Additional Proxy Soliciting Materials (definitive) (defa14a)

May 14 2021 - 2:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

TETRA TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 14A (this “Amendment”) is being filed to amend TETRA Technologies, Inc.’s (the “Company”) definitive proxy statement (the “Proxy Statement”) for its 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”), which was filed with the Securities and Exchange Commission on April 13, 2021. This Amendment amends Proposal No. 4 (Approval of the First Amended and Restated 2018 Equity Incentive Plan) of the Proxy Statement (“Proposal No. 4”). Proposal No. 4, includes a summary of the principal terms of the 2018 Equity Incentive Plan (the “2018 Plan”) and requests approval of the Company’s First Amended and Restated 2018 Equity Incentive Plan (the “Amended 2018 Plan”) in order to both (i) increase the number of shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), available for issuance under the 2018 Plan by 5,500,000 shares and (ii) ease the administrative burden of maintaining two equity incentive plans by permitting non-employee directors to participate in the Amended 2018 Plan (subject to an annual individual limit on the fair market value of non-employee director awards of $300,000).

In Proposal No. 4 of the Proxy Statement, the Company made statements regarding the factors considered in setting the number of additional shares of Common Stock requested for reservation under the Amended 2018 Plan, including (i) the number of shares of Common Stock remaining available for issuance under the 2018 Plan as of the close of business on each of December 31, 2020 and March 29, 2021, and (ii) the potential dilution rate from the increased share reserve of the Amended 2018 Plan and the annual dilution from all of the Company’s equity incentive plans.

The Company has determined that the number of shares shown as remaining available for issuance under the 2018 Plan in the tables under the headings “Equity Compensation Plan Information” and “Shares Available for Grant and Outstanding Awards” in the Proxy Statement was inaccurate, which had a corresponding impact on the annual dilution rate from all of the Company’s equity plans reported for 2020 in the table under the heading “Potential Dilution” in the Proxy Statement. This Amendment hereby removes the tables identified in the preceding sentence included in the Proxy Statement and replaces them with the tables below. The footnotes and narrative associated with each of the below tables contained in the Proxy Statement are correct and as such have not been included in this Amendment.

Equity Compensation Plan Information

In the table below, we provide information about the shares of our common stock that may be issued under the 2018 Plan as of December 31, 2020, the end of our most recent fiscal year.

|

Plan Category

|

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (1)

|

|

|

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (2)

|

|

|

Number of Securities

Remaining Available

for Future Issuance

under Equity Compensation

Plans (Excluding Securities

Shown in the First Column)

|

|

|

Equity compensation plans

|

|

|

|

|

|

|

|

|

|

|

|

|

approved by stockholders(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 Long Term Incentive

|

|

547,863

|

|

|

$

|

6.79

|

|

|

|

—

|

|

|

2011 Long Term Incentive

|

|

2,564,124

|

|

|

$

|

6.73

|

|

|

|

—

|

|

|

2018 Non-Employee Director(4)

|

|

—

|

|

|

|

—

|

|

|

|

171,898

|

|

|

2018 Long Term Incentive (4)

|

|

3,057,327

|

|

|

$

|

4.19

|

|

|

|

2,309,199

|

|

|

Total

|

|

6,169,314

|

|

|

$

|

6.73

|

|

|

|

2,481,097

|

|

|

Equity compensation plans not

|

|

|

|

|

|

|

|

|

|

|

|

|

approved by stockholders(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

Serrano Plan

|

|

79,051

|

|

|

$

|

6.60

|

|

|

|

—

|

|

|

2018 Inducement Restricted Stock Plan

|

|

—

|

|

|

|

—

|

|

|

|

76,495

|

|

|

Total

|

|

79,051

|

|

|

$

|

6.60

|

|

|

|

76,495

|

|

|

All Plans Total (6)

|

|

6,248,365

|

|

|

$

|

6.73

|

|

|

|

2,557,592

|

|

Shares Available for Grant and Outstanding Awards

The following table summarizes information regarding awards outstanding and shares remaining available for grant under the 2018 Plan, the Director Plan, the 2011 Plan, the 2007 Plan and under the Inducement Plan, as of the close of business on March 29, 2021:

|

|

|

2018 Plan

|

|

All Other Plans

|

|

|

Inducement Plan

|

|

|

Total shares underlying outstanding stock options and restricted stock units

|

|

3,904,508

|

|

|

3,096,658

|

|

|

__

|

|

|

Weighted average exercise price of outstanding stock options

|

|

$ 4.19

|

|

$ 6.74

|

|

|

|

|

|

|

Weighted average remaining duration (years) of outstanding stock options

|

|

7.1

|

|

|

4.7

|

|

|

|

|

|

|

Total shares underlying outstanding unvested time-based restricted stock awards

|

|

24,682

|

|

|

4,242

|

|

|

__

|

|

|

Total shares available for grant

|

|

627,455

|

|

|

171,898

|

|

|

|

76,495

|

|

Potential Dilution

In addition to overall dilution, in recommending the increase to the share reserve under the Amended 2018 Plan, the Human Capital Management and Compensation Committee considered annual dilution from our equity incentive plans, as shown on the following table:

|

|

|

Basic Dilution(1)

|

|

|

Fully Diluted(2)

|

|

|

December 31, 2018

|

|

|

10.7

|

%

|

|

|

9.7

|

%

|

|

December 31, 2019

|

|

|

9.2

|

%

|

|

|

8.5

|

%

|

|

December 31, 2020

|

|

|

7.5

|

%

|

|

|

7.0

|

%

|

No other changes have been made to the Proxy Statement or to the matters to be considered by the stockholders at the 2021 Annual Meeting. All other items of the Proxy Statement are incorporated herein by reference without change. Capitalized terms used but not otherwise defined in this Amendment shall have the meanings assigned to such terms in the Proxy Statement. This Amendment should be read in conjunction with the Proxy Statement.

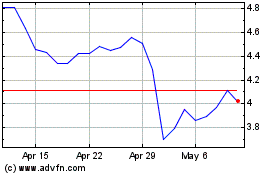

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

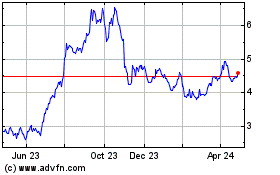

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Nov 2023 to Nov 2024