USD Partners Announces Quarterly Distribution and its Second Quarter 2022 Earnings Release Date

July 20 2022 - 4:21PM

Business Wire

USD Partners LP (NYSE: USDP) (the “Partnership”) announced today

that the Board of Directors of its general partner declared a

quarterly cash distribution of $0.1235 per unit for the second

quarter of 2022 ($0.494 per unit on an annualized basis), the same

amount as distributed in the prior quarter. The Partnership intends

to issue further details and distribution guidance in its second

quarter earnings release and discuss further on its second quarter

earnings call on Thursday, August 4, 2022. The distribution is

payable on August 12, 2022, to unitholders of record at the close

of business on August 3, 2022.

Second Quarter 2022 Earnings Release Date and Conference Call

Information

The Partnership plans to report second quarter 2022 financial

and operating results after market close on Wednesday, August 3,

2022. The Partnership will host a conference call and webcast

regarding second quarter 2022 results at 11:00 a.m. Eastern Time

(10:00 a.m. Central Time) on Thursday, August 4, 2022.

To listen live over the Internet, participants are advised to

log on to the Partnership’s website at www.usdpartners.com and

select the “Events & Presentations” sub-tab under the

“Investors” tab. To join via telephone, participants may dial (800)

909-7113 domestically or +1 (785) 830-1914 internationally,

conference ID 6306282. Participants are advised to dial in at least

five minutes prior to the call.

An audio replay of the conference call will be available for

thirty days by dialing (800) 839-2434 domestically or +1 (402)

220-7211 internationally, conference ID 6306282. In addition, a

replay of the audio webcast will be available by accessing the

Partnership's website after the call is concluded.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited

partnership formed in 2014 by US Development Group, LLC (“USD”) to

acquire, develop and operate midstream infrastructure and

complementary logistics solutions for crude oil, biofuels and other

energy-related products. The Partnership generates substantially

all of its operating cash flows from multi-year, take-or-pay

contracts with primarily investment grade customers, including

major integrated oil companies and refiners. The Partnership’s

principal assets include a network of crude oil terminals that

facilitate the transportation of heavy crude oil from Western

Canada to key demand centers across North America. The

Partnership’s operations include railcar loading and unloading,

storage and blending in on-site tanks, inbound and outbound

pipeline connectivity, truck transloading, as well as other related

logistics services. In addition, the Partnership provides customers

with leased railcars and fleet services to facilitate the

transportation of liquid hydrocarbons and biofuels by rail.

USD, which owns the general partner of USD Partners LP, is

engaged in designing, developing, owning, and managing large-scale

multi-modal logistics centers and energy-related infrastructure

across North America. USD’s solutions create flexible market access

for customers in significant growth areas and key demand centers,

including Western Canada, the U.S. Gulf Coast and Mexico. Among

other projects, USD is currently pursuing the development of a

premier energy logistics terminal on the Houston Ship Channel with

capacity for substantial tank storage, multiple docks (including

barge and deepwater), inbound and outbound pipeline connectivity,

as well as a rail terminal with unit train capabilities. For

additional information, please visit texasdeepwater.com.

Information on websites referenced in this release is not part of

this release.

Qualified Notice to Nominees

This release serves as qualified notice to nominees as provided

for under Treasury Regulation Section 1.1446-4(b)(4) and (d).

Please note that we believe that 100 percent of the Partnership’s

distributions to foreign investors are attributable to income that

is effectively connected with a United States trade or business.

Accordingly, all of the Partnership’s distributions to foreign

investors are subject to federal income tax withholding at the

highest effective tax rate for individuals or corporations, as

applicable. Nominees, and not the Partnership, are treated as

withholding agents responsible for withholding distributions

received by them on behalf of foreign investors.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including statements

with respect to the amount and timing of the Partnership’s second

quarter 2022 cash distribution and the business prospects of the

Partnership and USD. Words and phrases such as “plans,” “expects,”

“will,” “progressing on,” “pursuing,” and similar expressions are

used to identify such forward-looking statements. However, the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements relating to the

Partnership are based on management’s expectations, estimates and

projections about the Partnership, its interests, USD’s projects

and the energy industry in general on the date this press release

was issued. These statements are not guarantees of future

performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. The current economic

downturn (including the effects of the ongoing situation in Ukraine

and its regional and global ramifications) and pandemic introduces

unusual risks and an inability to predict all risks that may impact

the Partnership’s business and outlook. Therefore, actual outcomes

and results may differ materially from what is expressed or

forecast in such forward-looking statements. Factors that could

cause actual results or events to differ materially from those

described in the forward-looking statements include those as set

forth under the heading “Risk Factors” in the Partnership’s most

recent Annual Report on Form 10-K and in its subsequent filings

with the Securities and Exchange Commission. The Partnership is

under no obligation (and expressly disclaims any such obligation)

to update or alter its forward-looking statements, whether as a

result of new information, future events or otherwise.

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220720005860/en/

Investor Relations Contacts:

Adam Altsuler, (281) 291-3995 Executive Vice President and Chief

Financial Officer

Jennifer Waller, (832) 991-8383 Senior Director, Financial

Reporting and Investor Relations

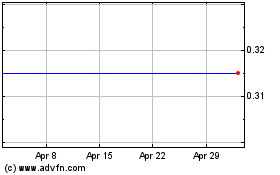

USD Partners (NYSE:USDP)

Historical Stock Chart

From Aug 2024 to Sep 2024

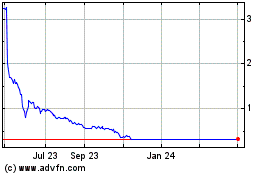

USD Partners (NYSE:USDP)

Historical Stock Chart

From Sep 2023 to Sep 2024