Vertiv Holdings to Restate 2020 Results Due to SEC Guidance for SPAC Warrant Accounting

April 22 2021 - 8:05PM

Dow Jones News

By Josh Beckerman

Vertiv Holdings Co. will restate its 2020 results due to

Securities and Exchange Commission guidance for warrant accounting

for special-purpose acquisition companies.

In February 2020, the digital infrastructure company merged with

a SPAC backed by Goldman Sachs Group Inc.

On April 12, the SEC said that under certain circumstances,

warrants should be classified as liabilities, rather than as

equity.

Several companies have delayed their 2020 annual reports as they

review SEC guidance, including Tekkorp Digital Acquisition Corp.,

Mallard Acquisition Corp., Blue Water Acquisition Corp., Better

World Acquisition Corp. and Edoc Acquisition Corp.

Discussing public and private placement warrants that were

outstanding at the time of the merger, Vertiv said that "consistent

with market practice among SPACs, we had been accounting for the

warrants as equity under a fixed accounting model." Given the SEC's

April 12 statement, it will restate financial statements "such that

the warrants are accounted for as liabilities and marked-to-market

each reporting period."

As a result of the restatement and the increase in its stock

price over the applicable period, Vertiv expects to recognize

incremental 2020 non-operating expense between $140 million to $160

million. There will be no impact to previously reported net cash

flow.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

April 22, 2021 19:50 ET (23:50 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

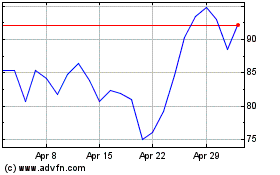

Vertiv (NYSE:VRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vertiv (NYSE:VRT)

Historical Stock Chart

From Apr 2023 to Apr 2024