

Stockholder

|

|

|

Shares

beneficially

owned before

offering (1)

|

|

|

|

Number of

outstanding

shares offered

by selling

stockholder

|

|

|

|

Number of

shares offered

by selling

stockholder

upon exercise

of warrants

|

|

|

|

Percentage

beneficial

ownership

after

offering(1)

|

|

|

Securities issued

in June 2008 private placement

|

|

2739-1291

Quebec Inc. (2a)

|

|

|

10,317

|

|

|

|

10,317

|

|

|

|

-

|

|

|

|

-

|

|

|

3071341

Canada Inc. (2b)

|

|

|

41,277

|

|

|

|

41,277

|

|

|

|

-

|

|

|

|

-

|

|

|

4210573

Canada Inc. (2c)

|

|

|

20,637

|

|

|

|

20,637

|

|

|

|

-

|

|

|

|

-

|

|

|

87111

Canada Limited (2c)

|

|

|

61,916

|

|

|

|

61,916

|

|

|

|

-

|

|

|

|

-

|

|

|

A.

Lapidot Pharmaceuticals Ltd. (3)

|

|

|

95,690

|

|

|

|

41,277

|

|

|

|

-

|

|

|

|

-

|

|

|

Allen

Rubin

|

|

|

10,317

|

|

|

|

10,317

|

|

|

|

-

|

|

|

|