SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

| AMERICAN CANNABIS COMPANY, INC. |

(Name of

Issuer)

|

| Common

Stock, par value $0.00001 per share |

(Title

of Class of Securities)

|

| 024870107 |

(CUSIP

Number)

Corey Hollister

American Cannabis Company, Inc.

3457 Ringsby Court, Unit 111

Denver, Colorado 80216-4900

(720) 466-3789

Copy to:

|

Peter

J. Gennuso, Esq.

Thompson Hine LLP

335 Madison Avenue, 12th Floor

New York, NY 10017

(212) 908-3958 |

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| May

23, 2014 |

| (Date of

Event Which Requires Filing of this Statement) |

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

_______________

* The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME

OF REPORTING PERSON

Corey A. Hollister |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b) n |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

OO |

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA |

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

12,684,251 |

| 8 |

SHARED

VOTING POWER 0 |

| 9 |

SOLE

DISPOSITIVE POWER

12,684,251 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

12,684,251 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

31.38% (1) |

|

| 14 |

TYPE

OF REPORTING PERSON

IN |

|

| |

|

|

|

|

_________________

(1) Based on the 40,425,000 shares of Common Stock reported by

the Company as outstanding as of the Effective Date in its Current Report on Form 8-K filed with the SEC on October 3, 2014.

Item 1. Security and Issuer.

This Statement relates to the Common Stock,

par value $0.00001 per share (the “Common Stock”), of American Cannabis Company, Inc., a Delaware corporation (the

“Company”). The Company reports that its principal executive offices are located at 3457 Ringsby Court, Unit 111,

Denver, Colorado 80216.

Item 2. Identity and Background.

(a) This Statement

is filed by Corey James Ariel Hollister (“Mr. Hollister”), who serves as the Chief Executive Officer and as a director

of the Company.

(b) The business

addresses of Mr. Hollister, who serves as an officer and director of the Company as noted above, is 3457 Ringsby Court, Unit 111,

Denver, Colorado 80216.

(c) Mr. Hollister

has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(d) Mr. Hollister

has not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(e) Mr. Hollister

is a citizen of the United States of America.

Item 3. Source and Amount of Funds or Other Consideration.

Mr. Hollister obtained all shares of

Common Stock held by him pursuant to the Agreement and Plan of Merger dated May 15, 2014 (the “Merger Agreement”)

by and among the Company, Cannamerica, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger

Sub”), and Hollister & Blacksmith, Inc. d/b/a American Cannabis Consulting, Inc., a Colorado corporation (“ACC”).

Pursuant to the Merger Agreement, Merger Sub was merged with and into ACC through a reverse triangular merger transaction (the

“Merger”). Prior to entering into the Merger Agreement, there was no relationship between the Company or its affiliates

and ACC, other than in respect of the Merger Agreement and the transactions contemplated thereby.

As of the date of the Merger Agreement, 10,000

shares of ACC’s common stock, par value $0.001 per share, were issued and outstanding. Mr. Hollister held 4,000 shares of

ACC’s common stock. Pursuant to the terms of the Merger Agreement, each share of ACC’s common stock was to be exchanged

for shares of the Company’s Common Stock based on a ratio of 3,171.0628 to 1. On May 23, 2014 and pursuant to the effectiveness

of the Merger, the Company issued 12,684,251 shares of Common Stock to Mr. Hollister, in exchange for all of his shares of ACC’s

common stock.

On September 29, 2014 (the “Effective Date”), all of the

transactions contemplated by the Merger Agreement were complete, and the Merger became effective upon the filing of certificates

of merger with the Secretary of State of the States of Delaware and Colorado. Pursuant to the terms of the Merger Agreement and

as of the Effective Date, each share of the common stock of Merger Sub was converted into and exchanged for one share of common

stock of ACC held by the Company, ACC continued as a surviving wholly-owned subsidiary of the Company and Merger Sub ceased to

exist.

The above summary of the Merger Agreement,

and the transactions contemplated thereby, does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the Merger Agreement, which is filed as Exhibit 99.1 hereto and incorporated herein by reference.

Except as noted above, no other funds or other

consideration were used in making any purchases of Common Stock by Mr. Hollister.

Item 4. Purpose of Transaction.

Mr. Hollister obtained

all shares of Common Stock held by him for the purpose of consummating the transactions contemplated by the Merger Agreement.

The Merger Agreement and the issuance of Common Stock to Mr. Hollister pursuant thereto, are discussed in more detail in Item

3 above, which information is hereby incorporated by reference into this Item 4.

The transactions described below were consummated

by the Company pursuant to or in relation to the Merger Agreement, and may reflect plans or proposals that would result in one

or more of the actions described in paragraphs (a) through (j) of Item 4 of Schedule 13D.

On May 16, 2014, the Company

entered into a Separation and Exchange Agreement (the “Separation Agreement”) between the Company, BIMI, Inc. (“BIMI”),

a Delaware corporation and wholly-owned subsidiary of the Company, and Brazil Investment Holding, LLC (“Holdings”),

a Delaware limited liability company and the majority stockholder of the Company, pursuant to which the Company distributed all

shares of common stock of BIMI held by the Company in exchange for all of the Company’s Common Stock held by Holdings. As

of the date of the Separation Agreement, Holdings held 35,000,000 shares of the Company’s Common Stock, which represented

approximately 77.30% of all issued and outstanding shares. Pursuant to the Separation Agreement, the Company distributed all 1,000,000

shares of common stock, par value $0.0001 per share, of BIMI held by the Company, which constituted all of the issued and outstanding

shares of BIMI, in exchange for all 35,000,000 shares of Common Stock held by Holdings. On May 21, 2015 (the “Separation

Exchange Date”), the Company returned all 35,000,000 shares of Common Stock received from Holdings into treasury. Pursuant

to the Separation Agreement, the Company effectuated a complete divestiture of BIMI.

The above summary

of the Separation Agreement, and the transactions contemplated thereby, does not purport to be complete and is subject to, and

qualified in its entirety by, the full text of the Separation Agreement, which is filed as Exhibit 99.2 hereto and incorporated

herein by reference.

In connection with

the Merger Agreement, Mr. Hollister was appointed to the Company’s board of directors (the “Board”) on April

30, 2014, and effective with the Merger Agreement, Mr. Hollister was appointed to serve as the Chief Executive Officer and Themistocles

Psomiadis resigned as Chief Executive Officer. On June 6, 2014, the Board appointed Ellis Smith to serve as the Chief Development

Officer and Anthony Baroud as the Chief Technology Officer.

On September 22,

2014, in connection with the Merger Agreement, Michael Novielli and Themistocles Psomiadis resigned from the Board, and the Board

appointed Messrs. Smith and Baroud to serve on the Board and fill the vacancies created by the resignations of Messrs. Novielli

and Psomiadis.

Also pursuant to

the Merger Agreement, the Company amended its Certificate of Incorporation to change its name from “Brazil Interactive Media,

Inc.” to “American Cannabis Company, Inc.” as of the Effective Date.

Prior to the consummation

of the transactions contemplated by the Merger Agreement and Separation Agreement, there were 45,279,114 shares of Common Stock

issued and outstanding. As of the Effective Date, following the consummation of all of the transactions contemplated by the Merger

Agreement and Separation Agreement, there were 40,425,000 shares of Common Stock issued and outstanding.

Additional information and disclosures concerning

the Merger Agreement, Separation Agreement, the change in control and any other transactions contemplated thereby, including detailed

financial, business, operational and management information, can be found in the Company’s Current Report on Form 8-K filed

with the SEC on October 3, 2014, the Company’s Information Statement on Schedule 14C filed with the SEC on September 9,

2014 and the Company’s Information Statement on Schedule 14f-1 filed with the SEC on September 10, 2014.

Mr. Hollister may

in the future determine to purchase more Common Stock and/or dispose of Common Stock of the Company in the ordinary course of

his investment activities, as market and other conditions dictate.

Item 5. Interest in Securities of the Issuer.

(a) Mr. Hollister beneficially

owns 12,684,251 shares of Common Stock, all held in his name, constituting 31.38% of all shares of Common Stock issued and outstanding

as of the Effective Date. Each percentage ownership of shares of Common Stock set forth in this Statement is based on the 40,425,000

shares of Common Stock reported by the Company as outstanding as of the Effective Date in its Current Report on Form 8-K filed

with the SEC on October 3, 2014.

(b) Mr. Hollister

has sole voting and dispositive power over all 12,684,251 shares of Common Stock held in his name.

(c) Not applicable.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

On May 2, 2014, Mr.

Hollister entered into a Lock-Up and Leak-Out Agreement with the Company (the “Lock-Up Agreement”), pursuant to which

he agreed to lock-up all of his shares of Common Stock for an initial period of twelve (12) months beginning on the date of the

Lock-Up Agreement (the “Lock-Up Period”). Following the Lock-Up Period, beginning on May 3, 2015 and for twelve (12)

month thereafter (the “Restricted Period”), Mr. Hollister may begin selling a percentage of his Common Stock in an

aggregate amount equal to a specified percentage of the total weekly volume of Common Stock, based on the price of Common Stock

in the open market at the time of sale.

During the Restricted Sale Period, if the price per share of

Common Stock is less than $0.50, Mr. Hollister may sell shares of Common Stock in the aggregate amount up to 2.719% of the

weekly volume of Common Stock. If the price per share of Common Stock is more than $0.50 and less than $0.75, Mr. Hollister

may sell shares of Common Stock in the aggregate amount up to 3.579% of the weekly volume of Common Stock. If the price per

share of Common Stock is more than $0.75 and less than $1.00, Mr. Hollister may sell shares of Common Stock in the aggregate

amount up to 4.438% of the weekly volume of Common Stock. If the price per share of Common Stock is more than $1.00, there is

no restriction on the amount of Common Stock that Mr. Hollister may sell. The number of shares of Common Stock that may be

sold by Mr. Hollister in any such scenario, if applicable, will be rounded up to the nearest one-hundred (100) shares.

A form of the Lock-Up Agreement is attached as Exhibit 99.3 hereto and is incorporated

herein by reference.

Except for the Lock-Up

Agreement, the Merger Agreement and the Separation Agreement, to the knowledge of Mr. Hollister, there are no contracts, arrangements,

understandings or relationships (legal or otherwise), including, but not limited to, transfer or voting of any of the securities,

finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or

loss, or the giving or withholding of proxies, between Mr. Hollister and any other person, with respect to any securities of the

Company, including any securities pledged or otherwise subject to a contingency the occurrence of which would give another person

voting power or investment power over such securities other than standard default and similar provisions contained in such agreements.

Item 7. Material to Be Filed as Exhibits.

The following documents are filed as exhibits:

| Exhibit No. |

Description |

| 99.1 |

Agreement and Plan of Merger, dated as of May

15, 2014, by and among the Company, Cannamerica, Inc., and Hollister & Blacksmith, Inc., filed as Exhibit 2.1 to the Company’s

Form 8-K filed with the SEC on October 3, 2014 and incorporated herein by reference. |

| 99.2 |

Separation and Exchange Agreement, dated as of

May 16, 2014, by and among the Company, BIMI, Inc., and Brazil Investment Holding, LLC, filed as Exhibit 2.2 to the Company’s

Form 8-K filed with the SEC on October 3, 2014 and incorporated herein by reference. |

| 99.3 |

Form of Lock-Up and Leak-Out Agreement between the Company and certain shareholders, filed herewith. |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth

in this statement is true, complete and correct.

Dated: October 22, 2014

/s/ Corey Hollister

Corey Hollister

LOCK-UP AND LEAK OUT AGREEMENT

This LOCK-UP AND LEAK-OUT AGREEMENT (the “Agreement”)

is made as of May 2, 2014 (the “Effective Date”) by and between Brazil Interactive Media, Inc., a Delaware

corporation, (the “Company”), and the undersigned holder of common stock (the “Stockholder”) of the Company.

WHEREAS, to ensure the development of

an orderly trading market in the Company’s common stock, the Company and the undersigned intend to enter into this

Agreement that provides the circumstances under which the undersigned may sell or otherwise dispose of shares of the Company’s

securities; and

NOW, THEREFORE, IN CONSIDERATION of

the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy

of which are hereby acknowledged, the Company and the undersigned Stockholder agree as follows:

1.

Twelve Month Prohibition on Sales or Transfers. The Stockholder, including the Stockholder’s Affiliated Entities

(as defined below), hereby agrees that for a period of twelve (12) months from the date of this Agreement (the “Lock-Up

Period”), the Stockholder will not offer, sell, contract to sell, pledge, give, donate, transfer or otherwise dispose of,

directly or indirectly, any shares of the common stock of the Company (the “Common Stock ”) or securities convertible

into or exercisable for Common Stock issued to the Stockholder (the “Lock-Up Shares”) or securities or rights convertible

into or exchangeable or exercisable for any Lock-Up Shares, enter into a transaction which would have the same effect, or enter

into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic or voting consequences of ownership

of such securities, whether any such aforementioned transaction is to be settled by delivery of the Lock-Up Shares or such other

securities, in cash or otherwise, or publicly disclose the intention to make any such offer, sale, pledge or disposition, or to

enter into any such transaction, swap, hedge or other arrangement (the “Lock-Up Agreement”). As used in this Agreement

“Affiliated Entities” shall mean any legal entity, including any corporation, limited liability company, partnership,

not-for-profit corporation, estate planning vehicle or trust, which is directly or indirectly owned or controlled by the Stockholder

or his or her descendants or spouse, of which such Stockholder or his or her descendants or spouse are beneficial owners, or which

is under joint control or ownership with any other person or entity subject to a lock-up agreement regarding the Common Stock

with terms substantially identical to this Agreement.

2. Restrictions on Sales;

Volume Limitations. Notwithstanding any federal or state securities laws or regulations governing insider stock sales which

supersede this Agreement, or the restrictions in Section 1. of this Agreement, any time after May 2, 2015 and during the twelve

(12) month period following the Lock-Up Period (“Leak-Out Period”), if the share price of the Common Stock (“Share

Price”) is less than fifty-cents ($0.50), the Stockholder shall have the right to effect open marketsales of his Common

Stock in an aggregate amount equal to 0.02719 multiplied by the total weekly volume, of the Common Stock (“Sellable

Shares”).

If during the Leak-Out Period,

the Share Price is greater than or equal to fifty cents ($0.50) but less than seventy-five cents ($0.75) per share, the Stockholder

shall have the right to effect open market sales of his Common Stock in an aggregate amount equal to 0.03579 multiplied

by the total weekly volume in the Common Stock, during such time that the Share Price is greater than or equal to fifty cents

($0.50) but less than seventy five-cents ($0.75).

If during the Leak-Out Period,

the Share price is greater than or equal to seventy-five cents ($0.75) but is less than one dollar ($1.00), the Holder shall have

the right to effect open market sales of his Common Stock in an aggregate amount equal to 0.04438 multiplied by

the total weekly volume in the Common Stock, only during that time the Share Price is greater than or equal to seventy five-cents

($0.75) but less than one dollar ($1.00).

If during the Leak-Out Period

the Share Price is greater than one dollar ($1.00), there shall be no limitations on the amount of Common Stock that may be sold

by the Stockholder, during such time the Share Price is greater than one dollar ($1.00).

The amount of Sellable Shares that may be sold pursuant to this

Section 2, shall rounded up or down, to the nearest one hundred (100) shares. Sellable Share amounts equaling less than one hundred

(100) shares shall be rounded up to equal one hundred shares.

By way of example only, if the

Stockholder’s multiplier is equal to 0.00055 when the share price is equal to or below sixty-cents ($0.60), and during one

week the share price and total volume of the Common Stock is equal to fifty-cents ($0.50) and one-hundred thousand (100,000) shares,

respectively, then the Stockholder shall apply his multiplier (0.00055) to one-hundred thousand (100,000) which generates a product

of 55 shares. Because the amount of shares is less than one-hundred (100), the Stockholder will be eligible to sell one-hundred

(100) shares during that week.

If during one week the share price

and total volume of the Common Stock is equal to fifty-cents ($0.50) and two-hundred thousand (200,000) shares, respectively,

then the Stockholder shall apply his multiplier (0.00055) to two-hundred thousand (200,000) which generates a product of one-hundred

and ten (110) shares. Because the amount of shares is greater than one-hundred (100), the Stockholder will be eligible to sell

only that amount which results from the application of the multiplier to the total volume of the Common Stock, which in this example,

is equal to one-hundred and ten (110) shares.

Sellable Share amounts are not

cumulative. If the Stockholder waives his rights at any time during the Leak-Out Period, pursuant to this Section 2 (“Waivable

Period”), the calculated Sellable Share amounts for those Waivable Periods, shall not be accrued and added to Sellable Shares

amounts, in a future period.

3. Application of this Agreement

to Shares Sold or Otherwise Transferred. So long as such sales or other Transfers are made in compliance with the requirements

of this Agreement, Lock-Up Shares sold in the public market shall thereafter not be subject to the restrictions on sale or other

Transfer contained in this Agreement. Lock-Up Shares sold or otherwise Transferred in private sales or other Transfers pursuant

to an Option shall thereafter not be subject to the restrictions on sale or other Transfer contained in this Agreement.

4. Attempted Transfers.

Any attempted or purported sale or other Transfer of any Lock-Up Shares by the Stockholder in violation or contravention of the

terms of this Agreement shall be null and void ab initio. The Company shall instruct its transfer agent to, reject and refuse

to transfer on its books any Lock-Up Shares that may have been attempted to be sold or otherwise Transferred in violation or contravention

of any of the provisions of this Agreement and shall not recognize any person or entity.

5. Broker and Account

Verification. The Stockholder agrees and consents to (i) effect sales of the Sellable Shares through a broker approved by

the Company’s board of directors, (ii) the entry of stop transfer instructions with the Company's transfer agent against

the transfer of the Securities held by the undersigned except in compliance with this Lock-Up and Leak-Out Agreement.

6. Broker Authorization.

The Stockholder hereby authorizes any and all brokers, for all accounts holding the Stockholder’s Lock-Up Shares and Sellable

Shares, to provide directly to the Company, immediately upon the Company’s request, a copy of all account statements showing

the Lock-Up Shares and Sellable Shares and all trading activity in the Sellable Shares during the Leak-Out Period.

7. Waiver of Claims. The

Stockholder hereby irrevocably waives any and all known or unknown claims and rights, whether direct or indirect, fixed or contingent,

that the Stockholder may now have or that may hereafter arise against the Company or any of its affiliates, or any of its respective

officers, directors, stockholders, employees, agents, attorneys or advisors arising out of the negotiation, documentation of this

Agreement.

8. Acknowledgement of

Representation. The Stockholder represents and warrants to the Company that the Stockholder was or had the opportunity to

be represented by legal counsel and other advisors selected by Stockholder in connection with this Agreement. The Stockholder

has reviewed this Agreement with his, her or its legal counsel and other advisors and understands the terms and conditions hereof.

9. Legends on Certificates. All Lock-Up Shares and Sellable

Shares now or hereafter owned by the Stockholder, except any shares purchased in open market transactions by Stockholders that

are not affiliates (as such term is defined under securities laws) of the Company, shall be subject to the provisions of this

Agreement and the certificates representing such Lock-Up Shares shall bear the following legends:

THE SECURITIES REPRESENTED

BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR

ANY STATE SECURITIES LAWS. THEY MAY NOT BE SOLD, ASSIGNED, PLEDGED OR OTHERWISE TRANSFERRED FOR VALUE UNLESS THEY ARE REGISTERED

UNDER THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS OR UNLESS THE CORPORATION RECEIVES AN OPINION OF COUNSEL SATISFACTORY TO

IT, OR OTHERWISE SATISFIES ITSELF, THAT AN EXEMPTION FROM REGISTRATION IS AVAILABLE.

THE SALE, ASSIGNMENT, GIFT,

BEQUEST, TRANSFER, DISTRIBUTION, PLEDGE, HYPOTHECATION OR OTHER ENCUMBRANCE OR DISPOSITION OF THE SHARES REPRESENTED

BY THIS CERTIFICATE IS RESTRICTED BY AND MAY BE MADE ONLY IN ACCORDANCE WITH THE TERMS OF A LOCK-UP AGREEMENT, A COPY OF WHICH

MAY BE EXAMINED AT THE OFFICE OF THE CORPORATION.

10. Governing Law; Venue.

This Agreement will be governed as to validity, interpretation, construction, effect and in all other respects by the laws of

the State of Colorado.

11. Binding Effect. This

Agreement will be binding upon and inure to the benefit of the Company, its successors and assigns and to the Stockholder

and their respective permitted heirs, personal representatives, successors and assigns.

12. Entire Understanding.

This Agreement sets forth the entire agreement and understanding of the parties hereto in respect of the subject matter hereof

and the transactions contemplated hereby and supersedes all prior written and oral agreements, arrangements and understandings

relating to the subject matter hereof. This Agreement may not be changed orally, but may only be changed by an agreement in writing

signed by the party against whom enforcement of any waiver, change, modification or discharge is sought.

13. Remedies. The parties

hereto acknowledge that money damages are not an adequate remedy for violations of this Agreement and that any party may, in such

party’s sole discretion, apply to any court of competent jurisdiction for specific performance or injunctive relief or such

other relief as such court may deem just and proper in order to enforce this Agreement or prevent any violation hereof and, to

the extent permitted by applicable law, each party hereto waives any objection to the imposition of such relief. All rights, powers

and remedies provided under this Agreement or otherwise available in respect hereof, whether at law or in equity, shall be cumulative

and not alternative, and the exercise or beginning of the exercise of any thereof by any party hereto shall not preclude the simultaneous

or later exercise of any other such right, power or remedy by such party.

14. Counterparts. This

Agreement may be executed by facsimile and in any number of counterparts, each of which shall be deemed to be an original, but

all of which together shall constitute one and the same instrument. Each counterpart may consist of a number of copies each signed

by less than all, but together signed by all, of the parties hereto.

IN WITNESS WHEREOF,

this Agreement has been signed as of the date first above written.

BRAZIL INTERACTIVE MEDIA,

INC.

By: _________________________________

Name: Themistocles Psomiadis

Title: Chief Executive Officer

IN WITNESS WHEREOF,

the undersigned have caused this Lock-Up Leak-Out Agreement to be duly executed by their respective authorized signatories as

of the date first indicated above.

| Name of Stockholder: |

|

| |

|

| Signature of Authorized Signatory of Stockholder: |

|

| |

|

| Name of Authorized Signatory: |

|

| |

|

| Title of Authorized Signatory: |

|

| |

|

| Telephone Number of Stockholder: |

|

| |

|

| Email Address of Stockholder: |

|

| |

|

| Facsimile Number of Stockholder: |

|

| |

|

| Address for Notice of Stockholder: |

|

| |

|

| Address for Delivery of Shares for Stockholder (if not same as address for notice): |

| |

STOCKHOLDER’S SPOUSE (if

and as applicable):

The undersigned

spouse of the Stockholder has read and hereby approves the foregoing Agreement and agrees to be irrevocably bound by the Agreement

and further agrees that any community property interest shall be similarly bound by the Agreement. I hereby irrevocably appoint

my spouse as my attorney-in-fact with respect to any amendment or exercise of any rights under the Agreement.

Signature: ______________________________________________________________________

Name: _________________________________________________________________________

Signature of Authorized Signatory of Spouse: ____________________________

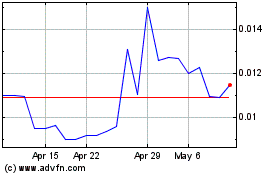

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From May 2024 to Jun 2024

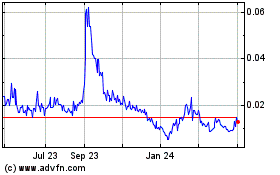

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jun 2023 to Jun 2024