false

0000092230

001-10853

0000092230

2024-02-20

2024-02-20

0000092230

TFC:CommonStock5DollarParValueMember

2024-02-20

2024-02-20

0000092230

TFC:CommonStock5ParValueMember

2024-02-20

2024-02-20

0000092230

TFC:DepositarySharesEachRepresenting14000thInterestInShareOfSeriesIPerpetualPreferredStockMember

2024-02-20

2024-02-20

0000092230

TFC:Sec5.853PercentFixedtofloatingRateNormalPreferredPurchaseSecuritiesEachRepresenting1100thInterestInShareOfSeriesJPerpetualPreferredStockMember

2024-02-20

2024-02-20

0000092230

TFC:Sec5.853FixedtofloatingRateNormalPreferredPurchaseSecuritiesEachRepresenting1100thInterestInShareOfSeriesJPerpetualPreferredStockMember

2024-02-20

2024-02-20

0000092230

TFC:DepositarySharesEachRepresenting11000thInterestInShareOfSeriesONoncumulativePerpetualPreferredStockMember

2024-02-20

2024-02-20

0000092230

TFC:DepositarySharesEachRepresenting11000thInterestInShareOfSeriesRNoncumulativePerpetualPreferredStockMember

2024-02-20

2024-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February

20, 2024

Date of Report (Date of earliest event reported)

Truist Financial

Corporation

(Exact name of registrant as specified in its

charter)

Commission file

number: 1-10853

| North Carolina |

|

56-0939887 |

| (State or other jurisdiction of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

214 North Tryon Street

Charlotte, North Carolina

|

|

28202 |

| (Address of principal executive offices) |

|

(Zip Code) |

(336) 733-2000

(Registrant’s telephone number, including

area code)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on

which registered

|

| Common Stock, $5 par value |

|

TFC |

|

New York Stock Exchange |

| |

|

|

|

|

| Depositary Shares each representing 1/4,000th interest in a share of Series I Perpetual Preferred Stock |

|

TFC.PI |

|

New York Stock Exchange |

| |

|

|

|

|

| 5.853% Fixed-to-Floating Rate Normal Preferred Purchase Securities each representing 1/100th interest in a share of Series J Perpetual Preferred Stock |

|

TFC.PJ |

|

New York Stock Exchange |

| |

|

|

|

|

| Depositary shares each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock |

|

TFC.PO |

|

New York Stock Exchange |

| |

|

|

|

|

| Depositary Shares each representing 1/1,000th interest in a share of Series R Non-Cumulative Perpetual Preferred Stock |

|

TFC.PR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement |

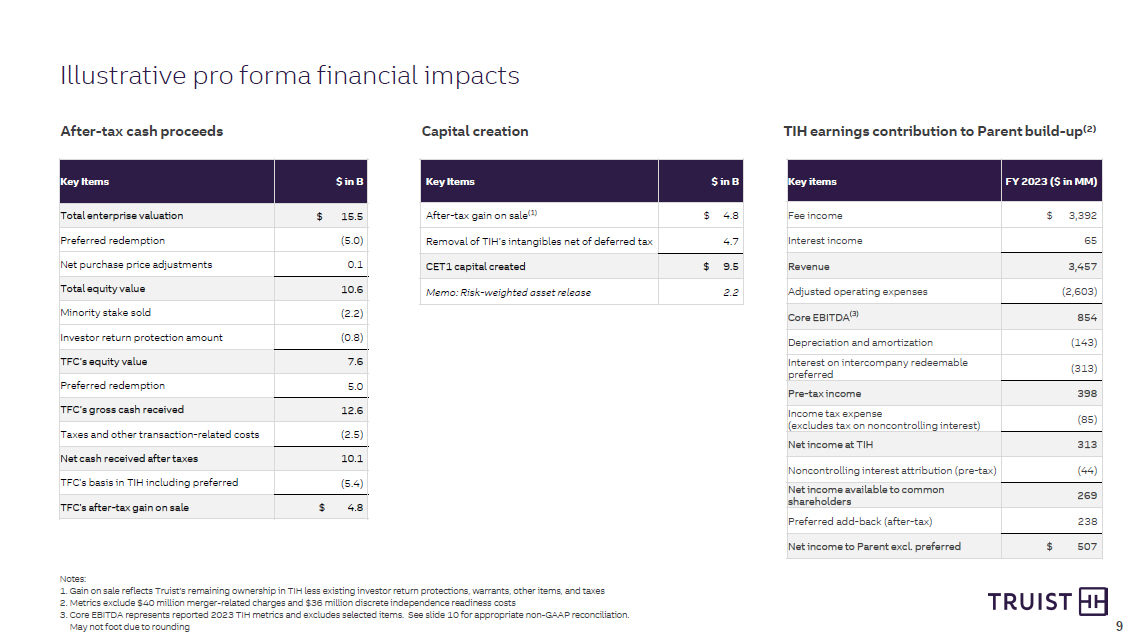

On February 20, 2024, Truist Bank, a North Carolina-chartered

state nonmember bank (“Truist”) and wholly owned subsidiary of Truist Financial Corporation (the “Company”), entered

into an Equity Interest Purchase Agreement (the “Purchase Agreement”) by and among Truist, Trident Butterfly Investor, Inc.,

a Delaware corporation (“Buyer Entity 1”), Panther Blocker I, Inc., a Delaware corporation (“Buyer Entity 2”),

Panther Blocker II, Inc., a Delaware corporation (together with Buyer Entity 1 and Buyer Entity 2, the “Buyer Entities”),

Truist TIH Holdings, Inc., a Delaware corporation (“Truist Holdings”), Truist TIH Partners, Inc., a Delaware corporation (“Truist

Partners”), TIH Management Holdings, LLC, a Delaware limited liability company (“Management Holdings”), TIH Management

Holdings II, LLC, a Delaware limited liability company (“Management Holdings II”), and Truist Insurance Holdings, LLC, a Delaware

limited liability company (“Truist Insurance”), pursuant to which Truist will sell its remaining equity interests in Truist

Insurance (the “Transaction”) to an investor group led by Stone Point Capital LLC, Clayton, Dubilier & Rice, LLC and Mubadala

Investment Company for a purchase price that implies an enterprise value for Truist Insurance of $15.5 billion, and is expected to result

in cash proceeds to Truist of approximately $10.1 billion, reflecting certain adjustments for, and subject to further adjustments for,

cash, debt and debt-like items, working capital, transaction expenses and other matters.

The obligation of the parties to consummate the

closing (the “Closing”) is subject to the satisfaction or waiver of customary conditions, including, among other things, the

receipt of applicable regulatory approvals and the expiration or termination of applicable waiting periods. The Purchase Agreement contains

certain termination rights for each of Truist and the Buyer Parties, including the right of each party to terminate the Purchase Agreement

if the Closing has not been consummated by August 20, 2024 (subject to automatic extension until November 20, 2024, in the event that

on August 20, 2024 all conditions have been satisfied other than the regulatory conditions). The Purchase Agreement provides for the

payment by the Buyer Parties to Truist of a termination fee in the amount of $700 million if the Purchase Agreement is terminated in certain

circumstances described in the Purchase Agreement, including if Truist terminates the Purchase Agreement in the event that the Buyer Parties

do not consummate the Closing when they are required to do so.

The Purchase Agreement contains customary representations

and warranties by each party. The parties have also agreed to various customary covenants and agreements relating to the Transaction.

Among other things, prior to the consummation of the Transaction, Truist will be subject to certain business conduct restrictions with

respect to its operation of Truist Insurance.

Truist has agreed to indemnify the Buyer Parties

for certain liabilities retained by Truist, and the Buyer Parties have agreed to indemnify Truist for liabilities relating to the business

conducted by Truist Insurance, in each case as described in the Purchase Agreement.

Truist and the Buyer Parties have agreed to enter

into related agreements ancillary to the transaction that will become effective upon the consummation of the transaction, including (i)

a customary transition services agreement, (ii) a relationship marketing agreement pursuant to which Truist and Truist Insurance will

agree to provide co-marketing materials and, as may be needed, business services, to the other party’s clients, (iii) one or more

agreements pursuant to which Truist Insurance will continue to serve as the Company’s broker of record for the property and casualty

insurance coverage for the Company, and (iv) one or more agreements pursuant to which Truist Insurance will continue to serve as the provider

of employee benefits coverages for the Company and its subsidiaries (including an extension of the Company’s LifeForce premium reduction

program and its flexible benefits and COBRA services).

The foregoing description of the Purchase Agreement

and related documents does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement,

which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Purchase Agreement has been attached to provide investors

with information regarding its terms. It is not intended to provide any other factual information about Truist, any of the other parties

to the Purchase Agreement or the businesses or operations of Truist Insurance. In particular, the assertions embodied in the representations

and warranties contained in the Purchase Agreement are qualified by information in confidential disclosure schedules provided by the parties

in connection with the signing of the Purchase Agreement. These confidential disclosure schedules contain information that modifies, qualifies

and creates exceptions to the representations and warranties and certain covenants set forth in the Purchase Agreement.

Moreover,

certain representations and warranties in the Purchase Agreement were used for the purpose of allocating risk among the parties rather

than establishing matters as facts and were made only as of the date of the Purchase Agreement (or such other date or dates as may be

specified in the Purchase Agreement). Accordingly, the representations and warranties in the Purchase Agreement should not be relied

upon as characterizations of the actual state of facts about Truist, any of the parties to the Purchase Agreement or the businesses or

operations of Truist Insurance.

Forward Looking Statements

This Current Report on Form

8-K, including any information incorporated by reference in this report, contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical

or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,”

“intend,” “pursue,” “seek,” “continue,” “estimate,” “project,”

“outlook,” “forecast,” “potential,” “target,” “objective,” “trend,”

“plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense

or conditional verbs such as “may,” “will,” “should,” “would,” or “could.”

In particular, forward-looking statements include, but are not limited to, statements we make about the expected cash proceeds to be received

by Truist in connection with the Transaction. Forward-looking statements convey our expectations, intentions, or forecasts about future

events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties,

which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction

or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, and results may differ

materially from those set forth in any forward-looking statement. While no list of assumptions, risks, and uncertainties could be complete,

some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements

include the risks and uncertainties more fully discussed in Part I, Item 1A (Risk Factors) in Truist’s most recently filed Annual

Report on Form 10-K and in Truist’s subsequent filings with the Securities and Exchange Commission: Any forward-looking statement

made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to

reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable

securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make

in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, or Current Report on Form 8-K.

| Item 7.01 | Regulation FD Disclosure |

On February 20, 2024,

the Company issued a press release announcing the Transaction and will host a conference call and a webcast at 8:00 a.m on such date

to discuss the Transaction. Copies of the press release and the presentation to be discussed during the conference call and webcast are

attached as Exhibits 99.1 and 99.2, respectively, and each such document is incorporated by reference herein.

The information

furnished pursuant to this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of such section, nor shall such

information or exhibits be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing by the Company with the Securities and Exchange Commission.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description of Exhibit |

| 2.1 | Equity Interest Purchase Agreement, dated as of February 20, 2024, by and among Trident Butterfly Investor, Inc., Panther Blocker I, Inc., Panther Blocker II, Inc., Truist Bank, Truist TIH Holdings, Inc., Truist TIH Partners, Inc., TIH Management Holdings, LLC, TIH Management Holdings II, LLC and Truist Insurance Holdings, LLC* |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

* Certain schedules and exhibits have been omitted pursuant to Item

601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRUIST FINANCIAL CORPORATION |

| |

(Registrant) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Cynthia B. Powell |

|

| |

|

Name: |

Cynthia B. Powell |

|

| |

|

Title: |

Executive Vice President and |

|

| |

|

|

Corporate Controller |

|

Date: February 20, 2024

Exhibit 2.1

EQUITY INTEREST PURCHASE AGREEMENT

dated as of

February 20, 2024

by and among

TRIDENT BUTTERFLY INVESTOR, INC.,

PANTHER BLOCKER I, INC.,

PANTHER BLOCKER II, INC.,

TRUIST BANK,

TRUIST TIH HOLDINGS, INC.,

TRUIST TIH PARTNERS, INC.,

TIH MANAGEMENT HOLDINGS, LLC,

TIH MANAGEMENT HOLDINGS II, LLC

and

TRUIST INSURANCE HOLDINGS, LLC

TABLE OF CONTENTS

Page

Article 1

Definitions |

| Section 1.01. Definitions |

2 |

| Section 1.02. Other Definitional and Interpretative Provisions |

27 |

Article 2

Purchase and Sale of Purchased Interests |

| Section 2.01. Purchase and Sale of Purchased Interests |

29 |

| Section 2.02. Estimated Closing Statement |

29 |

| Section 2.03. Closing |

29 |

| Section 2.04. Post-Closing Purchase Price Adjustment |

31 |

| Section 2.05. Withholding |

34 |

| Section 2.06. Management Transactions |

35 |

| Section 2.07. Payment to Management Holders |

36 |

Article 3

Representations and Warranties Regarding the Company and Truist Partners |

| Section 3.01. Existence and Power |

36 |

| Section 3.02. Authorization |

37 |

| Section 3.03. Governmental Authorizations |

37 |

| Section 3.04. Noncontravention |

38 |

| Section 3.05. Capitalization |

38 |

| Section 3.06. Subsidiaries |

39 |

| Section 3.07. Financial Statements |

40 |

| Section 3.08. Absence of Certain Changes |

41 |

| Section 3.09. No Undisclosed Material Liabilities |

41 |

| Section 3.10. Material Contracts |

41 |

| Section 3.11. Litigation; Orders |

43 |

| Section 3.12. Compliance with Laws; Governmental Approvals |

43 |

| Section 3.13. Employee Benefit Plans |

44 |

| Section 3.14. Labor Matters |

45 |

| Section 3.15. Taxes |

46 |

| Section 3.16. Properties |

48 |

| Section 3.17. Intellectual Property |

49 |

| Section 3.18. Sufficiency of Assets |

51 |

| Section 3.19. Environmental Matters |

51 |

| Section 3.20. Finders’ Fees |

51 |

| Section 3.21. Compliance with Insurance Regulatory Requirements |

51 |

| Section 3.22. Insurance |

53 |

| Section 3.23. Anti-Corruption Compliance |

54 |

| Section 3.24. Sanctions |

54 |

| Section 3.25. Anti-Money Laundering Laws |

54 |

| Section 3.26. Contracts with Affiliates |

55 |

| Section 3.27. Compliance with Investment Adviser and Broker-Dealer Regulatory Requirements |

55 |

| Section 3.28. No Other Representations and Warranties |

57 |

Article 4

Representations and Warranties of the Buyer Entities |

| Section 4.01. Existence and Power |

58 |

| Section 4.02. Authorization |

58 |

| Section 4.03. Governmental Authorization |

58 |

| Section 4.04. Noncontravention |

59 |

| Section 4.05. [Intentionally Omitted] |

59 |

| Section 4.06. Litigation; Orders |

59 |

| Section 4.07. Compliance with Laws |

59 |

| Section 4.08. Financing |

60 |

| Section 4.09. Guarantee |

61 |

| Section 4.10. Purchase for Investment |

62 |

| Section 4.11. Solvency |

62 |

| Section 4.12. Finders’ Fees |

62 |

| Section 4.13. Inspections; No Other Representations and Warranties |

62 |

Article 5

Covenants of the Buyer Entities, the Company and the Truist Parties |

| Section 5.01. Conduct of Business |

63 |

| Section 5.02. Reasonable Best Efforts; Further Assurances |

68 |

| Section 5.03. Access to Information |

71 |

| Section 5.04. Notices of Certain Events |

72 |

| Section 5.05. Public Announcements |

72 |

| Section 5.06. Conduct of the Buyer Entities |

73 |

| Section 5.07. Exclusivity |

73 |

| Section 5.08. Termination of Related Party Agreements |

73 |

| Section 5.09. Transaction Agreements |

74 |

| Section 5.10. Client Consents |

74 |

| Section 5.11. Revolving Credit Agreement |

75 |

| Section 5.12. Buyer Financing Covenants |

75 |

| Section 5.13. Cooperation with Debt Financing |

79 |

| Section 5.14. IP Matters |

83 |

| Section 5.15. Pension Plan, ESPP and Truist Incentive Plan |

85 |

| Section 5.16. Directors and Officers |

86 |

| Section 5.17. Replacement of Guarantees |

86 |

| Section 5.18. Wrong Pockets |

87 |

| Section 5.19. Insurance |

87 |

| Section 5.20. Further Assurances |

88 |

| Section 5.21. Litigation Support |

88 |

| Section 5.22. Noncompetition and Nonsolicitation. |

88 |

| Section 5.23. Terminated Agreements |

90 |

| Section 5.24. Certain Consents |

91 |

| Section 5.25. Delivery of Financial Statements |

91 |

| Section 5.26. Resignations |

91 |

| Section 5.27. Shared Contracts |

91 |

| Section 5.28. Bank Accounts |

93 |

| Section 5.29. R&W Policy |

93 |

| Section 5.30. Retention of Books and Records. |

93 |

| Section 5.31. Covenant Relating to Truist Partners |

94 |

| Section 5.32. Intercompany Accounts |

94 |

| Section 5.33. Management Holdco Agreements |

95 |

| Section 5.34. Special Distribution |

95 |

| Section 5.35. Truist Partners Distribution |

95 |

| Section 5.36. Real Property Transfers |

96 |

| Section 5.37. Cooperation with Respect to Recapitalization |

96 |

| Section 5.38. Commercial Agreements |

96 |

| Section 5.39. New Buyer Entity |

97 |

| Section 5.40. Consent under the A&R LLC Agreement |

97 |

Article 6

Tax Matters |

| Section 6.01. Transfer Taxes |

97 |

| Section 6.02. Tax Returns |

97 |

| Section 6.03. 754 Election |

98 |

| Section 6.04. Tax Disputes |

98 |

| Section 6.05. Allocation of Purchase Price |

99 |

| Section 6.06. Computation of Tax Liability |

100 |

| Section 6.07. Post-Closing Tax Actions |

100 |

| Section 6.08. Tax Refunds |

101 |

| Section 6.09. Tax Sharing Agreements |

101 |

| Section 6.10. Cooperation |

102 |

| Section 6.11. Section 338 Election |

102 |

Article 7

Employee Matters |

| Section 7.01. Treatment of Company Employees |

103 |

| Section 7.02. Continuation of Benefits |

103 |

| Section 7.03. Service Credit |

103 |

| Section 7.04. Establishing of Company Benefit Plans |

104 |

| Section 7.05. Vesting of Appreciation Units, LTIP Units and Incentive Units |

104 |

| Section 7.06. No Third-Party Beneficiaries |

104 |

Article 8

Conditions to Closing |

| Section 8.01. Conditions to Obligations of the Buyer Entities, the Company and the Truist Parties |

104 |

| Section 8.02. Conditions to Obligations of the Buyer Entities |

105 |

| Section 8.03. Conditions to Obligations of the Company and the Truist Parties |

106 |

Article 9

Termination |

| Section 9.01. Grounds for Termination |

106 |

| Section 9.02. Effect of Termination |

108 |

| Section 9.03. Termination Fee and Related Matters |

108 |

Article 10

Indemnification |

| Section 10.01. Indemnification |

110 |

| Section 10.02. Third Party Claim Procedures |

111 |

| Section 10.03. Direct Claim Procedures |

113 |

| Section 10.04. Calculation of Damages; Limitations of Liabilities; Set Off |

113 |

| Section 10.05. No Right to Set-Off |

114 |

Article 11

Miscellaneous |

| Section 11.01. Notices |

114 |

| Section 11.02. No Survival of Representations, Warranties and Covenants; Waiver of Claims; Covenant Not to Sue |

115 |

| Section 11.03. Amendments and Waivers |

117 |

| Section 11.04. Expenses |

117 |

| Section 11.05. Successors and Assigns |

117 |

| Section 11.06. Governing Law |

117 |

| Section 11.07. Jurisdiction |

118 |

| Section 11.08. WAIVER OF JURY TRIAL |

118 |

| Section 11.09. Counterparts; Effectiveness; Third-Party Beneficiaries |

118 |

| Section 11.10. Entire Agreement |

118 |

| Section 11.11. Severability |

119 |

| Section 11.12. Company Disclosure Schedule |

119 |

| Section 11.13. Waiver of Conflicts; Attorney-Client Privilege |

119 |

| Section 11.14. Specific Performance |

120 |

| Section 11.15. No Recourse |

121 |

| Section 11.16. Debt Financing Sources |

121 |

EXHIBITS

| Exhibit A |

Illustrative Closing Working Capital Calculation |

| Exhibit B |

Form of Guarantee |

| Exhibit C |

FMV Determination Schedule |

| Exhibit D |

Form of Transition Services Agreement |

| Exhibit E |

Sample Fiduciary Cash Calculation |

| Exhibit F |

Form of Relationship Marketing Agreement |

| Exhibit G |

Illustrative Purchase Price Calculation |

EQUITY INTEREST PURCHASE AGREEMENT

EQUITY INTEREST PURCHASE AGREEMENT (this “Agreement”)

dated as of February 20, 2024, by and among Trident Butterfly Investor, Inc., a Delaware corporation (“Buyer Entity 1”),

Panther Blocker I, Inc., a Delaware corporation (“Buyer Entity 2”), Panther Blocker II, Inc., a Delaware corporation

(“Buyer Entity 3” and, together with Buyer Entity 1 and Buyer Entity 2, the “Buyer Entities”), Truist

Bank, a North Carolina-chartered state nonmember bank (“Truist”), Truist TIH Holdings, Inc., a Delaware corporation

(“Truist Holdings”), Truist TIH Partners, Inc., a Delaware corporation (“Truist Partners”), TIH

Management Holdings, LLC, a Delaware limited liability company (“Management Holdings”), TIH Management Holdings II,

LLC, a Delaware limited liability company (“Management Holdings II” and, together with Truist, Truist Holdings, Truist

Partners and Management Holdings, each a “Truist Party” and, collectively, the “Truist Parties”),

and Truist Insurance Holdings, LLC, a Delaware limited liability company (the “Company”).

W I T N E S S E T H :

WHEREAS, Truist Holdings and Management Holdings

II are, collectively, the registered and beneficial owners of 78.1% of the issued and outstanding Common Units (as defined in the A&R

LLC Agreement) (other than, after giving effect to the Rollover, the Rollover Units) (the “Purchased Common Units”);

WHEREAS, Truist Partners is the registered and

beneficial owner of 1.5% of the Common Units;

WHEREAS, Truist Holdings is the registered and

beneficial owner of 100% of the issued and outstanding shares of common stock of Truist Partners (the “Truist Partners Stock”);

WHEREAS, Management Holdings is the registered

and beneficial owner of 100% of the issued and outstanding Incentive Units (as defined in the A&R LLC Agreement) (other than, after

giving effect to the Rollover, the Rollover Units) (the “Incentive Interests” and, together with the Truist Partners

Stock and the Purchased Common Units, the “Purchased Interests”);

WHEREAS, Truist Holdings is the registered and

beneficial owner of 100% of the issued and outstanding Preferred Units (as defined in the A&R LLC Agreement) (the “Preferred

Equity Interests”);

WHEREAS, the Management Holders are the registered

and beneficial owners of all of the issued and outstanding MH II Common Units or MH Incentive Units (before giving effect to the Rollover);

and

WHEREAS, the parties hereto desire to enter into

a transaction pursuant to which the Buyer Entities will acquire from the Truist Sellers all of the Purchased Interests upon the terms

and subject to the conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the foregoing

and the respective representations, warranties, covenants and agreements set forth herein, and for other good and

valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto agree as follows:

Article

1

Definitions

Section 1.01.

Definitions. (a) As used herein, the following terms have the following meanings:

“A&R LLC Agreement” means

that certain Amended and Restated Limited Liability Company Agreement of the Company, dated as of April 3, 2023, as may be amended from

time to time in accordance with the terms thereof; provided that any such amendment shall only be given effect for purposes of

this Agreement if it was entered into with Truist’s written consent.

“Accounting Principles” means

(a) the accounting principles, practices, and methodologies set forth on Exhibit A; (b) to the extent not inconsistent with clause

(a), and solely to the extent consistent with GAAP as of the date hereof, the accounting principles, practices, procedures, policies and

methods (with consistent classifications) used and applied in the preparation of the Audited Balance Sheet; and (c) to the extent not

addressed in the foregoing clauses (a) and (b), GAAP as of the date hereof.

“Adviser Subsidiary” means Precept

Advisory Group, LLC, a California limited liability company.

“Advisory Contract” means all

agreements and arrangements that contemplate the performance by the Adviser Subsidiary of discretionary or non-discretionary investment

advisory or investment management (including sub-advisory or other similar) services to, or otherwise managing any investment or trading

account of, or for, any Person.

“Affiliate” means, with respect

to any Person, any other Person directly or indirectly controlling, controlled by or under common control with such Person; provided

that, regardless of whether a Person may in fact directly or indirectly control, be controlled by, or under common control with, another

Person, for purposes of this Agreement, (a) the Company and the Company Entities shall not be deemed Affiliates of or deemed to be Subsidiaries

of (i) Truist or any of its other Subsidiaries or (ii) Stone Point or any investment fund or investment vehicle affiliated with, or managed

or advised by, Stone Point or its Affiliates, (b) other than for purposes of the second proviso of Section 5.02(c) and Section

11.15 and the definitions of “Buyer Indemnified Party” and “Related Party” (for which purposes the Trident

Investors shall be deemed to be Affiliates of the Buyer Entities), no investment fund or investment vehicle affiliated with, or managed

or advised by, Stone Point or its Affiliates or portfolio company (as such term is commonly understood in the private equity industry)

or investment of any such investment funds or investment vehicles shall be deemed to be an Affiliate of any Buyer Entity, (c) other than

for purposes of the second proviso of Section 5.02(c) and Section 11.15 and the definitions of “Buyer Indemnified

Party” and “Related Party” (for which purposes the CD&R Investor shall be deemed to be an Affiliate of the Buyer

Entities), no investment fund or investment vehicle affiliated with, or managed or advised by, CD&R or its Affiliates or portfolio

company (as such term is commonly understood in the private equity industry) or investment of any such investment funds or investment

vehicles shall be deemed to be an Affiliate of any Buyer Entity,

(d) other than for purposes of the second proviso

of Section 5.02(c) and Section 11.15 and the definitions

of “Buyer Indemnified Party” and “Related Party” (for which purposes the ATIC Investor shall be deemed to be an

Affiliate of the Buyer Entities), neither the ATIC Investor nor any of its Affiliates shall be deemed to be an Affiliate of any Buyer

Entity and (e) other than for purposes of the second proviso of Section 5.02(c) and Section

11.15 and the definitions of “Buyer Indemnified Party” and “Related Party” (for which purposes the Viggo Investor

shall be deemed to be an Affiliate of the Buyer Entities), neither the Viggo Investor nor any of its Affiliates shall be deemed to be

an Affiliate of any Buyer Entity and, in each case, vice versa. For purposes of this definition, “control” when used with

respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the

ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have correlative

meanings.

“Anti-Corruption Laws” means

the provisions of the U.S. Foreign Corrupt Practices Act of 1977 and the provisions of any other applicable domestic or foreign anti-corruption

laws.

“Anti-Money Laundering Laws”

means all applicable statutes, laws, rules, regulations or other requirements of the Bank Secrecy Act, as amended by Title III of the

Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT

Act), and all other applicable anti-money laundering, proceeds of crime, and related financial recordkeeping statutes, laws, regulations,

or other requirements of jurisdictions where the Company Entities conduct business.

“Antitrust Laws” means any federal,

state or foreign Law, regulation or decree designed to prohibit, restrict or regulate actions for the purpose or effect of monopolization

or restraint of trade or the significant impediment of effective competition or lessening of competition through merger or acquisition.

“Applicable Law” means, with

respect to any Person, any foreign, federal, state or local law (including common law), code, rule, regulation, injunction, judgment,

order, decree, ruling or other similar requirement enacted, adopted, promulgated or applied by any Governmental Authority that is binding

upon or applicable to such Person.

“Appreciation Unit” has the

meaning set forth in the Truist Insurance Holdings, LLC Appreciation Unit Plan.

“Appreciation Unit Amount” means

the aggregate payments that are payable at Closing under the Truist Insurance Holdings, LLC Appreciation Unit Plan and the related award

agreements thereunder, including each Appreciation Unit that vests in accordance with Section 7.05 of this Agreement.

“ATIC Investor” has the meaning

set forth on Section 1.01(a) of the Company Disclosure

Schedule.

“Balance Sheet” means the unaudited

consolidated balance sheet of the Company Entities as of the Balance Sheet Date.

“Balance Sheet Date” means September

30, 2023.

“BHC Act” means the Bank Holding

Company Act of 1956.

“Broker-Dealer Subsidiary” means

P.J. Robb Variable, LLC, a Tennessee limited liability company.

“Business” means the business

conducted by the Company Entities as of the 12-month period prior to the date hereof, including the business or operations reflected in

the Financial Statements.

“Business Day” means a day,

other than Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by Applicable Law

to close.

“CARES Act” means the Coronavirus

Aid, Relief, and Economic Security Act, Pub. L. 116-136 and any amendment thereof, or administrative or other guidance or legislation

published with respect thereto by any Governmental Authority.

“CD&R” means Clayton, Dubilier

& Rice, LLC, a Delaware limited liability company.

“CD&R Investor” means Clayton,

Dubilier & Rice Fund XII, L.P., a Cayman Islands exempted limited partnership.

“Client” means any Person that

is an investment advisory or investment management client of a Company Entity pursuant to an Investment Advisory Agreement.

“Client Consent” means, the

consent or approval or deemed consent or approval, as applicable, of such Client in accordance with Section

5.10 to the assignment or deemed assignment of such Client’s Investment Advisory Agreement with any Company Entity.

“Closing Cash” means, without

duplication, the sum of (a) the aggregate amount of all cash, cash equivalents, marketable securities and short-term investments (in each

case, to the extent convertible to cash within 90 days) and (b) the Fiduciary Cash Amount, held by the Company Entities as of the Measurement

Time. Closing Cash shall include checks, ACH transactions and other wire transfers and drafts deposited or available for deposit for the

account of any Company Entity, but shall be reduced by all uncleared checks, transfers, wires and other uncleared payments (but only to

the extent otherwise included in Closing Cash), in each case, as of the Measurement Time. For the avoidance of doubt, Closing Cash shall

(i) exclude any Restricted Cash and (ii) be reduced by amounts (if any) paid or distributed by any Company Entity after the Measurement

Time but prior to the Closing and any other amounts paid or distributed to any payee of Closing Indebtedness or Closing Transaction Expenses

or to any Truist Party or their respective Affiliates other than the Company Entities (other than in respect of the transactions set forth

on Section 5.32 of the Company Disclosure Schedule in the ordinary course of business and unrelated to any Person’s equity

or debt interests in the Company Entities).

“Closing Date” means the date

of the Closing.

“Closing Indebtedness” means

the aggregate amount of all obligations (including in respect of outstanding principal and accrued but unpaid interest and any premiums,

termination fees, expenses, prepayment penalties, commitments (including in respect of any nonuse charges required to be paid pursuant

to, and in connection with the termination of, the Revolving Credit Agreement), breakage costs or other fees, reimbursements and all other

amounts that are required to be paid as a result of or in connection with the transactions contemplated by this Agreement) of the Company

Entities as of the Measurement Time (but assuming the consummation of the Closing), without duplication, in respect of (i) indebtedness

for borrowed money, (ii) indebtedness evidenced by bonds, notes, debentures or other similar instruments or debt securities, (iii) capital/finance

lease obligations classified as such in the Financial Statements or in accordance with GAAP (excluding any effect of ASC 842 as it relates

to the classification of operating leases), (iv) any obligation evidenced by any performance bonds, letters of credit or bankers’

acceptances or similar facilities, in each case, solely to the extent drawn upon, (v) obligations related to interest rate swap, forward

contract, currency or other hedging arrangements, in each case, calculated at the termination value thereof as if terminated at or immediately

prior to the Closing; provided that the amount calculated pursuant to this clause (v) shall not be less than zero, (vi) all liabilities

secured by any mortgage, pledge, security interest, Lien (other than a Permitted Lien), (vii) any unpaid severance obligations (including

unpaid severance related to the Company Program), unpaid compensation (including unpaid compensation related to the Company Program) and

any obligations in respect of compensation adjustments associated with the Company Program, in each case, with respect to Company Employees

who terminated employment prior to the Closing and any bonuses related to the McGriff Insurance Services, LLC Out-of-the-Park program

(including the employer portion of any applicable payroll Taxes relating to such payments under this clause (vii)), (viii) the amount

by which any fiduciary escrow Liabilities exceeds any fiduciary escrow assets (which amount shall, for purposes of this clause (viii),

in no case be less than zero), (ix) the Income Tax Liability Amount, (x) the amounts of obligations for the deferred purchase price of

property, assets, businesses, securities, goods or services, including all earn-out payments (including retention payments), seller notes,

post-closing true-up obligations and other similar payments, in each case, (A) in the case of any transactions that are set forth on Section

1.01(b) of the Company Disclosure Schedule, only in the amounts set forth on such schedule (less any amounts paid after the date hereof

and prior to the Measurement Time) or (B) in the case of any other transactions, to be calculated in accordance with the Accounting Principles,

(xi) Net PC Reserve Amount, (xii) any accruals or reserves for litigation involving any Company Entity or to which any of the Company

Entities is a party, (xiii) deferred compensation, post-retirement welfare benefits, unfunded or underfunded pensions or pension-like

liabilities, accrued but unpaid cash incentive payments relating to Company Employees (including the employer portion of any applicable

payroll Taxes relating to such payments or benefits), (xiv) any obligations with respect to incentive-based producer loans, (xv) any declared

but unpaid dividends, or any other amounts accrued, incurred or owed, that are payable to Truist or its Affiliates (excluding the Company

Entities), including any fees, costs or expenses payable to the Escrow Agent, and any other amounts or obligations under any Related Party

Agreements that are required to be terminated prior to the Closing, (xvi) any obligations related to the elimination of the McGriff Insurance

Services, LLC car program, (xvii) any long-term deferred revenue of the Company Entities, (xviii) any accrued non-recurring costs of the

Company Entities or professional fees related to investigating and mitigating any cyber breach incident involving CRC Services, LLC,

(xix) any obligations relating to accrued professional

fees associated with the Company Program, (xx) the Payoff Amount in respect of the Preferred Equity Interests, (xxi) an amount equal to

(A) $82,200,000 minus (B) the amount of out-of-pocket one-time separation costs and other transactional and functional costs to establish

the Business as a standalone business that are incurred by the Company and its Subsidiaries between January 1, 2024 and the Measurement

Time, including costs associated with cloud migration, enterprise applications, network hardware and data centers, telephony equipment,

recruiting agencies, employee transitions, third-party consultants and brokers, human resources compliance and policy implementation,

legal, rebranding, and website and hosting solutions (such costs in this clause (B), the “Separation Costs”), (xxii)

Future Defined Benefit Obligations, (xxiii) Future LTIP Obligations and (xxiv) guarantees by any Company Entity described in the foregoing

clauses (i)-(xxiii) but excluding any guarantees of performance under contractual obligations in the ordinary course of business; provided

that, for the avoidance of doubt, “Closing Indebtedness” shall not include (A) any obligations solely between or among the

Company Entities, (B) any indebtedness pursuant to the Debt Financing, (C) any amounts with respect to the Appreciation Unit Amount or

(D) any amounts with respect to the LTIP Unit Amount. Closing Indebtedness incurred after the Measurement Time but before the Closing

shall be considered to have been incurred at the Measurement Time unless it has an equal and offsetting impact on Closing Cash or Closing

Working Capital.

“Closing Purchase Price Payments”

means the amounts required to be paid by the Buyer Entities at Closing pursuant to Section 2.03(b)(ii), Section 2.03(b)(iii),

Section 2.03(b)(iv), Section 2.03(b)(v) and Section 2.03(b)(vi).

“Closing Transaction Expenses”

means, without duplication, all fees, expenses and costs payable, incurred or subject to reimbursement by any of the Company Entities,

whether accrued for or not, in each case in connection with the transactions contemplated by this Agreement or in connection with other

negotiations or processes involving the sale of the Company and not paid prior to the Closing (but assuming the consummation of the Closing),

including (i) all fees, expenses and costs incurred by or on behalf of or payable by any Company Entity (including amounts that are liabilities

of any Truist Party but reimbursable or otherwise payable by any Company Entity) to financial advisors (including Morgan Stanley &

Co. LLC) (including any brokerage fees, commissions or finders’ fees), accountants, legal advisors (including Davis Polk & Wardwell

LLP) or other third party advisors or transaction-related service providers such as electronic data room vendors, in connection with the

transactions contemplated by this Agreement and the related solicitation, prior to the Closing, of potential other buyers of the Company

and its Subsidiaries and, prior to the Closing, other strategic alternatives, including any alternative capital raising transactions or

any public or private offering of securities (including by means of an underwritten public offering, a spin-off or a split-off or otherwise),

(ii) the Appreciation Unit Amount, (iii) the LTIP Unit Amount and (iv) all transaction, retention, change of control, bonus, single-trigger

severance or other similar compensatory payments that are payable by any Company Entity to any Person as a result of the consummation

of the transactions contemplated by this Agreement (including the employer’s portion of any applicable Taxes relating to such payments

or benefits, including any payroll, social security, employment or similar Taxes, or any Tax “gross up” or similar obligations

on or in respect of the amounts set forth or contemplated in the foregoing clauses (ii), (iii) and (iv) that are actually paid out as

a result of the transactions contemplated by this Agreement); provided

that, for the avoidance of doubt, “Closing

Transaction Expenses” shall not include any amounts included in Closing Indebtedness or Closing Working Capital or any amounts arising

pursuant to arrangements entered into, or as a result of actions taken, after the Closing, in each case, by the Buyer Entities.

“Closing Working Capital” means,

on a consolidated basis, (i) the sum of the amount of all current assets of the Company Entities (excluding Closing Cash and Restricted

Cash) as of the Measurement Time, minus (ii) the sum of the amount of all current liabilities of the Company Entities (excluding Closing

Indebtedness, the Separation Costs and Closing Transaction Expenses) as of the Measurement Time, in each case (A) determined in accordance

with the Accounting Principles and (B) solely reflecting the categories and line items of current assets and current liabilities included

in the illustrative calculation of Closing Working Capital set forth on Exhibit A. The calculation of Closing Working Capital shall

exclude (1) all deferred Tax assets and current income Tax assets and deferred Tax liabilities and current income Tax liabilities, (2)

the assets and liabilities included in the calculation of Fiduciary Cash Amount, (3) obligations for the deferred purchase price of property,

assets, businesses, securities, goods or services, including all earn-out payments (including retention payments), seller notes and other

similar payments and (4) the ESPP.

“Closing Working Capital Adjustment”

means, whether positive or negative, (i) Closing Working Capital, minus (ii) the Target Closing Working Capital.

“Code” means the Internal Revenue

Code of 1986.

“Company Disclosure Schedule”

means the schedule delivered by the Company to the Buyer Entities on the date hereof setting forth, among other things, items the disclosure

of which is necessary or appropriate either in response to an express disclosure requirement contained in a provision hereof or as an

exception to one or more of the representations and warranties contained in Article

3 or to one or more of the covenants contained in Article

5.

“Company Employee” means an

employee of any Company Entity.

“Company Entities” means, collectively,

the Company and its Subsidiaries (including any predecessor entity thereto).

“Company Intellectual Property Rights”

means all Intellectual Property Rights owned by or developed primarily for or on behalf of any of the Company Entities, including the

items set forth on Section 1.01(c) of the Company Disclosure

Schedule.

“Company Program” has the meaning

set forth on Section 1.01(h) of the Company Disclosure

Schedule.

“Compliant” means, with respect

to any Required Information, that (i) such Required Information does not contain any untrue statement of a material fact regarding the

Company and its Subsidiaries or omit to state any material fact regarding the Company and its Subsidiaries necessary in order to make

such Required Information, in light of the circumstances under which it was made available, not misleading, (ii) the Company’s auditor

has not withdrawn, or advised the Company that it intends to withdraw, its audit opinion with respect to any financial

statements contained in the Required Information,

(iii) the Company has not stated its intent to, or determined that it must, restate any historical financial information included in the

Required Information, it being understood that the Required Information will be Compliant, in respect of this clause (iii), once such

restatement is completed and the applicable Required Information has been amended or the Company or any of its Subsidiaries has, or such

auditors have, as applicable, publicly announced that it has concluded that no restatement shall be required, as applicable, (iv) such

Required Information would not be deemed stale or otherwise be unusable under customary practices for offerings of non-convertible, high

yield debt securities issued under Rule 144A promulgated under the Securities Act and is sufficient to permit the Company and its Subsidiaries’

applicable independent accountants to issue comfort letters to the Debt Financing Sources (including underwriters, placement agents or

initial purchasers), including as to customary negative assurances and change period comfort, in order to consummate any offering of debt

securities on the last day of the Marketing Period and (v) such Required Information is compliant in all material respects with all applicable

requirements of Regulation S-K and Regulation S-X and a registration statement on Form S-1 (or any applicable successor form) under the

Securities Act for an offering of non-convertible, high yield debt securities (other than those provisions of Regulation S-K and Regulation

S-X for which compliance is not customary in a Rule 144A high yield offering of debt securities). For the avoidance of doubt, the financial

statements contained in the Required Information are prepared in accordance with the standards and rules established by the American Institute

of Certified Public Accountants and are not prepared in accordance with the standards and rules established by the Public Company Accounting

Oversight Board.

“Confidentiality Agreement”

means the letter agreement, dated as of October 12, 2023, by and between Stone Point and Truist.

“Consent” means any consent,

approval, authorization, waiver, permit, grant, franchise, concession, agreement, license, exemption or order of, registration, declaration

or filing with, or report or notice to, a Person.

“Consenting Client” means each

Client whose Consent shall have been obtained or be deemed to be obtained, as applicable, in accordance with Section

5.10 (including pursuant to a Negative Consent Notice); provided, however, that no Client that has withdrawn its consent

or approval in writing prior to the Closing or terminated its Investment Advisory Agreement, or given written notice of such withdrawal

or termination, shall be considered a Consenting Client.

“Contract” means any contract,

agreement, commitment, lease, sublease, license, sublicense, subcontract, sale or purchase order, indenture, note, bond, loan, mortgage,

deed of trust, instrument or any other arrangement or undertaking of any nature, whether written or oral, including any exhibits, annexes,

appendices or attachments thereto.

“COVID-19” means SARS-CoV-2

or COVID-19, and any evolutions or mutations thereof or related or associated epidemics, pandemic or disease outbreaks.

“COVID-19 Measures” means (a)

any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure,

sequester, safety or similar Applicable Law, directive, guidelines or recommendations promulgated by any industry group or

any Governmental Authority, including the Centers

for Disease Control and Prevention and the World Health Organization, in each case, in connection with or in response to COVID-19, including

the CARES Act and Families First Act and (b) the reversal or discontinuation of any of the foregoing.

“Debt Financing Sources” means

each of the entities that have committed to provide or arrange or otherwise entered into agreements providing for the Debt Financing,

including the parties to the Debt Commitment Letter (including any Alternative Financing Commitment Letter) and any joinder agreements,

indentures or credit agreements (or similar definitive financing documents) entered pursuant thereto or relating thereto, together with

their respective Affiliates, and their respective Affiliates’ officers, directors, employees, controlling Persons, agents and Representatives

and their respective permitted successors and permitted assigns. For the avoidance of doubt, Truist or any Affiliate of Truist who is

a party to the Revolving Credit Agreement in such capacity will not be a Debt Financing Source.

“DTCC” means the Depository

Trust & Clearing Corporation.

“Enterprise Value” means $15,500,000,000.

“Environmental Law” means any

Applicable Law concerning pollution, public or worker health or safety, or the protection of the environment.

“Equity Value” means an amount

in cash equal to (i) Enterprise Value, plus (ii) Closing Cash, plus (iii) the Closing Working Capital Adjustment (which

may be a positive or negative number), minus (iv) Closing Indebtedness, minus (v) Closing Transaction Expenses.

“ERISA” means the Employee Retirement

Income Security Act of 1974.

“ERISA Affiliate” means any

entity, business or other Person, whether or not incorporated, that together with any Company Entity is treated as a single employer under

Section 414(b) or (c) of the Code or, solely for purposes of Section 302 of ERISA and Section 412 of the Code, is treated as a single

employer under Section 414(m) or (o) of the Code.

“ERISA Client” means each Investment

Advisory Client that is (i) an “employee benefit plan” (as defined in Section 3(3) of ERISA) that is subject to Title I of

ERISA, (ii) a plan, individual retirement account or other arrangement that is subject to Section 4975 of the Code, (iii) an employee

benefit plan, plan, account or arrangement that is subject to any similar applicable law, or (iv) any entity whose underlying assets are

considered to include “plan assets” (as defined by the regulations of the Department of Labor, as amended by Section 3(42)

of ERISA), or its equivalent under applicable law, of any such employee benefit plan, plan, account or arrangement, or a Person acting

on behalf of such an Investment Advisory Client.

“Escrow Agent” means Truist

Corporate Trust and Escrow Services, a division of Truist (solely in its capacity as an escrow agent), or another nationally recognized

financial institution with escrow agent capabilities to be agreed in writing by Truist and the Buyer Entities.

“Escrow Agreement” means that

certain escrow agreement to be entered into on or prior to the Closing in connection with the transactions contemplated hereby by and

among Buyer

Entity 1, Management Holdings, Management Holdings

II and the Escrow Agent, in form and substance reasonably agreed by the parties thereto.

“Exchange Act” means the Securities

Exchange Act of 1934.

“Excluded Information” means

(1) pro forma financial statements (it being understood that the Company, its Subsidiaries and their respective Representatives will assist

the Buyer Entities in, but the Buyer Entities and not the Company, its Subsidiaries or their respective Representatives shall be responsible

for, the preparation of the pro forma financial statements and related notes thereto); (2) any description of all or any portion of the

Financing, including any “description of notes” or information regarding the notes in a pricing supplement, and other information

customarily provided by financing sources or their counsel; (3) risk factors relating to all or any component of the Financing; (4) “segment”

financial information or (5) other information required by Rules 3-09, 3-10 or 3-16 of Regulation S-X under the Securities Act, any Compensation

Discussion and Analysis or other information required by Item 402 of Regulation S-K under the Securities Act or any other information

customarily excluded from an offering memorandum for private placements of nonconvertible high-yield debt securities under Rule 144A promulgated

under the Securities Act.

“Federal Reserve” means the

Board of Governors of the Federal Reserve System.

“Fiduciary Cash Amount” means

the sum of the fiduciary assets of the Company and its Subsidiaries of the type included in the applicable line item categories on the

sample fiduciary adjustment amount attached hereto as Exhibit E (the “Sample Fiduciary Cash Calculation”), minus

the sum of the fiduciary liabilities of the Company and its Subsidiaries of the type included in the applicable line item categories on

the Sample Fiduciary Cash Calculation, in each case as of the Measurement Time and calculated in accordance with the Accounting Principles.

“FINRA” means the Financial

Industry Regulatory Authority.

“Future Defined Benefit Obligations”

means $175,000,000.00.

“Future LTIP Obligations” means

$61,308,064.97.

“GAAP” means generally accepted

accounting principles in the United States.

“General Indemnified Matter”

means any action, suit, litigation or proceeding brought by third parties arising from events that occurred or were alleged to have occurred,

and for which a claim is made, prior to the Closing and that would be covered by the “tail” insurance policies set forth on

Section 5.19(c) of the Company Disclosure Schedule

if the claim were reported post-Closing (and disregarding any deductible or retentions therein), other than (x) the Specified Indemnified

Matters and (y) any action, suit, litigation, proceeding, investigation or claim that is covered by (i) the occurrence-based Truist Insurance

Policies to which the post-Closing Company has access under Section 5.19 hereof (and for which coverage is actually available to the post-Closing

Company, but disregarding any deductible or retention thereunder) or (ii) the “tail” insurance policies set forth on Section

5.19(c) of the Company Disclosure Schedule.

“Governmental Approval” means

a Consent of, by or from a Governmental Authority (including the expiration of any waiting or other time period required to elapse before

Consent or acquiescence of an applicable Governmental Authority may be assumed or relied on).

“Governmental Authority” means

any foreign or domestic, federal, state, or local, governmental, regulatory or administrative authority (including any political subdivision,

commission, department, bureau, court, tribunal, agency or other authority thereof) and any quasi-governmental or private body exercising

any regulatory, taxing, importing or other governmental or quasi-governmental authority, or any self-regulatory organization.

“HSR Act” means the Hart-Scott-Rodino

Antitrust Improvements Act of 1976.

“Income Tax Liability Amount”

means, without duplication, an amount equal to the aggregate liability for accrued but unpaid income Taxes of Truist Partners (other than

income Taxes payable by the parent or any other member (that is not Truist Partners or a Company Entity) of a consolidated group (within

the meaning of Treasury Regulations § 1.1502-2) or other consolidated, combined, unitary or similar Tax group of which Truist Partners

is a member as of the date hereof) and the Company Entities (other than, for the avoidance of doubt and subject to clause (e) of this

definition, Company Entities treated as partnerships, pass-throughs or disregarded entities (or similar entities) for applicable income

Tax purposes, in each case solely to the extent that such income Taxes are not imposed on, or otherwise payable by, such Company Entities),

whether or not then due, in each case for any Pre-Closing Tax Period and with respect to either (i) a Tax Return that is due after the

Closing and has not been filed as of the end of the day on the Closing Date (taking into account any applicable extensions) or (ii) a

Tax Return that was filed on or before the end of the day on the Closing Date (taking into account any applicable extensions), in each

case, for which the amount shown as due on such Tax Return was not paid in full, which amount in no case shall be an amount less than

zero. In determining the Income Tax Liability Amount, (a) all unpaid income Tax liabilities with respect to Pre-Closing Tax Periods shall

be calculated in accordance with Section 6.06, (b)

such calculations and determinations shall take into account any income Tax assets, payments of estimated income Taxes or similar amounts

which may be credited against income Taxes otherwise due, in each case in respect of the applicable Company Entity or Truist Partners,

as the case may be (including any Transaction Tax Deductions) solely to the extent (if any) that they would actually reduce as a matter

of applicable Tax law (but not below zero and determined at a “more likely than not” (or higher) standard) the amount of any

income Tax liabilities owed by a Company Entity or Truist Partners, as the case may be, in the same jurisdiction as such income Tax assets

with respect to the relevant Pre-Closing Tax Period, (c) such calculations and determinations shall exclude any income Taxes attributable

to transactions undertaken by the Buyer Entities or any of their Affiliates not contemplated by this Agreement and outside the ordinary

course of business on the Closing Date after the Closing, (d) such calculations and determinations shall exclude deferred Tax assets and

deferred Tax liabilities established for GAAP purposes to reflect timing differences between book and Tax income, (e) accrued and unpaid

income Taxes will include for these purposes (x) any income Tax imposed on, or otherwise payable by, any Company Entity treated as a Tax-transparent

entity for U.S. federal, state, local or non-U.S. income Tax purposes and (y) any other obligations of such a Company Entity to pay income

Taxes of such Company Entity’s direct or indirect owners (other than such direct or indirect owners that are Company Entities included

in this definition of Income Tax

Liability Amount) on a composite state or local Tax

Return as a result of an election by such Company Entity and for which Company Entity has not received, and is not entitled to receive,

reimbursement (directly or indirectly) by a Person that is not another Company Entity, (f) accrued and unpaid income Taxes will include

for these purposes the Pre-Closing CFC Amount and (g) any liabilities for accruals or reserves established or required to be established

under GAAP methodologies that require the accrual for contingent income Taxes or with respect to uncertain Tax positions shall be excluded.

Notwithstanding anything to the contrary contained herein, (i) the calculation of Income Tax Liability Amount shall be determined as of

11:59 p.m. (New York time) on the Closing Date, and (ii) any Taxes imposed pursuant to Sections 6221 through 6241 of the Code, as amended

by the U.S. Bipartisan Budget Act of 2015 (together with any binding administrative guidance issued thereunder or successor provisions

and any similar provision of state or local tax laws) shall not be treated as imposed on, or otherwise payable by, a Company Entity for

purposes of this definition.

“Indemnified Taxes” means: (A)

any Taxes of Truist, Truist Holdings, any of their respective Affiliates (other than the Company Entities or Truist Partners) and/or any

other Person which are required to be paid by any of the Company Entities or Truist Partners by reason of any such Person having been

a member of any consolidated, combined or unitary Tax group that includes Truist or any of its Affiliates (other than such a group consisting

solely of the Company Entities and Truist Partners) on or prior to the Closing Date, including pursuant to Treasury Regulations §

1.1502-6 (or any similar provision of state, local, or non-U.S. Tax Law) ; (B) any and all Taxes of any Person (other than the Company

Entities or Truist Partners) imposed on any Company Entity or Truist Partners for any period as a transferee or successor in respect of

a transaction occurring on or before the Prior Purchase Agreement Closing Date, by Law, contract, or otherwise; (C) any payments in respect

of Taxes required to be made after the Prior Purchase Agreement Closing Date pursuant to any Tax sharing, Tax indemnification, or Tax

allocation agreement or similar contract or arrangement to which any Company Entity or Truist Partners was obligated, or was a party,

on or prior to the Prior Purchase Agreement Closing Date (other than the Prior Purchase Agreement, the A&R LLC Agreement, any agreements

entered into solely by and among the Company Entities, Truist Partners and/or the Buyer Entities, any customary commercial contract entered

into in the ordinary course of business, or any other agreement the principal subject of which is not Taxes); (D) 80% of any and all Taxes

of any Person (other than the Company Entities or Truist Partners) imposed on any Company Entity (or, with respect to Truist Partners,

100%) for any period as a transferee or successor in respect of a transaction occurring after the Prior Purchase Agreement Closing Date

and on or before the Closing Date, by Law, contract, or otherwise; and (E) 80% (or, with respect to Truist Partners, 100%) of any payments

in respect of Taxes required to be made after the Closing Date pursuant to any Tax sharing, Tax indemnification, or Tax allocation agreement

or similar contract or arrangement to which any Company Entity or Truist Partners was obligated, or was a party, on or prior to Closing

Date (except to the extent such Company Entity or Truist Partners was obligated, or was a party, to such contract or arrangement on or

prior to the Prior Purchase Agreement Closing Date, and other than the Prior Purchase Agreement, the A&R LLC Agreement, any agreements

entered into solely by and among the Company Entities, Truist Partners and/or the Buyer Entities, any customary commercial contract entered

into in the ordinary course of business, or any other agreement the principal subject of which is not Taxes).

“Intellectual Property Right”

means any Trademark, mask work, invention, patent, trade secret, copyright, know-how, methods and processes (including any registrations

or applications for registration of any of the foregoing and all goodwill associated therewith) or any other worldwide intellectual property

right.

“Investment Advisory Agreement”

means an investment advisory agreement entered into by any Company Entity with a Client for the purpose of providing Investment Advisory

or Supervisory Services to such Client.

“Investment Advisory Client”

means a client that is party to any investment advisory, sub-advisory, investment management, consulting, administrative, trust, plan-related

or other similar agreement or arrangement with a Company Entity.

“Investor Return Protection Amount”

means the amount by which (i) $2,901,843,157.50 exceeds (ii) the amount that would have been payable at Closing to the Buyer Entities

(or their Permitted Transferees (as defined in the A&R LLC Agreement)) pursuant to Section 4.01 of the A&R LLC Agreement with

respect to the Common Units and Class W Units (as defined in the A&R LLC Agreement) held by the Buyer Entities (or their Permitted

Transferees) as of immediately prior to the Closing if 100% of the equity interests of the Company were sold to an unaffiliated third-party

pursuant to a Drag-Along Sale (assuming for these purposes that such equity interests do not include the Preferred Equity Interests and

that the full Preferred Unit Redemption Amount (as defined in the A&R LLC Agreement) has been satisfied in accordance with the A&R

LLC Agreement prior to such sale, such that no Preferred Equity Interests remain outstanding immediately prior to such sale) for an amount

in cash equal to the Equity Value and the proceeds of such sale were payable in accordance with Section 4.01 of the A&R LLC Agreement

and, for the avoidance of doubt, without giving effect to the Sponsor Return Threshold (as defined in the A&R LLC Agreement). The

Investor Return Protection Amount shall in no event be less than zero.

“IRS” means the Internal Revenue

Service.

“knowledge of Buyer”, “Buyer’s

knowledge” or any other similar knowledge qualification in this Agreement means to the actual knowledge, following due inquiry,

of Nicolas Zerbib, Andrew Reutter and Justin Rispler.

“knowledge of the Company”,

“Company’s knowledge” or any other similar knowledge qualification in this Agreement means to the actual knowledge,

following due inquiry, of any of the following individuals: John Howard, Andrea Holder, Tammy Stringer, Dave Obenauer, Todd Wartchow,

Matthew Spriggs and Chris Bradley.

“Leased Real Property” means

all interests in real property leased, licensed, used or occupied, in whole or in part, pursuant to any written or oral agreement with

a third-party, in each case, by the Company Entities.

“Liability” means any direct

or indirect liability, debt, guaranty, claim, loss, damage, cost, expense (including, without duplication, reasonable attorneys’

fees), settlement payment, award, judgment, fine, penalty or obligation, whether accrued, absolute, contingent, matured,

unmatured or otherwise and whether known or unknown,

fixed or unfixed, choate or inchoate, liquidated or unliquidated, secured or unsecured.

“Lien” means, with respect to

any property or asset, any mortgage, lien, pledge, charge, security interest, deed of trust, option, easement or right of way, right of

first refusal, similar adverse ownership claim or encumbrance in respect of such property or asset.

“LTIP Unit” has the meaning

set forth in the Truist Insurance Holdings, LLC LTIP Unit Plan.

“LTIP Unit Amount” means the

aggregate payments that are payable at Closing under the Truist Insurance Holdings, LLC LTIP Unit Plan and the related award agreements

thereunder, including each LTIP Unit that vests in accordance with Section

7.05 of this Agreement.

“Management Holder” means any

Member (as defined in the Management Holdings LLC Agreement or the Management Holdings II LLC Agreement, as applicable) who is a registered

and beneficial owner of MH II Common Units and/or MH Incentive Units prior to giving effect to Section

2.06.

“Management Holder Amount” means

the amount in cash equal to the amount that would have been payable to a Management Holder, if no Management Holder was a Rollover Holder

and the Rollover did not occur, pursuant to Section 4.01 of the Management Holdings LLC Agreement or the Management Holdings II LLC Agreement

with respect to the MH II Common Units and MH Incentive Units held by such Management Holder as of the Closing if 100% of the equity interests

of the Company were sold to an unaffiliated third-party pursuant to a Drag-Along Sale (assuming for these purposes that such equity interests

do not include the Preferred Equity Interests and that the full Preferred Unit Redemption Amount (as defined in the A&R LLC Agreement)

has been satisfied in accordance with the A&R LLC Agreement prior to such sale, such that no Preferred Equity Interests remain outstanding

immediately prior to such sale) for an amount in cash equal to the Equity Value and the proceeds of such sale were payable in accordance

with Section 4.01 of the A&R LLC Agreement and, for the avoidance of doubt, without giving effect to the Sponsor Return Threshold

or the Rollover.

“Management Holdings Escrow Amount”

means $1,500,000.

“Management Holdings LLC Agreement”

means that certain Limited Liability Company Agreement of Management Holdings, dated as of April 3, 2023, as may be amended from time

to time.

“Management Holdings Purchase Price”

means the amount in cash equal to the amount that would have been payable at Closing to Management Holdings pursuant to Section 4.01 of

the A&R LLC Agreement with respect to the Incentive Units held by Management Holdings as of immediately prior to the Closing if 100%

of the equity interests of the Company were sold to an unaffiliated third-party pursuant to a Drag-Along Sale (assuming for these purposes

that such equity interests do not include the Preferred Equity Interests and that the full Preferred Unit Redemption Amount (as defined

in the A&R LLC Agreement) has been satisfied in accordance with the A&R LLC Agreement prior to such sale, such that no Preferred

Equity Interests remain

outstanding immediately prior to such sale) for an

amount in cash equal to the Equity Value and the proceeds of such sale were payable in accordance with Section 4.01 of the A&R LLC

Agreement and, for the avoidance of doubt, without giving effect to the Sponsor Return Threshold or the Rollover.

“Management Holdings II Escrow Amount”

means $4,500,000.

“Management Holdings II LLC Agreement”

means that certain Limited Liability Company Agreement of Management Holdings II, dated as of April 3, 2023, as may be amended from time

to time.

“Management Holdings II Purchase Price”

means the amount in cash equal to the amount that would have been payable at Closing to Management Holdings II pursuant to Section 4.01

of the A&R LLC Agreement with respect to the Common Units held by Management Holdings II as of immediately prior to the Closing if

100% of the equity interests of the Company were sold to an unaffiliated third-party pursuant to a Drag-Along Sale (assuming for these

purposes that such equity interests do not include the Preferred Equity Interests and that the full Preferred Unit Redemption Amount (as

defined in the A&R LLC Agreement) has been satisfied in accordance with the A&R LLC Agreement prior to such sale, such that no

Preferred Equity Interests remain outstanding immediately prior to such sale) for an amount in cash equal to the Equity Value and the

proceeds of such sale were payable in accordance with Section 4.01 of the A&R LLC Agreement and, for the avoidance of doubt, without

giving effect to the Sponsor Return Threshold or the Rollover.

“Marketing Period” means the

first period of 12 consecutive Business Days commencing on or after the date of this Agreement (i) on the date of which the Buyer Entities

have received the Required Information, (ii) throughout which period such Required Information is Compliant (it being understood and agreed

that if the Required Information is not Compliant at any time during such period of 12 consecutive Business Days, the Marketing Period

shall terminate and “restart” when such Required Information is Compliant and the other conditions of this definition are

satisfied) and (iii) throughout which period all of the conditions set forth in Sections 8.01 and 8.02 have been satisfied

or waived (other than those conditions that by their terms are to be satisfied at the Closing, but subject to the satisfaction or waiver

in writing of such conditions at the Closing, and other than as a result of one or more of the circumstances set forth on Section

9.03(a)(i) of the Company Disclosure Schedule) and nothing has occurred and no condition exists that would cause any of the conditions

set forth in Sections 8.01 and 8.02 to fail to be satisfied assuming the Closing were to be scheduled for any time during

such 12 consecutive Business Day period, and other than as a result of one or more of the circumstances set forth on Section

9.03(a)(i) of the Company Disclosure Schedule); provided that (1) May 27, 2024, June 19, 2024, July 4, 2024 and July 5, 2024

each shall not constitute a Business Day for purposes of the Marketing Period and (2) the Marketing Period shall either end on or prior

to August 16, 2024 or, if the Marketing Period has not ended on or prior to August 16, 2024, then the Marketing Period shall commence

no earlier than September 5, 2024; provided further that the Marketing Period shall end on any earlier date that is the date on