UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

____________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of March 2022

Commission File Number: 001-38303

______________________

WPP plc

(Translation of registrant's name into English)

________________________

Sea Containers, 18 Upper Ground

London, United Kingdom SE1 9GL

(Address of principal executive offices)

_________________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F X Form 40-F

___

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an

attached annual report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ___

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report

or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been

distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form

6-K submission or other Commission filing on EDGAR.

Forward-Looking Statements

In

connection with the provisions of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”), WPP plc and its

subsidiaries (the “Company”) may include

forward-looking statements (as defined in the Reform Act) in oral

or written public statements issued by or on behalf of the Company.

These forward-looking statements may include, among other things,

plans, objectives, projections and anticipated future economic

performance based on assumptions and the like that are subject to

risks and uncertainties. As such, actual results or outcomes may

differ materially from those discussed in the forward-looking

statements. Important factors that may cause actual results to

differ include but are not limited to: the unanticipated loss of a

material client or key personnel, delays or reductions in client

advertising budgets, shifts in industry rates of compensation,

regulatory compliance costs or litigation, natural disasters or

acts of terrorism, the Company’s exposure to changes in the

values of major currencies other than the UK pound sterling

(because a substantial portion of its revenues are derived and

costs incurred outside of the United Kingdom) and the overall level

of economic activity in the Company’s major markets (which

varies depending on, among other things, regional, national and

international political and economic conditions and government

regulations in the world’s advertising markets). In addition,

you should consider the risks described in Item 3D, captioned

“Risk Factors” in the Company’s Form 20-F for the

year ended 31 December 2019, which could also cause actual results

to differ from forward-looking information. In light of these and

other uncertainties, the forward-looking statements included in the

oral or written public statements should not be regarded as a

representation by the Company that the Company’s plans and

objectives will be achieved.

The

Company undertakes no obligation to update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

1

|

Annual Report 2021 and AGM 2022 dated 31 March 2022, prepared by

WPP plc.

|

|

FOR

IMMEDIATE RELEASE

|

31

March 2022

|

WPP

PLC (“WPP” or “the Company”)

Publication of Annual Report 2021, Sustainability Report and 2022

Notice of Annual General Meeting

WPP has today published on its website its Annual Report for

the year ended 31 December 2021 ('Annual Report 2021',

www.wpp.com/investors/annual-report-2021)

together with its Sustainability Report. WPP has also today

published its 2022 Notice of Annual General Meeting (the '2022 AGM

Notice', www.wpp.com/investors/shareholder-centre/shareholder-meetings),

which will be distributed to shareholders

shortly.

The

Company’s AGM will be held on 24 May 2022 at 2.00pm at Sea

Containers House, 18 Upper Ground, London SE1 9GL, with facilities

to follow the business of the AGM virtually.

In

compliance with 9.6.1 of the Listing Rules, copies of the

Annual Report 2021 and 2022 AGM

Notice will be submitted to the UK Listing

Authority and will shortly be available for inspection at the

National Storage Mechanism https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

A hard copy version of the Annual Report 2021 will be sent to those

shareholders who have elected to receive paper communications on or

about 19 April 2022.

The

information included in the unaudited preliminary results

announcement released on 24 February 2022, together with the

information in the Appendices to this announcement which is

extracted from the Annual Report 2021, constitute the materials

required by the FCA's Disclosure Guidance and Transparency Rule

6.3.5R. This announcement is not a substitute for reading the

Annual Report 2021 in full. Page and note references in the

Appendices below refer to page and note references in the Annual

Report 2021.

Balbir

Kelly-Bisla

Company

Secretary

Further information

|

Chris

Wade, WPP

Richard

Oldworth,

Buchanan

Communications

|

+44

(0)20 7282 4600

+44

(0)20 7466 5000

|

About WPP

WPP is the creative transformation company. We use the power of

creativity to build better futures for our people, planet, clients

and communities. For more information, visit www.wpp.com.

APPENDIX A: PRINCIPAL RISKS AND UNCERTAINTIES

PRINCIPAL

RISKS

The Board has

carried out a robust assessment of the principal risks and

uncertainties affecting the Group and the markets we operate in and

strategic decisions taken by the Board as at 31 December 2021 and

up to the date of this report including any adverse effects of the

Covid-19 pandemic and the geopolitical situation following the

Russian invasion of Ukraine and which are described in the table on

the following pages.

COVID-19

PANDEMIC

Risk

definition

The extent of the

continued impact of the Covid-19 pandemic on our business will

depend on numerous factors that we are not able to accurately

predict, including the duration and scope of the pandemic, any

existing or new variants, government actions to mitigate the

effects of the pandemic and the intermediate and long-term impact

of the pandemic on our clients’ spending plans.

Potential

impact

The Covid-19

pandemic and any new variants and the measures to contain its

spread may have a continuing adverse effect on our business,

revenues, results of operations and financial condition and

prospects.

How

it is managed and reflected in our strategic

priorities

A strong balance

sheet, supported further by action to maintain liquidity including,

if needed, the suspension of share buybacks, dividends and

acquisitions, cost reduction and cash conservation measures,

savings on property and IT capex. Constant monitoring of working

capital position.

STRATEGIC

RISKS

Risk

definition

The failure to

successfully complete the strategic plan updated in December 2020

to return the business to sustained growth and simplify our

structure.

Potential

impact

A failure or delay

in implementing or realising the benefits from the transformation

plan and/or returning the business to sustained growth may have a

material adverse effect on our market share and our business,

revenues, results of operations, financial condition or

prospects.

How

it is managed and reflected in our strategic

priorities

Board oversight of

the implementation of the strategic plan and regular briefings on

the Group’s response to the pandemic and the economic and

geopolitical consequences of the invasion of Ukraine by

Russia.

The Executive

Committee regularly reviews progress against the strategic plan and

actions required to deliver against the plan and convenes regularly

to discuss the Group’s response to and implementation of the

measures highlighted above to mitigate the impact of the pandemic

and the economic and geopolitical consequences of the invasion of

Ukraine by Russia on the Group’s operations, people, clients

and financial condition.

The focus on

managing cost and changes in ways of working have accelerated

aspects of the transformation as we move faster towards a

simplified company structure and enhanced use of technology by our

people as a consequence of adapting to remote working.

OPERATIONAL

RISKS - CLIENTS

Risk

definition

We compete for

clients in a highly competitive industry which has been evolving

and undergoing structural change. Client loss to competitors or as

a consequence of client consolidation, insolvency or a reduction in

marketing budgets due to recessionary economic conditions triggered

by the pandemic, the invasion of Ukraine by Russia, or a

geopolitical change or shift in client spending would have a

material adverse effect on our market share, business, revenues,

results of operations, financial condition and

prospects.

Potential

impact

The competitive

landscape in our industry is constantly evolving and the role of

more traditional services and operators in our sector is being

challenged. Competitors include multinational advertising and

marketing communication groups, marketing services companies,

database marketing information and measurement and professional

services and consultants and consulting internet

companies.

Client contracts

can generally be terminated on 90 days’ notice or are on an

assignment basis and clients put their business up for competitive

review from time to time. The ability to attract new clients and to

retain or increase the amount of work from existing clients may be

impacted if we fail to react quickly enough to changes in the

market and to evolve our structure, and by loss of reputation, and

may be limited by clients’ policies on conflicts of

interest.

There are a range

of different impacts on our clients globally as a consequence of

the pandemic and the geopolitical and economic consequences of the

invasion of Ukraine and imposition of sanctions. In the past,

clients have responded to weak economic and financial conditions by

reducing or shifting their marketing budgets which are easier to

reduce in the short term than their other operating

expenses.

How

it is managed and reflected in our strategic

priorities

The transformation

plan updated in December 2020. Emphasis on providing faster, more

agile and more effectively integrated solutions for our

clients.

Simplifying our

organisational structure such as the reduction in the number of

legal entities in the Group as part of an ongoing programme and the

disposal of non-core minority holdings.

Launch of further

campus co-locations including in London, Warsaw and Milan.

Embedding data and technology more deeply into our offer to

clients.

Board focus on the

importance of a positive and inclusive culture across our business

to attract and retain talent and clients. Team focused on culture,

diversity and inclusion across the Group and the WPP Global

Inclusion Council and commitments to anti-racism.

Continuous

improvement of our creative capability and reputation of our

businesses.

The development and

implementation of senior leadership incentives to align more

closely with our strategy and performance.

Business review at

every Board, management and Executive Committee meeting to identify

client loss. Monthly updates to the management team on the status

of the Group’s major clients and upcoming pitches for

potential new clients. Continuous engagement with our clients and

suppliers through this period of uncertainty and reduction in

economic activity.

OPERATIONAL

RISKS - CLIENTS

Risk

definition

We receive a

significant portion of our revenues from a limited number of large

clients and the net loss of one or more of these clients could have

a material adverse effect on our prospects, business, financial

condition and results of operations.

Potential

impact

A relatively small

number of clients contribute a significant percentage of our

consolidated revenues. Our ten largest clients accounted for 17% of

revenue less pass-through costs in the year ended 31 December 2021.

Clients can reduce their marketing spend, terminate contracts or

cancel projects on short notice. The loss of one or more of our

largest clients, if not replaced by new accounts or an increase in

business from existing clients, would adversely affect our

financial condition.

How

it is managed and reflected in our strategic

priorities

Increased

flexibility in the cost structure (including incentives,

consultants and freelancers).

Business review at

every Board meeting and regular engagement at executive level with

our clients.

A monthly new and

existing business tracker is reviewed by the Executive Committee on

a monthly basis with regular updates to the Board.

PEOPLE,

CULTURE AND SUCCESSION

Risk

definition

Our performance

could be adversely affected if we do not react quickly enough to

changes in our market and fail to attract, develop and retain key

creative, commercial, technology and management talent, or are

unable to retain and incentivise key and diverse

talent.

Potential

impact

We are highly

dependent on the talent, creative abilities and technical skills of

our people as well as their relationships with clients. We are

vulnerable to the loss of people to competitors (traditional and

emerging) and clients, leading to disruption to the

business.

How

it is managed and reflected in our strategic

priorities

Our incentive plans

are structured to provide retention value, for example by paying

part of annual incentives in shares that vest two years after grant

date.

We are working

across the businesses to embed collaboration and investing in

training and development to retain and attract talented people. The

investment in co-located campus properties is increasing the

co-operation across our companies and provides extremely attractive

and motivating working environments.

Succession planning

for the Chief Executive Officer, the Chief Financial Officer and

key executives of the Company is undertaken by the Board and

Nomination and Governance Committee on a regular basis and a pool

of potential internal and external candidates are identified in

emergency and planned scenarios.

The Compensation

Committee provides oversight for the Group’s incentive plans

and compensation. Our first priority during the Covid-19 pandemic

has been the safety and welfare of our people and seeking to

protect them as much as possible as well as maintaining the ability

to serve clients and win new business as markets

recover.

CYBER

AND INFORMATION SECURITY

Risk

definition

We are undertaking

a series of IT transformation programmes to support the

Group’s strategic plan and a failure or delay in implementing

the IT programmes may have a material adverse effect on its

business, revenues, results of operations, financial conditions or

prospects. The Group is reliant on third parties for the

performance of a significant portion of our worldwide information

technology and operations functions. A failure to provide these

functions could have an adverse effect on our business. During the

transformation, we are still reliant on legacy systems which could

restrict our ability to change rapidly.

The Group has in

the past and may in the future experience a cyber-attack which

results in disruption to one or more of our businesses or the

security of data being compromised.

Potential

impact

We may be subject

to investigative or enforcement action or legal claims or incur

fines, damages, or costs and client loss if we fail to adequately

protect data. A system breakdown or intrusion could have a material

adverse effect on our business, revenues, results of operations,

financial condition or prospects and have an impact on long-term

reputation and lead to client loss.

The imposition of

sanctions following the Russian invasion of Ukraine has triggered

an increase in cyber attacks generally.

How

it is managed and reflected in our strategic

priorities

The IT

transformation programmes are underpinning our strategic plan and

enhance our data security.

There is a rolling

programme to retire servers across the Group and move to cloud

solutions.

We monitor and log

our network and systems and keep raising our people’s

security awareness through our WPP Safer Data training and mock

phishing attacks. Heightened focus on monitoring our network and

systems and raising awareness of the potential for phishing and

other cyber-attacks during the period of remote working and the

geopolitical situation and an increased focus on our control

environment.

FINANCIAL

RISKS – ECONOMIC AND CREDIT RISK

Risk

definition

Economic conditions

have a direct impact on our business, results of operations and

financial position. Adverse economic conditions, including those

caused by the pandemic, invasion of Ukraine by Russia, severe and

sustained inflation in key markets where we operate, supply chain

issues affecting the distribution of our clients’ products

and/or disruption in credit markets, pose a risk our clients may

reduce, suspend or cancel spend with us or be unable to satisfy

obligations. We are subject to credit risk through the default of a

client or other counterparty.

Potential

impact

We are generally

paid in arrears for our services. Invoices are typically payable

within 30 to 60 days.

We commit to media

and production purchases on behalf of some of our clients as

principal or agent depending on the client and market

circumstances. If a client is unable to pay sums due, media and

production companies may look to us to pay those amounts and there

could be an adverse effect on our working capital and operating

cash flow.

How

it is managed and reflected in our strategic

priorities

Evaluating and

monitoring clients’ ongoing creditworthiness and in some

cases requiring credit insurance or payments in

advance.

We are working

closely with our clients during this period of economic uncertainty

to ensure timely payment for services in line with contractual

commitments and with vendors to maintain the settlement flow on

media.

Our treasury

position and compliance with lending covenants is a recurring

agenda item for the Audit Committee and Board.

Increased

management processes to manage working capital and review cash

outflows and receipts during the Covid-19 pandemic and as a

consequence of the invasion of Ukraine by Russia.

FINANCIAL

RISKS – INTERNAL CONTROLS

Risk

definition

Our performance

could be adversely impacted if we failed to ensure adequate

internal control procedures are in place.

We have previously

identified material weaknesses in our internal control over

financial reporting. If we failed to properly remediate these

material weaknesses or new material weaknesses are identified, they

could adversely affect our results of operations, investor

confidence in the Group and the market price of our ADSs and

ordinary shares.

Potential

impact

Failure to ensure

that our businesses have robust control environments, or that the

services we provide and trading activities within the Group are

compliant with client obligations, could adversely impact client

relationships and business volumes and revenues.

As disclosed in our

Form 20-F, in connection with the Group’s assessment of the

effectiveness of internal control over financial reporting as of

December 31, 2020, we previously identified material weaknesses in

our internal control over financial reporting with respect to

management’s review of the impairment assessment of

intangible assets and goodwill (specifically the selection of

appropriate discount rates for use in the impairment calculations,

the determination of the appropriateness of the cash flow periods

and associated discounting and determination of the assumptions in

respect of working capital cash flows, in each case used in the

impairment calculation); the design and implementation of internal

controls to ensure that the complex accounting matters and

judgements are assessed against the requirements of IFRS and to

reflect changes in the applicable accounting standards and

interpretations or changes in the underlying business on a timely

basis; and our net investment hedging arrangements (specifically

concerning the eligibility of hedging relationships under IFRS, the

adequacy and maintenance of contemporaneous documentation of the

application of hedge accounting, and the review of the impact of

changes in internal financing structures on such hedging

relationships). We implemented remedial measures during 2021 and

believe that we have remediated each of these material weaknesses

such that our internal control over financial reporting is

effective as at 31 December 2021.

If

the remedial measures were ultimately insufficient to address the

material weaknesses, or if additional material weaknesses in

internal control are discovered or occur in the future, our ability

to accurately record, process and report financial information and,

consequently, our ability to prepare financial statements within

required time periods, could be adversely affected. In addition,

the Group may be unable to maintain compliance with the federal

securities laws and NYSE listing requirements regarding the timely

filing of periodic reports. Any of the foregoing could cause

investors to lose confidence in the reliability of our financial

reporting, which could have a negative effect on the trading price

of the Group’s ADSs and ordinary shares.

How

it is managed and reflected in our strategic

priorities

Transparency and

contract compliance are embedded through the networks and

reinforced by audits at a WPP and network level.

Regular monitoring

of key performance indicators for trading are undertaken to

identify trends and issues. An authorisation matrix on inventory

trading is agreed with the Company and the Audit

Committee.

In 2021, our new

controls function continued to review and enhance controls across

the Group, under the direction of our Global Director of Risk and

Controls. As part of this effort, we significantly enhanced the

staffing, capabilities and resources of our technical accounting

function, which supported the retrospective review efforts and will

continue to provide ongoing support in regards to complex

accounting matters and judgment and changes in accounting

standards.

Management is

committed to maintaining a strong internal control environment,

with appropriate oversight from our Audit Committee. We have made

significant enhancements to our controls through the implementation

of the remediation and continue to evaluate further opportunities

to improve our control environment. We have engaged an independent

valuation specialist, on an on-going basis with oversight by

management, to assist us as an integral part of the discount rate

and cash flow determination process in the impairment assessment of

intangible assets and goodwill.

This has included

such items as updating our discount determination methodology for a

current market participant approach; enhancing the level of review

and controls related to the selection of the variables underpinning

the discount rate calculation, the discount rate methodology and

annual refresh; and implementing additional validation controls and

additional reviews of the selection of cash flow periods and net

working capital assumptions. In the case of complex accounting

matters and hedging arrangements, we performed a comprehensive

retrospective review of our controls and procedures and implemented

enhanced periodic controls into our control framework and have

engaged outside advisors with specialist expertise in the

respective subject matter areas to assist with the performance of

the comprehensive retrospective review.

COMPLIANCE

RISKS – DATA PRIVACY

Risk

definition

We are subject to

strict data protection and privacy legislation in the jurisdictions

in which we operate and rely extensively on information technology

systems. We store, transmit and rely on critical and sensitive data

such as strategic plans, personally identifiable information and

trade secrets:

-

Security of this

type of data is exposed to escalating external threats that are

increasing in sophistication, as well as internal data

breaches

-

Data transfers

between our global operating companies, clients or vendors may be

interrupted due to changes in law (eg EU adequacy decisions, CJEU

Schrems II decision)

Potential

impact

We may be subject

to investigative or enforcement action or legal claims or incur

fines, damages, or costs and client loss if we fail to adequately

protect data or observe privacy legislation in every

instance:

-

The Group has in

the past and may in the future experience a system breakdown or

intrusion that could have a material adverse effect on our

business, revenues, results of operations, financial condition or

prospects

-

Restrictions or

limitations on international data transfers could have an adverse

effect on our business and operations

How

it is managed and reflected in our strategic

priorities

We develop

principles on privacy and data protection and compliance with local

laws. We also monitor pending changes to regulations and identify

changes to our processes and policies that would need to be

implemented. In the case of data transfers, we also identify

alternative approaches, including using other permitted transfer

mechanisms, in order to limit any potential disruption (eg SCCs

instead of Privacy Shield following the CJEU Schrems II

decision).

We implemented

extensive training ahead of GDPR and CPPA implementation and the

roll-out of toolkits to assist our people to prepare for

implementation and will do the same as new legislation is adopted

in other markets.

A Chief Privacy

Officer and Data Protection Officer have been appointed at the

Company and Data Protection Officers are in place at a number of

our companies.

Our people must

take Privacy & Data Security Awareness training and understand

the WPP Data Code of Conduct and WPP policies on data privacy and

security.

The Data Health

Checker survey is performed annually to understand the scale and

breadth of data we collect so the level of risk associated with

this can be assessed.

COMPLIANCE

RISKS – TAXATION

Risk

definition

We may be subject

to regulations restricting our activities or effecting changes in

taxation.

Potential

impact

Changes in local or

international tax rules, for example, as a consequence of the

financial support programmes implemented by governments during the

Covid-19 pandemic, the OECD/G20 Inclusive Framework on Base Erosion

and Profit Shifting, and changes arising from the application of

existing rules, or challenges by tax or competition authorities,

may expose us to significant additional tax liabilities or impact

the carrying value of our deferred tax assets, which would affect

the future tax charge.

How

it is managed and reflected in our strategic

priorities

We actively monitor

any proposed regulatory or statutory changes and consult with

government agencies and regulatory bodies where possible on such

proposed changes.

Bi-annual briefings

to the Audit Committee of significant changes in tax laws and their

application and regular briefings to executive management. We

engage advisors and legal counsel to obtain opinions on tax

legislation and principles.

COMPLIANCE

RISKS – REGULATORY

Risk

definition

We are subject to

strict anti-corruption, anti-bribery and anti-trust legislation and

enforcement in the countries in which we operate.

Potential

impact

We operate in a

number of markets where the corruption risk has been identified as

high by groups such as Transparency International. Failure to

comply or to create a culture opposed to corruption or failing to

instil business practices that prevent corruption has previously

and could expose us to civil and criminal sanctions.

How

it is managed and reflected in our strategic

priorities

Online and

in-country ethics, anti-bribery, anti-corruption and anti-trust

training on a Group-wide basis to raise awareness and seek

compliance with our Code of Conduct and the Anti-Bribery &

Corruption Policy.

A continuously

evolving business integrity function to ensure compliance with our

codes and policies and remediation of any breaches of

policy.

Continuous

communication of the Right to Speak confidential, independently

operated helpline for our people and stakeholders to raise any

potential breaches of our Code and policies, which are investigated

and reported to the Audit Committee on a regular

basis.

Due diligence on

acquisitions and on selecting and appointing suppliers and

restrictions on the use of third-party consultants in connection

with any client pitches. Rolling programme of creating shared

financial services in the markets in which we operate and the

creation of a new controls function in 2020.

Risk Committees are

well established at WPP and across the networks to monitor risk and

compliance through all of our businesses and the enhancement of our

business integrity programme across our markets.

Gift and

hospitality register and approvals process.

COMPLIANCE

RISKS – SANCTIONS

Risk

definition

We are subject to

the laws of the United States, the EU, the UK and other

jurisdictions that impose sanctions and regulate the supply of

services to certain countries.

The Russian

invasion of Ukraine has caused the adoption of comprehensive

sanctions by, among others, the EU, the United States and the UK,

which restrict a wide range of trade and financial dealings with

Russia and Russian persons.

Potential

impact

Failure to comply

with these laws could expose us to civil and criminal penalties

including fines and the imposition of economic sanctions against us

and reputational damage and withdrawal of banking facilities which

could materially impact our results.

How

it is managed and reflected in our strategic

priorities

Online training to

raise awareness and seek compliance and updates for our companies

on any new sanctions.

Regular briefings

to the Audit Committee and constant monitoring by the WPP legal

team with assistance from external advisors of the sanctions

regimes. Executive Committee briefed and working with WPP legal to

ensure compliance with escalating sanctions as a consequence of the

Russian invasion of Ukraine.

We have taken a

number of actions as a consequence of the invasion. We have

announced the discontinuance of our operations in Russia and

ensured compliance with all sanctions as they impact any clients,

suppliers or financial arrangements.

EMERGING

RISKS

Risk

definition

Increased frequency

of extreme weather and climate-related natural

disasters.

Potential

impact

This includes

storms, flooding, wildfires and water and heat stress which can

damage our buildings, jeopardise the safety of our people and

significantly disrupt our operations. At present 10% of our

headcount is located in countries at “extreme” risk

from the physical impacts of climate change in the next 30

years.

How

it is managed and reflected in our strategic

priorities

Our strategy of

co-locating our people in WPP campuses is enabling us to centralise

emergency preparedness procedures. It will also enable us to more

efficiently deploy climate mitigation measures. We integrate

climate-related risk assessment into the technical due diligence

suite that we follow when we invest in a new campus building to

help ensure that material, acute and chronic physical climate risks

are considered in design and embedded into business continuity

procedures.

EMERGING

RISKS

Risk

definition

Increased

reputational risk associated with working on client briefs

perceived to be environmentally detrimental and/or misrepresenting

environmental claims.

Potential

impact

As consumer

consciousness around climate change rises, our sector is seeing

increased scrutiny of its role in driving unsustainable

consumption. Our clients seek expert partners who can give

recommendations that take into account stakeholder concerns around

climate change.

Additionally, WPP

serves some clients whose business models are under increased

scrutiny, for example energy companies or associated industry

groups who are not actively decarbonising. This creates both a

reputational and related financial risk for WPP if we are not

rigorous in our content standards as we grow our

sustainability-related services.

How

it is managed and reflected in our strategic

priorities

Our climate crisis

training seeks to ensure that our people recognise the importance

of our sector’s role in addressing the climate crisis. It is

part of a broader sustainability training programme being run in

multiple markets with localised content in key

regions.

We have developed

internal tools to help our people identify environmentally harmful

briefs. These tools embed climate-related issues within existing

content-review procedures across the organisation. The

misrepresentation of environmental issues is governed by our Code

of Conduct. We also ensure our policies reduce the risk that any

client brief undermines the implementation of the Paris

Agreement.

EMERGING

RISKS

Risk

definition

Changes in

regulation and reporting standards.

Potential

impact

We could be subject

to increased costs to comply with potential future changes in

environmental laws and regulations and increasing carbon offset

pricing to meet our net zero commitments.

Carbon emission

accounting for marketing and media is in its infancy and

methodologies continue to evolve. This is particularly the case for

emissions associated with digital media.

How

it is managed and reflected in our strategic

priorities

We are developing a

net zero roadmap to deliver against our net zero commitments and

aim to disclose more details of that roadmap in 2023.

As part of this

plan and through our work to decarbonise media and media supply

chains, we are exploring opportunities to improve accounting for

emissions from media.

As we seek to limit

emissions we need to reduce the total footprint of any product or

service as far as possible. To manage the cost and quality of

carbon credits purchased to offset remaining emissions, WPP

developed a new offsetting policy and is further developing our

offsetting strategy as part of our net zero roadmap.

APPENDIX B: DIRECTORS' RESPONSIBILITY STATEMENT

Each of the current

Directors whose names and functions are listed in the Corporate

Governance section of the Annual Report 2021 confirms that, to the

best of his or her knowledge:

●

the Group financial

statements, which have been prepared in accordance with IFRS,

issued by the International Accounting Standards Board (IASB) as

they apply to the financial statements of the Group for the year

ended 31 December 2021, give a true and fair view of the assets,

liabilities, financial position and profit of the Group.

and

●

the Strategic

report and risk sections of the Annual Report, which represent the

management report, include a fair review of the development and

performance of the business and the position of the Company and the

Group taken as a whole, together with a description of the

principal risks and uncertainties that it faces.

APPENDIX C: RELATED PARTY TRANSACTIONS

The

Group enters into transactions with its associate undertakings. The

Group has continuing transactions with Kantar, including sales,

purchases, the provision of IT services, subleases and property

related items. In the year ended 31 December 2021, revenue of

£117.2 million (2020: £90.6 million) was reported in

relation to Compas, an associate in the USA. All other transactions

in the years presented were immaterial. The Group invested a

further £92.9 million in Kantar in 2021 to fund its 40% share

of the Numerator acquisition.

The

following amounts owed by related parties were outstanding at 31

December 2021:

Kantar £30.3

million

Other £45.7

million

The

following amounts owed to related parties were outstanding at 31

December 2021:

Kantar £(6.2)

million

Other £(51.4)

million

END

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

WPP PLC

|

|

|

(Registrant)

|

|

Date:

31 March 2022

|

By:

______________________

|

|

|

Balbir

Kelly-Bisla

|

|

|

Company

Secretary

|

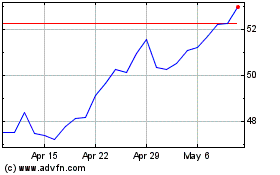

WPP (NYSE:WPP)

Historical Stock Chart

From Oct 2024 to Nov 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Nov 2023 to Nov 2024