Current Report Filing (8-k)

February 19 2020 - 4:46PM

Edgar (US Regulatory)

VECTOR GROUP LTD DE false 0000059440 0000059440 2020-02-18 2020-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2020

VECTOR GROUP LTD.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

|

1-5759

|

|

65-0949535

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

4400 Biscayne Boulevard, Miami, Florida

|

|

33137

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(305) 579-8000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 240.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class:

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered:

|

|

Common stock, par value $0.10 per share

|

|

VGR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On February 18, 2020, Ronald J. Bernstein, the President and Chief Executive Officer of Liggett Group LLC (“Liggett”) and the President and Chief Executive Officer of Liggett Vector Brands LLC (“LVB”), announced that he will retire from the above roles, effective March 31, 2020. Mr. Bernstein will continue to serve as a member of the Board of Directors (the “Board”) of Vector Group Ltd. (“Vector”) following his retirement and will be deemed a non-employee director with respect to such ongoing Board service. Mr. Bernstein has served as President and Chief Executive Officer of Liggett since September 2000, as President and Chief Executive Officer of LVB since March 2002 and as a member of the Vector Board since March 2004.

In addition, on February 18, 2020, LVB and Vector entered into an agreement (the “Letter Agreement”) with Mr. Bernstein pursuant to which Mr. Bernstein will serve as Non-Executive Chairman of the Board of Managers of LVB and as a Senior Advisor to Liggett, effective April 1, 2020 until March 31, 2021, unless the term is earlier terminated or extended in accordance with the Letter Agreement. In such roles, Mr. Bernstein will (i) provide advice and counsel regarding all aspects of the Liggett business to the senior management of Liggett, (ii) assist with special projects as requested by the senior management of Vector, (iii) continue to assist Vector with investor and shareholder engagement as well as community, customer and business relations as requested by the senior management of Vector, (iv) perform such additional duties as are customarily performed by a non-executive chairman and member of a board of managers and (v) perform such other services as the parties may mutually agree upon from time to time during the term. As compensation for these services, Mr. Bernstein will receive $60,000 per month as well as access to an office, administrative support and reimbursement of expenses reasonably incurred in connection with the services, subject to LVB’s existing reimbursement policy.

If Mr. Bernstein terminates the arrangement due to material breach by LVB or LVB terminates the arrangement other than for “cause” (as defined in the agreement), LVB will pay the monthly fee to Mr. Bernstein and provide him with the other benefits under the Letter Agreement, in each case for the remainder of the term. Mr. Bernstein will not be entitled to these payments or benefits upon any other termination. Under the Letter Agreement, Mr. Bernstein is also subject to perpetual confidentiality and non-disparagement covenants as well as non-solicitation and non-competition covenants that expire 24 months after receipt of the last payment under the Letter Agreement. The foregoing summary of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference.

A copy of Vector’s related press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K. Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

VECTOR GROUP LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Marc N. Bell

|

|

Date: February 19, 2020

|

|

|

|

|

|

Marc N. Bell

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

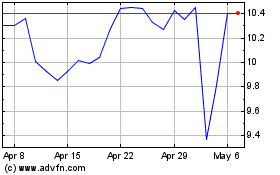

Vector (NYSE:VGR)

Historical Stock Chart

From Aug 2024 to Sep 2024

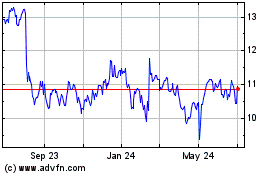

Vector (NYSE:VGR)

Historical Stock Chart

From Sep 2023 to Sep 2024