A.M. Best Affirms Ratings of Unum Group and Its Core U.S. Subsidiaries

March 15 2012 - 2:45PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

of A (Excellent) and issuer credit ratings (ICR) of “a” of the core

U.S. life/health insurance subsidiaries of Unum Group (Unum)

(headquartered in Chattanooga, TN) [NYSE: UNM]. Concurrently, A.M.

Best has affirmed the ICR of “bbb” of Unum as well as all existing

debt securities issued by the organization. The outlook for all

ratings is stable. (See below for a complete listing of the

companies and ratings.)

The rating affirmations reflect Unum’s strong capitalization,

good profitability and generally favorable operating trends,

despite the impact of the weakened economic environment on its core

operations. The group’s operating segments—Unum U.S., Colonial Life

and Unum U.K.—have reported modest sales growth over the past 12

months; however, this was offset by pressure on inforce premiums,

driven by the impact of economic conditions on consumer trends and

increased competition within its core market. A.M. Best notes that

Unum’s core business lines are generating strong earnings and cash

flows, with returns exceeding industry medians. Moreover, A.M. Best

believes capital is being deployed in an efficient and prudent

manner as the enterprise maintains sound risk-adjusted capital

ratios at its operating companies.

Unum’s strong franchise in the United States is anchored by its

leading position in the group disability market and supplemented by

its top-three rankings in group life and voluntary benefits. Its

core group disability segment recently reported a loss ratio that

was relatively flat compared to the prior year (84.6% versus 84.4 %

at year-end 2010), despite a slight uptick in claims incidence

during the second half of 2011, which was consistent with some of

Unum’s competitors. The Unum U.K. business, which markets group

long-term disability, life and supplemental coverages, also

reported somewhat unfavorable disability experience over the past

few quarters due to lower levels of claim resolutions. Colonial

Life, the group’s worksite benefits segment, reported good growth

in premiums driven by sales growth in its core offerings.

Persistency within all segments continues to be generally

favorable, reflecting the group’s ability to retain quality

business.

Unum’s recent strategic decision to exit the marketing of its

group long-term care (LTC) business, placing it into closed block

status with its individual LTC and other run-off lines, resulted in

significant charges relating to reserve strengthening and deferred

acquisition cost impairment. On a GAAP basis, net income was

significantly impacted in the fourth quarter of 2011; however,

there was no statutory impact. At year-end 2011, reserves related

to closed-block business represented over 45% of Unum’s total

reserves. A.M. Best will continue to closely monitor the closed

block for any additional reserve strengthening or other related

charges, which could negatively impact operating results or

risk-adjusted capitalization.

Over the past several years, Unum has maintained its

consolidated risk-adjusted capitalization primarily though

favorable operating results. While the capital cushion at some of

its subsidiaries fluctuates periodically as it is deployed through

share repurchase or other means, A.M. Best believes the group’s

prospective risk-adjusted capital position will remain appropriate

for its ratings. Moreover, with total debt-to-capital below 25%,

interest coverage exceeding 8 times and over $750 million of cash

and marketable securities at the holding company as of December 31,

2011, Unum has excellent financial flexibility. Additionally, the

organization has over $5 billion of unrealized capital gains in its

bond portfolio with modest exposure to structured securities and

real estate-related investments.

A.M. Best expects that Unum will continue to be challenged to

grow total premium income as long as the U.S. economy continues to

be sluggish and unemployment rates remain high. Also, the extended

period of low interest rates continues to inhibit operating

earnings somewhat as new money yields are depressed.

A.M. Best believes that Unum is well positioned at its current

ratings in the near term.

Factors that could lead to negative rating actions include

sizable statutory reserve charges associated with Unum’s recent

exit from the group LTC business or a considerable decline in

operating income or capitalization relative to A.M. Best’s

expectations.

The FSR of A (Excellent) and ICRs of “a” have been affirmed for

the following core U.S. subsidiaries of Unum Group:

- Unum Life Insurance Company of

America

- Provident Life and Accident

Insurance Company

- The Paul Revere Life Insurance

Company

- Colonial Life & Accident

Insurance Company

- First Unum Life Insurance

Company

- Provident Life and Casualty

Insurance Company

The FSR of B++ (Good) and ICR of “bbb” have been affirmed for

The Paul Revere Variable Annuity Insurance Company, a

non-core subsidiary of Unum Group.

The ICR of “bbb” has been affirmed for Unum Group.

The following debt ratings have been affirmed:

Unum Group—-- “bbb” on $350 million 7.125% senior

unsecured notes, due 2016-- “bbb” on $200 million 7.00% senior

unsecured notes, due 2018-- “bbb” on $400 million 5.625% senior

unsecured notes, due 2020-- “bbb” on $250 million 6.75% senior

unsecured notes, due 2028-- “bbb” on $200 million 7.25% senior

unsecured notes, due 2028-- “bbb” on $250 million 7.375% senior

unsecured notes, due 2032

UnumProvident Finance Company plc—-- “bbb” on $400

million 6.85% senior unsecured notes, due 2015

Provident Financing Trust I—-- “bb+” on $300 million

7.405% capital securities, due 2038

The following indicative debt ratings under shelf registration

have been affirmed:

Unum Group—-- “bbb” on senior unsecured-- “bbb-” on

subordinated-- “bb+” on preferred stock

UnumProvident Financing Trust II and III—-- “bb+” on

preferred securities

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Key

criteria utilized include: “Understanding BCAR for Life/Health

Insurers”; “Rating Members of Insurance Groups”; “A.M. Best’s

Perspective on Operating Leverage”, “Assessing Country Risk”; and

“Risk Management and the Rating Process for Insurance Companies.”

Best’s Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world's oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com

Copyright © 2012 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

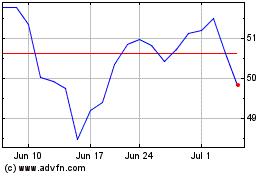

Unum (NYSE:UNM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Unum (NYSE:UNM)

Historical Stock Chart

From Aug 2023 to Aug 2024