|

|

UNITED

STATES

|

|

|

|

SECURITIES AND EXCHANGE

COMMISSION

|

|

|

|

Washington,

D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE

13D/A

|

|

Under

the Securities Exchange Act of 1934

(Amendment

No. **)*

Brazil

Interactive Media, Inc.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

105856108

(CUSIP

Number)

Michael

Novielli

1110 Rt. 55,

Suite 206

LaGrangeville,

NY 12540

(845) 575-6772

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

March

27, 2013**

(Date

of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

/ /

Note

: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

*

The remainder

of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

** This report on Schedule

13D includes holdings at earlier dates which, as a result of administrative error, were not identified as requiring a filing on

Schedule 13D at the time such reports were due. Upon discovering this oversight, the reporting persons promptly took steps to

include all such information on this Schedule 13D, which reflects current information and the information that should have been

reported earlier. See Item 5 of the disclosure herein for additional information. Reporting persons Novielli and Leighton (as

defined herein) also had transactions in the Common Stock that is the subject of this report on Schedule 13D that pre-date the

earliest transaction set forth in this report on Schedule 13D, which were reported jointly with Dutchess Private Equities Fund

Ltd.

|

|

|

|

|

|

|

1.

|

Names of Reporting

Persons

Dutchess

Opportunity Fund II LP

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group

(See Instructions)

|

|

|

|

|

(a)

|

o

|

|

|

|

|

(b)

|

x

|

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

|

|

4.

|

Source of Funds

(See Instructions)

WC

|

|

|

|

|

|

|

5.

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

|

|

6.

|

Citizenship or

Place of Organization

Delaware

|

|

|

|

|

|

Number of

Shares

Beneficially

Owned

By Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

|

|

|

|

|

|

|

|

8.

|

Shared Voting

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.

|

Sole Dispositive

Power

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.

|

Shared Dispositive

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.

|

Aggregate Amount

Beneficially Owned by Each Reporting Person

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.

|

Percent of Class

Represented by Amount in Row (11)

Approximately

9.7%*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.

|

Type of Reporting

Person (See Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* As of June 2, 2014. See Item 5 of

the disclosure for information regarding earlier holdings.

|

|

|

|

|

1.

|

Names of Reporting

Persons

Michael

Novielli

|

|

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group

(See Instructions)

|

|

|

|

|

|

(a)

|

o

|

|

|

|

|

|

(b)

|

x

|

|

|

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

|

|

|

|

4.

|

Source of Funds

(See Instructions)

WC/AF

|

|

|

|

|

|

|

|

|

5.

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

|

|

|

|

6.

|

Citizenship or

Place of Organization

U.S.

Citizen

|

|

|

|

|

|

|

|

Number of

Shares

Beneficially

Owned

By Each

Reporting

Person With

|

7.

|

Sole Voting Power

296,278*

†

|

|

|

|

|

|

|

|

|

|

|

8.

|

Shared Voting

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.

|

Sole Dispositive

Power

296,278*

†

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.

|

Shared Dispositive

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.

|

Aggregate Amount

Beneficially Owned by Each Reporting Person

4,192,663*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.

|

Percent of Class

Represented by Amount in Row (11)

Approximately

10.4%*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.

|

Type of Reporting

Person (See Instructions)

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* As of June 2, 2014. See Item 5 of

the disclosure for information regarding earlier holdings.

†

Held in the name of Dutchess Global Strategies Fund LLC, a private investment vehicle

the investments in which are beneficially owned solely by Novielli, who has sole power to vote and to dispose or direct the disposition

of the 296,278 shares of Common Stock.

|

|

|

|

|

1.

|

Names of Reporting

Persons

Douglas

Leighton

|

|

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group

(See Instructions)

|

|

|

|

|

|

(a)

|

o

|

|

|

|

|

|

(b)

|

x

|

|

|

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

|

|

|

|

4.

|

Source of Funds

(See Instructions)

WC/AF

|

|

|

|

|

|

|

|

|

5.

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

|

|

|

|

6.

|

Citizenship or

Place of Organization

U.S.

Citizen

|

|

|

|

|

|

|

|

Number of

Shares

Beneficially

Owned

By Each

Reporting

Person With

|

7.

|

Sole Voting Power

50,578*

†

|

|

|

|

|

|

|

|

|

|

|

8.

|

Shared Voting

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.

|

Sole Dispositive

Power

50,578

*

†

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.

|

Shared Dispositive

Power

3,896,385*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.

|

Aggregate Amount

Beneficially Owned by Each Reporting Person

3,946,963*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.

|

Percent of Class

Represented by Amount in Row (11)

Approximately

9.8%*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.

|

Type of Reporting

Person (See Instructions)

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* As of June 2, 2014. See Item 5 of

the disclosure for information regarding earlier holdings.

†

Held in the name of Bass Point Capital LLC, a private investment vehicle the investments

in which are beneficially owned solely by Leighton, who has sole power to vote and to dispose or direct the disposition of the

50,578 shares of Common Stock.

--------------------------------------------------------------------------------

Item 1.

Security and Issuer

.

This Statement relates to the common

stock, $.00001 par value per share (the “Common Stock”), of Brazil Interactive Media, Inc., a Delaware corporation

(the “Issuer,” the “Company,” or “Brazil Interactive), with its principal executive offices at 3457

Ringsby Ct., Unit 111, Denver CO, 80216-4900.

Item

2.

Identity and Background

.

This Statement on Schedule 13D is

being filed by Dutchess Opportunity Fund II LP (“Dutchess”), Michael Novielli (“Novielli”) and Douglas

Leighton (“Leighton”) (each a “Reporting Person” and, collectively, the “Reporting Persons”).

Novielli and Leighton are the Directors of Dutchess and may be deemed indirect beneficial owners of the Common Stock directly

beneficially owned by Dutchess pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules thereunder

Each of the Reporting Persons disclaims beneficial ownership of the securities reported herein except to the extent of its pecuniary

interest therein.

During the last five years neither

Dutchess, Novielli nor Leighton have (i) been convicted in a criminal proceeding, or (ii) been a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or state securities

laws or finding any violation with respect to such laws. Dutchess is a limited partnership organized under the laws of Delaware.

Mr. Novielli and Mr. Leighton are citizens of the United States.

Item 3.

Source and

Amount of Funds or Other Consideration

.

All purchases of the Common

Stock reported herein, and all purchases of other securities which may from time to time have been converted into Common Stock

were made using working capital of the relevant Reporting Person. As discussed in Item 5 of this report on Schedule 13D, certain

shares of the Common Stock were acquired in exchange for other securities of the company in transactions with the Company or to

settle certain previously contracted debts with the Company. As of the date hereof, Dutchess has used approximately $288,524 of

its working capital to purchase shares of Common Stock, Novielli has used approximately $60,000 of his personal working capital

to purchase shares of Common Stock, and Leighton has used approximately $10,000 of his personal working capital to purchase shares

of Common Stock.

Except as noted above, no other

funds or other consideration were used in making any purchases of Common Stock.

Item

4.

Purpose of Transaction

.

Each of the Reporting Persons acquired

beneficial ownership of the Common Stock to which this Statement relates for investment purposes. Each of the Reporting Persons

may in the future determine to purchase more Common Stock and/or dispose of Common Stock of the Company in the ordinary course

of their investment activities, as market and other conditions dictate.

|

Item 5.

|

Interest in Securities of the Issuer

.

|

(a),(b),(c). As of June 2, 2014,

Dutchess directly beneficially owned 3,896,385 shares of Common Stock, which represents approximately 9.7 percent of the total

shares of Common Stock outstanding. As Directors of Dutchess, each of Messrs. Novielli and Leighton may be deemed to be indirect

beneficial owners of the 3,896,385 shares of Common Stock directly beneficially owned by Dutchess. As a result, each of the Reporting

Persons may be deemed to have shared power to vote the 3,896,385 shares of Common Stock and shared power to dispose or direct

the disposition of the 3,896,385 shares of Common Stock. In addition, as of May 19, 2014, Novielli directly beneficially owned

296,278 shares of Common Stock, which represents approximately 0.7 percent of the total shares of Common Stock outstanding. These

shares are held in the name of Dutchess Global Strategies Fund LLC, a private investment vehicle the investments in which are

beneficially owned solely by Novielli, who has sole power to vote the 296,278 shares of Common Stock and sole power to dispose

or direct the disposition of the 296,278 shares of Common Stock. In addition, as of May 19, 2014, Leighton directly beneficially

owned 50,578 shares of Common Stock, which represents approximately 0.1 percent of the total shares of Common Stock outstanding.

These shares are held in the name of Bass Point Capital LLC, a private investment vehicle the investments in which are beneficially

owned solely by Leighton, who has sole power to vote the 50,578 shares of Common Stock and sole power to dispose or direct the

disposition of the 50,578 shares of Common Stock.

On May 16, in connection with an

Agreement and Plan of Merger to acquire all of the issued and outstanding shares of common stock of Denver, Colorado-based Hollister

& Blacksmith Inc. (the “Merger”), Dutchess received 982,801 shares of Common Stock in exchange for certain other

securities of the Company, and 197,101 shares of Common Stock to settle certain previously contracted debts with the Company.

No additional consideration was paid for these shares. At the time of Merger, Dutchess held 2,800,008 shares of Common Stock,

bringing its total to 3,979,910 shares of Common Stock.

Also on May 16, 2014, in connection

with the Merger and a new round of financing (the “Financing”), Dutchess acquired $71,500. face value of convertible

debentures (the “Debentures”) for a purchase price of $71,500. The Debentures expire on April 24, 2016, and are convertible

into shares of Common Stock at a conversion price of $0.08 per share; however, the Debentures are subject to a provision stating

that the holder is not entitled to convert, and that the Company will not permit such conversion, into that number of shares which,

when added to the number of shares of Common Stock already beneficially owned by the converting party (as such term is defined

under Section 13(d) of the Act and Rule 13d-3 thereunder), would exceed 4.99 percent of the number of shares of Common Stock then

outstanding. Given that the Reporting Persons already beneficially own in excess of 4.99 percent of the number of shares of Common

Stock outstanding, this makes the Debentures presently unexercisable in the hands of the Reporting Persons and the Reporting Persons

are therefore not deemed to be the beneficial owner of any shares of Common Stock underlying the Debentures.

Additional information regarding

the Merger, the Financing and the Debentures is provided in the Company’s current report on Form 8-K filed with the U.S.

Securities and Exchange Commission on May 15, 2014, which is expressly incorporated by reference herein and made a part hereof.

Also on May 16, in connection with

the Merger, Novielli received 245,700 shares of Common Stock in exchange for certain other securities of the Company and 50,578

shares of Common Stock to settle a previously contracted debt with the Company, and Leighton received 50,578 shares of common

stock to settle a previously contracted debt with the Company. No additional consideration was paid for these shares.

Also on May 16, 2014, Dutchess sold

71,200 shares of Common Stock in open market transactions at an average price of $0.84 per share. These shares were sold in open-market

transactions at prices ranging from $0.63 to $1.05, inclusive. The Reporting Persons undertake to provide upon request to the

staff of the Securities and Exchange Commission, full information regarding the number of shares sold at each separate price within

the ranges set forth above.

On May 19, 2014, Dutchess sold 10,000

shares of Common Stock in an open market transaction at $1.03 per share.

On June 1, 2014, Dutchess sold 2,325

shares of Common Stock in an open market transaction at $1.50 per share.

Other than the matters referred to

herein, there have been no other transactions in the Common Stock effected by the Reporting Persons during the sixty days preceding

the filing of this report on Schedule 13D

.

__________________________

On October 1, 2013, Dutchess acquired

800,000 shares of Common

Stock in return for services provided to the Company. As a result of this transaction, Dutchess

directly beneficially owned 3,466,675 shares of Common Stock, which represented approximately 7.7 percent of the then total shares

of Common Stock outstanding. As Directors of Dutchess, each of Novielli and Leighton may be deemed to have been indirect beneficial

owners of the 3,466,675 shares of Common Stock directly beneficially owned by Dutchess. As a result, the Reporting Persons may

be deemed to have had shared power to vote the 3,466,667 shares of Common Stock and shared power to dispose or direct the disposition

of the 3,466,667 shares of Common Stock. In addition, Novielli also beneficially owned certain convertible securities that resulted

in deemed beneficial ownership of 166,667 shares of Common Stock. These shares were held in the name of Dutchess Global Strategies

Fund LLC, a private investment vehicle the investments in which are beneficially owned solely by Novielli, who has sole power

to vote the shares of Common Stock and sole power to dispose or direct the disposition of the shares of Common Stock.

___________________________

On March 27, 2013, Dutchess acquired

2,000,008 shares of Common Stock in a private transaction

.

Dutchess also beneficially owned certain convertible securities

that resulted in beneficial ownership of 666,667 shares of Common Stock.

As a result, Dutchess directly beneficially owned

2,666,675 shares of Common Stock, which represented 6.7 percent of the then total shares of Common Stock outstanding. As Directors

of Dutchess, each of Novielli and Leighton may be deemed to have been indirect beneficial owners of the 2,666,675 shares of Common

Stock directly beneficially owned by Dutchess. As a result, the Reporting Persons may be deemed to have had shared power to vote

the 2,666,675 shares of Common Stock and shared power to dispose or direct the disposition of the 2,666,675 shares of Common Stock.

In addition, Novielli also beneficially owned certain convertible securities that resulted in deemed beneficial ownership of 166,667

shares of Common Stock. These shares were held in the name of Dutchess Global Strategies Fund LLC, a private investment vehicle

the investments in which are beneficially owned solely by Novielli, who has sole power to vote the shares of Common Stock and

sole power to dispose or direct the disposition of the shares of Common Stock.

(d) Except as set forth herein, no

other person is known to have the right to receive or the power to direct the receipt of dividends from, or any proceeds from

the sale of, securities of the Issuer beneficially owned by the Reporting Persons.

(e) Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Other than the matters discussed

herein, including but not limited to the matters discussed in Item 5 of this report on Schedule 13D, none of the Reporting Persons

has any contracts, arrangements, understandings or relationships with Respect to Securities of the Issuer.

Item

7. Material to be Filed as Exhibits

Exhibit A Joint Filing Agreement.

Exhibit

B Information regarding the Merger, the Financing and the Debentures (incorporated herein by reference to the

Company’s current report on Form 8-K and related exhibits filed with the U.S. Securities and Exchange Commission on May

15, 2014).

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated this 3rd day of

June, 2014.

DUTCHESS OPPORTUNITY

FUND II LP

By:

/s/ Michael

Novielli

Name: Michael Novielli

Title: Director

/s/ Michael Novielli

Michael

Novielli

/s/ Douglas Leighton

Douglas

Leighton

EXHIBIT A

TO SCHEDULE 13D/A

June

3, 2014

In accordance with Rule

13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, DUTCHESS OPPORTUNITY FUND II LP, MICHAEL NOVIELLI and DOUGLAS

LEIGHTON hereby agree to the joint filing of this statement on Schedule 13D (including any and all amendments hereto). In addition,

each party to this Agreement expressly authorizes each other party to this Agreement to file on its behalf any and all amendments

to such Statement on Schedule 13D. A copy of this Agreement shall be attached as an exhibit to the Statement on Schedule 13D filed

on behalf of each of the parties hereto, to which this Agreement relates.

This Agreement may be

executed in multiple counterparts, each of which shall constitute an original, one and the same instrument.

DUTCHESS OPPORTUNITY

FUND II LP

By:

/s/ Michael

Novielli

Name: Michael Novielli

Title: Director

/s/ Michael Novielli

Michael

Novielli

/s/ Douglas Leighton

Douglas

Leighton

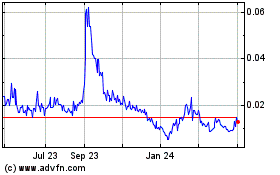

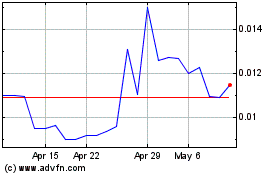

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From May 2024 to Jun 2024

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jun 2023 to Jun 2024