Technitrol Announces Credit Amendment and 1H09 Outlook, Explores Options to Significantly Reduce Debt

February 23 2009 - 8:21AM

Business Wire

Technitrol, Inc. (NYSE:TNL) announced that it has amended its

credit facilities to provide significant additional operating

flexibility to navigate through the current uncertain economic

environment. The amendments took effect February 20, 2009 and will

extend through the maturity of the facility in 2013.

Technitrol also provided its current internally generated

revenue and operating profit outlooks for the first half of 2009,

based on current industry analyses, customer activity and other

anecdotal evidence. In the first quarter, the company currently

expects revenues to be between $180 million and $185 million, and

EBITDA, excluding severance and asset-impairment expenses, to be

approximately $10 million to $12 million. In the second quarter of

2009, Technitrol expects revenues to be between $185 million and

$190 million. EBITDA before special items is expected to grow

sequentially to $16 million to $18 million due to a full quarter of

reduced costs resulting from fourth-quarter actions, plus early

benefits from additional reduction activities in the first quarter

of 2009. Technitrol believes that the overall demand environment

will be at its worst in the first half of 2009 and begin to improve

modestly and slowly in the second half. Assuming sales throughout

the year approximate first-half levels, Technitrol expects to

produce sequential EBITDA improvement in each quarter as savings

from cost-reduction activities increase.

The principal changes to the terms of the credit facility are as

follows:

- an increase in the maximum debt

from 3.25 times EBITDA to 4.5 times, decreasing to 3.0 times by

December 2010. Based on the above outlook, the company believes

that its debt-to-EBITDA ratio will remain well below the new

limit;

- an increase in the EBITDA

coverage of fixed charges (mandatory principal, cash interest and

tax payments) from 1.5 times under the original agreement to 2.0

times (through the end of the second quarter of 2009), decreasing

to 1.25 times by March 2011;

- a return to the bank group of

$125 million in unused borrowing capacity, reducing the facility

from $500 million to $375 million (comprising the existing $200

million term loan and $175 million in revolving credit). Technitrol

had drawn approximately $136 million of revolving credit as of

December 26, 2008 and believes that the $175 million limit is more

than sufficient to meet future needs;

- a pledge of a group of selected

assets, which may be eliminated at the company�s option when debt

decreases to less than 2.5 times EBITDA; and

- increases in the interest rate

from a previous maximum of floating LIBOR plus 150 basis points to

a maximum of LIBOR plus 325 basis points with no minimum LIBOR

provision. At current LIBOR rates, the company�s borrowing rate

remains less than 5% per annum.

For these amendments, Technitrol has paid up-front costs

amounting to approximately $2.7 million. The company is very

pleased with the amended terms, particularly the continuing ability

to borrow at relatively low rates of interest. Coupled with

previously announced reductions in annual expenses and costs by

almost $30 million, this credit pricing will allow the company to

continue to aggressively repay debt and emerge from the recession

in a strong competitive position. The company is also pleased that

the amendment process and terms demonstrate the cooperation of its

bank syndicate in these difficult times. The agent for the banks in

the credit facility is JPMorgan.

For the foreseeable future, Technitrol intends to continue

conserving cash in a variety of ways and to apply cash savings

toward repayment of debt. Consistent with the company�s ongoing

desire to reduce leverage (which has had an irrational negative

effect on its equity value), Technitrol also has decided to explore

monetization alternatives with respect to its Electrical Contact

Products Group (AMI Doduco) in whole or in part and has retained

Morgan Stanley & Co. as its financial advisor to assist in this

matter. For the fiscal year ended December 26, 2008, AMI Doduco

generated EBITDA, excluding severance and asset-impairment expenses

but unadjusted for other non-recurring items, of $22.8 million. In

addition, AMI Doduco continues to provide the company with positive

cash flows. This process is in an early exploratory stage as there

is no requirement or immediate need to commence or complete any

transaction or series of transactions. While this process is

pending, AMI Doduco will operate normally in all aspects, with no

change in customer and vendor support, capital expenditures or new

product development efforts, all remaining consistent with usual

practice.

Meanwhile, Technitrol continues to actively market its

microelectromechanical systems (MEMS) business, which it expects to

divest by the middle of 2009.

Based in Philadelphia, Technitrol is a worldwide producer of

electronic components, electrical contacts and assemblies and other

precision-engineered parts and materials for manufacturers in the

wireless and wireline communications, hearing, medical,

military/aerospace, automotive and electrical equipment industries.

For more information, visit Technitrol�s Web site at

http://www.technitrol.com.

Cautionary Note: This message contains "forward looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Actual results may differ materially. This

release should be read in conjunction with the factors set forth in

Technitrol's report on Form 10-Q for the quarter ended September

26, 2008, in Item 1a under the caption "Factors that May Affect

Our Future Results (Cautionary Statements for Purposes of the 'Safe

Harbor' Provisions of the Private Securities Litigation Reform Act

of 1995)."

Copyright � 2009 Technitrol, Inc. All rights reserved. All brand

names and trademarks are properties of their respective

holders.

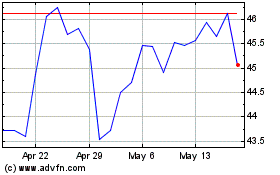

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Jun 2024 to Jul 2024

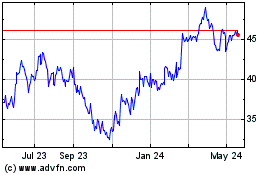

Travel plus Leisure (NYSE:TNL)

Historical Stock Chart

From Jul 2023 to Jul 2024