UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check the appropriate box:

|

[x]

|

Preliminary Information Statement

|

|

|

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by

Rule 14c-5(d)(2))

|

|

|

|

|

[ ]

|

Definitive Information Statement

|

BRAZIL INTERACTIVE MEDIA, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

[ ]

|

No fee required

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

BRAZIL INTERACTIVE MEDIA, INC.

3457 Ringsby Court, Unit 111

Denver, Colorado 80216-4900

NOTICE OF WRITTEN CONSENT IN LIEU OF MEETING

OF STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholders:

Notice is hereby given

to you that all members of our board of directors and the holders of a majority of the outstanding shares of our common stock have,

by written consent in lieu of a stockholders’ meeting, approved and authorized the Company to: (1) enter into the Agreement

and Plan of Merger, dated as of May 15, 2014, by and among the Company, Cannamerica, Inc., a Delaware corporation and a wholly

owned subsidiary of the Company, and Hollister & Blacksmith, Inc. d/b/a American Cannabis Consulting, Inc., a Colorado corporation,

and perform the transactions contemplated thereby (2) file the necessary certificates of merger to effectuate the transactions

contemplated by the Agreement and Plan of Merger; (3) file a Certificate of Amendment to the Company’s Restated Certificate

of Incorporation, as amended, to change the Company’s name to “American Cannabis Company, Inc.” upon the effectiveness

of the transactions contemplated by the Agreement and Plan of Merger; and (4) enter into the Separation and Exchange Agreement,

dated as of May 16, 2014, by and among the Company, BIMI, Inc., a Delaware corporation and wholly-owned subsidiary of the Company,

and Brazil Investment Holding, LLC, a Delaware limited liability company and the majority stockholder of the Company, and perform

the transactions contemplated thereby.

Holders of a majority of

the outstanding shares of our common stock, being approximately 77.30%, approved the foregoing corporate actions pursuant

to a written consent, such holders reflecting shares of our common stock held prior to the transactions contemplated by the Agreement

and Plan of Merger or the Separation and Exchange Agreement.

This Notice and the accompanying Information Statement is

being made available on or about June 18, 2014 to all of our stockholders of record at the close of business on

April 30, 2014.

In accordance with Rule

14c-2 of the Securities Exchange Act of 1934, as amended, the corporate actions will be effective no earlier than twenty (20) days

after this Information Statement has been made available to our stockholders.

By Order of the Board of Directors

,

/s/ Corey Hollister

Corey Hollister, Chief Executive Officer

Denver, Colorado

June 18, 2014

INFORMATION STATEMENT

OF

BRAZIL INTERACTIVE MEDIA, INC.

3457 Ringsby Court, Unit 111

Denver, Colorado 80216-4900

NOTICE OF WRITTEN CONSENT IN LIEU OF MEETING

OF STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Brazil Interactive Media, Inc., a Delaware

corporation (the “Company,” “we,” “our,” or “us”), is making this Information Statement

available on or about June 18, 2014 to all of the Company’s stockholders of record as of April 30, 2014

(the “record date”). As of the record date, 45,279,114 shares of our common stock were issued and outstanding.

Each outstanding share of our common stock

is entitled to one vote per share. Holders of approximately 77.30% of the outstanding shares of our common stock prior to the transactions

referenced herein have, by written consent in lieu of a stockholders’ meeting (the “Written Consent”), approved

and authorized the Company to: (1) enter into the Agreement and Plan of Merger, dated as of May 15, 2014, by and among the Company,

Cannamerica, Inc. (“Merger Sub”), a Delaware corporation and a wholly owned subsidiary of the Company, and Hollister

& Blacksmith, Inc. d/b/a American Cannabis Consulting, Inc. (“ACC”), a Colorado corporation (the “Merger

Agreement”), and perform the transactions contemplated thereby (2) file the necessary certificates of merger to effectuate

the transactions contemplated by the Agreement and Plan of Merger; (3) file a Certificate of Amendment to the Company’s Restated

Certificate of Incorporation, as amended, to change the Company’s name to “American Cannabis Company, Inc.” upon

the effectiveness of the transactions contemplated by the Agreement and Plan of Merger; and (4) enter into the Separation and Exchange

Agreement, dated as of May 16, 2014, by and among the Company, BIMI, Inc. (“BIMI”), a Delaware corporation and wholly-owned

subsidiary of the Company, and Brazil Investment Holding, LLC (“Holdings”), a Delaware limited liability company and

the majority stockholder of the Company (the “Separation Agreement”), and perform the transactions contemplated thereby.

This Information Statement is being made available

pursuant to the requirements of Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), to inform holders of our common stock who were entitled to consent to the matters authorized by the Written Consent.

This Information Statement also constitutes notice of the actions that have been approved pursuant to the Written Consent for purposes

of Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”).

Because the Written Consent was executed by

holders representing approximately 77.30% of the outstanding shares of our common stock on the record date, which was prior

to the transactions contemplated by the Merger Agreement and Separation Agreement, no vote or consent of any other stockholder

is being, or will be, solicited in connection with the authorization of the matters set forth in the Written Consent. Under the

DGCL and our Bylaws, the votes represented by the holders signing the Written Consent are sufficient in number to authorize the

matters set forth in the Written Consent, without the vote or consent of any other stockholder of the Company. The DGCL

provides that any action that is required to be taken, or that may be taken, at any annual or special meeting of stockholders of

a Delaware corporation may be taken, without a meeting, without prior notice and without a vote, if a written consent, setting

forth the action taken, is signed by the holders of outstanding capital stock having not less than the minimum number of votes

necessary to authorize such action.

Based on the foregoing, our board of directors (our “Board”)

has determined not to call a meeting of stockholders to approve the transactions contemplated by the Written Consent.

TABLE OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

|

|

INFORMATION ON CONSENTING STOCKHOLDER

|

|

|

1

|

|

|

VOTING SECURITIES

|

|

|

1

|

|

|

ACTION NO. 1: MERGER AGREEMENT

|

|

|

3

|

|

|

ACTION NO. 2: CERTIFICATES OF MERGER

|

|

|

4

|

|

|

ACTION NO. 3: NAME CHANGE AND AMENDMENT OF CHARTER

|

|

|

4

|

|

|

ACTION NO. 4: SEPARATION AGREEMENT AND DIVESTURE

|

|

|

4

|

|

|

OTHER MATTERS

|

|

|

4

|

|

|

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

|

|

|

4

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

5

|

|

|

APPENDICES

|

|

|

6

|

|

|

EXHIBIT A

|

|

|

7

|

|

INFORMATION ON CONSENTING STOCKHOLDER

Pursuant to our Bylaws and the DGCL, a vote

by the holders of at least a majority of our outstanding shares of common stock was required to approve the corporate actions set

forth in the Written Consent. Our Restated Certificate of Incorporation, as amended, does not authorize cumulative voting. As of

the record date, 45,279,114 shares of our common stock were issued and outstanding, of which 22,684,836 shares were required to

pass any stockholder resolutions. Brazil Investment Holding LLC, formerly named Brazil Interactive Holdings, LLC (the “Consenting

Stockholder”), was the record and/or beneficial owner of 35,000,000 shares of the outstanding shares of our common stock

outstanding on the record date, which was prior to the transactions contemplated by the Merger Agreement and Separation Agreement.

Accordingly, the Consenting Stockholder represented approximately 77.30% of the issued and outstanding shares of our common stock

as of such date. Pursuant to Section 228 of the DGCL, the Consenting Stockholder voted in favor of the actions described herein

in a written consent, dated the record date. No consideration was paid for any stockholder’s consent.

VOTING SECURITIES

Voting Securities of the Company

Our authorized capital stock consists

of 100,000,000 shares of common stock, $0.00001 par value per share, and 5,000,000 shares of blank check preferred stock, par value

$0.01 per share. As of April 30, 2014, there were 45,279,114 shares of our common stock issued and outstanding.

We anticipate that there will be 40,350,000

shares of our common stock issued and outstanding as of the date that all transactions contemplated by the Merger Agreement and

Separation Agreement have been consummated (such date being hereinafter referred to as, the “Post-Transaction Date”).

Security Ownership of Certain Beneficial Owners of More

than Five Percent of our Common Stock

The following table sets forth information

regarding each stockholder who will beneficially own more than five percent of our common stock as of the Post-Transaction Date.

Except as otherwise indicated, we believe, based on information furnished by such persons, that each person listed below has sole

voting and investment power over the voting securities shown as beneficially owned, subject to community property laws, where applicable.

Beneficial ownership is determined under the rules of the Securities and Exchange Commission (“SEC”) and includes any

shares which the person has the right to acquire within 60 days after the Post-Transaction Date through the exercise of any stock

option, warrant or other right.

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

Percentage

of Class

(1)

|

Corey Hollister

5316 Rustic Ave.

Firestone, CO 80504

|

|

12,684,251

(2)

|

|

|

31.44

|

%

|

Ellis Smith

5163 Raleigh St.

Denver, CO 80212

|

|

12,684,251

(3)

|

|

|

31.44

|

%

|

Anthony Baroud

2225 East Oakton Street

Arlington Heights, IL 60005

|

|

4,756,594

(4)

|

|

|

11.79

|

%

|

Dutchess Opportunity Fund II LP

50 Commonwealth Ave., Suite 2

Boston, MA 02116

|

|

4,823,912

(5)

|

|

|

11.70%

(6)

|

|

____________________________

|

(1)

|

|

The percentages are based on 40,350,000 shares of our common stock outstanding as

of the Post-Transaction Date, plus shares of common stock that may be acquired by the beneficial owner within 60 days after the

Post-Transaction Date, by exercise of stock conversions and/or warrants.

|

|

(2)

|

|

Shares beneficially owned by Mr. Corey Hollister consist of issued common stock (12,684,251

shares) held in his name.

|

|

(3)

|

|

Shares beneficially owned by Mr. Ellis Smith consist of issued common stock (12,684,251

shares) held in his name.

|

|

(4)

|

|

Shares beneficially owned by Mr. Anthony Baroud consist of issued common stock (4,756,594

shares) held in his name.

|

|

(5)

|

|

Shares beneficially owned are aggregated without regard to the 4.99% Blocker (defined

below), and consist of (i) issued common stock (3,930,162 shares) and (ii) shares of common stock issuable upon the conversion

of that certain Debenture, dated April 24, 2014 (the “Dutchess Debenture”), issued by the Company (893,750 shares),

all held in the name of Dutchess Opportunity Fund II LP, of which Michael Novielli is a managing director and has shared voting

and dispositive power over the securities. Certain debentures issued by the Company, including the Dutchess Debenture, contain

a provision which prevents the Company from effecting the conversion or exercise of the debenture, to the extent that, as a result

of such conversion or exercise, the holder beneficially owns more than 4.99%, in the aggregate, of the issued and outstanding

shares of the Company's common stock calculated immediately after giving effect to the issuance of shares of common stock upon

the conversion or exercise (the “4.99% Blocker”).

|

|

(6)

|

|

Dutchess Opportunity Fund II LP would beneficially own 11.70% of our issued and outstanding

common stock upon exercise of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that Dutchess Opportunity

Fund II LP will beneficially own 9.75% of our issued and outstanding common stock as of the Post-Transaction Date.

|

Security

Ownership of Management

The following table sets forth

the number of shares of our common stock beneficially owned as of the Post-Transaction Date by our directors, executive officers

and our directors and executive officers as a group. Beneficial ownership is determined under the rules of the SEC and includes any shares which the person has the right to acquire within 60 days after the Post-Transaction

Date through the exercise of any stock option, warrant or other right.

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

Percentage

of Class

(1)

|

|

Corey Hollister

|

|

|

12,684,251

(2)

|

|

|

|

31.44

|

%

|

|

Themistocles Psomiadis

|

|

|

1,639,900

(3)

|

|

|

|

4.06

|

%

|

|

Michael Novielli

|

|

|

5,169,938

(4)

|

|

|

|

12.54%

(5)

|

|

|

Officers and Directors as a group

|

|

|

19,494,089

|

|

|

|

47.27%

(6)

|

|

_____________________________

|

(1)

|

|

The percentages are based on 40,350,000 shares of our common stock outstanding as

of the Post-Transaction Date, plus shares of common stock that may be acquired by the beneficial owner within 60 days after the

Post-Transaction Date, by exercise of stock conversions and/or warrants.

|

|

(2)

|

|

Mr. Corey Hollister is our Chief Executive Officer, and is a director. Shares beneficially

owned by Mr. Hollister consist of issued common stock (12,684,251 shares) held in his name.

|

|

(3)

|

|

Mr. Themistocles Psomiadis is a director. Shares beneficially owned by Mr. Psomiadis

consist of issued common stock (1,639,900 shares) held in his name.

|

|

(4)

|

|

Mr. Michael Novielli is a director. Shares beneficially owned by Mr. Novielli are

aggregated without regard to the 4.99% Blocker, and consist of (i) issued common stock (3,979,910 shares) of which Michael Novielli

has shared dispositive power over due to his ownership in Dutchess Opportunity Fund II LP, Dutchess Advisors LLC, Dutchess Private

Equities Fund II LP and Dutchess Private Equities Fund, Ltd.; (ii) previously-issued common stock (296,278 shares) held by Dutchess

Global Strategies Fund LLC of which Michael Novielli has sole voting and dispositive power over; and (iii) shares of common stock

issuable upon the conversion of the Dutchess Debenture (893,750 shares), which is subject to the 4.99% Blocker, held in the name

of Dutchess Opportunity Fund II LP, of which Michael Novielli has shared voting and dispositive power over.

|

|

(5)

|

|

Mr. Novielli would beneficially own 12.54% of our issued and outstanding common stock

upon exercise of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that Mr. Novielli will beneficially own

10.60% of our issued and outstanding common stock as of the Post-Transaction Date.

|

|

(6)

|

|

All of our officers and directors as a group would beneficially own 47.27% of our

issued and outstanding common stock upon exercise of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that

all of our officers and directors as a group will beneficially own 46.10% of our issued and outstanding common stock as of the

Post-Transaction Date.

|

Change of Control

Pursuant to the terms of the Merger

Agreement, and upon the effectiveness of the transactions contemplated thereby, ACC will become our wholly-owned subsidiary. In

exchange for 100% of the common stock of ACC, ACC’s former shareholders will collectively own approximately 70% of our common

stock on a fully-diluted basis. Among ACC’s former shareholders, Corey Hollister and Ellis Smith will each beneficially own

approximately 31.44% of our common stock, and Anthony Baroud will beneficially own approximately 11.79% of our common stock.

Pursuant to the terms of the Merger

Agreement and upon the effectiveness of the transactions contemplated thereby, including the effectiveness of the Company’s

Schedule 14f-1, Themistocles Psomiadis and Michael Novielli will resign from our Board, and Mr. Corey Hollister will appoint new

members to our Board to fill the vacancies created by the resignations of Messrs. Psomiadis and Novielli. In addition, because

of the change in composition of our Board and the issuance of securities pursuant by the Merger Agreement, there will be a change

of control of the Company upon the effectiveness of the transactions contemplated by the Merger Agreement.

Consummation of the transactions contemplated

by the Merger Agreement is also conditioned upon, among other things, preparation, filing and distribution to our stockholders

of this Information Statement. There can be no assurance that the transactions contemplated by the Merger Agreement will be completed.

ACTION NO. 1:

MERGER AGREEMENT

Pursuant to the Written Consent, a majority

of the stockholders and all members of our Board approved the Merger Agreement and authorized the Company to enter into the Merger

Agreement and perform all the transactions contemplated thereby. On May 15, 2014, the Company entered into the Merger Agreement,

pursuant to which Merger Sub will be merged with and into ACC through a reverse triangular merger transaction upon the terms and

subject to the conditions of the Merger Agreement, and in accordance with the DGCL.

Pursuant to the transactions contemplated by

the Merger Agreement, (i) each share of common stock of ACC will be exchanged for shares of the Company based on a ratio of 3,171.0628

to one, (ii) ACC shall continue as the surviving corporation after the transactions contemplated by the Merger Agreement, (iii)

each share of common stock of Merger Sub will be converted into and exchanged for one share of common stock of ACC and (iv) the

Company shall change its name to “American Cannabis Company, Inc.”

The foregoing description of the Merger Agreement

does not purport to be complete and is qualified in its entirety by the terms of the actual Merger Agreement. The Merger Agreement

is filed as an exhibit to the Form 8-K filed by the Company with the SEC on May 15, 2014, as amended

on May 16, 2014.

ACTION NO. 2:

CERTIFICATES OF MERGER

Pursuant to the Written Consent, a majority

of the stockholders and all members of our Board approved and authorized an action to consummate the transactions contemplated

by the Merger Agreement. Accordingly, the Written Consent authorizes the Company to file certificates of merger (the ''Certificates

of Merger'') with the Secretary of State of the States of Delaware and Colorado in such form as is required by, and executed in

accordance with, the relevant provisions of the DGCL and the Colorado Business Corporation Act, respectively.

ACTION NO. 3:

NAME CHANGE AND AMENDMENT OF CHARTER

Pursuant to the Written Consent, a majority

of the stockholders and all members of our Board approved and authorized an action to change the name of the Company to “American

Cannabis Company, Inc.” (the “Name Change”), as contemplated by the Merger Agreement, which will more accurately

reflect the Company’s operations following consummation of the transactions contemplated by the Merger Agreement. The Written

Consent authorizes the Company, upon the effectiveness of the Certificates of Merger, to effectuate the Name Change by filing a

Certificate of Amendment to the Company’s Restated Certificate of Incorporation, as amended, with the Secretary of State

of the State of Delaware. A draft of the Certificate of Amendment is attached as

Exhibit A

hereto.

ACTION NO. 4:

SEPARATION AGREEMENT AND DIVESTURE

Pursuant to the Written Consent, a majority

of the stockholders and all members of our Board approved the Separation Agreement and authorized the Company to enter into the

Separation Agreement and perform all the transactions contemplated thereby. On May 16, 2014, the Company entered into the Separation

Agreement, pursuant to which the Company agreed to distribute all shares of common stock of BIMI held by the Company in exchange

for all of our common stock held by Holdings.

Pursuant to the Separation Agreement, the Company

and BIMI each shall retain all assets and liabilities in its respective name, and shall take any and all actions necessary so that

(i) the Company will own or be liable for all existing Company assets and liabilities and (ii) BIMI will own or be liable

for all existing BIMI assets and liabilities, including all assets and liabilities of BIMI’s subsidiaries.

The Separation Agreement provides that all

intercompany agreements by and between the Company, or any of its subsidiaries, and BIMI, or any of its subsidiaries, are terminated

except for confidentiality, non-disclosure or release of liability agreements.

The foregoing description of the Separation

Agreement does not purport to be complete and is qualified in its entirety by the terms of the actual Separation Agreement. The

Separation Agreement is filed as an exhibit to the Form 8-K filed by the Company with the SEC on

May 20, 2014.

OTHER MATTERS

No other matters will be effected pursuant

to the Written Consent.

INTEREST OF CERTAIN PERSONS IN MATTERS

TO BE ACTED UPON

No director or executive officer of the Company

at any time since the beginning of the last fiscal year, nor any individual nominated to be a director of the Company, nor any

associate or affiliate of any of the foregoing, has any material interest, directly or indirectly, by way of beneficial ownership

of securities or otherwise, in any matter to be acted upon pursuant to the Written Consent (except as disclosed in this Information

Statement).

WHERE YOU CAN FIND MORE INFORMATION

The Company is subject to the informational

requirements of the Exchange Act and files reports and other information with the SEC. Such reports and other information filed

by the Company may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the SEC’s public reference rooms.

The SEC also maintains an Internet site that contains reports, proxy statements and other information about issuers, like us, who

file electronically with the SEC. The address of the SEC’s web site is

http://www.sec.gov

.

By Order of the Board of Directors

,

/s/ Corey Hollister

Corey Hollister, Chief Executive Officer

Denver, Colorado

June 18, 2014

APPENDICES

Exhibit A

– Certificate of Amendment of the Restated

Certificate of Incorporation of Brazil Interactive Media, Inc.

EXHIBIT A

CERTIFICATE OF AMENDMENT OF THE

RESTATED CERTIFICATE OF INCORPORATION

OF

BRAZIL INTERACTIVE MEDIA, INC.

Brazil Interactive Media, Inc. (the “Corporation”) hereby

certifies that:

|

1.

|

|

FIRST: The original Certificate of Incorporation of the Corporation was filed with

the Secretary of State of the State of Delaware on September 24, 2001 under the name “NatureWell, Incorporated”, and

a Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on April 20, 2006.

|

|

2.

|

|

SECOND: A Certificate of Amendment to the Restated Certificate of Incorporation of

the Corporation was filed with the Secretary of State of the State of Delaware on April 21, 2013 whereby the Corporation, among

other things, changed the name of the Corporation to “Brazil Interactive Media, Inc.”

|

|

3.

|

|

THIRD: Pursuant to Section 242 of the General Corporation Law of the State of Delaware,

this Certificate of Amendment to the Restated Certificate of Incorporation, as amended (this “Amendment”), further

amends the provisions of the Corporation’s Restated Certificate of Incorporation.

|

|

4.

|

|

FOURTH: The terms and provisions of this Amendment have been duly approved by written

consent of the required number of shares of outstanding stock of the Corporation pursuant to Subsection 228(a) of the General

Corporation Law of the State of Delaware.

|

|

5.

|

|

FIFTH: Article First of the Corporation’s Restated Certificate of Incorporation,

as amended, is deleted in its entirety and substituted by the following:

|

“The name of the Corporation

is American Cannabis Company, Inc.”

IN WITNESS WHEREOF, the undersigned has executed this Certificate

of Amendment of the Corporation’s Restated Certificate of Incorporation, as amended, on ________, 2014.

Corey Hollister

Chief Executive Officer

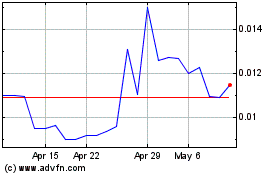

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From May 2024 to Jun 2024

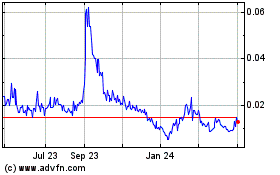

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jun 2023 to Jun 2024