UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2016

Commission File Number: 001-35454

Vipshop Holdings Limited

No. 20 Huahai Street

Liwan District, Guangzhou 510370

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Vipshop Reports Unaudited Fourth Quarter and Full Year 2015 Financial Results

4Q15 Total Net Revenue up 65% YoY to RMB13.90 Billion (US$2.15 Billion)

4Q15 Gross Profit up 60% YoY to RMB3.35 Billion (US$517 Million)

4Q15 Income from Operations up 114% YoY to RMB802 Million (US$124 Million)

FY15 Total Net Revenue up 74% to RMB40.20 Billion (US$6.21 Billion)

Conference Call to be Held at 8:00 AM U.S. Eastern Time on February 25, 2016

Guangzhou, China, February 24, 2016 — Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China (“Vipshop” or the “Company”), today announced its unaudited financial results for the fourth quarter and full year ended December 31, 2015.

Fourth Quarter 2015 Highlights

· Total net revenue increased by 65% to RMB13.90 billion (US$2.15 billion), primarily attributable to a 58% year-over-year increase in the number of active customers1 to 19.8 million and a 67% year-over-year increase in total orders2 to 64.9 million.

· Gross profit increased by 60% to RMB3.35 billion (US$517 million) from RMB2.09 billion in the prior year period.

· Income from operations increased by 114% to RMB802 million (US$124 million) from RMB375 million in the prior year period. Operating margin increased to 5.8% from 4.5% in the prior year period.

· Non-GAAP income from operations3 increased by 96% to RMB966 million (US$149 million) from RMB493 million in the prior year period. Non-GAAP operating margin4 increased to 6.9% from 5.9% in the prior year period.

· Net income attributable to Vipshop’s shareholders increased by 45% to RMB506 million (US$78 million) from RMB349 million in the prior year period.

· Non-GAAP net income attributable to Vipshop’s shareholders5 increased by 61% to RMB741 million (US$114 million) from RMB460 million in the prior year period.

Full Year 2015 Highlights

1 Beginning in the first quarter of 2015, the Company has updated its definition of “active customers” from “registered members who have purchased products from the Company at least once during the relevant period” to “registered members who have purchased from the Company or the Company’s online marketplace platforms at least once during the relevant period.” The active customer figures in 2014 and 2015 include active Lefeng customers after the Lefeng acquisition was completed in February 2014.

2 Beginning in the first quarter of 2015, the Company has updated its definition of “total orders” from “the total number of orders placed during the relevant period” to “the total number of orders placed during the relevant period, including the orders for products and services sold in the Company’s online sales business and on the Company’s online marketplace platforms, net of orders returned.” The total order figures in 2014 and 2015 include orders attributable to Lefeng after the Lefeng acquisition was completed in February 2014.

3 Non-GAAP income from operations is a non-GAAP financial measure, which is defined as income from operations excluding share-based compensation expenses and amortization of intangible assets resulting from a business acquisition.

4 Non-GAAP operating income margin is a non-GAAP financial measure, which is defined as non-GAAP income from operations as a percentage of total net revenues.

5 Non-GAAP net income attributable to Vipshop’s shareholders is a non-GAAP financial measure. Effective from the fourth quarter of 2015, the non-GAAP net income attributable to Vipshop’s shareholders is defined as net income attributable to Vipshop’s shareholders excluding share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from a business acquisition and equity method investments.

1

· Total net revenue increased by 74% to RMB40.20 billion (US$6.21 billion) over prior year, primarily attributable to a 51% year-over-year increase in the number of active customers to 36.6 million and a 64% year-over-year increase in total orders to 193.1 million.

· Gross profit increased by 72% to RMB9.90 billion (US$1.53 billion) from RMB5.75 billion in the prior year.

· Income from operations increased by 148% to RMB2.07 billion (US$320 million) from RMB834 million in the prior year. Operating margin increased to 5.2% from 3.6% in the prior year.

· Non-GAAP income from operations increased by 108% to RMB2.64 billion (US$407 million) from RMB1.27 billion in the prior year period. Non-GAAP operating margin increased to 6.6% from 5.5% in the prior year.

· Net income attributable to Vipshop’s shareholders increased by 89% to RMB1.59 billion (US$245 million) from RMB841 million in the prior year. Net margin increased to 4.0% from 3.6% in the prior year.

· Non-GAAP net income attributable to Vipshop’s shareholders increased by 78% to RMB2.20 billion (US$339 million) from RMB1.23 billion in the prior year.

Mr. Eric Shen, chairman and chief executive officer of Vipshop, stated, “In 2015, we topped RMB40 billion in annual sales and attracted nearly 37 million active customers as of the end of the year. Looking at the fourth quarter 2015 results, we are very pleased to see our strategies to expand market share pay off, as evidenced by the reacceleration of revenue, active users and total orders on our platform. We also continued to enhance the user experience by optimizing our platform for mobile interaction and purchasing, as well as expanding our product categories through various initiatives including the build out of our emerging cross-border offering. In the fourth quarter of 2015, mobile accounted for approximately 82% of our GMV, up from 66% a year ago, further validating the appeal of our flash sale offering to on-the-go shoppers. Our cross-border business continues to gain momentum and has reached approximately 5% of GMV, demonstrating solid potential to be a strong growth driver in the future. As we diversify our product offering and further enhance the customer experience, we are confident in our ability to drive further growth and value for investors.”

Mr. Donghao Yang, chief financial officer of Vipshop, commented, “We are very pleased with our fourth quarter and full year 2015 results. What was particularly encouraging was our ability to simultaneously reaccelerate growth in revenue, active users and total orders in the fourth quarter, while maintaining stable customer acquisition costs and marketing expenses as a percentage of total revenue. Furthermore, we were able to continue to strengthen our quarterly operating margins to 5.8% from 4.5% in the prior year period, even as our gross margins slightly contracted due to increased promotional activities to expand market share. We continued to make progress building out our warehousing and logistics capabilities. By the end of January 2016, our in-house and invested last mile capabilities supported over 83% of the orders on our platform. Looking ahead, our goal is to further grow our market share and top-line through investments in new user acquisition and marketing, while maintaining discipline with our expenses and investments.”

Fourth Quarter 2015 Financial Results

REVENUE

Total net revenue for the fourth quarter of 2015 increased by 65% to RMB13.90 billion (US$2.15 billion) from RMB8.41 billion in the prior year period, primarily driven by the growth in the numbers of total active customers, repeat customers, total orders, as well as the increasing revenue contribution from the mobile platform.

2

The number of active customers for the fourth quarter of 2015 increased by 58% to 19.8 million from 12.5 million in the prior year period. The number of total orders for the fourth quarter of 2015 increased by 67% to 64.9 million from 38.9 million in the prior year period6.

In an effort to increase focus on its core flash sales business, the Company began to substantially scale down its lower-margin group-buy business in the third quarter of 2014. Excluding the impact of the group-buy business and Lefeng, the number of total customers and total orders for Vipshop’s core flash sales business increased by 76% and 80% year over year, respectively. On the mobile platform, the number of total active customers and total orders for Vipshop’s core flash sales business increased by 124% and 126% year over year, respectively.

GROSS PROFIT

Gross profit for the fourth quarter of 2015 increased by 60% to RMB3.35 billion (US$517 million) from RMB2.09 billion in the prior year period. Gross margin was 24.1%, as compared with 24.9% in the prior year period. The decline in gross margin is primarily attributable to increased promotional activities and sales to drive user and order growth on the platform.

OPERATING INCOME AND EXPENSES

Total operating expenses for the fourth quarter of 2015 were RMB2.72 billion (US$420 million), as compared with the RMB1.78 billion in the prior year period. As a percentage of total net revenue, total operating expenses decreased to 19.6% from 21.2% in the prior year period.

· Fulfillment expenses for the fourth quarter of 2015 were RMB1.26 billion (US$195 million), as compared with RMB789 million in the prior year period, primarily reflecting the increase in sales volume, and number of orders fulfilled. As a percentage of total net revenue, fulfillment expenses decreased to 9.1% from 9.4% in the prior year period, primarily reflecting the scale effect associated with the growth in total net revenue.

· Marketing expenses for the fourth quarter of 2015 were RMB715 million (US$110 million), as compared with RMB421 million in the prior year period, reflecting the Company’s strategy to drive long-term growth through increasing investments in strengthening its brand awareness, attracting new users and expanding market share. As a percentage of total net revenue, marketing expenses were 5.1%, as compared to 5.0% in the prior year period.

· Technology and content expenses for the fourth quarter of 2015 were RMB322 million (US$50 million), as compared with RMB236 million in the prior year period, reflecting the Company’s continued efforts to invest in human capital and advanced technologies such as data analytics, which can help improve the ability to predict consumer behavior and further enhance user experience. As a percentage of total net revenue, technology and content expenses decreased to 2.3% from 2.8% in the prior year period, primarily reflecting the scale effect associated with the growth in total net revenue.

6 The prior year period figures of active customers and total orders in this release have also been revised to reflect the broadened definitions as explained in footnotes 1 and 2 above to ensure comparability.

3

· General and administrative expenses for the fourth quarter of 2015 were RMB421 million (US$65 million), as compared with RMB334 million in the prior year period. As a percentage of total net revenue, general and administrative expenses decreased to 3.0% from 4.0% in the prior year period, primarily reflecting the scale effect associated with the growth in total net revenue.

Income from operations for the fourth quarter of 2015 increased by 114% to RMB802 million (US$124 million) from RMB375 million in the prior year period due to the growing scale of the Company’s operations and decrease in fulfillment, technology and content and general and administrative expenses as a percentage of total net revenue. Operating margin increased to 5.8% from 4.5% in the prior year period.

Non-GAAP income from operations, which excludes share-based compensation expenses and amortization of intangible assets resulting from a business acquisition, increased by 96% to RMB966 million (US$149 million) from RMB493 million in the prior year period. Non-GAAP operating income margin increased to 6.9% from 5.9% in the prior year period.

NET INCOME

Exchange loss was RMB73 million (US$11 million), as compared to RMB20 million in the prior year period, primarily driven by the weakening value of the Renminbi relative to the U.S. dollar. Income tax expense was RMB163 million (US$25 million), as compared to RMB61 million in the prior year period, primarily due to the increase in net income before taxes as well as an increase in the effective tax rate over the prior year period. The lower effective tax rate in the prior year period was primarily due to the utilization of tax loss carryforward, and the recognition of catch-up tax savings of a subsidiary, which saw its income tax rate lowered to 15% from 25% after the local tax bureau approved its preferential tax treatment in the prior year period.

Net income attributable to Vipshop’s shareholders increased by 45% to RMB506 million (US$78 million) from RMB349 million in the prior year period. Net margin attributable to Vipshop’s shareholders was 3.6%, as compared to 4.2% in the prior year period. Net income attributable to Vipshop’s shareholders per diluted ADS7 increased to RMB0.84 (US$0.13) from RMB0.58 in the prior year period.

Non-GAAP net income attributable to Vipshop’s shareholders, which excludes share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from a business acquisition and equity method investments, increased by 61% to RMB741 million (US$114 million) from RMB460 million in the prior year period. Non-GAAP net margin attributable to Vipshop’s shareholders was 5.3%, as compared to 5.5% in the prior year period. The contractions in both net margin and non-GAAP net margin attributable to Vipshop’s shareholders were primarily due to the relatively large exchange loss in the period as well as the large increase in income tax expense. Non-GAAP net income attributable to Vipshop’s shareholders per diluted ADS increased to RMB1.22 (US$0.19) from RMB0.77 in the prior year period.

For the quarter ended December 31, 2015, the Company’s weighted average number of ADSs used in computing diluted income per ADS was 628,282,951.

As of December 31, 2015, the Company had cash and cash equivalents of RMB3.32 billion (US$513 million) and held-to-maturity securities of RMB1.81 billion (US$279 million).

7 “ADS” means American Depositary Share. Effective November 3, 2014, the Company changed its ADS to Class A Ordinary Share (“Share”) ratio from one ADS representing two Shares to five ADSs representing one Share. The computations of GAAP and non-GAAP income per diluted ADS have been adjusted retroactively for all periods presented to reflect this change.

4

For the quarter ended December 31, 2015, net cash from operating activities was RMB1.61 billion (US$248 million).

Full Year 2015 Financial Results

Total net revenues increased by 74% year over year for the full year of 2015 to RMB40.20 billion (US$6.21 billion) from RMB23.13 billion in the prior year, primarily driven by growth in the number of new active customers, total active customers, total orders, as well as the increasing revenue contribution from the mobile platform.

The number of active customers for the full year of 2015 increased by 51% to 36.6 million from 24.3 million in the prior year. The number of total orders for the full year of 2015 increased by 64% to 193.1 million from 118.0 million in the prior year.

Gross profit increased by 72% to RMB9.90 billion (US$1.53 billion) for the full year of 2015 from RMB5.75 billion in the prior year. Gross margin was 24.6%, as compared to 24.9% in the prior year.

Income from operations for the full year of 2015 increased by 148% to RMB2.07 billion (US$320 million) from RMB834 million in the prior year due to the growing scale of the Company’s operations and decrease in fulfillment and general and administrative expenses as a percentage of total net revenue. Operating margin increased to 5.2% from 3.6% in the prior year.

Non-GAAP income from operations for the full year of 2015 increased by 108% to RMB2.64 billion (US$407 million) from RMB1.27 billion in the prior year. Non-GAAP operating income margin increased to 6.6% from 5.5% in the prior year.

Net income attributable to Vipshop’s shareholders for the full year of 2015 increased by 89% to RMB1.59 billion (US$245 million) from RMB841 million in the prior year. Net margin increased to 4.0% from 3.6% in the prior year. Net income attributable to Vipshop’s shareholders per diluted ADS increased to RMB2.65 (US$0.41) from RMB1.40 in the prior year.

Non-GAAP net income attributable to Vipshop’s shareholders for the full year of 2015 increased by 78% to RMB2.20 billion (US$339 million) from RMB1.23 billion in the prior year. Non-GAAP net margin increased to 5.5% from 5.3% in the prior year. Non-GAAP net income attributable to Vipshop’s shareholders per diluted ADS increased to RMB3.66 (US$0.56) from RMB2.05 in the prior year.

For the full year ended December 31, 2015, the Company’s weighted average number of ADSs used in computing diluted earnings per ADS was 600,840,315.

For the full year of 2015, net cash from operating activities was RMB1.92 billion (US$296 million).

Share Repurchase Program

On November 17, 2015, the Company’s board of directors approved a share repurchase program whereby the Company may purchase its own ADSs with an aggregate value of up to US$300 million over the following 24-month period, ending on November 16, 2017. As of December 31, 2015, the Company had repurchased approximately US$130 million in aggregate of its own ADSs.

5

Business Outlook

For the first quarter of 2016, the Company expects its total net revenue to be between RMB11.8 billion and RMB12.3 billion, representing a year-over-year growth rate of approximately 37% to 43%. These forecasts reflect the Company’s current and preliminary view on the market and operational conditions, which is subject to change.

Exchange Rate

This announcement contains currency conversions of certain Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars are made at a rate of RMB6.4778 to US$1.00, the effective noon buying rate for December 31, 2015 as set forth in the H.10 statistical release of the Federal Reserve Board.

Conference Call Information

The Company will hold a conference call on Thursday, February 25, 2016 at 8:00 am Eastern Time or 9:00 pm Beijing Time to discuss its financial results and operating performance for the fourth quarter and full year 2015.

|

United States: |

|

+1-845-675-0438 |

|

International Toll Free: |

|

+1-855-500-8701 |

|

China Domestic: |

|

400-1200654 |

|

Hong Kong: |

|

+852-3018-6776 |

|

Conference ID: |

|

#54231245 |

The replay will be accessible through March 3, 2016 by dialing the following numbers:

|

United States Toll Free: |

|

+1-855-452-5696 |

|

International: |

|

+61 2 90034211 |

|

Conference ID: |

|

#54231245 |

A live and archived webcast of the conference call will also be available at the Company’s investor relations website at http://ir.vip.com.

About Vipshop Holdings Limited

Vipshop Holdings Limited is a leading online discount retailer for brands in China. Vipshop offers high quality and popular branded products to consumers throughout China at a significant discount to retail prices. Since it was founded in August 2008, the Company has rapidly built a sizeable and growing base of customers and brand partners. For more information, please visit www.vip.com.

6

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Vipshop’s strategic and operational plans, contain forward-looking statements. Vipshop may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Vipshop’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Vipshop’s goals and strategies; Vipshop’s future business development, results of operations and financial condition; the expected growth of the online discount retail market in China; Vipshop’s ability to attract customers and brand partners and further enhance its brand recognition; Vipshop’s expectations regarding demand for and market acceptance of flash sales products and services; competition in the discount retail industry; fluctuations in general economic and business conditions in China and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Vipshop’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Vipshop does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Use of Non-GAAP Financial Measures

The unaudited condensed consolidated financial information is prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), except that the consolidated statement of shareholders’ equity, consolidated statements of cash flows, and the detailed notes required by Accounting Standards Codification 270 Interim Reporting (“ASC270”), have not been presented. Vipshop uses non-GAAP net income attributable to Vipshop’s shareholders, non-GAAP net income per diluted ADS, non-GAAP income from operations, non-GAAP net income margin, and non-GAAP operating income margin, each of which is a non-GAAP financial measure. Non-GAAP net income attributable to Vipshop’s shareholders is net income attributable to Vipshop’s shareholders excluding share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from a business acquisition and equity method investments. Non-GAAP net income per diluted ADS is non-GAAP net income divided by weighted average number of diluted ADS. Non-GAAP income from operations is income from operations excluding share-based compensation expenses and amortization of intangible assets resulting from a business acquisition. Non-GAAP operating income margin is non-GAAP income from operations as a percentage of total net revenue. Non-GAAP net income margin is non-GAAP net income as a percentage of total net revenue. The Company believes that separate analysis and exclusion of the non-cash impact of share-based compensation, impairment loss of investments and amortization of intangible assets adds clarity to the constituent parts of its performance. The Company reviews these non-GAAP financial measures together with GAAP financial measures to obtain a better understanding of its operating performance. It uses these non-GAAP financial measures for planning, forecasting and measuring results against the forecast. The Company believes that non-GAAP financial measures are useful supplemental information for investors and analysts to assess its operating performance without the effect of non-cash share-based compensation expenses, impairment loss of investments, and amortization of intangible assets. Share-based compensation expenses and amortization of intangible assets have been and will continue to be significant recurring expenses in its business. However, the use of non-GAAP financial measures has material limitations as an analytical tool. One of the limitations of using non-GAAP financial measures is that they do not include all items that impact the Company’s net income for the period. In addition, because non-GAAP financial measures are not measured in the same manner by all companies, they may not be comparable to other similar titled measures used by other companies. In light of the foregoing limitations, you should not consider non-GAAP financial measure in isolation from or as an alternative to the financial measure prepared in accordance with U.S. GAAP.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, or as a substitute for, the financial information prepared and presented in accordance with U.S. GAAP. For more information on these non-GAAP financial measures, please see the table captioned “Vipshop Holdings Limited Reconciliations of GAAP and Non-GAAP Results” at the end of this release.

Investor Relations Contact

|

Vipshop Holdings Limited |

|

|

Millicent Tu |

|

|

Tel: +86 (20) 2233-0732 |

|

|

Email:IR@vipshop.com |

|

|

|

|

|

ICR, Inc. |

|

|

Jeremy Peruski |

|

|

Tel: +1 (646) 405-4866 |

|

|

Email: IR@vipshop.com |

|

7

Vipshop Holdings Limited

Condensed Consolidated Statements of Income and Comprehensive Income

(In thousands, except per share data)

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

|

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenues |

|

8,250,360 |

|

13,657,163 |

|

2,108,303 |

|

22,685,111 |

|

39,409,961 |

|

6,083,850 |

|

|

Other revenues (1) |

|

163,559 |

|

243,983 |

|

37,664 |

|

444,202 |

|

793,251 |

|

122,457 |

|

|

Total net revenues |

|

8,413,919 |

|

13,901,146 |

|

2,145,967 |

|

23,129,313 |

|

40,203,212 |

|

6,206,307 |

|

|

Cost of goods sold |

|

(6,320,857 |

) |

(10,552,727 |

) |

(1,629,060 |

) |

(17,378,044 |

) |

(30,306,723 |

) |

(4,678,552 |

) |

|

Gross profit |

|

2,093,062 |

|

3,348,419 |

|

516,907 |

|

5,751,269 |

|

9,896,489 |

|

1,527,755 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fulfillment expenses(2) |

|

(788,516 |

) |

(1,263,359 |

) |

(195,029 |

) |

(2,268,949 |

) |

(3,667,031 |

) |

(566,092 |

) |

|

Marketing expenses |

|

(421,189 |

) |

(714,520 |

) |

(110,303 |

) |

(1,164,149 |

) |

(2,089,348 |

) |

(322,540 |

) |

|

Technology and content expenses |

|

(235,848 |

) |

(321,602 |

) |

(49,647 |

) |

(670,998 |

) |

(1,076,520 |

) |

(166,186 |

) |

|

General and administrative expenses(3) |

|

(334,445 |

) |

(421,401 |

) |

(65,053 |

) |

(967,463 |

) |

(1,301,472 |

) |

(200,913 |

) |

|

Total operating expenses |

|

(1,779,998 |

) |

(2,720,882 |

) |

(420,032 |

) |

(5,071,559 |

) |

(8,134,371 |

) |

(1,255,731 |

) |

|

Other income |

|

62,270 |

|

174,223 |

|

26,895 |

|

153,977 |

|

308,431 |

|

47,614 |

|

|

Income from operations |

|

375,334 |

|

801,760 |

|

123,770 |

|

833,687 |

|

2,070,549 |

|

319,638 |

|

|

Other non-operating income |

|

— |

|

— |

|

— |

|

20,300 |

|

— |

|

— |

|

|

Impairment loss of investments |

|

(6,166 |

) |

(89,749 |

) |

(13,854 |

) |

(6,166 |

) |

(99,749 |

) |

(15,398 |

) |

|

Interest expenses |

|

(12,777 |

) |

(24,441 |

) |

(3,773 |

) |

(75,249 |

) |

(85,762 |

) |

(13,239 |

) |

|

Interest income |

|

84,830 |

|

46,844 |

|

7,232 |

|

288,622 |

|

267,208 |

|

41,250 |

|

|

Exchange loss |

|

(20,197 |

) |

(73,307 |

) |

(11,316 |

) |

(853 |

) |

(101,726 |

) |

(15,704 |

) |

|

Income before income taxes and share of loss of affiliates |

|

421,024 |

|

661,107 |

|

102,059 |

|

1,060,341 |

|

2,050,520 |

|

316,547 |

|

|

Income tax expense(4) |

|

(60,957 |

) |

(162,748 |

) |

(25,124 |

) |

(245,032 |

) |

(457,745 |

) |

(70,664 |

) |

|

Share of loss of affiliates |

|

(34,306 |

) |

(7,777 |

) |

(1,201 |

) |

(62,716 |

) |

(84,063 |

) |

(12,977 |

) |

|

Net income |

|

325,761 |

|

490,582 |

|

75,734 |

|

752,593 |

|

1,508,712 |

|

232,906 |

|

|

Net loss attributable to noncontrolling interests |

|

23,734 |

|

15,584 |

|

2,406 |

|

88,693 |

|

80,952 |

|

12,497 |

|

|

Net income attributable to Vipshop’s shareholders |

|

349,495 |

|

506,166 |

|

78,140 |

|

841,286 |

|

1,589,664 |

|

245,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in calculating earnings per share(5): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

97,841,008 |

|

99,486,779 |

|

99,486,779 |

|

96,800,324 |

|

99,225,734 |

|

99,225,734 |

|

|

—Diluted |

|

103,265,376 |

|

109,146,232 |

|

109,146,232 |

|

103,717,226 |

|

103,657,705 |

|

103,657,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class B ordinary shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

|

—Diluted |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per Class A share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Vipshop’s shareholders—Basic |

|

3.06 |

|

4.36 |

|

0.67 |

|

7.42 |

|

13.74 |

|

2.12 |

|

|

Net income attributable to Vipshop’s shareholders—Diluted |

|

2.92 |

|

4.22 |

|

0.65 |

|

7.00 |

|

13.23 |

|

2.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per Class B share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Vipshop’s shareholders—Basic |

|

3.06 |

|

4.36 |

|

0.67 |

|

7.42 |

|

13.74 |

|

2.12 |

|

|

Net income attributable to Vipshop’s shareholders—Diluted |

|

2.92 |

|

4.22 |

|

0.65 |

|

7.00 |

|

13.23 |

|

2.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per ADS (1 ordinary share equals to 5 ADSs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Vipshop’s shareholders—Basic |

|

0.61 |

|

0.87 |

|

0.13 |

|

1.48 |

|

2.75 |

|

0.42 |

|

|

Net income attributable to Vipshop’s shareholders—Diluted |

|

0.58 |

|

0.84 |

|

0.13 |

|

1.40 |

|

2.65 |

|

0.41 |

|

|

|

|

|

|

(1)Other revenues primarily consist of revenues from product promotion and online advertising, fees charged to third-party merchants which the Company provides platform access for sales of their products. |

|

(1)Other revenues primarily consist of revenues from product promotion and online advertising, fees charged to third-party merchants which the Company provides platform access for sales of their product. |

|

|

|

|

|

(2) Including shipping and handling expenses, which amounted RMB 403million and RMB 647 million in the three month periods ended December 31, 2014 and December 31, 2015, respectively. |

|

(2) Including shipping and handling expenses, which amounted RMB1,175 million and RMB1,714 million in the twelve month periods ended December 31,2014 and 2015 respectively. |

|

|

|

|

|

(3)Including amortization of intangible assets resulting from a business acquisition, which amounted to RMB 60 million and RMB 72 million in the three months period ended December 31, 2014 and December 31, 2015, respectively. |

|

(3)Including amortization of intangible assets resulting from a business acquisition, which amounted to RMB212 million and RMB265 million in the twelve months period ended December 31, 2014 and December 31, 2015, respectively. |

|

|

|

|

|

(4)Included income tax benefits of RMB 15 million and RMB 18 million related to the reversal of deferred tax liabilities, which was recognized on the businss acquisition of Lefeng for the three months period ended December 31, 2014 and December 31, 2015, respectively. |

|

(4)Included income tax benefits of RMB54 million and RMB67 million related to the reversal of deferred tax liabilities, which was recognized on the businss acquisition of Lefeng for the twelve months period ended December 31, 2014 and December 31, 2015, respectively. |

|

|

|

|

|

(5) Authorized share capital are re-classified and re-designated into Class A ordinary shares and Class B ordinary shares, with each Class A ordinary share being entitled to one vote and each Class B ordinary share being entitled to ten votes on all matters that are subject to shareholder vote. |

|

(5) Authorized share capital are re-classified and re-designated into Class A ordinary shares and Class B ordinary shares, with each Class A ordinary share being entitled to one vote and each Class B ordinary share being entitled to ten votes on all matters that are subject to shareholder vote. |

|

Net income |

|

325,761 |

|

490,582 |

|

75,734 |

|

752,593 |

|

1,508,712 |

|

232,906 |

|

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(10,404 |

) |

(2,815 |

) |

(435 |

) |

(1,709 |

) |

(55,653 |

) |

(8,591 |

) |

|

Unrealized gain or loss of available-for-sales securities |

|

— |

|

(8,233 |

) |

(1,271 |

) |

— |

|

(7,783 |

) |

(1,201 |

) |

|

Comprehensive income |

|

315,357 |

|

479,534 |

|

74,028 |

|

750,884 |

|

1,445,276 |

|

223,114 |

|

|

Less: Comprehensive loss attributable to non-controlling interests |

|

(24,850 |

) |

(22,048 |

) |

(3,404 |

) |

(89,975 |

) |

(84,119 |

) |

(12,986 |

) |

|

Comprehensive income attributable to Vipshop’s shareholders |

|

340,207 |

|

501,582 |

|

77,432 |

|

840,859 |

|

1,529,395 |

|

236,100 |

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

|

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

Share-based compensation charges included are follows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fulfillment expenses |

|

3,206 |

|

6,259 |

|

966 |

|

10,822 |

|

18,665 |

|

2,881 |

|

|

Marketing expenses |

|

3,695 |

|

7,537 |

|

1,163 |

|

17,293 |

|

19,938 |

|

3,078 |

|

|

Technology and content expenses |

|

23,785 |

|

34,714 |

|

5,359 |

|

103,160 |

|

126,274 |

|

19,493 |

|

|

General and administrative expenses |

|

26,549 |

|

43,594 |

|

6,730 |

|

94,219 |

|

138,064 |

|

21,313 |

|

|

Total |

|

57,235 |

|

92,104 |

|

14,218 |

|

225,494 |

|

302,941 |

|

46,765 |

|

Vipshop Holdings Limited

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

|

|

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

|

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

4,790,751 |

|

3,324,384 |

|

513,196 |

|

|

Restricted cash |

|

400 |

|

— |

|

— |

|

|

Held-to-maturity securities |

|

3,768,338 |

|

1,807,403 |

|

279,015 |

|

|

Accounts receivable, net |

|

41,447 |

|

351,423 |

|

54,250 |

|

|

Amounts due from related parties |

|

30,991 |

|

31,856 |

|

4,918 |

|

|

Other receivables and prepayments |

|

767,074 |

|

1,869,461 |

|

288,596 |

|

|

Inventories |

|

3,588,304 |

|

4,566,746 |

|

704,984 |

|

|

Deferred tax assets |

|

233,149 |

|

202,003 |

|

31,184 |

|

|

Total current assets |

|

13,220,454 |

|

12,153,276 |

|

1,876,143 |

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

1,911,453 |

|

2,949,604 |

|

455,340 |

|

|

Deposits for property and equipment |

|

207,509 |

|

933,419 |

|

144,095 |

|

|

Land use rights, net |

|

81,991 |

|

197,462 |

|

30,483 |

|

|

Intangible assets, net |

|

1,038,949 |

|

744,369 |

|

114,911 |

|

|

Investment in affiliates |

|

287,390 |

|

252,706 |

|

39,011 |

|

|

Other investments |

|

102,792 |

|

489,862 |

|

75,622 |

|

|

Available-for-sale securities investment, non-current |

|

— |

|

269,736 |

|

41,640 |

|

|

Other long-term assets |

|

40,503 |

|

1,936,307 |

|

298,914 |

|

|

Goodwill |

|

60,000 |

|

108,781 |

|

16,793 |

|

|

Total non-current assets |

|

3,730,587 |

|

7,882,246 |

|

1,216,809 |

|

|

TOTAL ASSETS |

|

16,951,041 |

|

20,035,522 |

|

3,092,952 |

|

|

|

|

|

|

|

|

|

|

|

LIABILTIES AND EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable (Including accounts payable of the VIE without recourse to the Company of RMB 7,490 and RMB 48,178 as of December 31, 2014 and December 31, 2015, respectively) |

|

6,121,256 |

|

6,645,262 |

|

1,025,852 |

|

|

|

|

|

|

|

|

|

|

|

Advance from customers (Including advance from customers of the VIE without recourse to the Company of RMB 1,217,429 and RMB 879,848 as of December 31, 2014 and December 31, 2015, respectively) |

|

1,422,935 |

|

2,009,578 |

|

310,225 |

|

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities(Including accrued expenses and other current liabilities of the VIE without recourse to the Company of RMB 944,097 and RMB 1,127,270 as of December 31, 2014 and December 31, 2015, respectively) |

|

2,340,756 |

|

3,104,622 |

|

479,271 |

|

|

|

|

|

|

|

|

|

|

|

Amounts due to related parties(Including amounts due to related parties of the VIE without recourse to the Company of RMB 2,474 and RMB 82,994 as of December 31, 2014 and December 31, 2015, respectively) |

|

75,784 |

|

206,966 |

|

31,950 |

|

|

|

|

|

|

|

|

|

|

|

Deferred income (Including deferred income of the VIE without recourse to the Company of RMB 178,920 and RMB 95,643 as of December 31, 2014 and December 31, 2015, respectively) |

|

194,560 |

|

104,531 |

|

16,137 |

|

|

|

|

|

|

|

|

|

|

|

Short term loans (Including short term loans of the VIE without recourse to the Company of nil and nil as of December 31, 2014 and December 31, 2015) |

|

— |

|

95,000 |

|

14,665 |

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

10,155,291 |

|

12,165,959 |

|

1,878,100 |

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Deferred tax liability |

|

242,697 |

|

175,416 |

|

27,080 |

|

|

Deferred income-non current |

|

|

|

22,699 |

|

3,504 |

|

|

Convertible senior notes |

|

3,854,985 |

|

4,058,181 |

|

626,475 |

|

|

Total non-current liabilities |

|

4,097,682 |

|

4,256,296 |

|

657,059 |

|

|

Total liabilities |

|

14,252,973 |

|

16,422,255 |

|

2,535,159 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares (US$0.0001 par value, 483,489,642 shares authorized, and 100,085,519 and 98,028,314 shares issued and outstanding as of December 31, 2015 and December 31, 2014, respectively) |

|

63 |

|

65 |

|

10 |

|

|

|

|

|

|

|

|

|

|

|

Class B ordinary shares (US$0.0001 par value, 16,510,358 shares authorized, and 16,510,358 and 16,510,358 shares issued and outstanding as of December 31, 2015 and December 31, 2014, respectively) |

|

11 |

|

11 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

Treasury shares, at cost - 1,614,135 shares as of December 31, 2015 |

|

— |

|

(844,711 |

) |

(130,401 |

) |

|

Additional paid-in capital |

|

2,538,217 |

|

2,838,591 |

|

438,203 |

|

|

Retained earnings |

|

26,544 |

|

1,616,209 |

|

249,500 |

|

|

Accumulated other comprehensive income (loss) |

|

(10,711 |

) |

(70,980 |

) |

(10,957 |

) |

|

Non-controlling interests |

|

143,944 |

|

74,082 |

|

11,436 |

|

|

Total shareholders’ equity |

|

2,698,068 |

|

3,613,267 |

|

557,793 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

16,951,041 |

|

20,035,522 |

|

3,092,952 |

|

Vipshop Holdings Limited

Reconciliations of GAAP and Non-GAAP Results

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

December 31,2014 |

|

December 31,2015 |

|

December 31,2015 |

|

|

|

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

RMB’000 |

|

RMB’000 |

|

USD’000 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

Income from operations |

|

375,334 |

|

801,760 |

|

123,771 |

|

833,687 |

|

2,070,549 |

|

319,638 |

|

|

Share-based compensation expenses |

|

57,235 |

|

92,104 |

|

14,218 |

|

225,494 |

|

302,941 |

|

46,766 |

|

|

Amortization of intangible assets resulting from a business acquisition |

|

59,931 |

|

71,775 |

|

11,080 |

|

212,260 |

|

264,842 |

|

40,885 |

|

|

Non-GAAP income from operations |

|

492,500 |

|

965,639 |

|

149,069 |

|

1,271,441 |

|

2,638,332 |

|

407,289 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

325,761 |

|

490,582 |

|

75,733 |

|

752,593 |

|

1,508,712 |

|

232,905 |

|

|

Share-based compensation expenses |

|

57,235 |

|

92,104 |

|

14,218 |

|

225,494 |

|

302,941 |

|

46,766 |

|

|

Impairment loss of investments |

|

6,166 |

|

89,749 |

|

13,854 |

|

6,166 |

|

99,749 |

|

15,398 |

|

|

Amortization of intangible assets resulting from a business acquisition and equity method investments (net of tax) |

|

58,336 |

|

66,867 |

|

10,322 |

|

201,118 |

|

255,918 |

|

39,507 |

|

|

Non-GAAP net income |

|

447,498 |

|

739,302 |

|

114,127 |

|

1,185,371 |

|

2,167,320 |

|

334,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Vipshop’s shareholders |

|

349,495 |

|

506,166 |

|

78,139 |

|

841,286 |

|

1,589,664 |

|

245,402 |

|

|

Share-based compensation expenses |

|

57,235 |

|

92,104 |

|

14,218 |

|

225,494 |

|

302,941 |

|

46,766 |

|

|

Impairment loss of investments |

|

6,166 |

|

89,749 |

|

13,854 |

|

6,166 |

|

99,749 |

|

15,398 |

|

|

Amortization of intangible assets resulting from a business acquisition and equity method investments (exclude non-controlling interests and net of tax) |

|

47,278 |

|

53,472 |

|

8,255 |

|

161,498 |

|

206,490 |

|

31,877 |

|

|

Non-GAAP net income attributable to Vipshop’s shareholders |

|

460,174 |

|

741,491 |

|

114,466 |

|

1,234,444 |

|

2,198,844 |

|

339,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in calculating earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic ordinary shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

97,841,008 |

|

99,486,779 |

|

99,486,779 |

|

96,800,324 |

|

99,225,734 |

|

99,225,734 |

|

|

—Diluted |

|

103,265,376 |

|

109,146,232 |

|

109,146,232 |

|

103,717,226 |

|

103,657,705 |

|

103,657,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class B ordinary shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

|

—Diluted |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

16,510,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income per Class A share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Basic |

|

4.02 |

|

6.39 |

|

0.99 |

|

10.89 |

|

19.00 |

|

2.93 |

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Diluted |

|

3.84 |

|

6.10 |

|

0.94 |

|

10.27 |

|

18.30 |

|

2.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income per Class B share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Basic |

|

4.02 |

|

6.39 |

|

0.99 |

|

10.89 |

|

19.00 |

|

2.93 |

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Diluted |

|

3.84 |

|

6.10 |

|

0.94 |

|

10.27 |

|

18.30 |

|

2.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income per ADS (1 ordinary share equal to 5 ADSs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Basic |

|

0.80 |

|

1.28 |

|

0.20 |

|

2.18 |

|

3.80 |

|

0.59 |

|

|

Non-GAAP net income attributable to Vipshop’s shareholders—Diluted |

|

0.77 |

|

1.22 |

|

0.19 |

|

2.05 |

|

3.66 |

|

0.56 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vipshop Holdings Limited |

|

|

|

|

|

|

|

|

By |

: |

/s/ Donghao Yang |

|

|

Name: |

: |

Donghao Yang |

|

|

Title: |

: |

Chief Financial Officer |

Date: February 25, 2016

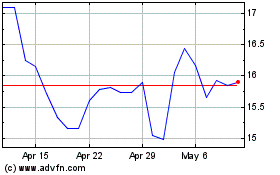

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Oct 2024 to Nov 2024

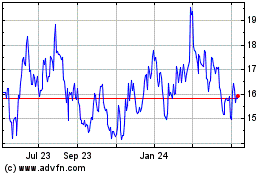

Vipshop (NYSE:VIPS)

Historical Stock Chart

From Nov 2023 to Nov 2024