0000098222

TIDEWATER INC

false

--12-31

Q3

2023

15,448

14,060

0.001

0.001

125,000,000

125,000,000

52,839,862

52,839,862

50,554,179

50,554,179

0.001

0.001

0.01

0.01

0.001

0.001

1.2

8.50

8.50

10.375

10.375

11.2

3

1

5

2.6

10.5

7

1

4

1

10

1

8

As of September 30, 2023 and December 31, 2022, the fair value (Level 2) of the Senior Secured Notes was $185.3 million and $177.3 million, respectively.

Current and long-term liabilities related to certain existing charter contracts accompanying the acquired Solstad Vessels that are below current market rates. These liabilities will be ratably amortized into revenue over the life of the related contracts.

As of September 30, 2023, the fair value (Level 2) of the 10.375% Senior Unsecured Notes due July 2028 was $263.3 million.

The working capital adjustment included $1.3 million for lubricants which are expensed by Tidewater.

The $5.0 million restricted cash on the condensed consolidated balance sheet at September 30, 2023, represents the pro rata amount due for our next semiannual interest payment obligation on the 8.50% Senior Secured Notes.

Consists primarily of tax liabilities existing at the Closing Date that are recorded in other current liabilities and other liabilities.

As of September 30, 2023, the fair value of the Senior Secured Term Loan approximates book value.

00000982222023-01-012023-09-30

0000098222us-gaap:CommonStockMember2023-01-012023-09-30

0000098222us-gaap:WarrantMember2023-01-012023-09-30

xbrli:shares

00000982222023-10-31

iso4217:USD

00000982222023-09-30

00000982222022-12-31

0000098222us-gaap:TradeAccountsReceivableMember2023-09-30

0000098222us-gaap:TradeAccountsReceivableMember2022-12-31

0000098222tdw:SwirePacificOffshoreHoldingsLtdMember2023-09-30

0000098222tdw:SwirePacificOffshoreHoldingsLtdMember2022-12-31

iso4217:USDxbrli:shares

0000098222tdw:VesselMember2023-07-012023-09-30

0000098222tdw:VesselMember2022-07-012022-09-30

0000098222tdw:VesselMember2023-01-012023-09-30

0000098222tdw:VesselMember2022-01-012022-09-30

0000098222us-gaap:ProductAndServiceOtherMember2023-07-012023-09-30

0000098222us-gaap:ProductAndServiceOtherMember2022-07-012022-09-30

0000098222us-gaap:ProductAndServiceOtherMember2023-01-012023-09-30

0000098222us-gaap:ProductAndServiceOtherMember2022-01-012022-09-30

00000982222023-07-012023-09-30

00000982222022-07-012022-09-30

00000982222022-01-012022-09-30

00000982222021-12-31

00000982222022-09-30

0000098222us-gaap:CommonStockMember2023-06-30

0000098222us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000098222us-gaap:RetainedEarningsMember2023-06-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0000098222us-gaap:NoncontrollingInterestMember2023-06-30

00000982222023-06-30

0000098222us-gaap:CommonStockMember2023-07-012023-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0000098222us-gaap:RetainedEarningsMember2023-07-012023-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0000098222us-gaap:NoncontrollingInterestMember2023-07-012023-09-30

0000098222us-gaap:CommonStockMember2023-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2023-09-30

0000098222us-gaap:RetainedEarningsMember2023-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0000098222us-gaap:NoncontrollingInterestMember2023-09-30

0000098222us-gaap:CommonStockMember2022-06-30

0000098222us-gaap:AdditionalPaidInCapitalMember2022-06-30

0000098222us-gaap:RetainedEarningsMember2022-06-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

0000098222us-gaap:NoncontrollingInterestMember2022-06-30

00000982222022-06-30

0000098222us-gaap:CommonStockMember2022-07-012022-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0000098222us-gaap:RetainedEarningsMember2022-07-012022-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30

0000098222us-gaap:NoncontrollingInterestMember2022-07-012022-09-30

0000098222us-gaap:CommonStockMember2022-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2022-09-30

0000098222us-gaap:RetainedEarningsMember2022-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0000098222us-gaap:NoncontrollingInterestMember2022-09-30

0000098222us-gaap:CommonStockMember2022-12-31

0000098222us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000098222us-gaap:RetainedEarningsMember2022-12-31

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0000098222us-gaap:NoncontrollingInterestMember2022-12-31

0000098222us-gaap:CommonStockMember2023-01-012023-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-30

0000098222us-gaap:RetainedEarningsMember2023-01-012023-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-30

0000098222us-gaap:NoncontrollingInterestMember2023-01-012023-09-30

0000098222us-gaap:CommonStockMember2021-12-31

0000098222us-gaap:AdditionalPaidInCapitalMember2021-12-31

0000098222us-gaap:RetainedEarningsMember2021-12-31

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0000098222us-gaap:NoncontrollingInterestMember2021-12-31

0000098222us-gaap:CommonStockMember2022-01-012022-09-30

0000098222us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-30

0000098222us-gaap:RetainedEarningsMember2022-01-012022-09-30

0000098222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-30

0000098222us-gaap:NoncontrollingInterestMember2022-01-012022-09-30

xbrli:pure

0000098222tdw:VesselsFromSolstadOffshoreASAMember2023-07-052023-07-05

0000098222us-gaap:UnsecuredDebtMember2023-09-30

0000098222tdw:VesselsFromSolstadOffshoreASAMember2023-07-05

0000098222tdw:VesselsFromSolstadOffshoreASAMembertdw:LubricantsMember2023-07-052023-07-05

0000098222tdw:SwirePacificOffshoreHoldingsLtdMember2022-04-222022-04-22

0000098222tdw:SwirePacificOffshoreHoldingsLtdMembertdw:WarransIssuedToAcquireSwirePacificOffshoreHoldingsLtdMember2022-04-222022-04-22

0000098222tdw:WarransIssuedToAcquireSwirePacificOffshoreHoldingsLtdMember2022-04-222022-04-22

0000098222tdw:SwirePacificOffshoreHoldingsLtdMember2022-04-22

0000098222tdw:SwirePacificOffshoreHoldingsLtdMember2022-01-012022-09-30

0000098222us-gaap:TradeAccountsReceivableMember2023-01-012023-09-30

0000098222tdw:PreviouslyDueFromAffiliatesMember2023-09-30

0000098222tdw:PreviouslyDueFromAffiliatesMember2022-12-31

0000098222us-gaap:PrepaidExpensesAndOtherCurrentAssetsMembertdw:VesselMember2023-09-30

0000098222us-gaap:OtherAssetsMembertdw:VesselMember2023-09-30

0000098222us-gaap:OtherCurrentLiabilitiesMembertdw:VesselMember2023-09-30

0000098222us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-07-012023-09-30

0000098222us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-07-012022-09-30

0000098222us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-09-30

0000098222us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-09-30

0000098222tdw:NewCreditorWarrantsMember2023-09-30

0000098222tdw:NewCreditorWarrantsMember2022-09-30

0000098222tdw:GulfmarkCreditorWarrantsMember2023-09-30

0000098222tdw:GulfmarkCreditorWarrantsMember2022-09-30

0000098222tdw:SpoAcquisitionWarrantsMember2023-09-30

0000098222tdw:SpoAcquisitionWarrantsMember2022-09-30

0000098222tdw:RestrictedStockUnitsAndStockOptionsMember2023-09-30

0000098222tdw:RestrictedStockUnitsAndStockOptionsMember2022-09-30

0000098222tdw:OutofthemoneyWarrantsMember2023-09-30

0000098222tdw:GlfEquityWarrantsMember2023-09-30

0000098222tdw:SeriesAWarrantsMember2023-09-30

0000098222tdw:SeriesBWarrantsMember2023-09-30

0000098222tdw:SeriesAAndBWarrantsMember2023-07-31

0000098222tdw:SeriesAAndBWarrantsMember2023-07-012023-07-31

0000098222tdw:SpoMember2023-09-30

0000098222us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-03-31

0000098222us-gaap:PensionPlansDefinedBenefitMember2023-04-012023-06-30

0000098222us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-09-30

0000098222us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-01-012023-09-30

0000098222us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-09-30

0000098222us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-12-31

0000098222tdw:PensionPlanAndSupplementalPlanMember2023-07-012023-09-30

0000098222tdw:PensionPlanAndSupplementalPlanMember2022-07-012022-09-30

0000098222tdw:PensionPlanAndSupplementalPlanMember2023-01-012023-09-30

0000098222tdw:PensionPlanAndSupplementalPlanMember2022-01-012022-09-30

0000098222tdw:The800SeniorSecuredNotesDueAugust2022Member2023-09-30

0000098222tdw:The800SeniorSecuredNotesDueAugust2022Member2022-12-31

0000098222tdw:SupplierFacilityAgreementsMember2023-09-30

0000098222tdw:SupplierFacilityAgreementsMember2022-12-31

0000098222us-gaap:SecuredDebtMember2023-09-30

0000098222us-gaap:SecuredDebtMember2022-12-31

0000098222us-gaap:UnsecuredDebtMember2022-12-31

0000098222tdw:NordicBondMember2023-09-30

0000098222tdw:NordicBondMember2022-12-31

iso4217:EUR

0000098222tdw:SupplierFacilityAgreementsMembersrt:MinimumMember2023-09-30

0000098222tdw:SupplierFacilityAgreementsMembersrt:MaximumMember2023-09-30

0000098222us-gaap:SecuredDebtMember2023-07-05

0000098222tdw:TrancheATermLoanMemberus-gaap:SecuredDebtMember2023-07-05

0000098222tdw:TrancheBTermLoanMemberus-gaap:SecuredDebtMember2023-07-05

utr:Y

0000098222tdw:TrancheBTermLoanMemberus-gaap:SecuredDebtMember2023-07-052023-07-05

0000098222tdw:TrancheATermLoanMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-07-052023-07-05

0000098222tdw:TrancheATermLoanMemberus-gaap:SecuredDebtMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-07-052023-07-05

0000098222tdw:TrancheBTermLoanMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-07-052023-07-05

0000098222us-gaap:UnsecuredDebtMember2023-07-03

0000098222us-gaap:UnsecuredDebtMember2023-07-05

0000098222us-gaap:RevolvingCreditFacilityMember2021-11-16

0000098222us-gaap:RevolvingCreditFacilityMember2023-09-30

0000098222tdw:PemexMember2022-06-30

0000098222us-gaap:ForeignCorporateDebtSecuritiesMember2022-06-30

0000098222tdw:PemexMember2023-09-30

00000982222022-01-012022-12-31

0000098222tdw:AlucatCrewBoatsMember2023-01-012023-09-30

0000098222tdw:AlucatCrewBoatsMember2022-01-012022-12-31

0000098222tdw:AlucatCrewBoatsMember2023-01-012023-10-01

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:Americas1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:Americas1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:Americas1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:Americas1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:AsiaPacific1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:AsiaPacific1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:AsiaPacific1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:AsiaPacific1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:MiddleEast1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:MiddleEast1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:MiddleEast1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:MiddleEast1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:EuropeAndMediterraneanMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:EuropeAndMediterraneanMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:EuropeAndMediterraneanMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:EuropeAndMediterraneanMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:WestAfricaMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:WestAfricaMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:WestAfricaMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:VesselMembertdw:WestAfricaMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMember2022-01-012022-09-30

0000098222us-gaap:CorporateNonSegmentMember2023-07-012023-09-30

0000098222us-gaap:CorporateNonSegmentMember2022-07-012022-09-30

0000098222us-gaap:CorporateNonSegmentMember2023-01-012023-09-30

0000098222us-gaap:CorporateNonSegmentMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2023-07-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2022-07-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2023-01-012023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2022-01-012022-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:Americas1Member2022-12-31

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:AsiaPacific1Member2022-12-31

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:MiddleEast1Member2022-12-31

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:EuropeAndMediterraneanMember2022-12-31

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2023-09-30

0000098222us-gaap:OperatingSegmentsMembertdw:WestAfricaMember2022-12-31

0000098222us-gaap:CorporateNonSegmentMember2023-09-30

0000098222us-gaap:CorporateNonSegmentMember2022-12-31

0000098222tdw:VesselsActiveFleetMember2023-09-30

00000982222022-01-012022-03-31

0000098222tdw:VesselsHeldForSaleMember2023-06-30

0000098222tdw:VesselsHeldForSaleMember2022-06-30

0000098222tdw:VesselsHeldForSaleMember2023-07-012023-09-30

0000098222tdw:VesselsHeldForSaleMember2022-07-012022-09-30

0000098222tdw:VesselsHeldForSaleMember2023-09-30

0000098222tdw:VesselsHeldForSaleMember2022-09-30

0000098222tdw:VesselsHeldForSaleMember2022-12-31

0000098222tdw:VesselsHeldForSaleMember2021-12-31

0000098222tdw:VesselsHeldForSaleMember2023-01-012023-09-30

0000098222tdw:VesselsHeldForSaleMember2022-01-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 1-6311

Tidewater Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 72-0487776 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

842 West Sam Houston Parkway North, Suite 400

Houston, Texas 77024

(Address of principal executive offices) (Zip code)

(713) 470-5300

Registrant’s telephone number, including area code

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

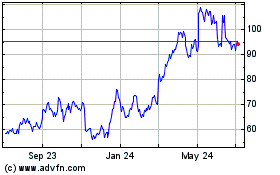

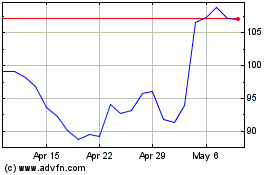

| Common stock, $0.001 par value per share | TDW | New York Stock Exchange |

| Warrants to purchase shares of common stock | TDW.WS | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | | | Accelerated filer ☐ |

| Non-accelerated filer ☐ Emerging Growth Company ☐ | | | Smaller reporting company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

52,841,838 shares of Tidewater Inc. common stock $0.001 par value per share were outstanding on October 31, 2023.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TIDEWATER INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In Thousands, except share and par value data)

| | September 30, 2023 | | | December 31, 2022 | |

| ASSETS | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | $ | 275,070 | | | $ | 164,192 | |

| Restricted cash | | 4,973 | | | | 1,241 | |

| Trade and other receivables, net of allowance for credit losses of $15,448 and $14,060 at September 30, 2023 and December 31, 2022, respectively | | 250,671 | | | | 156,465 | |

| Marine operating supplies | | 27,489 | | | | 30,830 | |

| Assets held for sale | | 565 | | | | 4,195 | |

| Prepaid expenses and other current assets | | 16,598 | | | | 20,985 | |

| Total current assets | | 575,366 | | | | 377,908 | |

| Net properties and equipment | | 1,348,001 | | | | 796,655 | |

| Deferred drydocking and survey costs | | 99,215 | | | | 61,080 | |

| Indemnification assets | | 18,648 | | | | 28,369 | |

| Other assets | | 30,325 | | | | 33,644 | |

| Total assets | $ | 2,071,555 | | | $ | 1,297,656 | |

| | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | $ | 57,183 | | | $ | 38,946 | |

| Accrued expenses | | 119,631 | | | | 105,518 | |

| Current portion of long-term debt | | 102,369 | | | | — | |

| Other current liabilities | | 53,301 | | | | 50,323 | |

| Total current liabilities | | 332,484 | | | | 194,787 | |

| Long-term debt | | 641,301 | | | | 169,036 | |

| Other liabilities | | 66,246 | | | | 67,843 | |

| | | | | | | | |

| Commitments and contingencies | | | | | | | |

| | | | | | | | |

| Equity: | | | | | | | |

| Common stock of $0.001 par value, 125,000,000 shares authorized, 52,839,862 and 50,554,179 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | | 53 | | | | 51 | |

| Additional paid-in capital | | 1,668,392 | | | | 1,556,990 | |

| Accumulated deficit | | (640,128 | ) | | | (699,649 | ) |

| Accumulated other comprehensive income | | 4,413 | | | | 8,576 | |

| Total stockholders’ equity | | 1,032,730 | | | | 865,968 | |

| Noncontrolling interests | | (1,206 | ) | | | 22 | |

| Total equity | | 1,031,524 | | | | 865,990 | |

| Total liabilities and equity | $ | 2,071,555 | | | $ | 1,297,656 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

TIDEWATER INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In Thousands, except per share data)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vessel revenues |

|

$ |

296,975 |

|

|

$ |

190,247 |

|

|

$ |

698,478 |

|

|

$ |

456,298 |

|

| Other operating revenues |

|

|

2,287 |

|

|

|

1,515 |

|

|

|

8,849 |

|

|

|

4,640 |

|

| Total revenue |

|

|

299,262 |

|

|

|

191,762 |

|

|

|

707,327 |

|

|

|

460,938 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vessel operating costs |

|

|

164,239 |

|

|

|

113,037 |

|

|

|

397,962 |

|

|

|

281,805 |

|

| Costs of other operating revenues |

|

|

1,481 |

|

|

|

592 |

|

|

|

3,005 |

|

|

|

1,436 |

|

| General and administrative |

|

|

21,001 |

|

|

|

27,267 |

|

|

|

70,559 |

|

|

|

73,288 |

|

| Depreciation and amortization |

|

|

57,730 |

|

|

|

30,856 |

|

|

|

121,164 |

|

|

|

89,279 |

|

| Long-lived asset impairment and other |

|

|

— |

|

|

|

1,214 |

|

|

|

— |

|

|

|

714 |

|

| (Gain) loss on asset dispositions, net |

|

|

(863 |

) |

|

|

(264 |

) |

|

|

(4,483 |

) |

|

|

826 |

|

| Total costs and expenses |

|

|

243,588 |

|

|

|

172,702 |

|

|

|

588,207 |

|

|

|

447,348 |

|

| Operating income |

|

|

55,674 |

|

|

|

19,060 |

|

|

|

119,120 |

|

|

|

13,590 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange loss |

|

|

(2,149 |

) |

|

|

(3,997 |

) |

|

|

(3,620 |

) |

|

|

(4,932 |

) |

| Equity in net earnings (losses) of unconsolidated companies |

|

|

4 |

|

|

|

9 |

|

|

|

29 |

|

|

|

(235 |

) |

| Interest income and other, net |

|

|

568 |

|

|

|

581 |

|

|

|

3,488 |

|

|

|

4,416 |

|

| Loss on warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,175 |

) |

| Interest and other debt costs, net |

|

|

(19,288 |

) |

|

|

(4,391 |

) |

|

|

(28,209 |

) |

|

|

(12,850 |

) |

| Total other expense |

|

|

(20,865 |

) |

|

|

(7,798 |

) |

|

|

(28,312 |

) |

|

|

(27,776 |

) |

| Income (loss) before income taxes |

|

|

34,809 |

|

|

|

11,262 |

|

|

|

90,808 |

|

|

|

(14,186 |

) |

| Income tax expense |

|

|

9,260 |

|

|

|

6,352 |

|

|

|

32,515 |

|

|

|

18,189 |

|

| Net income (loss) |

|

|

25,549 |

|

|

|

4,910 |

|

|

|

58,293 |

|

|

|

(32,375 |

) |

| Net loss attributable to noncontrolling interests |

|

|

(650 |

) |

|

|

(470 |

) |

|

|

(1,228 |

) |

|

|

(6 |

) |

| Net income (loss) attributable to Tidewater Inc. |

|

$ |

26,199 |

|

|

$ |

5,380 |

|

|

$ |

59,521 |

|

|

$ |

(32,369 |

) |

| Basic income (loss) per common share |

|

$ |

0.50 |

|

|

$ |

0.12 |

|

|

$ |

1.16 |

|

|

$ |

(0.76 |

) |

| Diluted income (loss) per common share |

|

$ |

0.49 |

|

|

$ |

0.10 |

|

|

$ |

1.13 |

|

|

$ |

(0.76 |

) |

| Weighted average common shares outstanding |

|

|

52,230 |

|

|

|

44,451 |

|

|

|

51,235 |

|

|

|

42,570 |

|

| Dilutive effect of warrants, restricted stock units and stock options |

|

|

1,380 |

|

|

|

7,069 |

|

|

|

1,322 |

|

|

|

— |

|

| Adjusted weighted average common shares |

|

|

53,610 |

|

|

|

51,520 |

|

|

|

52,557 |

|

|

|

42,570 |

|

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

TIDEWATER INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(In Thousands)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

| Net income (loss) |

|

$ |

25,549 |

|

|

$ |

4,910 |

|

|

$ |

58,293 |

|

|

$ |

(32,375 |

) |

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized loss on note receivable |

|

|

(153 |

) |

|

|

(429 |

) |

|

|

(469 |

) |

|

|

(1,275 |

) |

| Change in liability of pension plans |

|

|

— |

|

|

|

140 |

|

|

|

(3,694 |

) |

|

|

81 |

|

| Total comprehensive income (loss) |

|

$ |

25,396 |

|

|

$ |

4,621 |

|

|

$ |

54,130 |

|

|

$ |

(33,569 |

) |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

TIDEWATER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In Thousands)

| | | Nine Months | | | Nine Months | |

| | | Ended | | | Ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| Operating activities: | | | | | | | | |

| Net income (loss) | | $ | 58,293 | | | $ | (32,375 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation | | | 85,989 | | | | 62,539 | |

| Amortization of deferred drydocking and survey costs | | | 35,175 | | | | 26,740 | |

| Amortization of debt premium and discounts | | | 2,644 | | | | 1,157 | |

| Amortization of below market contracts | | | (1,906 | ) | | | — | |

| Provision for deferred income taxes | | | 69 | | | | 134 | |

| (Gain) loss on asset dispositions, net | | | (4,483 | ) | | | 826 | |

| Gain on pension settlement | | | (1,807 | ) | | | — | |

| Gain on bargain purchase | | | — | | | | (1,300 | ) |

| Long-lived asset impairment and other | | | — | | | | 714 | |

| Loss on warrants | | | — | | | | 14,175 | |

| Stock-based compensation expense | | | 7,247 | | | | 5,344 | |

| Changes in assets and liabilities, net of effects of business acquisition: | | | | | | | | |

| Trade and other receivables | | | (92,684 | ) | | | (30,301 | ) |

| Changes in due to/from affiliates, net | | | — | | | | (20 | ) |

| Accounts payable | | | 18,237 | | | | 9,364 | |

| Accrued expenses | | | 14,231 | | | | (913 | ) |

| Deferred drydocking and survey costs | | | (73,309 | ) | | | (43,883 | ) |

| Other, net | | | 9,778 | | | | (17,315 | ) |

| Net cash provided by (used in) operating activities | | | 57,474 | | | | (5,114 | ) |

| Cash flows from investing activities: | | | | | | | | |

| Proceeds from asset dispositions | | | 9,604 | | | | 8,475 | |

| Acquisitions, net of cash acquired | | | (594,191 | ) | | | (20,740 | ) |

| Additions to properties and equipment | | | (23,202 | ) | | | (11,708 | ) |

| Net cash used in investing activities | | | (607,789 | ) | | | (23,973 | ) |

| Cash flows from financing activities: | | | | | | | | |

| Exercise of warrants | | | 111,483 | | | | — | |

| Proceeds from issuance of shares | | | — | | | | 70,630 | |

| Repurchase of SPO acquisition warrants | | | — | | | | (70,630 | ) |

| Issuance of long-term debt | | | 575,000 | | | | — | |

| Acquisition of non-controlling interest in a majority owned subsidiary | | | (1,427 | ) | | | — | |

| Debt issuance costs | | | (14,758 | ) | | | (393 | ) |

| Tax on share-based awards | | | (5,899 | ) | | | (2,276 | ) |

| Net cash provided by (used in) financing activities | | | 664,399 | | | | (2,669 | ) |

| Net change in cash, cash equivalents and restricted cash | | | 114,084 | | | | (31,756 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | | | 167,977 | | | | 154,276 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 282,061 | | | $ | 122,520 | |

TIDEWATER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS CONTINUED

(Unaudited)

(In Thousands)

| |

|

Nine Months |

|

|

Nine Months |

|

| |

|

Ended |

|

|

Ended |

|

| |

|

September 30, 2023 |

|

|

September 30, 2022 |

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

|

|

|

|

| Interest, net of amounts capitalized |

|

$ |

8,452 |

|

|

$ |

7,979 |

|

| Income taxes |

|

$ |

36,585 |

|

|

$ |

16,143 |

|

| Supplemental disclosure of noncash investing activities: |

|

|

|

|

|

|

|

|

| Acquisition of SPO |

|

$ |

— |

|

|

$ |

162,648 |

|

| Purchase of three vessels |

|

$ |

12,198 |

|

|

$ |

— |

|

| Supplemental disclosure of noncash financing activities: |

|

|

|

|

|

|

|

|

| Warrants issued for SPO acquisition |

|

$ |

— |

|

|

$ |

162,648 |

|

| Repurchase of SPO acquisition warrants |

|

$ |

— |

|

|

$ |

992 |

|

| Debt incurred for purchase of three vessels |

|

$ |

12,198 |

|

|

$ |

— |

|

| Cash, cash equivalents and restricted cash at September 30, 2023 includes $2.0 million in long-term restricted cash, which is included in other assets in our condensed consolidated balance sheet. |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

TIDEWATER INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In Thousands)

| |

|

Three Months Ended |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Additional |

|

|

|

|

|

|

other |

|

|

Non |

|

|

|

|

|

| |

|

Common |

|

|

paid-in |

|

|

Accumulated |

|

|

comprehensive |

|

|

controlling |

|

|

|

|

|

| |

|

stock |

|

|

capital |

|

|

deficit |

|

|

income (loss) |

|

|

interest |

|

|

Total |

|

| Balance at June 30, 2023 |

|

$ |

51 |

|

|

$ |

1,554,793 |

|

|

$ |

(666,327 |

) |

|

$ |

4,566 |

|

|

$ |

(556 |

) |

|

$ |

892,527 |

|

| Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

26,199 |

|

|

|

(153 |

) |

|

|

(650 |

) |

|

|

25,396 |

|

| Exercise of warrants into common stock |

|

|

2 |

|

|

|

111,481 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

111,483 |

|

| Amortization of share-based awards |

|

|

— |

|

|

|

2,118 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,118 |

|

| Balance at September 30, 2023 |

|

$ |

53 |

|

|

$ |

1,668,392 |

|

|

$ |

(640,128 |

) |

|

$ |

4,413 |

|

|

$ |

(1,206 |

) |

|

$ |

1,031,524 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30, 2022 |

|

$ |

42 |

|

|

$ |

1,554,561 |

|

|

$ |

(715,649 |

) |

|

$ |

1,763 |

|

|

$ |

930 |

|

|

$ |

841,647 |

|

| Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

5,380 |

|

|

|

(289 |

) |

|

|

(470 |

) |

|

|

4,621 |

|

| Issuance of common stock |

|

|

4 |

|

|

|

72,253 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

72,257 |

|

| Repurchase of SPO acquisition warrants |

|

|

— |

|

|

|

(73,249 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(73,249 |

) |

| Amortization of share-based awards |

|

|

— |

|

|

|

1,823 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,823 |

|

| Balance at September 30, 2022 |

|

$ |

46 |

|

|

$ |

1,555,388 |

|

|

$ |

(710,269 |

) |

|

$ |

1,474 |

|

|

$ |

460 |

|

|

$ |

847,099 |

|

| |

|

Nine Months Ended |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Additional |

|

|

|

|

|

|

other |

|

|

Non |

|

|

|

|

|

| |

|

Common |

|

|

paid-in |

|

|

Accumulated |

|

|

comprehensive |

|

|

controlling |

|

|

|

|

|

| |

|

stock |

|

|

capital |

|

|

deficit |

|

|

income (loss) |

|

|

interest |

|

|

Total |

|

| Balance at December 31, 2022 |

|

$ |

51 |

|

|

$ |

1,556,990 |

|

|

$ |

(699,649 |

) |

|

$ |

8,576 |

|

|

$ |

22 |

|

|

$ |

865,990 |

|

| Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

59,521 |

|

|

|

(4,163 |

) |

|

|

(1,228 |

) |

|

|

54,130 |

|

| Acquisition of non-controlling interest in a majority owned subsidiary |

|

|

— |

|

|

|

(1,427 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,427 |

) |

| Exercise of warrants into common stock |

|

|

2 |

|

|

|

111,481 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

111,483 |

|

| Amortization of share-based awards |

|

|

— |

|

|

|

1,348 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,348 |

|

| Balance at September 30, 2023 |

|

$ |

53 |

|

|

$ |

1,668,392 |

|

|

$ |

(640,128 |

) |

|

$ |

4,413 |

|

|

$ |

(1,206 |

) |

|

$ |

1,031,524 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

|

$ |

41 |

|

|

$ |

1,376,494 |

|

|

$ |

(677,900 |

) |

|

$ |

2,668 |

|

|

$ |

466 |

|

|

$ |

701,769 |

|

| Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

(32,369 |

) |

|

|

(1,194 |

) |

|

|

(6 |

) |

|

|

(33,569 |

) |

| Issuance of common stock |

|

|

5 |

|

|

|

72,252 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

72,257 |

|

| SPO acquisition warrants |

|

|

— |

|

|

|

176,823 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

176,823 |

|

| Repurchase of SPO acquisition warrants |

|

|

— |

|

|

|

(73,249 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(73,249 |

) |

| Amortization of share-based awards |

|

|

— |

|

|

|

3,068 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,068 |

|

| Balance at September 30, 2022 |

|

$ |

46 |

|

|

$ |

1,555,388 |

|

|

$ |

(710,269 |

) |

|

$ |

1,474 |

|

|

$ |

460 |

|

|

$ |

847,099 |

|

The accompanying notes are an integral part of the Condensed Consolidated Financial Statements.

| (1) | INTERIM FINANCIAL STATEMENTS |

The accompanying unaudited condensed consolidated financial statements reflect the financial position, results of operations, comprehensive income, cash flows, and changes in stockholders’ equity of Tidewater Inc., a Delaware corporation, and its consolidated subsidiaries, collectively referred to as the “company”, “Tidewater”, “we”, “our”, or “us”.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with United States (U.S.) generally accepted accounting principles (GAAP) for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC) for interim financial information. Accordingly, certain information and disclosures normally included in our annual financial statements have been condensed or omitted. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 27, 2023 (2022 Annual Report). In the opinion of management, the accompanying financial information reflects all normal recurring adjustments necessary to fairly state our results of operations, financial position and cash flows for the periods presented and are not indicative of the results that may be expected for a full year.

Our financial statements have been prepared on a consolidated basis. Under this basis of presentation, our financial statements consolidate all subsidiaries (entities in which we have a controlling financial interest), and all intercompany accounts and transactions have been eliminated. We use the equity method to account for equity investments over which we exercise significant influence but do not exercise control and are not the primary beneficiary.

Certain prior year amounts have been reclassified to conform to the current year presentation. Unless otherwise specified, all per share information included in this document is on a diluted basis.

| (2) | RECENTLY ISSUED OR ADOPTED ACCOUNTING PRONOUNCEMENTS |

In September 2022, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2022-04, Disclosures of Supplier Finance Program Obligations, which requires disclosures about supplier finance programs including the nature of the program, activity during the period, changes from period to period and potential magnitude. The guidance is effective for annual periods beginning after December 15, 2022, with early adoption permitted, and most disclosures are applied retrospectively to each period in which a balance sheet is presented. We adopted this standard on January 1, 2023, and it did not have any impact on our consolidated financial statements and related disclosures.

In October 2021, the FASB issued ASU 2021-08, Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which amends Topic 805, Business Combinations, to require an acquirer to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606, Revenue from Contracts with Customers. The guidance is effective for annual and interim periods beginning after December 15, 2022, with early adoption permitted. We adopted this standard on January 1, 2023, and it did not have any impact on our consolidated financial statements and related disclosures.

Solstad Vessels

On

March

7,

2023, we entered into an Agreement for the Sale and Purchase of Vessels, Charter Parties and Other Assets, which was amended on

June 30, 2023 (the “Acquisition Agreement”), with certain subsidiaries of Solstad Offshore ASA, a Norwegian public limited company (collectively, the “Sellers”), pursuant to which we agreed to acquire from the Sellers (the “Solstad Acquisition”): (i)

37 platform supply vessels owned by the Sellers (the “Solstad Vessels”); and (ii) the charter parties governing certain of the Solstad Vessels. On

July

5,

2023, we completed the Solstad Acquisition for an aggregate cash purchase price of approximately

$594.2 million, consisting of the

$577.0 million base purchase price plus an initial

$3.0 million purchase price adjustment;

$3.2 million for working capital items comprised of fuel and lubricants; and

$11.0 million in estimated transaction costs, consisting primarily of advisory and legal fees. The purchase price was funded through a combination of cash on hand and net proceeds from both the Senior Secured Term Loan and the

10.375% Senior Unsecured Notes due

July 2028. See “Note (

9) Debt” for additional disclosure on these debt instruments.

We have determined that, under the provisions of FASB Accounting Standard Codification (ASC)

805, substantially all of the fair value of the gross assets acquired is concentrated in a group of identifiable assets and accordingly, the Solstad Acquisition is considered an asset acquisition. As a result, the assets acquired and liabilities assumed are measured at cost, which consists of the amount of cash paid and direct transaction costs. The cost of a group of assets acquired in an asset acquisition are allocated to the individual assets acquired or liabilities assumed based on their relative fair values and does

not give rise to goodwill.

As of July 5, 2023, the cost of the asset acquisition was allocated to the following individual assets acquired and liabilities assumed based on their relative fair values.

| (In Thousands) | | | | |

| | | | | |

| | | | | |

| | | Estimated Fair Value | |

| | | | | |

| Marine operating supplies | | $ | 1,891 | |

| Net properties and equipment | | | 601,000 | |

| Total assets | | | 602,891 | |

| | | | | |

| | | | | |

| Other current liabilities (A) | | | 8,600 | |

| Other liabilities (A) | | | 1,400 | |

| Total liabilities | | | 10,000 | |

| | | | | |

| Net assets acquired | | $ | 592,891 | |

| | | | | |

| Costs and expenses | | | | |

| Vessel operating costs (B) | | | 1,300 | |

| | | | | |

| Purchase consideration | | $ | 594,191 | |

| (A) | Current and long-term liabilities related to certain existing charter contracts accompanying the acquired Solstad Vessels that are below current market rates. These liabilities will be ratably amortized into revenue over the life of the related contracts. |

| (B) | The working capital adjustment included $1.3 million for lubricants which are expensed by Tidewater. |

Swire Pacific Offshore Holdings LTD

On April 22, 2022 (Closing Date), we acquired Swire Pacific Offshore Holdings Ltd., a limited company organized under the laws of Bermuda (SPO), which at closing owned 50 offshore support vessels operating primarily in West Africa, Southeast Asia and the Middle East. On the Closing Date, we paid $42.0 million in cash and issued 8,100,000 warrants, each exercisable at $0.001 per share for one share of our common stock (SPO acquisition warrants). In addition, we paid $19.6 million at closing and received an $8.8 million post-closing working capital refund related to pre-closing working capital adjustments, for a total consideration of $215.5 million. Assets acquired and liabilities assumed in the business combination were recorded at their estimated fair values as of the Closing Date under the acquisition method of accounting.

As of March 31, 2023, the following recorded fair value amounts for the assets acquired and liabilities assumed were final, with no material measurement period adjustments made during the year:

| (In Thousands) | | | | |

| | | | | |

| Assets | | | | |

| Cash | | $ | 33,152 | |

| Trade and other receivables | | | 64,621 | |

| Marine operating supplies | | | 5,122 | |

| Assets held for sale | | | 2,500 | |

| Prepaid expenses and other current assets | | | 4,174 | |

| Net properties and equipment | | | 174,415 | |

| Indemnification assets (A) | | | 32,279 | |

| Other assets | | | 1,153 | |

| Total assets | | | 317,416 | |

| | | | | |

| Liabilities | | | | |

| Accounts payable | | | 1,594 | |

| Accrued expenses | | | 54,924 | |

| Other current liabilities | | | 28,511 | |

| Other liabilities | | | 16,886 | |

| Total liabilities | | | 101,915 | |

| | | | | |

| Net assets acquired | | $ | 215,501 | |

| (A) | Consists primarily of tax liabilities existing at the Closing Date recorded in other current liabilities and other liabilities. |

Business combination related costs were expensed as incurred in general and administrative expense and consist of various advisory, legal, accounting, travel, training, valuation and other professional fees totaling $0.6 million and $1.4 million for the three and nine months ended September 30, 2023, respectively. Business combination related costs totaled $3.4 million and $12.8 million for the three and nine months ended September 30, 2022, respectively.

The unaudited supplemental pro forma results present consolidated information as if the business combination were completed on January 1, 2022. The pro forma results include, among others: (i) a reduction in depreciation expense for adjustments to property and equipment; and (ii) the reversal of any income or expense related to assets retained by the seller and SPO’s former parent, Banyan Overseas Limited, a limited company organized under the laws of Bermuda (Banyan). The pro forma results do not include any potential synergies or non-recurring charges that may result directly from the business combination.

| (In Thousands) | | | | |

| | | Period from | |

| | January 1, 2022 to | |

| | September 30, 2022 | |

| Revenues | | $ | 528,037 | |

| | | | | |

| Net loss | | $ | (28,501 | ) |

| | | | | |

| (4) | ALLOWANCE FOR CREDIT LOSSES |

Expected credit losses are recognized on the initial recognition of our trade accounts receivable and contract assets. In each subsequent reporting period, even if a loss has not yet been incurred, credit losses are recognized based on the history of credit losses and current conditions, as well as reasonable and supportable forecasts affecting collectability. We developed an expected credit loss model applicable to our trade accounts receivable and contract assets that considers our historical performance and the economic environment, as well as the credit risk and its expected development for each segmented group of customers that share similar risk characteristics. It is our practice to write off receivables when all legal options for collection have been exhausted.

Activity in the allowance for credit losses for the nine months ended September 30, 2023 is as follows:

| | | Trade | |

| (In Thousands) | | and Other | |

| | | Receivables | |

| Balance at January 1, 2023 | | $ | 14,060 | |

| Current period provision for expected credit losses | | | 2,841 | |

| Write offs | | | (1,484 | ) |

| Recoveries | | | 407 | |

| Other | | | (376 | ) |

| Balance at September 30, 2023 | | $ | 15,448 | |

The balance in our allowance for credit losses at September 30, 2023 and December 31, 2022, includes $11.3 million and $11.7 million respectively, previously reported in the allowance for credit losses related to amounts due from affiliates, which are now combined with trade and other receivables.

See “Note (13) Segment and Geographic Distribution of Operations” for revenue by segment and in total for the worldwide fleet.

Contract Balances

At September 30, 2023, we had $5.6 million of deferred mobilizations costs included within prepaid expenses and other current assets and $3.0 million of deferred mobilization costs included in other assets.

At September 30, 2023, we had $6.6 million of deferred mobilization revenue included within accrued expenses related to unsatisfied performance obligations that will be recognized during the remainder of 2023 and 2024.

| (6) | STOCKHOLDERS’ EQUITY AND DILUTIVE EQUITY INSTRUMENTS |

Earnings per share

Until the second quarter of 2022, we reported annual and quarterly losses from operations and reported basic and diluted losses per share based on the actual average shares of common stock outstanding during the relevant period. For the three months ended September 30, 2023 and 2022, and for the nine months ended September 30, 2023, we reported net income from operations. Our diluted earnings per share for the these periods is based on our weighted average common shares outstanding and is computed using the treasury stock method for our outstanding “in-the-money” warrants, restricted stock units and stock options.

Accumulated Other Comprehensive Income (Loss)

The following tables present the changes in accumulated other comprehensive income (loss) (OCI) by component, net of tax:

| (In Thousands) | | Three Months Ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| Balance at June 30, 2023 and 2022 | | $ | 4,566 | | | $ | 1,763 | |

| Unrealized loss on note receivable | | | (153 | ) | | | (429 | ) |

| Pension benefits recognized in OCI | | | — | | | | 140 | |

| Balance at September 30, 2023 and 2022 | | $ | 4,413 | | | $ | 1,474 | |

| (In Thousands) | | Nine Months Ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| Balance at December 31, 2022 and 2021 | | $ | 8,576 | | | $ | 2,668 | |

| Unrealized loss on note receivable | | | (469 | ) | | | (1,275 | ) |

| Pension benefits recognized in OCI | | | (3,694 | ) | | | 81 | |

| Balance at September 30, 2023 and 2022 | | $ | 4,413 | | | $ | 1,474 | |

Dilutive Equity Instruments

The following table presents the changes in the number of common shares, incremental “in-the-money” warrants, restricted stock units and stock options outstanding:

| Total shares outstanding including warrants, restricted stock units and stock options | | September 30, 2023 | | | September 30, 2022 | |

| Common shares outstanding | | | 52,839,862 | | | | 46,494,323 | |

| New creditor warrants (strike price $0.001 per common share) | | | 81,244 | | | | 119,215 | |

| GulfMark creditor warrants (strike price $0.01 per common share) | | | 95,835 | | | | 185,126 | |

| SPO acquisition warrants (strike price $0.001 per common share) | | | — | | | | 4,003,299 | |

| Restricted stock units and stock options | | | 1,505,519 | | | | 1,619,132 | |

| Total | | | 54,522,460 | | | | 52,421,095 | |

We also have “out-of-the-money” warrants outstanding exercisable for 861,310 shares of common stock at September 30, 2023 at an exercise price of $100.00, which expire in November 2024. Prior to August 1, 2023, we had outstanding Series A Warrants, exercise price of $57.06 and Series B Warrants, exercise price of $62.28, both with an expiration date of July 31, 2023. During July 2023, an aggregate of 2.0 million Series A Warrants and Series B Warrants were exercised and 1.9 million shares of common stock were issued in exchange for $111.5 million in cash proceeds. The remaining unexercised Series A Warrants and Series B Warrants, 3.1 million in the aggregate, expired according to their terms on July 31, 2023. No warrants, restricted stock units or stock options, whether in the money or out of the money, are included in our earnings (loss) per share calculations if the effect of such inclusion is antidilutive.

Income tax rates and taxation systems in the jurisdictions where we and our subsidiaries conduct business vary and our subsidiaries are frequently subjected to minimum taxation regimes. In some jurisdictions, tax liabilities are based on gross revenues, statutory deemed profits or other factors, rather than on net income. We use a discrete effective tax rate method to calculate taxes for interim periods instead of applying the annual effective tax rate to an estimate of the full fiscal year due to the level of volatility and unpredictability of earnings in our industry, both overall and by jurisdiction.

For the nine months ended September 30, 2023, income tax expense reflects tax liabilities in various jurisdictions based on either revenue (deemed profit regimes) or pre-tax profits.

The tax liabilities for uncertain tax positions are primarily attributable to permanent establishment issues related to foreign jurisdictions, subpart F income inclusions and withholding taxes on foreign services. Penalties and interest related to income tax liabilities are included in income tax expense. Income tax payable is included in other current liabilities.

As of December 31, 2022, our balance sheet reflected approximately $439.7 million of net deferred tax assets prior to a valuation allowance of $441.9 million. As of September 30, 2023, we had net deferred tax assets of approximately $449.6 million prior to a valuation allowance of $451.9 million. The net deferred tax assets amounts as of September 30, 2023 include $64.4 million of deferred tax assets from the SPO acquisition offset by a valuation allowance of $64.4 million.

Management assesses all available positive and negative evidence to permit use of existing deferred tax assets.

With limited exceptions, we are no longer subject to tax audits by U.S. federal, state, local or foreign taxing authorities for years prior to March 2016. We are subject to ongoing examinations by various foreign tax authorities and do not believe that the results of these examinations will have a material adverse effect on our financial position, results of operations or cash flows.

| (8) | EMPLOYEE BENEFIT PLANS |

U.S. Defined Benefit Pension Plan

We sponsor a defined benefit pension plan (pension plan) that was frozen in 2010 covering certain U.S. employees. We have not made contributions to the pension plan since 2019. Actuarial valuations are performed annually, and an assessment of the future pension obligations and market value of the assets will determine if contributions are made in the future.

During the second quarter of 2023, we entered into an agreement committing the pension plan to use a portion of its assets to purchase an annuity from an insurance company (the “Insurer”) to transfer approximately $11.8 million of the pension plan’s pension liabilities. Under the terms of this agreement, we irrevocably transferred to the Insurer all future pension plan benefit obligations for approximately 500 Tidewater participants (“Transferred Participants”) effective in April 2023. This annuity transaction was funded entirely with existing pension plan assets. The Insurer assumed responsibility for administrative and customer service support of the pension plan, including distribution of payments to the Transferred Participants. We recognized a $1.8 million settlement gain in the second quarter of 2023 in connection with this transaction.

Supplemental Executive Retirement Plan

We support a non-contributory and non-qualified defined benefit supplemental executive retirement plan (supplemental plan) that was closed to new participants during 2010. We contributed $1.2 million to the supplemental plan during each of the nine months ended September 30, 2023 and 2022, respectively, and expect to contribute $0.4 million during the remainder of 2023. Our obligations under the supplemental plan were $17.0 million and $17.3 million at September 30, 2023 and December 31, 2022, respectively, and are included in “accrued expenses” and “other liabilities” in the consolidated condensed balance sheet.

Net Periodic Benefit Costs

The net periodic benefit cost for our defined benefit pension plans and supplemental plan (referred to collectively as “Pension Benefits”) is comprised of the following components:

| (In Thousands) | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, 2023 | | | September 30, 2022 | | | September 30, 2023 | | | September 30, 2022 | |

| Pension Benefits: | | | | | | | | | | | | | | | | |

| Interest cost | | $ | 750 | | | $ | 578 | | | $ | 2,249 | | | $ | 1,735 | |

| Expected return on plan assets | | | (526 | ) | | | (751 | ) | | | (1,579 | ) | | | (2,254 | ) |

| Amortization of net actuarial (gains) losses | | | (36 | ) | | | 15 | | | | (106 | ) | | | 47 | |

| Net periodic pension (benefit) cost | | $ | 188 | | | $ | (158 | ) | | $ | 564 | | | $ | (472 | ) |

The components of the net periodic pension cost are included in the caption “Interest income and other, net.”

The following is a summary of all debt outstanding:

| (In Thousands) | | | | | | | | |

| | | September 30, 2023 | | | December 31, 2022 | |

| Senior bonds: | | | | | | | | |

| 8.50% Senior Secured Notes due November 2026 (A) (B) | | $ | 175,000 | | | $ | 175,000 | |

| Supplier Facility Agreements | | | 11,844 | | | | — | |

| Senior Secured Term Loan (C) | | | 325,000 | | | | — | |

| 10.375% Senior Unsecured Notes due July 2028 (D) | | | 250,000 | | | | — | |

| | | $ | 761,844 | | | $ | 175,000 | |

| Debt discount and issuance costs | | | (18,174 | ) | | | (5,964 | ) |

| Less: Current portion of long-term debt | | | (102,369 | ) | | | — | |

| Total long-term debt | | $ | 641,301 | | | $ | 169,036 | |

| | (A) | As of September 30, 2023 and December 31, 2022, the fair value (Level 2) of the Senior Secured Notes was $185.3 million and $177.3 million, respectively. |

| | (B) | The $5.0 million restricted cash on the condensed consolidated balance sheet at September 30, 2023, represents the pro rata amount due for our next semiannual interest payment obligation on the 8.50% Senior Secured Notes. |

| | (C) | As of September 30, 2023, the fair value of the Senior Secured Term Loan approximates book value. |

| | (D) | As of September 30, 2023, the fair value (Level 2) of the 10.375% Senior Unsecured Notes due July 2028 was $263.3 million. |

Supplier Facility Agreements

We have signed agreements for the construction of eight new vessels. Upon delivery of each vessel, we may enter into Facility Agreements to finance a portion of the construction and delivery costs. Three vessels have been delivered through September 30, 2023, and we entered into Facility Agreements for approximately EUR11.2 million ($11.8 million) in financing. Each of the three Facility Agreements bear interest at rates ranging from 2.7% to 6.0% and are payable in ten equal principal semi-annual installments, with the first installment commencing six months following delivery of the vessel. Payments for the three delivered vessels begin in the fourth quarter of 2023. The Facility Agreements are secured by the vessels, guaranteed by Tidewater as parent guarantor and contain no financial covenants.

Senior Secured Term Loan

Tidewater entered into a Credit Agreement, by and among Tidewater, as parent guarantor, TDW International Vessels (Unrestricted), LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company (“TDW International”), as borrower, certain other unrestricted subsidiaries of Tidewater, as other security parties, the lenders party thereto, DNB Bank ASA, New York Branch (“DNB Bank”), as facility agent and DNB Markets, Inc. (“DNB Markets”), as bookrunner and mandated lead arranger (the “Credit Agreement”), which was fully drawn on July 5, 2023, in a single advance of $325.0 million yielding net proceeds of approximately $318.3 million, which were used to fund a portion of the purchase price for the Solstad Acquisition.

The Senior Secured Term Loan is composed of a $100.0 million Tranche A loan and a $225.0 million Tranche B loan, each maturing on July 5, 2026. The Tranche A loan is required to be repaid by $50.0 million within one year, with the remaining $50.0 million due at maturity. The Tranche B loan amortizes over the three-year term of the Senior Secured Term Loan. The Tranche A loan bears interest at the Secured Overnight Financing Rate (“SOFR”) plus 5% initially, increasing to 8% over the term of the Term Loan. The Tranche B loan bears interest at SOFR plus 3.75%. The Tranche A loan and the Tranche B loan may each be prepaid at any time without premium or penalty. The security for the Senior Secured Term Loan includes mortgages over the Solstad Vessels and associated assignments of insurances and assignments of earnings in respect of such vessels, a pledge of 100% of the equity interests in TDW International, a pledge of 66% of the equity interests in TDW International Unrestricted, Inc., an indirect wholly owned subsidiary of the Company, and negative pledges over certain vessels indirectly owned by TDW International Unrestricted, Inc. The obligations of the borrower are guaranteed by Tidewater, subject to a cap equal to 50% of the purchase price for the Solstad Acquisition.

The Credit Agreement contains three financial covenants: (i) a minimum free liquidity test equal to the greater of $20.0 million or 10% of net interest-bearing debt, (ii) a minimum equity ratio of 30%, in each case for us and our consolidated subsidiaries and (iii) an interest coverage ratio of not less than 2:1. The Credit Agreement also contain certain equity cure rights with respect to such financial covenants. The Credit Agreement also includes (i) customary vessel management and insurance covenants in the vessel mortgages, (ii) negative covenants, and (iii) certain customary events of default. We are currently in compliance with all of these financial covenants.

10.375% Senior Unsecured Notes due July 2028

On July 3, 2023, Tidewater completed a previously announced offering of $250.0 million aggregate principal amount of senior unsecured bonds in the Nordic bond market (the “Senior Unsecured Notes”). The bonds were privately placed, at an issue price of 99%, outside the United States pursuant to Regulation S under the Securities Act of 1933, as amended. We used the net proceeds from the offering of approximately $243.1 million to fund a portion of the purchase price of the Solstad Acquisition.

The Senior Unsecured Notes were issued pursuant to the Bond Terms, dated as of June 30, 2023 (the “Bond Terms”), between the Nordic Trustee AS, as Bond Trustee and us. An application will be made for the Senior Unsecured Notes to be listed on the Nordic ABM. The Senior Unsecured Notes are senior unsecured obligations and are not guaranteed by any of our subsidiaries.

The Senior Unsecured Notes will mature on July 3, 2028. Interest on the Senior Unsecured Notes will accrue at a rate of 10.375% per annum payable semi-annually in arrears on January 3 and July 3 of each year in cash, beginning January 3, 2024. Prepayment of the Senior Unsecured Notes prior to July 3, 2025 requires the payment of make-whole amounts, and prepayments after that date are subject to prepayment premiums that decline over time.

The Senior Unsecured Notes contain two financial covenants: (i) a minimum free liquidity test equal to the greater of $20.0 million and 10% of net interest-bearing debt, and (ii) a minimum equity ratio of 30%. The Bond Terms also contain certain equity cure rights with respect to such financial covenants. Our ability to make certain distributions to our stockholders after November 16, 2023, is subject to certain limits, including in some circumstances a minimum liquidity test and a maximum net leverage ratio. The Senior Unsecured Notes are also subject to negative covenants as set forth in the Bond Terms. The Bond Terms contain certain customary events of default, including, among other things: (i) default in the payment of any amount when due; (ii) default in the performance or breach of any other covenant in the Bond Terms, which default continues uncured for a period of 20 business days; and (iii) certain voluntary or involuntary events of bankruptcy, insolvency or reorganization. We are currently in compliance with all of these financial covenants.

Super Senior Revolver

We have entered into a Super Senior Revolving Credit Facility Agreement maturing on November 16, 2026 that provides access to $25.0 million for general working capital purposes. No amounts have been drawn on this credit facility.

| (10) | COMMITMENTS AND CONTINGENCIES |

Currency Devaluation and Fluctuation Risk

Due to our international operations, we are exposed to foreign currency exchange rate fluctuations against the U.S. dollar. For some of our international contracts, a portion of the revenue and local expenses are incurred in local currencies with the result that we are at risk for changes in the exchange rates between the U.S. dollar and foreign currencies. We generally do not hedge against any foreign currency rate fluctuations associated with foreign currency contracts that arise in the normal course of business, which exposes us to the risk of exchange rate losses. To minimize the financial impact of these items, we attempt to contract a significant majority of our services in U.S. dollars. In addition, we attempt to minimize the financial impact of these risks by matching the currency of our operating costs with the currency of our revenue streams when considered appropriate. We continually monitor the currency exchange risks associated with all contracts not denominated in U.S. dollars.

Legal Proceedings

We are named defendants or parties in certain lawsuits, claims or proceedings incidental to our business and involved from time to time as parties to governmental investigations or proceedings arising in the ordinary course of business. Although the outcome of such lawsuits or other proceedings cannot be predicted with certainty and the amount of any liability that could arise with respect to such lawsuits or other proceedings cannot be predicted accurately, we do not expect these matters to have a material adverse effect on our financial position, operating results or cash flows.

| (11) | FAIR VALUE MEASUREMENTS |

Other Financial Instruments

Our primary financial instruments consist of cash and cash equivalents, restricted cash, trade receivables and trade payables with book values that are considered to be representative of their respective fair values. The carrying value for cash equivalents is considered to be representative of its fair value due to the short duration and conservative nature of the cash equivalent investment portfolio. In the second quarter of 2022, we agreed to a transaction with PEMEX, the Mexican national oil company, to exchange $8.6 million in accounts receivable for an equal face amount of seven-year 8.75% PEMEX corporate bonds (PEMEX Note). The PEMEX Note is classified as “available for sale.” For the three and nine months ended September 30, 2023, we recorded $0.2 million and $0.5 million in mark-to-market losses in other comprehensive income, respectively, valuing the PEMEX Note at $7.6 million in our consolidated balance sheet as of September 30, 2023. The PEMEX Note mark-to-market valuations are considered to be Level 2.

| (12) | PROPERTIES AND EQUIPMENT, ACCRUED EXPENSES, OTHER CURRENT LIABILITIES AND OTHER LIABILITIES |

As of September 30, 2023, our property and equipment consist primarily of 219 active vessels located around the world, excluding one vessel we have classified as held for sale. As of December 31, 2022, our property and equipment consisted primarily of 183 active vessels, which excluded eight vessels classified as held for sale. We have five Alucat crew boats under construction for which we have made down payments totaling approximately EUR2.6 million ($2.9 million) in 2022 and 2023 and will incur debt with the shipyard upon deliveries in 2023 and 2024 totaling approximately EUR10.5 million ($11.1 million). These crew boats, upon completion, will be employed in our African market.

A summary of properties and equipment is as follows:

| (In Thousands) | | | | | | | | |

| | | September 30, 2023 | | | December 31, 2022 | |

| Properties and equipment: | | | | | | | | |

| Vessels and related equipment | | $ | 1,704,505 | | | $ | 1,070,821 | |

| Other properties and equipment | | | 38,168 | | | | 35,819 | |

| | | | 1,742,673 | | | | 1,106,640 | |

| Less accumulated depreciation and amortization | | | 394,672 | | | | 309,985 | |

| Properties and equipment, net | | $ | 1,348,001 | | | $ | 796,655 | |