Mutual Fund Summary Prospectus (497k)

February 28 2014 - 3:16PM

Edgar (US Regulatory)

Summary Prospectus

Russell Global

Opportunistic Credit Fund

March 1, 2014

Before you invest, you may

want to review the Fund's Prospectus, which contains more information about the Fund and its risks. You can find the Fund's Prospectus, Statement of Additional Information (SAI), Annual Report and other information about the Fund online at

http://hosted.rightprospectus.com/Russell/. You can also get this information at no cost by calling 1-800-290-2604 or by sending an e-mail to: RussellProspectuses@RRD.com. For other information please call 1-800-787-7354. The Fund's Prospectus and

SAI, both dated March 1, 2014, and the Fund's most recent shareholder report, for the period ended October 31, 2013, are all incorporated by reference into this Summary Prospectus.

|

Share

Class:

|

Class

A

|

|

Class

C

|

|

Class

E

|

|

Class

S

|

|

Class

Y

|

|

Ticker:

|

RGCAX

|

|

RGCCX

|

|

RCCEX

|

|

RGCSX

|

|

RGCYX

|

Investment Objective

(Non-Fundamental)

The Fund seeks to provide total

return.

Fees and Expenses of the Fund

The following tables describe the

fees and expenses that you may pay if you buy and hold Shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Russell Funds. More information about these

and other discounts is available from your financial professional and in the Front-End Sales Charges section and the More About Deferred Sales Charges section beginning on pages 220 and 222, respectively, of the Prospectus, and the Purchase,

Exchange and Redemption of Fund Shares section, beginning on page 27 of the Fund’s Statement of Additional Information. Please see the Expense Notes section of the Fund's Prospectus for further information regarding expenses of the Fund.

Shareholder Fees (fees paid directly from your

investment)

|

|

Class

A

|

|

Class

C, E, S, Y

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

3.75%

|

|

None

|

|

Maximum Deferred Sales Charge (Load)*

|

1.00%

|

|

None

|

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends

|

None

|

|

None

|

|

*

|

The Maximum

Deferred Sales Charge (Load) is charged on the lesser of the purchase price of the Shares being redeemed or the net asset value of those Shares at the time of redemption.

|

Annual Fund Operating Expenses (expenses that you pay

each year as a percentage of the value of your investment)#

|

|

Class

A

Shares

|

|

Class

C

Shares

|

|

Class

E

Shares

|

|

Class

S

Shares

|

|

Class

Y

Shares

|

|

Advisory Fee

|

1.00%

|

|

1.00%

|

|

1.00%

|

|

1.00%

|

|

1.00%

|

|

Distribution (12b-1) Fees

|

0.25%

|

|

0.75%

|

|

None

|

|

None

|

|

None

|

|

Other Expenses

|

0.35%

|

|

0.60%

|

|

0.60%

|

|

0.35%

|

|

0.15%

|

|

Total Annual Fund Operating Expenses

|

1.60%

|

|

2.35%

|

|

1.60%

|

|

1.35%

|

|

1.15%

|

|

Less Fee Waivers and Expense

Reimbursements

|

(0.40)%

|

|

(0.40)%

|

|

(0.40)%

|

|

(0.40)%

|

|

(0.28)%

|

|

Net Annual Fund Operating Expenses

|

1.20%

|

|

1.95%

|

|

1.20%

|

|

0.95%

|

|

0.87%

|

(See footnotes on next

page)

|

#

|

Until February 28,

2015, Russell Investment Management Company (“RIMCo”) has contractually agreed to waive 0.28% of its 1.00% advisory fee. This waiver may not be terminated during the relevant period except with Board approval.

|

|

|

Until February 28,

2015, Russell Fund Services Company (“RFSC”) has contractually agreed to waive 0.12% of its transfer agency fees for Class A, C, E and S Shares. This waiver may not be terminated during the relevant period except with Board approval.

|

|

|

“Other

Expenses,” “Total Annual Fund Operating Expenses” and “Net Annual Fund Operating Expenses” have been restated to reflect the Fund's proportionate share of the operating expenses of any other fund in which the Fund

invests, including the Russell U.S. Cash Management Fund.

|

|

|

“Less Fee

Waivers and Expense Reimbursements” and “Net Annual Fund Operating Expenses” have been restated to remove the effect of non-contractual waivers that were in effect for the fiscal period ended October 31, 2013.

|

Example

This example is intended to help

you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you

invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes your investment has a 5% return each year and that operating expenses remain the same. The calculation

of costs for the one year period takes into account the effect of any current contractual fee waivers and/or reimbursements. The calculation of costs for the remaining periods takes such fee waivers and/or reimbursements into account only for

the first year of the periods.

Although your actual costs may

be higher or lower, under these assumptions your costs would be:

|

|

Class

A

Shares

|

|

Class

C

Shares

|

|

Class

E

Shares

|

|

Class

S

Shares

|

|

Class

Y

Shares

|

|

1 Year

|

$

493

|

|

$

198

|

|

$

122

|

|

$

97

|

|

$

89

|

|

3 Years

|

$

823

|

|

$

695

|

|

$

466

|

|

$

388

|

|

$

338

|

|

5 Years

|

$1,177

|

|

$1,219

|

|

$

833

|

|

$

701

|

|

$

606

|

|

10 Years

|

$2,171

|

|

$2,656

|

|

$1,866

|

|

$1,589

|

|

$1,373

|

Portfolio Turnover

The Fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable

account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 85% of the average value of its

portfolio.

Investments, Risks and

Performance

Principal Investment Strategies of the Fund

The Fund has a non-fundamental

policy to invest, under normal circumstances, at least 80% of the value of its net assets plus borrowings for investment purposes in bonds. The Fund employs a multi-manager approach whereby portions of the Fund are allocated to different money

managers. Fund assets not allocated to money managers are managed by Russell Investment Management Company (“RIMCo”). Assets not allocated to money managers include the Fund's liquidity reserves and assets which may be managed directly

by RIMCo to effect the Fund's investment strategies and/or to modify the Fund's overall portfolio characteristics by investing in securities or other instruments that RIMCo believes will achieve the desired risk/return profile for the Fund. The

Fund invests in various tactical global bond opportunities including high yield debt securities, emerging markets debt securities (including Brady Bonds), U.S. and non-U.S. corporate debt securities, Yankee Bonds (dollar denominated obligations

issued in the U.S. by non-U.S. banks and corporations), fixed income securities issued or guaranteed by the U.S. government (including Treasury Inflation Protected Securities and zero coupon securities) or by non-U.S. governments, or by any U.S.

government or non-U.S. government agency or instrumentality (including emerging markets sovereign debt) and investment grade securities. The Fund may invest in debt securities that are rated below investment grade (commonly referred to as

“high yield” or “junk bonds”). The Fund may invest without limitation in securities denominated in foreign currencies, in U.S. dollar-denominated securities of foreign issuers and in developed and emerging markets debt

securities. The Fund may invest in currency futures and options on futures, forward currency contracts, currency swaps and currency options for speculative purposes or to seek to protect its investments against adverse currency exchange rate

changes. The Fund invests in certain types of derivative instruments, including synthetic foreign fixed income securities. The Fund’s use of derivatives may cause the Fund’s investment returns to be impacted by the performance of

securities the Fund does not own and result in the Fund’s

total investment exposure exceeding the value of its portfolio. The

Fund usually, but not always, pursues a strategy to be fully invested by exposing all or a portion of its cash to the performance of appropriate markets or sectors by purchasing fixed income securities and/or derivatives, which typically

include total return swaps, index credit default swaps and to be announced (“TBA”) securities. The Fund also purchases loans and other direct indebtedness, including bank loans (also called “leveraged loans”). The Fund may

enter into repurchase agreements. The Fund may invest in commercial paper, including asset-backed commercial paper. A portion of the Fund’s net assets may be “illiquid” securities. The Fund may invest in variable and floating rate

securities. Please refer to the “Investment Objective and Investment Strategies” section in the Fund's Prospectus for further information.

Principal Risks of Investing in the Fund

An investment in the Fund, like

any investment, has risks. The value of the Fund fluctuates and you could lose money. The principal risks of investing in the Fund are those associated with:

|

•

|

Active Management

. Despite strategies designed to achieve the Fund’s investment objective, the value of investments will change with market conditions, and so will the value of any investment in the Fund and you could lose money.

The securities selected for the portfolio may not perform as RIMCo or the Fund's money managers expect. Additionally, securities selected may cause a Fund to underperform relative to other funds with similar investment objectives and strategies.

There is no guarantee that RIMCo will effectively assess a Fund's portfolio characteristics and it is possible that its judgments regarding a Fund's risk/return profile may prove incorrect. In addition, actions taken to modify overall portfolio

characteristics, including risk, may be ineffective and/or cause the Fund to underperform.

|

|

•

|

Multi-Manager

Approach.

While the investment styles employed by the money managers are intended to be complementary, they may not in fact be complementary. A multi-manager approach could result in more exposure to certain types of

securities and higher portfolio turnover.

|

|

•

|

Fixed Income

Securities

. Prices of fixed income securities generally rise and fall in response to, among other things, interest rate changes. Volatility in interest rates and in fixed income markets may increase the risk that the

Fund’s investments in fixed income securities could lose money. In addition, the Fund could lose money if the issuer or guarantor of a fixed income security or other issuer of credit support is unable or unwilling to make timely principal

and/or interest payments, or to otherwise honor its obligations. Fixed income securities may be downgraded in credit rating or go into default.

|

|

•

|

Non-Investment

Grade Debt Securities (“High Yield” or “Junk Bonds”)

. Non-investment grade debt securities involve higher volatility and higher risk of default than investment grade bonds.

|

|

•

|

U.S. and Non-U.S.

Corporate Debt Securities Risk

. Investments in U.S. and non-U.S. corporate debt securities are subject to interest rate risk and market risk, and are affected by perceptions of the creditworthiness and business

prospects of individual issuers. Non-U.S. corporate debt securities may expose the Fund to greater risk than investments in U.S. corporate debt securities.

|

|

•

|

Government Issued

or Guaranteed Securities, U.S. Government Securities

. Bonds issued or guaranteed by a government are subject to inflation risk, price depreciation risk and default risk.

|

|

•

|

Money Market

Securities (Including Commercial Paper)

. Prices of money market securities generally rise and fall in response to interest rate changes.

|

|

•

|

Asset-Backed

Commercial Paper

. Investment in asset-backed commercial paper is subject to the risk that insufficient proceeds from the projected cash flows of the contributed receivables are available to repay the commercial

paper.

|

|

•

|

Variable and

Floating Rate Securities Risk.

Variable and floating rate securities generally are less sensitive to interest rate changes but may decline in value if their interest rates do not rise as much, or as quickly, as

interest rates in general.

|

|

•

|

Mortgage-Backed

Securities

. Mortgage-backed securities may be affected by, among other things, changes or perceived changes in interest rates, factors concerning the interests in and structure of the issuer or the originator of the

mortgage, or the quality of the underlying assets. The underlying assets may default or decline in quality or value.

|

|

•

|

Asset-Backed

Securities

. Payment of principal and interest on asset-backed securities may be largely dependent upon the cash flows generated by the assets backing the securities and asset-backed securities may not have the

benefit of any security interest in the related assets.

|

|

•

|

Loans and Other

Direct Indebtedness.

Loans and other direct indebtedness involve the risk that payment of principal, interest and other amounts due in connection with these investments may not be received. The highly leveraged

nature of many such loans, including bank loans, and other direct indebtedness may make such loans and other direct indebtedness especially vulnerable to adverse changes in economic or market conditions and/or changes in the financial condition of

the debtor. Investments in bank loans are typically subject to the risks of floating rate securities.

|

|

•

|

Repurchase

Agreements

. Repurchase agreements are subject to the risk that the sellers may not be able to pay the agreed-upon repurchase price on the repurchase date.

|

|

•

|

Non-U.S. and

Emerging Markets Securities.

Non-U.S. securities have risks relating to political, economic and regulatory conditions in foreign countries. The risks associated with non-U.S. securities may

be amplified for emerging markets securities.

|

|

•

|

Currency Risk

. Non-U.S. securities that trade in, and receive revenues in, non-U.S. currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that

the U.S. dollar will decline in value relative to the currency being hedged. As a result, investments in non-U.S. dollar-denominated securities and currencies may reduce the returns of the Fund.

|

|

•

|

Yankee Bonds and

Yankee CDs

. Issuers of Yankee Bonds and Yankee CDs are not necessarily subject to the same regulatory requirements that apply to U.S. corporations and banks.

|

|

•

|

Synthetic Foreign

Equity/Fixed Income Securities

. Investments in these instruments involve the risk that the issuer of the instrument may default on its obligation to deliver the underlying security or its value. These instruments may

also be subject to liquidity risk, foreign risk and currency risk. In addition, the exercise or settlement date may be affected by certain market disruption events which could cause the local access products to become worthless if the events

continue for a period of time.

|

|

•

|

Derivatives

. Investments in a derivative instrument could lose more than the principal amount invested. Compared to conventional securities, derivatives can be more sensitive to changes in interest rates or to sudden fluctuations in

market prices and thus the Fund’s losses may be greater if it invests in derivatives than if it invests only in conventional securities. The use of derivative instruments involves risks different from, or possibly greater than, the risks

associated with investing directly in equity or fixed income securities, currencies or other investments. Derivatives are subject to a number of risks such as liquidity risk, market risk, credit risk, default risk, counterparty risk (the risk that

the other party in an agreement will fail to perform its obligations) and management risk. They also involve the risk of mispricing or improper valuation and the risk that changes in the value of the derivative may not correlate exactly with the

change in the value of the underlying asset, rate or index.

|

|

•

|

Credit Default

Swaps

. Credit default swap agreements may involve greater risks than if the Fund had invested in the reference obligation directly since, in addition to risks relating to the reference obligation, credit default

swaps are subject to illiquidity risk and counterparty risk.

|

|

•

|

Currency Trading

Risk.

Currency trading strategies may involve instruments that have volatile prices, are illiquid or create economic leverage. Forward currency contracts are subject to the risk that should forward prices increase, a

loss will be incurred to the extent that the price of the currency agreed to be purchased exceeds the price of the currency agreed to be sold.

|

|

•

|

Leveraging Risk

. As a result of the Fund's use of derivatives, the Fund may be subject to leveraging risk. Leverage tends to exaggerate the effect of any increase or decrease in the value of a security, which exposes the Fund to a

heightened risk of loss.

|

|

•

|

Counterparty Risk.

Counterparty risk is the risk that the other party or parties to an agreement or a participant to a transaction, such as a broker, might default on a contract or fail to perform by failing to pay amounts due or failing

to fulfill the obligations of the contract or transaction.

|

|

•

|

Illiquid

Securities

. An illiquid security may be difficult to sell quickly and at a fair price, which could cause the Fund to realize a loss on the security if it was sold at a lower price than that at which it had been

valued.

|

|

•

|

Liquidity Risk

. The market for certain investments may become illiquid under adverse or volatile market or economic conditions, making those investments difficult to sell. The market price of certain investments may fall dramatically

if there is no liquid trading market.

|

|

•

|

Large Redemptions

. The Fund is used as an investment by certain funds of funds and in asset allocation programs and may have a large percentage of its Shares owned by such funds or held in such programs. Large redemption activity could

result in the Fund incurring additional costs and being forced to sell portfolio securities at a loss to meet redemptions.

|

|

•

|

Global Financial

Markets Risk.

Global economies and financial markets are becoming increasingly interconnected and conditions (including recent volatility and instability) and events (including natural disasters) in one country,

region or financial market may adversely impact issuers in a different country, region or financial market. In addition, governmental and quasi-governmental organizations have taken a number of unprecedented actions designed to support the markets.

Such events and conditions may adversely affect the value of the Fund’s securities, result in greater market or liquidity risk or cause difficulty valuing the Fund’s portfolio instruments or achieving the Fund’s objective.

|

Please refer to the

“Risks” section in the Fund’s Prospectus for further information.

An investment in the Fund is not a

bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance

The following bar chart

illustrates the risks of investing in the Fund by showing how the performance of the Fund’s Class S Shares varies from year to year over a 10-year period (or if the Fund has not been in operation for 10 years, since the beginning of the

Fund’s operations). The returns (both before and after tax) for other Classes of Shares offered by this Prospectus may be lower than the returns shown in the bar chart, depending upon the fees and expenses of those Classes. The highest and

lowest returns for a full quarter during the periods shown in the bar chart are set forth next to the bar chart.

The table accompanying the bar

chart further illustrates the risks of investing in the Fund by showing how the Fund’s average annual returns for the periods shown compare with the returns of one or more indexes that measure broad market performance. The Global Opportunistic

Credit Blended Benchmark is a composite index consisting of 60% Bank of America Merrill Lynch Global High Yield Index (USD hedged) and 40% JP Morgan EMBI Global Diversified Index. The Global Opportunistic Credit Blended Benchmark provides a

means to compare the Fund's average annual returns to a secondary benchmark that is more representative of the investment strategies pursued by the Fund. After-tax returns are shown only for one class. The after-tax returns for other classes will

vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may

differ from those shown. After-tax returns are not relevant to investors who hold their Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns reflect foreign tax credits passed by the

Fund to its shareholders thereby increasing total returns after taxes on distributions and total returns after taxes on distributions and sale of Fund Shares. If the Fund has realized capital losses, the total return after taxes on distributions and

sale of Fund Shares may be higher than the total return before taxes and the total return after taxes on distributions. For more information, see the Performance Notes section in the Fund’s Prospectus.

Past performance, both before-tax

and after-tax, is no indication of future results. More current performance information is available at www.russell.com.

Class S Calendar Year Total Returns

Average

annual total returns

for the periods ended December 31, 2013

|

|

1

Year

|

|

Since

Inception

|

|

Return Before Taxes, Class

A

|

|

(3.68)%

|

|

4.76%

|

|

Return Before Taxes, Class

C

|

|

(0.62)%

|

|

5.23%

|

|

Return Before Taxes, Class

E

|

|

0.21%

|

|

6.02%

|

|

Return Before Taxes, Class

Y

|

|

0.44%

|

|

6.38%

|

|

Return Before Taxes, Class S

|

|

0.46%

|

|

6.29%

|

|

Return After Taxes on Distributions, Class S

|

|

(1.98)%

|

|

3.86%

|

|

Return After Taxes on Distributions and Sale of Fund Shares, Class S

|

|

0.37%

|

|

3.93%

|

|

Bank of America Merrill Lynch Global High Yield Index (USD hedged) (reflects no deduction for fees, expenses or

taxes)

|

|

7.10%

|

|

9.56%

|

|

Global Opportunistic Credit Blended Benchmark (reflects no deduction for fees, expenses or

taxes)

|

|

2.02%

|

|

7.77%

|

Management

Investment Adviser

The Fund’s investment

adviser is RIMCo. Unlike most investment companies that have a single organization that acts as investment adviser, the Fund divides responsibility for investment advice between RIMCo and a number of money managers unaffiliated with RIMCo. The money

managers for the Fund are:

|

•

DDJ Capital Management, LLC

|

•

Stone Harbor Investment Partners L.P.

|

|

•

Lazard Asset Management LLC

|

•

THL Credit Advisors LLC

|

|

•

Oaktree Capital Management, L.P.

|

|

Portfolio Manager

Keith Brakebill, a Senior

Portfolio Manager, has primary responsibility for the management of the Fund. Mr. Brakebill has managed the Fund since August 2011.

Additional Information

How to Purchase Shares

Unless you are eligible to

participate in a Russell employee investment program, Shares are only available through a select network of Financial Intermediaries. Class E and S Shares of the Fund may only be purchased by specified categories of investors. There is

currently no required minimum initial investment for Class A, Class C, Class E or Class S Shares. For Class Y Shares, there is a $10 million minimum initial investment for each account in each Fund. However, for Class Y Shares there is no

required minimum initial investment for specified categories of investors. Each Fund reserves the right to close any account whose balance falls below $1,000 and to change the categories of investors eligible to purchase its Shares.

For more information about how to

purchase Shares, please see Additional Information about How to Purchase Shares in the Funds' Prospectus.

How to Redeem Shares

Shares may be redeemed through

your Financial Intermediary on any business day of the Funds (a day on which the New York Stock Exchange (“NYSE”) is open for regular trading). Redemption requests are processed at the next net asset value per share calculated after a

Fund receives an order in proper form as determined by your Financial Intermediary. Redemption requests must be received by a Fund or a Fund agent prior to 4:00 p.m. Eastern Time or the close of the NYSE, whichever is earlier, to be processed at the

net asset value calculated on that day. Because Financial Intermediaries and Fund agents may have earlier redemption order cut off times to allow them to deliver redemption orders to the Funds prior to the Funds’ order transmission cut off

time, please ask your Financial Intermediary what the cut off time is. Please contact your Financial Intermediary for instructions on how to place redemption requests.

For more information about how to

redeem Shares, please see Additional Information about How to Redeem Shares in the Funds' Prospectus.

Taxes

In general, distributions

from a Fund are taxable to you as either ordinary income or capital gains.

For more information about these

and other tax matters relating to each Fund and its shareholders, please see Additional Information about Taxes in the Funds' Prospectus.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you

purchase Shares of a Fund through a broker-dealer or other Financial Intermediary (such as a bank), a Fund and its related companies may pay the intermediary for the sale of Fund Shares and related services. These payments may create a conflict of

interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your Financial Intermediary’s Web site for more information.

For more information about

payments to broker-dealers and other Financial Intermediaries please see Distribution and Shareholder Services Arrangements and Payments to Financial Intermediaries in the Funds' Prospectus.

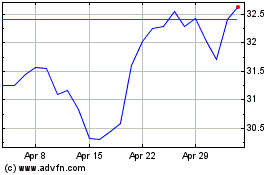

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From May 2024 to Jun 2024

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Jun 2023 to Jun 2024