WPP Cuts Full-Year Sales Guidance; Looks to Sell Kantar Stake

October 25 2018 - 2:31AM

Dow Jones News

By Nick Kostov and Adria Calatayud

WPP PLC (WPP.LN) on Thursday cut full-year guidance and

confirmed it is seeking to sell a stake in market-research unit

Kantar Group, as it reported third-quarter net sales below

expectations.

The world's largest advertising group said it now expects

like-for-like net sales to fall by between 0.5% and 1.0%.

Previously, the company had expected like-for-like net sales to

show trends similar to those experienced in the first half, when

like-for-like revenue rose 1.6% and comparable net sales were up

0.3%.

The U.K. company, which owns agencies including J. Walter

Thompson and Group M, said like-for-like net sales--a key measure

of its operating performance--fell 1.5% for the quarter ended Sept.

30. Analysts had expected a 0.4% rise.

WPP said a weakening of its businesses in North America and in

its creative agencies dragged down the group's third-quarter

performance. In North America, like-for-like net sales dropped

5.3%, WPP said.

Overall revenue declined 0.8% to 3.76 billion pounds ($4.86

billion) for the third quarter compared with GBP3.79 billion in the

year-earlier period.

In Thursday's statement, WPP confirmed it will seek to offload a

stake in Kantar Group, in what would be the largest sale since

Chief Executive Mark Read took the helm. The company is selling

assets to reduce its debt-to-earnings ratio and simplify its

sprawling operations, and previously signaled that disposing of all

or part of Kantar was an option.

Write to Nick Kostov at Nick.Kostov@wsj.com and Adria Calatayud

at adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

October 25, 2018 02:16 ET (06:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

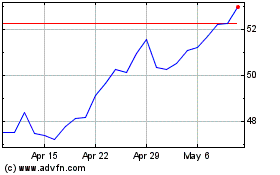

WPP (NYSE:WPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Jul 2023 to Jul 2024