U.S. Hot Stocks: Hot Stocks to Watch

November 22 2016 - 9:44AM

Dow Jones News

Among the companies with shares expected to trade actively in

Tuesday's session are Dollar Tree Inc. (DLTR), Medtronic PLC (MDT),

and Burlington Stores Inc. (BURL).

Dollar Tree provided upbeat top- and bottom-line guidance for

the current quarter even as sales rose less than it anticipated in

the latest period. Shares rose 8.2% to $88.75 in premarket

trading.

Medtronic on Tuesday said revenue growth lagged behind

expectations in the latest quarter while customers waited for new

product releases, and the company signaled some of that

sluggishness could linger. Shares of Medtronic fell 7.5% to $74.52

premarket.

Burlington Stores reported better-than-expected same-store sales

in the latest period as revenue topped views, bucking the trend of

retailers reporting disappointing results. Shares of the retailer

improved 8.5% to $80.49 premarket.

Palo Alto Networks Inc.'s (PANW) revenue jumped in the latest

quarter, but the growth was its slowest pace as a public company

and the cybersecurity company projected the deceleration would

continue this quarter. The company's shares dropped 11% to $143.40

premarket.

Signet Jewelers Ltd. (SIG) gave an upbeat forecast for earnings

in during the holiday quarter as the jeweler posted a

better-than-expected profit in the latest period, though sales

weakness persists. Shares were up 9.1% at $97.00 premarket.

Barnes & Noble Inc. (BKS) hopes you'll want to snap up more

books now that the election is over. The company, which improved

its bottom line amid cost cuts, posted another quarter of falling

sales and this time blamed the results on a heated race for the

White House.

China's flash sale e-commerce Vipshop (VIPS) tumbled 4.9% in

after-hours trading Monday after reporting disappointing

third-quarter earnings. Shares were down 7.9% at $13.05 premarket

Tuesday.

Analog Devices Inc. (ADI) said posted revenue and profit gains

in its latest quarter.

Campbell Soup Co. (CPB) said Tuesday that its profit rose above

expectations as it continues to work on fixing its struggling fresh

food business.

Dr Pepper Snapple Group Inc. (DPS) on Tuesday said it agreed to

buy Bai Brands LLC, the maker of low-calorie, coffee-fruit drinks,

for $1.7 billion, as consumers continue to turn away from

traditional sodas.

Amazon.com Inc. (AMZN) is exploring an ambitious push to

infiltrate the last bastion of traditional pay-television: live

sports.

Hormel Foods Corp. (HRL) said profit climbed in the latest

quarter thanks to solid performance from refrigerated foods

products and higher demand for its Jennie-O Turkey Store brand.

Chinese internet company Sina Corp.'s (SINA) quarterly profit

surged in the most recent period, driven by more than $100 million

in investment gains and continued strength at microblog portal

Weibo Corp.

DSW Inc. (DSW) raised its outlook for the year and said efforts

to improve cost management and reinvigorate sales are taking

hold.

Write to Jenny Roth at jenny.roth@wsj.com

(END) Dow Jones Newswires

November 22, 2016 09:29 ET (14:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

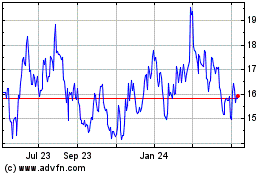

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Oct 2024 to Nov 2024

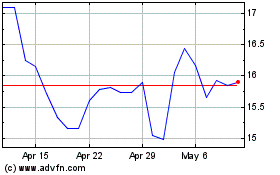

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Nov 2023 to Nov 2024