By Nick Kostov and Lara O'Reilly

Shares in WPP PLC fell sharply Thursday after the world's

largest advertising group reported disappointing quarterly results

and cut its full-year guidance, underscoring the challenge facing

new Chief Executive Mark Read.

Like much of the advertising world, WPP is wrestling with a

shift to digital ads from print and TV, as well as tighter spending

by clients with ad agencies and demand for new services such as

data analytics.

However, WPP appears to be struggling to meet those challenges

more than its rivals.

The British company, which owns agencies including J. Walter

Thompson and Group M, said like-for-like net sales -- a key measure

of its operating performance -- fell 1.5% for the quarter ended

Sept. 30. That's far worse than the 0.4% rise expected by analysts

and well below recent figures from rivals Omnicom Group Inc. and

Interpublic Group of Co.

"Clearly we've underperformed our competition in Q3. I can't

sugarcoat the reality," Mr. Read said on a call with analysts. "I

think there are issues in our sector, but the reasons we've

underperformed are clearly related to WPP."

Investors took fright from the downbeat quarter and warning that

full-year net sales would fall as much as 1%, rather than rise

modestly. It also said its profit margin would decline more than

expected and warned of a tough 2019.

WPP shares, down a third over the past 12 months, dropped more

than 20% in early trading in London and were down nearly 17% by

early afternoon. That puts the stock on course for its worst daily

fall since 1992, according to FactSet data.

The downbeat update adds to pressure on Mr. Read, who took the

helm in September after the departure of longtime CEO and founder

Martin Sorrell in April. Some analysts now fear Mr. Read's

turnaround plan could take longer than expected.

"A turnaround which could take at least three years is looking

increasingly likely," Conor O'Shea, an analyst at broker Kepler

Cheuvreux, said in a note.

Mr. Read said Thursday he still thought WPP could return to

growth, despite increased competition, lower fees and changes in

consumer behavior.

First, he will need to stop the drumroll of account losses in

recent weeks. Ford Motor Co., one of the firm's largest clients,

switched its creative duties to rival Omnicom Group Inc. in October

and companies including American Express Co., PepsiCo Inc. and

Daimler AG's Mercedes-Benz have moved business away from WPP

recently.

Mr. Read has sought to have greater oversight over such work,

telling agencies to report to corporate HQ any pitches that could

generate a minimum of $20 million in revenue.

He is also seeking to refine WPP's sprawling portfolio of

assets, selling some to reduce debt and simplify its

operations.

On Thursday, WPP confirmed it plans to unload a stake in its

underperforming market-research unit Kantar Group. A sale of even

part of the unit --valued by analysts at between EUR3 billion and

EUR4 billion -- would be the largest sale since Mr. Read became

CEO.

"Sentiment around WPP has been very weak, but hopefully this

move will help restore some confidence and part-repair a creaking

balance sheet," said Alex DeGroote, founder of media consultancy

DeGroote Consulting.

The Kantar plan is part of a broader effort by Mr. Read to

reorganize WPP's business in the hope of making it more nimble and

investing in companies that appear to be tech-savvy. On Wednesday,

WPP said it was consolidating its health care agencies into Ogilvy,

Wunderman and the recently merged VMLY&R creative agency.

"We have great strengths within the group, we just need to do a

better job at making it simpler for clients to access it," said Mr.

Read, adding it would "take some time" to see the results of his

strategy.

Again this quarter, WPP said a weakening of its businesses in

North America and in its creative agencies dragged down the group's

third-quarter performance. In North America, like-for-like net

sales dropped 5.3% on the comparable quarter a year earlier.

"We do have strong creative talent, we just need more of it,"

said Mr. Read, who said the company wouldn't rule out acquisitions

in this area although such deals would most likely focus on

technology.

Overall revenue declined by 0.8% to GBP3.76 billion ($4.85

billion) for the third quarter compared with GBP3.79 billion in the

year-earlier period.

WPP also announced Thursday its longtime Finance Director Paul

Richardson will retire in 2019.

The company is set to provide another strategy update in

December.

Adria Calatayud

contributed to this article.

Write to Nick Kostov at Nick.Kostov@wsj.com and Lara O'Reilly at

lara.o'reilly@wsj.com

(END) Dow Jones Newswires

October 25, 2018 09:36 ET (13:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

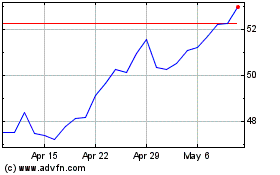

WPP (NYSE:WPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Jul 2023 to Jul 2024