UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

September 22, 2014

Date of Report (Date of earliest event reported)

BRAZIL INTERACTIVE MEDIA, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware |

|

000-26108 |

|

94-2901715 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

3457 Ringsby Court, Unit 111, Denver, Colorado

80216-4900

(Address of principal

executive offices) (Zip Code)

(720) 466-3789

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

This Current Report on Form 8-K contains

"forward-looking statements" which are not purely historical and include any statements regarding beliefs, plans, expectations

or intentions regarding the future. Such forward-looking statements include, among other things, the development, costs and results

of new business opportunities. Actual results could differ from those projected in any forward-looking statements due to numerous

factors. Such factors include, among others, the inherent uncertainties associated with new projects. These forward-looking statements

are made as of the date of this Current Report, and we assume no obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that any

beliefs, plans, expectations and intentions contained in this Current Report are reasonable, there can be no assurance that any

such beliefs, plans, expectations or intentions will prove to be accurate. For more information, please visit www.sec.gov.

Item 1.01

Entry Into a Material Definitive Agreement

On September 22, 2014, Brazil Interactive Media,

Inc., through its Hollister & Blacksmith (d/b/a American Cannabis Company) division (the “Company”), entered into

a Production and Distribution Agreement (the “Agreement”) with Coast of Main Organic Products Inc. (“COM”),

whereby COM will manufacture, blend and distribute the Company’s SoHum Living Soils™, which is a propriety formula

designed to provide time released macronutrients and micronutrients for use in medical-grade cannabis production. The Company will

sell SoHum Living Soils™ in retail bags and bulk sales to its current 500 retail clients.

Pursuant to the Agreement, COM will be the

Company’s exclusive manufacturer and non-exclusive distributor of the Company’s SoHum Living Soils™, providing

the Company with the full revenue stream on sales of its product. The Agreement will renew annually for five (5) years, and the

parties agree to use their best efforts to achieve increasing annual target sales, as further set forth in the Agreement.

In addition, the parties are bound by

mutual non-disclosure terms throughout the term of the Agreement, and for five (5) years after its termination. The Agreement

also provides that COM will not produce or sell any similar products under another label or distribution relationship during

the term of the Agreement and for two (2) years after its termination.

The foregoing summary of the Agreement and the transactions contemplated

thereby do not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement, which

is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 5.02

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On September 22, 2014, Michael Novielli

and Themistocles Psomiadis resigned from their positions as members of the board of directors of the Company. The resignations

were not for cause or due to any disagreement with the Company on any matter relating to the Company’s operations, policies

or practices. Also on September 22, 2014, the Company’s board of directors appointed Ellis Smith and Anthony Baroud to serve

as members of the board of directors, to fill the vacancies created by the resignations of Messrs. Novielli and Psomiadis.

On September 10, 2014, the Company filed

with the Securities and Exchange Commission and transmitted to our stockholders of record an Information Statement on

Schedule 14F-1, disclosing the anticipated change in majority control of our board of directors, including the biographical

information for Messrs. Smith and Baroud. The resignations of Messrs. Novielli and Psomiadis as directors of the Company, and the

election of Messrs. Smith and Baroud as directors of the Company, became effective no less than 10 days after the

Company filed the Information Statement on Schedule 14F-1.

Messrs. Smith and Baroud have no direct or

indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. There are no

family relationships among our directors and officers.

Item 8.01

Other Events

On September 25, 2014, the Company issued a

press release tilted, “American Cannabis Company Signs Licensing Manufacturing Agreement and Develops Strategy to Service

North America with its Proprietary SoHum Living Soils™”. A copy of the press release is filed as Exhibit 99.1

hereto and incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Brazil Interactive Media, Inc. |

|

| |

|

|

| Date: September 25, 2014 |

By: |

/s/ Corey Hollister |

|

|

|

Corey Hollister |

|

|

|

Chief Executive Officer |

|

|

|

|

|

EXHITBIT 10.1

PRODUCTION AND DISTRIBUTION AGREEMENT

COM’s Manufacture and Sale of Hollister

& Blacksmith Branded Soils and Related Matters

This will confirm the terms by which Coast

of Maine Organic Products, Inc. (“COM)” will manufacture at its Marion Township, ME production facility (the “Production

Facility”) and distribute certain Hollister & Blacksmith (“H&B”) branded Bulk, Bagged Soils, and Fertilizer

(the “Products”, as set forth in Exhibit A).

1. Role. H&B appoints COM as

its exclusive manufacturer and non-exclusive Distributor of these Products for the US and its territories. Products will be formulated

and manufactured in accordance with this agreement and distributed to both existing and prospective H&B Clients (as hereinafter

defined) and existing and prospective COM Customers (as hereinafter defined). The grant of rights by H&B is exclusive and COM

correspondingly agrees it will not, during the term of this agreement, and for a period of 2 years after termination hereof, produce

or sell the Products and/or products with recipes similar to the Products set forth in Exhibit A and defined below, either for

itself or under any existing or future private label and/or distribution relationship.

For purposes of this paragraph, a product shall

be deemed to be similar if it includes all of the ingredients set forth in Exhibit A and any one component is increased or decreased

by fifteen percent (15%) or less by volume.

H&B acknowledges and understands that COM

has an existing private label manufacturing and distribution contract with Master Nursery Garden Centers, Inc. (“MNGC”),

a co-operative buying association representing over 600 independent Dealers nationally, and that COM may and shall continue to

produce and sell both COM and MNGC-brand bagged soils and fertilizers (collectively “COM and MNGC Products”), including

but not limited to Stonington Blend, Lobster & Kelp Fertilizer and any new products COM may develop for sale to existing and

prospective COM Customers and MNGC members, so long as such COM and MNGC Products are not manufactured exclusively for the medical

cannabis market.

For purposes of this Agreement, the term “H&B

Clients” means licensed growers of medical cannabis, and the term “COM Customers” means distributors, wholesalers,

retailers, growers and end-users of lawn, garden, hydroponic and agricultural products and supplies.

2. Relationship. In all manufacturing

and distribution dealings under this agreement COM will act as an independent contractor (and not as agent, representative or any

other such relationship of H&B). Nothing in this Agreement affects the geographic area in which, or the customers to whom,

COM may sell COM and MNGC-branded products.

3. Products. The Products covered

by this Agreement fall within three categories, namely, (1) bulk soils packaged in bulk bags distributed to H&B Clients(“Bulk

Soils”), (2) bagged soils packaged in smaller pre-printed poly bags distributed to COM Customers (“Bagged Soils”)

and (3) fertilizers, packaged and bulk (“Fertilizers”). The Products will be formulated to H&B specifications (the

“Formulation”, as hereafter defined in Exhibit A) and no subsequent material change in the ingredients or Formulation

of any Product or its unit sizes or packaging will be made without the mutual consent and written approval of H&B and COM.

COM will use all reasonable efforts to produce, inventory and distribute the Products to meet the needs of H&B and will apprise

H&B of its sales and inventory levels of the Products on a monthly basis, in detail and format as H&B may reasonably request.

We mutually desire a transparent relationship, with continuous exchange of information and ideas, and in furtherance of this agreement

to meet at least twice per year for Product review (including possible additions to the line of Products), production and sales

planning, and other discussion. Product reviews will include possible new Products, and in this regard it is understood that COM

will have a right of first refusal to manufacture and distribute any new soil and/or fertilizer product H&B is interested in

for the Territory.

4. Supplies. H&B and COM will

each arrange for the provision of the raw materials, printed packaging components and other supplies (the “Supplies”)

as required to manufacture the Products and as set forth beneath their respective names as hereafter defined in Exhibit B. H&B

and COM further will ensure they meet the specifications and standards mutually agreed upon and more thoroughly described in the

Formulation as defined. Each party will pay its own costs to acquire these Supplies and deliver them to the Production Facility

in sufficient quantities and on a mutually acceptable schedule.

5. Minimum Annual Sales: The Parties

shall use their best efforts to achieve in the first year of this Agreement an annual minimum sales volume for Products, whether

sold by H&B or COM, of 1,250 (+/- 15%) cubic yards. Thereafter, the Parties shall be required to meet the following annual

minimum sales volumes of Products, whether sold by H&B or COM: 2500 (+/- 15%) cubic yards in year two; 3,750 (+/-15%) cubic

yards in year three, and 5,000 (+/-15%) cubic yards in years four and five. Both parties agree to use best efforts to achieve the

volumes set forth in this paragraph.

6. Services. COM agrees to arrange for the provision of

the following services for the prices set forth in Exhibit C:

A. Handling, unloading and storage of Supplies;

B. Provision of the Supplies for “COM to provide”

on Exhibit B;

C. Manufacture of finished Products as per Formulation

(as set forth on Exhibit A);

D. Packaging of Products at COM’s Production Facility;

and

E. Report Monthly inventory of poly

bags to H&B

COM shall also arrange for shipment

of finished Products, unless otherwise arranged by the H&B Client or H&B, and shall bill for such shipping services in

accordance with Section 8 hereof.

7. Supporting Activities. In the performance

of its duties, COM will provide knowledgeable customer service personnel to help answer H&B Client or Dealer questions or help

find solutions to problems and provide sales and marketing assistance to H&B Clients and Dealers within reasonable limits and

not to exceed 2 hours per week and as assisted by H&B as required.

8. H&B Sales of Products to Its Clients.

H&B will price, invoice and collect from H&B Clients supplied Products manufactured by COM. COM will pre-invoice H&B

prior to delivery of Product at a wholesale price previously agreed between COM and H&B (the “Bulk Price” as set

forth in Exhibit C). H&B further agrees to pay COM in good funds prior to the shipment of Product from COM’s Production

Facility. COM reserves the right to request an increase its pricing to H&B (a), if raw materials required for any of the Products

and supplied by a third party increase in cost or (b) with no less than sixty (60) days’ advance written notice to H&B,

for any reason COM deems appropriate. No such increase in pricing shall be effective without the prior written consent of H&B,

which consent shall not be unreasonably withheld, conditioned, delayed or denied. If COM is required to arrange and pay for transportation

to the H&B Client and quote a delivered price, it reserves the right to pass on all costs incurred (including but not limited

to fuel, drop and LTL surcharges, the cost of COM dispatch, etc.) in the transportation of the product upon the written approval

of H&B. All freight charges shall be invoiced to H&B as billed by the carrier, plus 10%. All freight charges shall be approved

by H&B in advance and in writing, and such approval shall not be unreasonably withheld, conditioned, delayed or denied. Services,

Supplies and Products not specified above (such as, but not limited to, travel to and attendance at recreational and medical marijuana

targeted trade shows and other such events, related advertising, booth fees, etc.) will be priced and invoiced separately, per

your and our mutual agreement. COM will obtain H&B’s written authorization prior to any such expenditure, which will

not be unreasonably withheld, conditioned, delayed or denied.

9. COM Sales of Products to Its Customers;

COM will use its best efforts to market the Product to existing and new COM Customers, and shall forward all such sales orders

to H&B for billing by H&B directly to the COM Customer. At such time, COM will pre-invoice H&B prior to delivery of

Product at the Bulk Price as set forth in Exhibit C. H&B further agrees to pay COM in good funds prior to the shipment of

Product from COM’s Production Facility. Services, Supplies and Products not specified above (such as but not limited to

travel to and attendance at recreational and medical marijuana targeted trade shows, other such events, related advertising, booth

fees, etc.) will be priced and invoiced separately, per your and our mutual agreement. COM will obtain H&B’s authorization

prior to any such expenditure, which will not be unreasonably withheld, conditioned, delayed or denied.

10. Product

Registration and Organic Listing Requirements. It is understood that some or all Bulk and Bagged Products will be required

to be registered with the appropriate state agencies wherever COM sells or intends to sell them. It is also understood that COM

and H&B may choose, by mutual consent, to list some or all of these Products as Organic with one or more National or State

Organic Listing Agencies (e.g. OMRI, MOFGA, NOFA, etc.). COM shall complete and maintain all such registration, licensing and/or

listing requirements on behalf of and in the name of H&B and H&B will have no obligations other than to provide information

as required for such applications. Any such disclosures of either or both ingredient suppliers and formulations will be covered

by a separately executed Confidentiality Agreements between COM, H&B and the appropriate registration, licensing or listing

agency, to the satisfaction of H&B. H&B will pay all related fees for Bulk and Bagged H&B brand Soil registration,

licensing and/or listing. H&B or H&B Clients will also be responsible for arranging for and paying for all permits relating

to the export of Products to Canada.

11. Testing. From time to time and

upon H&B’s written request, COM will provide to H&B finished products for testing and COM data from testing of raw

materials provided by COM. H&B and COM will also provide each other raw material and quality testing data as reasonably requested

by the other party, Material Safety Data Sheets (MSDS) and specifications for the Supplies

each supplies to the Facility.

12. Material and Packaging Inventories.

COM will purchase and maintain sufficient inventories of bulk, bagged and unbranded packaging materials as required by the Formulation.

H&B will purchase and cause to be delivered to COM H&B branded packaging materials (H&B Inventory) in predetermined

quantities and as per a schedule as agreed between the Parties. Please refer to 6 F for reporting details.

13. Forecasts, Purchase Orders & Product Changes.

| A. | Forecasts: 90 days prior to the commencement of each calendar quarter, H&B will provide to

COM a forecast and purchase orders for anticipated sales in that quarter of Products for shipment to H&B Clients. H&B will

also give COM semi-annual updates on non-binding forecasts, to enable COM to plan changes to packaging orders and production schedules

to better meet H&G’s requirements. |

| B. | Winter Inventory. Given COM’s limited production capabilities during the winter months, COM

will be required to accumulate sufficient finished Bulk Product inventory in the late fall to supply H&B Clients through the

winter. As in paragraph 8 above, these Products will be purchased by H&B as produced and either immediately delivered to H&B

Clients who will themselves maintain those winter inventories or pre-paid and held by H&B at a secure warehouse of H&B’s

choosing and at H&B’s expense. |

14. Laws/Regulations; Registrations.

COM will comply with all applicable laws and regulations relating to the manufacture and distribution of products hereunder and

upon H&B’s reasonable request will provide H&B with appropriate documentation confirming the same. In this connection:

| A. | H&B will provide to COM a list of each state or province in which H&B wishes each Product

subject to state or provincial registration requirements to be registered with the cognizant state or provincial authority. COM

will manage and H&B will pay for all costs and expenses related to any necessary registration in such states of the existing

Products. Any registration costs with respect to any subsequently introduced Product will be borne by H&B. |

| B. | We recognize the value of “organic” registrations/listings (e.g., OMRI, MOFGA, NOFA,

etc.) and wish to secure the same for the Products whenever commercially practical. Once a year (date to be determined by mutual

discussions), H&B will provide to COM a list of each certification body with which it wishes each H&B Product to be registered/listed

in the name of H&B. COM will manage any such registration/listing process, and the cost thereof will be paid by H&B. |

15. Rights, Intellctual Property Ownership

and Use. H&B will provide to COM a list of each state or province in which H&B wishes each Product subject to state

or provincial registration requirements to be registered with the cognizant state or provincial authority. COM will manage and

H&B will pay all costs and expenses related to any necessary registration in such states of the existing Products. Any registration

costs with respect to any subsequently introduced Product will be borne by H&B.

The parties acknowledge and agree that, notwithstanding

anything to the contrary set forth in this Agreement, COM may adopt and register the assumed name “Fog Island Company”

(or a substantially similar name should the proposed assumed name not be approved for registration by the Maine Secretary of State)(the

“Assumed Name”) and shall, at COM’s election and in lieu of its corporate name, use the Assumed Name on all product

packaging and containers for the Products.

In

furtherance of its responsibilities under this agreement, COM and H&B may use, for the duration of the Term of this Agreement,

each other’s trademarks, service marks, logos, and other commercial symbols (registered or unregistered) and copyrighted

or copyrightable works (collectively, the “Intellectual Property”), to market the Products, subject to COM’s

right to require that the Parties use only the Assumed Name and not COM’s corporate name on all product packaging

and containers as set forth above and, provided further, that all bags or other containers, and a representative

sample of any advertising, press releases or other publicity or

other promotional material is in advance of any use or publication submitted to the applicable party for its approval in writing,

which approval shall not be unreasonably withheld but which approval may be reasonably conditioned in order to protect such

party’s goodwill and its rights in such Intellectual Property. Subject to the foregoing, all

Product (including any subsequently added Product) brand names, symbols, bagging and other trade dress, or identifying material

of any sort whatsoever will be and remain the property of the respective Parties. The same will apply with respect to Product formulas

and, if permitted by applicable law or rules, any registrations, certifications, or the like.

16. Indemnifications. Each party

agrees to indemnify the other (and its directors, officers, and employees) against any claims, suits,

liabilities, or damages including amounts paid in settlement and legal fees and disbursements(“Claims”) arising out

of the indemnifying party’s performance or nonperformance of its obligations hereunder or any violations of applicable laws,

rules or regulations. Either party will promptly notify the other of any action or communication that may give rise to an obligation

of indemnification under this paragraph. The indemnifying party may control the defense of any Claim; however, no Claim

will be settled without the other party’s consent, which consent will not be unreasonably withheld.

17. Insurance. During the Term of

this agreement each party must maintain insurance and will cause the other to be named as an additional insured on its commercial

general liability policy/ies of insurance, which shall include a products liability endorsement. The limits of such insurance shall

not be less than $2,000,000 per claim and in the aggregate. Upon request either party will furnish the other with a certificate(s)

of insurance evidencing such coverage. These policies will provide for 60 day written notice to the additional insured party prior

to termination or expiration.

18. Term and Termination.

| A. | | Commencement and Renewal. Our relationship under this agreement will commence upon

mutual execution and continue until August 18, 2019 (the “Term”), at which time it will automatically renew annually

for an additional five years unless previously terminated by either party upon not less than 120 days prior written notice or

unless otherwise terminated in accordance with the terms hereof. |

| B. | | Termination. In addition to any other termination rights set forth in this Agreement,

either party may terminate this Agreement upon the occurrence of any of the following events: (i) any breach or default

by the other party of any of such defaulting party's covenants or obligations under this Agreement which is not cured within fifteen

(15) days after notice thereof; (ii) the bankruptcy, dissolution, termination, insolvency or similar circumstances of the other

party; (iii) the other party's attempted assignment or transfer of this Agreement or any of its rights hereunder; (iv) any of

the representations and warranties made by the other party in this Agreement were not true in any material respect when made or

would not be materially true if made on the date such performance would otherwise be due; or (v) any breach or violation of any

law or conviction of a crime. |

| C. | | No Limitation of Rights. The right to terminate this Agreement is in addition

to any other right set forth by the law and shall not replace such rights, and the exercise of one or more rights shall not be

interpreted as a waiver of any party’s ability to exercise another right(s). The failure by one of the parties to

exercise the right to terminate this Agreement shall not be interpreted as a limitation of the right of termination or other subsequent

right. |

| D. | | Upon termination by H&B, COM will, at the cost of H&B, ship all remaining

H&B Inventory to a destination specified by H&B. H&B will reimburse COM’s costs for all such Inventory of Products

and Supplies. |

19. Mutual Representations And Warranties.

Each party represents and warrants that (a) it has the power and authority to enter into this Agreement and has taken all necessary

corporate action to authorize its performance under this Agreement and to perform hereunder; (b) this Agreement, when executed

and delivered, will constitute a legal, valid and binding obligation of each such party, enforceable in accordance with its terms;

(c) no consent or authorization of, filing with, or notice to any governmental authority is required in connection with its performance

under this Agreement; and (d) its entering into this Agreement or performance by it hereunder will not violate any federal, state

or local licensing statute or any other applicable statute, law, rule or regulation, or any contractual obligation of such party.

Each party agrees to comply with all applicable laws, rules and regulations in connection with its activities under this Agreement.

20. Entire Agreement. This Agreement

and the Exhibits attached hereto sets forth the entire agreement between the parties relating to its subject matter, superseding

all prior discussions. No modification or any waiver will be effective unless in writing and signed by the party charged.

21. Confidentiality. Each party will

be bound by the Mutual Non-Disclosure Agreement dated February 25th, 2014 and incorporated herein as Exhibit F (the

“NDA”). The parties acknowledge and agree that (i) the Authorized Purpose under the NDA will include the transactions

and activities contemplated under this Agreement, (ii) each party’s respective obligations under the NDA will extend throughout

the Term of this Agreement and for 5 years thereafter as contemplated in Section 4 of the NDA; and (iii) the NDA shall be governed

by and construed in accordance with the laws of the State of Maine, and any and all disputes arising from the NDA shall be heard

by courts located in the State of Maine.

22. Notice. Any notice or other communication

required or permitted to be given under this Agreement, shall be in writing and shall be effective when actually delivered (in

the case of a fax, by a confirmed fax) or five (5) days from the date when deposited in the mail, registered or certified, addressed

to the parties at the addresses stated below in this Agreement or such other addresses as either party may designate by written

notice to the other. The parties’ respective notice addresses are:

Mr. Anthony Baroud

Chief Technology Officer

3457 Ringsby Court Suite #111

Denver, CO 80216

Mr. Carlos J. Quijano

President

4 Amy Lane

Cumberland Foreside, ME 04110

23. Lawful Performance. Both H&B and COM

will abide by all applicable laws and regulations in their activities relating to this Agreement. Either party shall promptly

notify the other if it reasonably believes the other party is not fulfilling this obligation

24. Force Majeure. COM and H&B may each

be excused from its obligations under the terms of this arrangement to the extent that such obligation is prevented or limited

by any reason beyond the reasonable control of the party affected, including governmental actions; natural catastrophes; strikes

or labor disputes; failure or reduction of sources of raw materials; power supplies or transportation.

25. Assignment. Except

as otherwise provided in this Agreement, neither party shall assign, transfer or sell its rights under this Agreement nor delegate

its duties hereunder without the prior written consent of the other party, and any attempt of assignment or delegation shall be

void and without effect. Any attempted assignment, transfer or delegation in violation of this Paragraph shall be null and void.

26. Informal Dispute

Resolution; Arbitration. In the case of disputes under this Agreement, the parties shall first attempt in good faith

to resolve their dispute informally, or by means of commercial mediation, without the necessity of a formal proceeding.

Any dispute arising in connection with this Agreement which is not resolved using any informal dispute resolution mechanism set

forth in this Agreement shall be finally settled under the rules of the American Arbitration Association by one arbitrator appointed

in accordance with said rules. The parties agree that a hearing before the arbitrator shall commence within 30 days after

the demand for arbitration is first given. Any putative arbitrator unable to commence hearing on such a dispute within 30

days shall be disqualified and the parties shall promptly choose an alternate arbitrator capable of commencing a hearing on the

dispute within 60 days of the initial demand. The place of arbitration shall be Portland, Maine. The arbitrator shall

determine the matters in dispute in accordance with the laws of the State of Maine.

27. Exhibits and Schedules. All agreements

and schedules set forth in the exhibits are incorporated by reference and made a part hereof as though fully set forth herein.

28. Counterparts. This Agreement may

be executed in two or more counterparts, including facsimile copies, each of which shall be deemed an original, but all of which

together shall constitute one and the same instrument.

29. Choice of Law. This Agreement shall

be governed by and construed in accordance with the laws of the State of Maine, excluding rules of conflicts of law.

30. Construction. Each of the parties

hereto acknowledges that each party has had sufficient time to seek legal counsel in connection with the preparation and execution

of this Agreement and that each party has thoroughly reviewed this Agreement and understands its terms. The rule of construction

that a written agreement is construed against the party preparing or drafting such agreement shall specifically not be applicable

to the interpretation of this Agreement.

31. Attorneys’ Fees. If any dispute

arises in connection with this Agreement, the prevailing party shall be entitled to reasonable attorneys’ fees, costs, and

necessary disbursements, in addition to any other relief to which it may be entitled.

32. Integration. This writing constitutes

the final expression of the parties’ agreement and is a complete and exclusive statement of the terms of this Agreement.

The parties expressly agree that the sale and shipment by COM of the Products ordered by H&B shall be exclusively deemed to

be subject to the terms and condition hereof, notwithstanding any contrary or additional terms and conditions that may be contained

in any purchase order delivered to COM by H&B.

33. Severability. If any provisions

of this Agreement, or the application of it to any circumstance, person or place, shall be held by a court or other tribunal of

competent jurisdiction to be invalid, unenforceable or void, the remainder of this Agreement and such provisions as applied to

other circumstances, persons or places shall remain in full force and effect, so as to give effect to the parties’ intentions

to the fullest extent possible.

34. This agreement shall be binding upon the

parties hereto and their respective heirs, successors and assigns.

| Hollister & Blacksmith, Inc: |

|

Coast of Maine Organiz Products Inc: |

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Anthony Baroud |

|

By: |

/s/ Carlos Quijano |

| Name: |

Anthony Baroud |

|

Name: |

Carlos Quijano |

| Title: |

Chief Technology Officer |

|

Title: |

President |

| Date: |

9/19/2014 |

|

Date: |

9/22/2014 |

EXHIBIT 99.1

American Cannabis Company Signs Licensing

Manufacturing

Agreement and Develops Strategy to Service North America with

its Proprietary SoHum Living Soils™

DENVER, CO – September 25, 2014

/ - Brazil Interactive Media, Inc. d/b/a American Cannabis Company Inc. (OTCQB: BIMI) (the “Company” or “ACC”)

an industry-specific advisory and consulting group that helps businesses obtain medical marijuana licenses and services customers

with proprietary and distributed cultivation facilities and products, today announced the signing of a licensing agreement with

Maine-based Coast of Maine Organic Products and its strategy to service both the US and Canadian markets with its SoHum® Living

Soil – a branded growing medium.

On September 22, American Cannabis Company (“ACC”) and

Coast of Maine Organic Products (“COM”) entered into a licensing agreement whereby COM will manufacture, blend and

distribute ACC’s SoHum Living Soil™. Developed by the Company’s Chief Development Officer, Ellis Smith in conjunction

with Felicia Newman, a chemical engineer with 10+ years of organic gardening experience. SoHum™ is the Company’s proprietary

formulation of PH balanced, fully amended coco/perlite medium which is designed to be time released medium with premium amendments

that are made readily available by beneficial microbes allowing for the perfect balance of macro and micronutrients to handle all

of your plant needs for medical-grade cannabis production. The soil produces a high quality medical grade product that passes stringent

testing requirements and reduces operator error. COM will begin manufacturing SoHum™ for distribution and sale to the US

market in an exclusive, five-year agreement with performance goals. ACC will sell SoHum™ in retail bags and bulk sales to

licensed medical marijuana facilities throughout the US. COM will sell SoHum™ in retail bags and bulk sales to its current

500 retail clients. The agreement will provide ACC with the full revenue stream on sales of SoHum™, which both companies

have estimated as $300,000 the first full year of its cooperation.

“SoHum Living Soil™ is the result

of several years of development, trials, customer feedback and strict guidlines to meet organic standards while yet providing the

market a soil technology to increase production while limiting disease risk and operator error,” stated Corey Hollister,

CEO of American Cannabis Company. “We maintain high expectations for the performance of all our products and believe this

will provide our partners with the best solution to increase their quality and service to their patients.”

American Cannabis Company services Canadian-based

Organigram, Inc. (TSX-V: OGI) (OTC US:OGRMF) with its SoHum™ Living Soil. With sales of SoHum™ to Organigram, the soil

was used to cultivate medicine for Canadian patients and passed testing by Health Canada, known for its comprehensive and stringent

testing requirements for medical cannabis. Organigram has been a client of ACC for 10 months and been producing medical cannabis

using SoHum™ for 7 months. ACC has recognized approximately $60,000 of revenue through Q2FY14 from Organigram, of which SoHum

has accounted for $4,500. To service Organigram and the Canadian market’s increasing demand, ACC will have a second licensing

partner, in Canada, combined this will allow ACC to fully service the collective North American market.

Organigram Inc. CEO, Denis Arsenault states,

“We have been very pleased with the technology and soil mediums provided by ACC. Our partnership, along with expertise that

out Master Grower brings to the table, has given Organigram Inc the competitive advantage needed to deliver the best Medicinal

Marijuana possible to our Customers and the Canadian Market.”

About Organigram

ORGANIGRAM, Inc. is

licensed by Health Canada to be an Authorized Licensed Producer under MMPR. Headquartered in Moncton, NB, ORGANIGRAM, Inc. specializes

in the production of Condition Specific Medical Marihuana under license from Health Canada. Our company is subject to the Marihuana

for Medical Purposes Regulation (MMPR), including the Good Manufacturing Practices as well as the security directives as defined

by the Office of Controlled Substances.

For more information,

please visit: www.organigram.ca

About Coast of

Maine:

There is a long composting tradition in Maine and Maritime Canada,

especially among the region's salmon, wild blueberry and shellfish processors. In the late 1980's the State formed the Maine Compost

Team - a group of specialists from the State Departments of Agriculture and Environmental Protection and the University of Maine

Cooperative Extension Service - to help many of these processors set up successful composting programs. This expanding line of

organically approved plant food and compost-based soils represents a real environmental win-win: we are finding important new uses

for our region's natural resources and introducing our customers to a cost-effective alternative for growing beautiful, healthy,

disease and pest resistant plants.

For more information, please visit: www.coastofmaine.com

About American

Cannabis Company:

American Cannabis Company (“ACC”)

owns and operates two vertically integrated businesses, American Cannabis Consulting and The Trade Winds Inc., which deliver

an end-to-end solution for their customers and clients within the cannabis industry. Through these businesses, ACC provides

industry specific advisory and consulting services, manufactures cultivation products and facilities, and manages a strategic

group partnership that produces private label customer products. ACC has successfully procured licensing agreements for its clients

in several states and is accessing existing and new growth opportunities, in both domestic and international cannabis markets.

For more information, please visit: www.americancannabiscompanyinc.com

Forward Looking Statements

This news release contains "forward-looking

statements" which are not purely historical and include any statements regarding beliefs, plans, expectations or intentions

regarding the future. Such forward-looking statements include, among other things, the development, costs and results of new business

opportunities. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such

factors include, among others, the inherent uncertainties associated with new projects. These forward-looking statements are made

as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons

why actual results could differ from those projected in the forward-looking statements. Although we believe that any beliefs, plans,

expectations and intentions contained in this press release are reasonable, there can be no assurance that any such beliefs, plans,

expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should

also refer to the risk factors disclosure outlined in our annual report on Form 10-K for the most recent fiscal year, our quarterly

reports on Form 10-Q and other periodic reports filed from time-to-time with the Securities and Exchange Commission. For more information,

please visit www.sec.gov.

Contact:

Company

John Mattio

Corporate,

Media and Investor Communications

Phone: (720)

466-3789

john@americancannabisconsulting.com

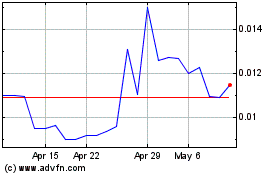

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

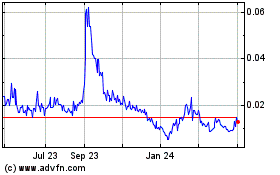

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Nov 2023 to Nov 2024