UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 27, 2014

BRAZIL INTERACTIVE MEDIA, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware |

|

000-26108 |

|

94-2901715 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

3457 Ringsby Court, Unit 111, Denver, Colorado

82016-4900

(Address of principal

executive offices) (Zip Code)

(720) 466-3789

Registrant’s telephone number, including

area code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

This Current Report on Form 8-K contains "forward-looking

statements" which are not purely historical and include any statements regarding beliefs, plans, expectations or intentions

regarding the future. Such forward-looking statements include, among other things, the development, costs and results of new business

opportunities. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such

factors include, among others, the inherent uncertainties associated with new projects. These forward-looking statements are made

as of the date of this Current Report, and we assume no obligation to update the forward-looking statements, or to update the

reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that any beliefs,

plans, expectations and intentions contained in this Current Report are reasonable, there can be no assurance that any such beliefs,

plans, expectations or intentions will prove to be accurate. For more information, please visit www.sec.gov.

Item 1.01

Entry Into a Material Definitive Agreement

On June 27, 2014, Brazil Interactive Media,

Inc., through its Hollister & Blacksmith (d/b/a American Cannabis Company) division (the “Company”), entered into

an Exclusive Marketing and Sales Agreement (the “Marketing Agreement”) with Kush Bottles, Inc./DANK Bottles, LLC (“Kush”).

The Marketing Agreement provides for the sale and distribution of the Company’s The Satchel™, a child-resistant bag

for use by dispensaries as an industry-approved exit package of cannabis-based products, through the Company’s diversified,

multi-product distribution division, The Trade Winds.

Pursuant to the Marketing Agreement, the Company

will ship and bill for 500,000 units of The Satchel™, in two increments of 170,000 units and a third and final order of 160,000

units, through December 2014.

The Marketing Agreement further provides that

Kush will be the Company’s exclusive seller of The Satchel™, subject to the shipment, billing and delivery of a combined

total of 500,000 units of The Satchel™ to the Company’s customers in a 12 month period. Kush’s continuing right

to exclusivity is subject to its ordering 500,000 units of The Satchel™ during each subsequent 12 month period. In addition,

Kush may option to renew the Marketing Agreement each year for up to ten years, with such option consisting of an order of 170,000

units of The Satchel™.

The foregoing summary of the Marketing Agreement

and the transactions contemplated thereby do not purport to be complete and is subject to, and qualified in its entirety by, the

full text of the Marketing Agreement, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 8.01

Other Events

On June 30, 2014, the Company issued a press

release tilted, “American Cannabis Company Secures 500,000 Unit Order for Its Recently Launched Product, The Satchel™”.

A copy of the press release is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Brazil Interactive Media, Inc. |

|

| |

|

|

|

| Date: July 1, 2014 |

By: |

/s/ Corey Hollister |

|

| |

|

Name: Corey Hollister |

|

| |

|

Title : Chief Executive Officer |

|

| |

|

|

|

EXCLUSIVE MARKETING AND SALES AGREEMENT

This Marketing and Sales Agreement

(the "Agreement") is made effective as of June 27, 2014 between Kush Bottles, Inc (Kush)/ DANK Bottles LLC (Kush Bottles

Colorado, and Hollister & Blacksmith Inc. 3457 Ringsby Ct. Unit 111 Denver, CO 80216-4900 (H&B).

In the Agreement, H&B who is providing

the Product, [fully described in Exhibit "A" attached hereto] will be referred to as "H&B", and Kush Bottles

Inc and Dank Bottles llc who are receiving the right to exclusively sell the child-resistant drawstring exit bag [define Product],

will be referred to as "Kush."

The parties agree as follows:

I. RIGHT TO SELL. H&B hereby grants

an exclusive right within the 50 United States and its territories to Kush to sell the Product. In accordance with this Agreement,

H&B grants Kush an exclusive right to sell the Product under the terms of this Agreement. H&B agrees to deliver the stated

quantities to Kush in a timely manner. Prices and terms of sale shall be determined in this Agreement.

II. PERFORMANCE TERMS: H&B agrees

to deliver a total of 500,000 Product units each term, within no more than 180 days total from the date of a Purchase Order from

Kush to H&B, to be delivered in three separate deliveries of full individual containers of 170,000 units per container with

the final (third) container to be 160,000 units. Kush will pay to H&B $150,000, upon execution of PO and a balance of set forth

in the table Exhibit A ). Kush will inspect and confirm the content of each shipping within 5 business days. Deliveries will be

FOB Denver, CO. Payment shall be in the United States dollars and shall be presented per direction of H&B in Denver; CO. Kush

deposit to H & B Inc for $150,000.00 provided as Exhibit B. This money will be used to secure the material and the manufacturer

to get “The Satchel” into production for a 6-8 week delivery time frame. ACC will put up as collateral to the above

named company 200,000 shares of Brazil Interactive Media (BIMI parent of H & B) stock. Once delivery of the 500k bags, is in

Kush Colorado’s warehouse in Denver the collateral is released, . Once the 500k units have been bought per this agreement,

ACC will assign 20,000 shares of BIMI stock to Kush Bottles Inc. H&B has the right to claw back all shares from Kush Bottles

Inc. if the payment terms set forth in Exhibit A are not fully fulfilled.

II.a Force Majeure. If either party is prevented,

hindered or delayed from performing any of its obligations under this Agreement (other than an obligation to pay money) by an

event of force majeure, then so long as that situation continues, that party shall be excused from performance of such obligations

to the extent it is so prevented, hindered, or delayed, and the time for performance of such obligations shall be extended accordingly.

A party affected by an event of force majeure shall notify the other party within seven (7) days after its occurrence and its

effect of likely effect and shall use all reasonable endeavors to minimize the effect of the event of force majeure and to bring

it to an end; provided that no party shall be obligated to settle any strike or other labor actions, labor disputes or labor disturbances

of any kind, except on terms wholly satisfactory to it. For purposes of this Agreement, an event of force majeure means a delay

in performance due to fire, strike, war, act of God or any other cause beyond reasonable control of either party.

II.b Exclusivity. Kush exclusivity will

be based on ordering a minimum volume of 500k units within a 12 month period starting 6/27/14, If 500k units are not ordered within

a 12 month period H&B reserves the right terminate this Agreement and sell the drawstring bag (Product).

III. TITLE TO MERCHANDISE. Merchandise

shall be delivered FOB Denver, CO (Delivery), at the Kush address set forth above. H&B shall be responsible for all shortages,

loss, or damage, until inspection and acceptance by Kush and H&B shall be responsible for any and all shortages, loss, damage

or defects in the merchandise through Delivery and inspection by Kush. Kush shall, within seven days after Delivery, notify H&B

of any shortage, damaged or defective product delivered by H&B under this agreement and such product shall be promptly replaced

or credited on future orders.

IV. WARRANTIES. Neither party makes

any warranties with respect to the use, sale or other transfer of the Product; except that H&B covenants and warrants that

the Product shall be suitable for its intended purpose of meeting the requirements and standards of the Title 16 C.F.R 1700.20

(1995) and ASTM classification standard D3475-12.

V. TRANSFER OF RIGHTS. This Agreement shall be binding on any successors of the

parties. Neither party shall have the right to assign its interests in this Agreement unless the prior written consent of the

other party is obtained.

VI. TERMINATION.

This Agreement may not be terminated unless a material breach of the Agreement is made, with the non-breaching party giving

7 days written notice to the other party, and the other party having 30 days thereafter to cure any such alleged breach. (i) If

Kush causes a material breach of this agreement, Kush will have 90 day to cure, if within 90 day Kush has not cured material breach,

H&B will have the right to terminate the agreement and sell the Product.

VII. OPTION. Kush , at its sole and

exclusive discretion, shall have the right to renew this Agreement upon written notice to H&B for subsequent full containers

orders of the Product (payment terms set forth in Paragraph II), for up to 10 YEARS from the date of this Agreement. Each option

shall be for a full container of 170,000 units, at the unit price agreed upon per unit in Exhibit A, with all other terms and conditions

of this Agreement applicable as set forth in Paragraph II.

VIII. ENTIRE AGREEMENT. This Agreement

contains the entire agreement of the parties with respect to the subject matter of this Agreement and there are no other promises

or conditions in any other agreement, whether oral or written. This Agreement supersedes any prior written or oral agreements between

the parties with respect to the subject matter of this agreement.

IX. AMENDMENT. This Agreement may be

modified or amended, if the amendment is made in writing and is signed by both parties.

X. SEVERABILITY. If any provision of

this Agreement shall be held to be invalid or unenforceable for any reason, the remaining provisions shall continue to be valid

and enforceable. If a court finds that any provision of this Agreement is invalid or unenforceable, but that by limiting such provision

it would become valid or enforceable, then such provision shall be deemed to be written, construed, and enforced as so limited.

XI. WAIVER OF CONTRACTUAL RIGHT. The

failure of either party to enforce any provision of this Agreement shall not be construed as a waiver or limitation of that party's

right to subsequently enforce and compel strict compliance with every provision of this Agreement.

XII. APPLICABLE LAW. This Agreement shall be governed by

the laws of the State of Colorado. In any action to enforce its rights, the prevailing party shall be entitled to recover

from the other party its reasonable attorney's fees and costs incurred as a result of the other party's breach of this Agreement.

XIII. SIGNATORIES.

This Agreement shall be executed on the behalf of Kush Bottles, Incby Ben Wu, its CEO, Dank Bottles, LLC by Greg Gamet, a member,

and on behalf of H&B by Corey Hollister, its CEO.

XIV. INTELLECTUAL

PROPERTY.

a.

“Intellectual Property” (IP) means all present and future United States and foreign patents (including, without limitation,

design patents, industrial designs and utility models) and patent applications (including, without limitation, docketed patent

disclosures awaiting filing, reissues, divisions, continuations and extensions), and inventions, processes, designs, formulae,

trade secrets, know-how, confidential information, trademarks, copyrights, service marks, domain names, computer software, data

and documentation, and all similar intellectual property rights including, without limitation, technology underlying patents and

patent applications, tangible embodiments of any of the foregoing and licenses of the foregoing regarding the Product [defined

as child-resistant exit bag].

b.

“Ownership”. All Intellectual Property regarding the Product shall be the exclusive property of H&B.

Kush shall be required to and shall require any employees, consultants, assistants, aides and the like who conceived,

developed, or otherwise invented any Newly Developed IP regarding child resistant exit bag ] regarding the Product or

participated in the conception, development, or invention of any Newly Developed IP of the Product to execute an agreement

assigning all of its rights, title and interest in any Newly Developed IP regarding the Product to H&B.

c. Protection of Newly Developed

IP. Kush will be available and cooperate, and will ensure that its employees, assistants, aides and the like will also assist

and cooperate, with H&B to secure the intellectual property rights in the Newly Developed IP regarding the Product, and to

aid H&B with any patent, trademark or copyright applications undertaken by H&B, at H&B’s expense.

d. Notice of Infringements.

Kush shall promptly notify H&B of any and all infringements of Existing H&B and Newly Developed IP that may come to Kush

attention regarding the Product and shall provide such assistance to H&B to enforce H&B’s rights as H&B shall

reasonably require, at H&B’s expense.

XV. Confidentiality.

a. Protection of Confidential

Information. Each party acknowledges that during the engagement it will have access to and become acquainted with various

trade secrets, inventions, innovations, processes, information, records and specifications or other confidential or proprietary

information of or licensed by the other and/or used by the other in connection with the operation of their respective businesses

or contemplated businesses, including, without limitation, product processes, methods, customer lists, accounts and procedures

(collectively, along with any analysis or reports embodying or derived from the foregoing the “Confidential Information”).

Each party agrees that it will not disclose any of the other’s Confidential Information, directly or indirectly, or use

any of it in any manner, either during the term of this Agreement or at any time thereafter, except as required in the course

of this engagement. The Confidential Information shall remain the exclusive property of the discloser. The receiving party

shall not retain any copies of the Confidential Information without the discloser’s prior written permission. Upon

the expiration or earlier termination of this Agreement, or whenever requested by the discloser, the receiving party shall immediately

deliver to the disclosing party all such files, records, documents, specifications, information, and other items in its possession

or under its control, and shall destroy any electronic records embodying or derived from the Confidential Information. Each

party shall maintain the Confidential Information in a reasonably secure location and employ precautions to restrict access to

and to protect the confidentiality of the Confidential Information that, in the aggregate, are no less protective than the precautions

it uses to protect the confidentiality of its own comparable confidential information and, in any event, no less than reasonable

precautions.

b. As used in this

Agreement, “Confidential Information” means any information, technical date, or know-how (either oral, written or digital)

provided by ether party to the other party(including any director, officer, employee, manager, agent, or representative of either

party or obtained by either party (including any director, officer, employee, agent, or representative of the other) including

but not limited to information related to: (1) any financial, engineering, business, planning, research, operations, services,

products, technical information and/or know-how, patents owned or assigned, organization charts, prototypes, formulas, production,

marketing, pricing, sales, profit, personnel, customer, prospective customer, supplier, or other lists or information; (2) any

papers, data, records, processes, techniques, systems, models, samples, devices, equipment, customer lists, or documents; (3) any

confidential information or trade secrets of any third party provided in confidence or subject to other use or disclosure restrictions

or limitations; and (4) any other information, written, oral or electronic, whether existing now or at some time in the future,

which pertains to either party’s affairs or interests or with whom either party does business. “Confidential

Information” does not include information that lawfully is or has become generally or publicly known, other than through

the unlawful or improper act or omission of any person that has or had an obligation of non-disclosure or non-use with respect

to such information, including without limitation my breach of this Agreement.

c. Notice of Compulsory

Disclosure; Cooperation Limiting Disclosure. Except as provided in otherwise herein, if either party or any of its

employees, agents, officers or directors is requested or becomes compelled by law or legal process to disclose or is required

by a regulatory body to disclose any of the Confidential Information, such party shall notify the other party promptly and

shall reasonably assist the other party to obtain a protective order or other remedy of the other party's election.

Each party shall furnish only that portion of the Confidential Information that is legally required to furnish, exercise

reasonable efforts to obtain reliable assurance that the Confidential Information shall be held in confidence, and allow the

other party a reasonable opportunity of prior review of such disclosure to the extent possible under such

circumstances.

d. Injunctive Relief. Given

the nature of the Confidential Information and the competitive damage that would result to each party upon unauthorized disclosure,

use or transfer of Confidential Information to any third party, the parties hereto agree that monetary damages would not be a

sufficient remedy for any breach of this Agreement. In addition to all other remedies, each party agrees that the other

party shall be entitled to specific performance and injunctive and other equitable relief as a remedy for any breach or threatened

breach of this Agreement. Each party agrees to waive any requirement for the securing or posting of any bond or the showing

of actual monetary damages in connection with such remedy hereunder. Notwithstanding the foregoing, it is not the agreement

or intent of the parties for this Agreement to be construed as a limitation or waiver of each party's right to pursue any remedies

at law or in equity.

XVI. Non-Competition;

Non-Circumvention.

| (a) | | Kush expressly covenants and agrees that during the term of this Agreement 8 month

immediately following the termination of the agreement for any reason, other than a breach of contract by Hollister &

Blacksmith, Kush will not engage directly or indirectly, whether individually, or as a shareholder, partner, member, owner,

manager, employee, agent, consultant or creditor of any business (which includes owning, managing, operating, controlling, being

employed by, acting as a consultant to, giving financial assistance to, participating in or being connected in any material way

with any business or person so engaged) anywhere in the United States, including its territories in the distribution of child-resistant

exit bags; except as permitted in XVI (b). |

| (b) | | Kush agrees to sell the drawstring bag (the satchel) as the preferred child-resistant

exit bag solution to the end customer in each of the 50 states and territories. If Kush carries a competing child-resistant exit

bag solution, 90% of sales must be the satchel. H&B reserves the right to request detail to ensure this standard is being

honored on a quarterly basis. |

XVII. Notices. All notices under this Agreement shall be tendered via

overnight delivery by Federal Express or UPS, with tracking and confirmation of receipt, to the party at the address set forth

below.

If notice to: Kush Bottles, Inc.

Ben Wu, CEO

1800 Newport Circle

Santa Ana, CA 92705

DANK Bottles, LLC

Greg Gamet, Member

3831 Eudora Way

Denver, CO 80207

If notice to: Hollister & Blacksmith,

Inc

Corey Hollister, CEO

3457 Ringsby Ct. #111

Denver, CO. 80

Remainder of this

page left blank

Signature page

to follow

Kush Bottles, Inc. and

DANK Bottles, LLC

By: /s/ Ben Wu

Ben Wu

Kush Bottles,

Inc., CEO

/s/ Greg Gamet

Greg Gamet

DANK Bottles,

LLC, CEO

Hollister & Blacksmith Inc.

By: /s/ Corey Hollister

Corey Hollister,

CEO

Exhibit A

[SPECIFY APPROXIMATE DELIVERY WINDOWS FOR CONTAINERS 1, 2 and 3]

American Cannabis Company Secures 500,000

Unit Order for Its Recently Launched Product, The Satchel™

Child-Resistant, Exit-Package Ordered by

Large Customer of Products for Cannabis Dispensaries

DENVER, CO – June 30, 2014 /

- Brazil Interactive Media, Inc. d/b/a American Cannabis Company Inc. (OTCQB: BIMI) (the “Company” or “ACC”),

today announced a significant order of its recently-launched product, The Satchel™, which will be for use by dispensaries

as an industry-approved exit package of cannabis-based products.

ACC’s The Satchel™ is a child-resistant bag for dispensaries

to assemble orders and ensure the proper handling of cannabis. The Satchel™ has also been awarded an approval from the American

Society for Testing and Materials (ASTM) and meets Colorado’s Marijuana Enforcement Division’s (MED) handling regulations

for cannabis-based products. The Satchel™ is sold through the Company’s diversified, multi-product distribution division,

The Trade Winds. As reported in press on June 12, 2014, the Company believes demand for The Satchel™ could be approximately

80,000 units per month.

“After first

identifying the niche in this market and the year of development and test marketing of The Satchel™ that followed, we are

not surprised at the demand for it," began ACC’s CEO, Corey Hollister. “Cannabis, just like any regulated prescription

medicine, must adhere to handling and transport standards. These safety and handling standards are equally important to the patient/individual

as the dispensary itself. Though previous versions of exit packages were tested, we believe our product now provides dispensaries

a cost-effective, compliant and approved option to this large market which is currently being serviced by only a handful of manufactures

of compliant exit-bags. Our recent order is a clear demonstration of this fast growing market in which we are a first mover.”

ACC’s 500,000 unit order will be shipped and billed to its

customer in 170,000 unit increments through December of 2014. The Company anticipates recognizing all of the revenues and profits

from this order in its calendar year ending December 31, 2014. Revenues from sales of The Satchel™ and other The Trade Winds

products will be reported to shareholders, the public and, as and when required, to the U.S. Securities and Exchange Commission.

About American

Cannabis Company:

American Cannabis Company (“ACC”)

owns and operates three vertically integrated businesses, American Cannabis Consulting, Cube Root Inc. and The Trade Winds Inc., which

deliver an end-to-end solution for their customers and clients within the cannabis industry. Through these businesses,

ACC provides industry specific advisory and consulting services, manufactures cultivation products and facilities, and manages

a strategic group partnership that produces private label customer products. ACC has successfully procured licensing agreements

for its clients in several states and is accessing existing and new growth opportunities, in both domestic and international

cannabis markets.

For more information, please visit: www.americancannabiscompanyinc.com

Forward Looking Statements

This news release contains "forward-looking

statements" which are not purely historical and include any statements regarding beliefs, plans, expectations or intentions

regarding the future. Such forward-looking statements include, among other things, the development, costs and results of new business

opportunities. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such

factors include, among others, the inherent uncertainties associated with new projects. These forward-looking statements are made

as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons

why actual results could differ from those projected in the forward-looking statements. Although we believe that any beliefs, plans,

expectations and intentions contained in this press release are reasonable, there can be no assurance that any such beliefs, plans,

expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should

also refer to the risk factors disclosure outlined in our annual report on Form 10-K for the most recent fiscal year, our quarterly

reports on Form 10-Q and other periodic reports filed from time-to-time with the Securities and Exchange Commission. For more information,

please visit www.sec.gov.

Contact:

Company

John Mattio

Corporate,

Media and Investor Communications

Phone: (720)

466-3789

john@americancannabisconsulting.com

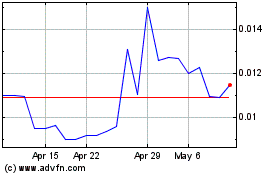

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From May 2024 to Jun 2024

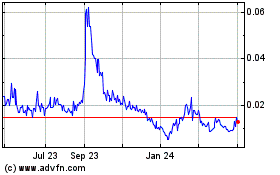

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jun 2023 to Jun 2024