Filed Pursuant to Rule 424(b)(2)

Registration No. 333-230818

PROSPECTUS

TETRA Technologies, Inc.

11,155,000 Shares of Common Stock Underlying Warrants

This prospectus relates to the offer and sale by us of 11,155,000 shares of our common stock, par value $0.01 per share, that are issuable upon the exercise of outstanding warrants, or the Warrants, at an exercise price of $5.75 per share of common stock, previously registered on our registration statement on Form S-3 (File Number 333-210335) originally filed with the Securities and Exchange Commission on March 23, 2016 and declared effective on April 13, 2016. The Warrants were previously issued on December 14, 2016. We will receive the proceeds from any cash exercises of the Warrants. Each of the Warrants is exercisable at any time until its expiration date, which such date is December 14, 2021. If all of the Warrants are exercised, we will receive aggregate proceeds of approximately $64,141,250.

Our common stock is listed and traded on the New York Stock Exchange under the symbol “TTI.”

The last reported sale price of our common stock as reported on the New York Stock Exchange on April 26, 2019 was $2.43 per share. None of the Warrants are listed, and we do not intend to apply to list them, on the New York Stock Exchange or any other national securities exchange.

Investing in our securities involves risks. Please read “Risk Factors” on page 3 of this prospectus and under similar headings in the documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 1, 2019.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

i

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

ii

|

|

INCORPORATION BY REFERENCE

|

ii

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

iii

|

|

SUMMARY

|

1

|

|

RISK FACTORS

|

3

|

|

USE OF PROCEEDS

|

5

|

|

DILUTION

|

5

|

|

DESCRIPTION OF CAPITAL STOCK

|

7

|

|

PLAN OF DISTRIBUTION

|

10

|

|

LEGAL MATTERS

|

10

|

|

EXPERTS

|

10

|

ABOUT THIS PROSPECTUS

This prospectus relates to the offering of our common stock issuable upon the exercise of outstanding warrants. Before investing in the common stock issuable upon the exercise of the outstanding warrants, we urge you to carefully read this prospectus, together with the information incorporated by reference as described under the headings “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus. These documents contain important information that you should consider when making your investment decision.

This prospectus describes the specific terms of the securities we are offering and also adds to, and updates information contained in the documents incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference into this prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in, or incorporated by reference into, this prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell or soliciting an offer to buy our securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information

i

in the documents to w

hich we have referred you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation by Reference.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

This prospectus contains and incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the SEC under the Securities Act of 1933, as amended, which we refer to as the Securities Act, that registers the issuance and sale of the securities offered by this prospectus. The registration statement, including the attached exhibits, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some information included in the registration statement from this prospectus.

We file annual, quarterly, and other reports, proxy statements and other information with the SEC under the Exchange Act. Such reports, proxy statements and other information, including the registration statement, and exhibits and schedules thereto, are available to the public through the SEC’s website at http://www.sec.gov.

General information about us, including our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, are available free of charge through our website at http://www.tetratec.com as soon as reasonably practicable after we file them with, or furnish them to, the SEC. Information on our website is not incorporated into this prospectus or our other securities filings and is not a part of this prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this document. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus. We incorporate by reference the documents listed below, other than any portions of the respective filings that were furnished (pursuant to Item 2.02 or Item 7.01 of current reports on Form 8-K or other applicable SEC rules) rather than filed:

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 4, 2019;

|

|

|

•

|

the information specifically incorporated by reference into such Annual Report on Form 10-K from our definitive proxy statement on Schedule 14A filed with the SEC on March 21, 2019;

|

|

|

•

|

our Current Reports on Form 8-K, filed with the SEC on February 25, 2019 and March 27, 2019; and

|

|

|

•

|

the description of our common stock contained in our registration statement on Form 8-A filed with the SEC on October 7, 1997, including any amendments and reports filed for the purpose of updating such description.

|

ii

All documents that we file pursuant to Section 13(a), 13(c)

, 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, after the date of this prospectus and until our offerings hereunder are completed will be deemed to be incorporated by reference into this prospectus a

nd will be a part of this prospectus from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of th

is prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is

modified or superseded will not constitute a part of this prospectus, except as modified or superseded.

We will provide to each person, including any beneficial owner to whom a prospectus is delivered, a copy of these filings, other than an exhibit to these filings, unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request and at no cost. Requests should be made by writing or telephoning us at the following address:

TETRA Technologies, Inc.

24955 Interstate 45 North

The Woodlands, Texas 77380

(281) 367-1983

Attn: Investor Relations

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some information contained in this prospectus and in the documents we incorporate by reference herein and therein may contain certain statements (other than statements of historical fact) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements include, but are not limited to, statements concerning such things as recognition of backlog, our level of capital, cash flow, capital expenditures, current debt and equity market conditions, tax impacts, technological systems, insurance coverage, alternative suppliers, sales levels, personnel, regulatory requirements, intellectual property, growth opportunities and oil and natural gas prices, and can generally can be identified by the use of words such as “anticipates,” “assumes,” “believes,” “budgets,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “might,” “plans,” “predicts,” “projects,” “schedules,” “seeks,” “should,” “targets,” “will,” and “would” or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes. However, these are not the exclusive means of identifying forward-looking statements.

Where any forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that, while we believe these assumptions or bases to be reasonable and to be made in good faith, assumed facts or bases almost always vary from actual results, and the difference between assumed facts or bases and actual results could be material, depending on the circumstances. It is important to note that actual results could differ materially from those projected by such forward-looking statements.

Although we believe that the expectations in our forward-looking statements are reasonable, we cannot give any assurance that those expectations will be correct. Our operations are subject to numerous uncertainties, risks and other influences, many of which are outside our control and any of which could materially affect our results of operations and ultimately prove the statements we make to be inaccurate.

Factors that could cause our results to differ materially from the results discussed in such forward-looking statements include, but are not limited to, the following:

|

|

•

|

economic and operating conditions that are outside of our control, including the supply, demand, and prices of oil and natural gas;

|

|

|

•

|

the availability of adequate sources of capital to us;

|

|

|

•

|

the levels of competition we encounter;

|

|

|

•

|

the activity levels of our customers;

|

|

|

•

|

our operational performance;

|

iii

|

|

•

|

the availability of raw materials and labor at reasonable prices;

|

|

|

•

|

risks related to acquisitions and our growth strategy;

|

|

|

•

|

restrictions under our debt agreements and the consequences of any failure to comply with debt covenants;

|

|

|

•

|

the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies;

|

|

|

•

|

risks related to our foreign operations;

|

|

|

•

|

information technology risks including the risk from cyberattack; and

|

|

|

•

|

other risks and uncertainties under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, those set forth in Item 1A “Risk Factors” in our Quarterly Reports on Form 10-Q, and as included in our other filings with the U.S. Securities and Exchange Commission, or the SEC, which are available free of charge on the SEC website at www.sec.gov.

|

The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material.

All subsequent written and oral forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

iv

summary

This summary highlights information contained elsewhere in this prospectus or incorporated herein by reference. This summary does not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the risks discussed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” included elsewhere in this prospectus and the consolidated financial statements and notes thereto and other information incorporated by reference herein. Unless otherwise indicated or unless the context otherwise requires, all references in this prospectus to “TETRA,” “TETRA Technologies,” “our company,” “we,” “our,” “us” or similar references mean TETRA Technologie

s, Inc. and its consolidated subsidiaries.

Overview

We are a geographically diversified oil and gas services company, focused on completion fluids and associated products and services, comprehensive water management, frac flowback, production well testing and offshore rig cooling services, and compression services and equipment. We are composed of three reporting segments organized into three Divisions - Completion Fluids & Products, Water & Flowback Services, and Compression.

Our Completion Fluids & Products Division manufactures and markets clear brine fluids, additives, and associated products and services to the oil and gas industry for use in well drilling, completion and workover operations in the United States and in certain countries in Latin America, Europe, Asia, the Middle East and Africa. The Division also markets liquid and dry calcium chloride products manufactured at its production facilities or purchased from third-party suppliers to a variety of markets outside the energy industry.

Our Water & Flowback Services Division provides onshore oil and gas operators with comprehensive water management services. The Division also provides frac flowback, production well testing, offshore rig cooling, and other associated services in many of the major oil and gas producing regions in the United States, Mexico, and Canada, as well as in oil and gas basins in certain regions in South America, Africa, Europe, the Middle East and Australia.

Our Compression Division is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. The Compression Division's equipment sales business includes the fabrication and sale of standard compressor packages and custom-designed compressor packages designed and fabricated at the Division's facilities. The Compression Division's aftermarket business provides compressor package reconfiguration and maintenance services and compressor package parts and components manufactured by third-party suppliers. The Compression Division provides its services and equipment to a broad base of natural gas and oil exploration and production, midstream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States, as well as in a number of foreign countries, including Mexico, Canada and Argentina.

We continue to pursue a long-term growth strategy that includes expanding our core businesses, through internal growth and acquisitions, domestically and internationally.

Company Information

We were incorporated in Delaware in 1981. Our corporate headquarters are located at 24955 Interstate 45 North in The Woodlands, Texas 77380. Our phone number is (281) 367-1983 and our website may be accessed at www.tetratec.com. Information on our website is not incorporated into this prospectus or our other securities filings and is not a part of this prospectus.

1

The Offering

|

|

|

|

Issuer:

|

TETRA Technologies, Inc.

|

|

Securities offered:

|

This offering involves the offer and sale of 11,155,000 shares of our common stock issuable upon the exercise of the Warrants at an exercise price of $5.75 per share. Each of the Warrants is exercisable at any time until its expiration date, which such date is December 14, 2021. If all of the Warrants are exercised, we will receive aggregate proceeds of approximately $64,141,250.

|

|

Use of proceeds:

|

Please see “Use of Proceeds” on page 5 of this prospectus for more information.

|

|

Risk factors:

|

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 3 of this prospectus, as well as the other information included in or incorporated by reference in this prospectus for a discussion of risks you should carefully consider before investing in our securities.

|

|

New York Stock Exchange symbol:

|

Our common stock is listed on the New York Stock Exchange under the symbol “TTI”.

|

|

Transfer Agent:

|

Computershare Trust Company, N.A.

|

2

RISK FACTORS

An investment in our securities involves various risks. You should carefully consider the matters discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, as well as other information we have provided in this prospectus and the documents incorporated by reference herein, before reaching a decision regarding an investment in our securities. The risks described below and cross-referenced in the documents above are not the only risks we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks related to our common stock

Our common stock has experienced, and may continue to experience, price volatility

.

The market price of our common stock may decline from its current levels in response to various factors and events beyond our control, including the following:

|

|

•

|

operating results that vary from the expectations of securities analysts and investors;

|

|

|

•

|

changes in expectations regarding our future financial performance, including financial estimates by securities analysts and investors;

|

|

|

•

|

general conditions in our industry, including levels of government funding for infrastructure projects;

|

|

|

•

|

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures, financings or capital commitments;

|

|

|

•

|

changes in laws and regulations;

|

|

|

•

|

general economic and competitive conditions;

|

|

|

•

|

the limited trading volume of our common stock;

|

|

|

•

|

our issuance of a significant number of shares of our common stock, including upon exercise of employee stock options or warrants; and

|

|

|

•

|

the other risk factors described herein or incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2018.

|

We currently do not intend to pay dividends on our common stock and, consequently, you will achieve a positive return on your investment in our common stock only if the market price of our common stock appreciates above the price that you pay for it

.

We have never paid any cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings in our business, and we do not anticipate paying any cash dividends. Whether or not we declare any dividends will be at the discretion of the board of directors considering then-existing conditions, including our financial condition and results of operations, capital requirements, bonding prospects, contractual restrictions (including those under our debt agreements), business prospects and other factors that our board of directors considers relevant. Consequently, your only opportunity to achieve a return on your investment in our company will be if the market price of our common stock appreciates and you are able to sell your shares at a profit.

Future sales or the possibility of future sales of our common stock in the public market could lower our stock price.

We may issue our common stock from time to time in connection with this offering, other offerings or as consideration for future acquisitions and investments. In the event that any such offering, acquisition or investment is significant, the number of shares of our common stock that we may issue could in turn be significant. In addition, we may also grant registration rights covering those shares in connection with any such acquisition and investment.

We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock (including shares of our common stock issued in connection with

3

an acquisition or compensation or incentive plan), or the perception that sales cou

ld occur, may adversely affect prevailing market prices for our common stock.

Delaware law and our charter documents may impede or discourage a takeover or change of control

.

Certain provisions of our certificate of incorporation, our bylaws and the provisions of Delaware law, individually or collectively, may impede a merger, takeover or other business combination involving us or discourage a potential acquirer from making a tender offer for our common stock, which could affect the market price of our common stock.

Risks related to this offering

Each purchaser in this offering will experience immediate and substantial dilution in the net tangible book value per share of common stock it purchases in this offering

.

The exercise price of the Warrants per share of common stock being offered may be substantially higher than the net tangible book value per share of our common stock, and you may suffer substantial dilution in the net tangible book value of the shares you purchase in this offering upon the exercise of the Warrants. Assuming that all 11,155,000 shares of our common stock are sold in this offering, the purchasers will suffer immediate and substantial dilution of $4.77 per share, representing the difference between the exercise price of $5.75 per share and our as adjusted net tangible book value per share as of December 31, 2018 after giving effect to this offering. See the section entitled “Dilution” below for a more detailed discussion of the dilution the purchasers will incur if they purchase our securities in this offering.

The purchasers in this offering may experience future dilution

.

In order to raise additional capital, we may in the future offer additional shares of common stock or other securities convertible into, or exchangeable for, our common stock at prices that may not be the same as the price per share in this offering. We have an effective shelf registration statement from which additional shares and other securities can be offered. We cannot assure you that we will be able to sell common stock or other securities in any other offering at a price per share that is equal to or greater than the exercise price per share of the Warrants in this offering. If the price per share at which we sell additional common stock or related securities in future transactions is less than the exercise price per share of the Warrants in this offering, investors who purchase our common stock in this offering will suffer a dilution of their investment. Investors may incur dilution upon vesting of any restricted share units or upon exercise of any outstanding stock options.

4

USE OF PROCEEDS

We estimate that our net proceeds from the sale of 11,155,000 shares of our common stock in this offering, assuming the exercise of the Warrants in full, will be approximately $64,141,250.

We intend to use the net proceeds from this offering to repay existing indebtedness.

On September 10, 2018, we entered into a credit agreement, or, the “ABL Credit Agreement,” with a syndicate of lenders, including JPMorgan Chase Bank, N.A., as administrative agent, providing for a senior secured revolving credit facility of up to $100 million, subject to a borrowing base to be determined by reference to the value of inventory and accounts receivable, and including a sublimit of $20.0 million for letters of credit and a swingline loan sublimit of $10.0 million. As of March 31, 2019, we had $30.7 million of borrowings and $9.0 million letters of credit outstanding under our ABL Credit Agreement. The average interest rate on the amounts outstanding under our ABL Credit Agreement during the three months ended March 31, 2019 was approximately 5.5%. Borrowings under the ABL Credit Agreement were used to repay certain of our debt existing on the effective date of the ABL Credit Agreement and may be used for working capital needs, capital expenditures and other general corporate purposes, including acquisitions.

On September 10, 2018, we entered into a term credit agreement, or, the “Term Credit Agreement,” with a syndicate of lenders, including Wilmington Trust, National Association, as administrative agent, providing for an initial term loan in the amount of $200.0 million and the availability of additional loans, up to an aggregate amount of $75.0 million for certain acquisitions. As of March 31, 2019, $200.0 million in aggregate principal amount was outstanding under the Term Credit Agreement. The average interest rate on the loans outstanding under the Term Credit Agreement during the three months ended March 31, 2019 was approximately 8.74%. The net proceeds from the Term Credit Agreement were used to prepay outstanding indebtedness under the 11% Senior Secured Notes due November 5, 2022 and indebtedness under our prior bank credit agreement.

DILUTION

If you purchase shares of our common stock upon the exercise of any of the Warrants, your ownership interest will be diluted to the extent of the difference between the exercise price per share and the net tangible book value per share of our common stock.

The net tangible book value of our common stock as of December 31, 2018, was approximately $69.5 million, or approximately $0.55 per share. Net tangible book value per common share represents the amount of our total tangible assets (total assets less goodwill, intangible assets and deferred costs), less total liabilities (all exclusive of amounts pertaining to noncontrolling interests), divided by the total number of shares of our common stock outstanding. Dilution per share to new investors represents the difference between the amount per share paid by purchasers for each share of common stock in this offering and the net tangible book value per share of our common stock immediately following the completion of this offering, assuming the Warrants are fully exercised.

After giving effect to the sale of 11,155,000 shares of our common stock to investors exercising the Warrants for cash at an exercise price of $5.75 per share, the as-adjusted net tangible book value of our common stock as of December 31, 2018 would have been approximately $133.6 million, or approximately $0.98 per share. This represents an immediate increase in net tangible book value of approximately $0.43 per share to our existing stockholders and an immediate dilution in as-adjusted net tangible book value of approximately $4.77 per share to investors exercising the Warrants, as illustrated by the following table:

|

Exercise price per share of the Warrants

|

|

$5.75

|

|

Net tangible book value per common share as of December 31, 2018

|

$0.55

|

|

|

Increase per share attributable to this offering

|

$0.43

|

|

|

As-adjusted net tangible book value per common share as of December 31, 2018, after giving effect to this offering

|

|

$0.98

|

|

Dilution per share to investors purchasing shares in this offering upon exercise of the Warrants

|

|

$4.77

|

The table above assumes, for illustrative purposes only, that all 11,155,000 shares of our common stock are sold in this offering upon the exercise of the Warrants for cash for aggregate gross proceeds of $64,141,250.

5

The table above is based on

125,737,565

shares of our common stock outstanding as of December 31, 2018 and excludes as of such date:

|

|

•

|

11,155,000 shares of our common stock issuable upon exercise of warrants outstanding as of December 31, 2018, with a weighted-average exercise price of $5.75 per share;

|

|

|

•

|

3,323,916 shares of our common stock issuable upon exercise of stock options outstanding as of December 31, 2018, with a weighted-average exercise price of $7.48 per share; and

|

|

|

•

|

6,373,059 shares of our common stock reserved for future grant under our 2018 Equity Incentive Plan, 2018 Non-Employee Director Incentive Plan and 2018 Inducement Plan.

|

To the extent that any outstanding options or warrants are exercised, new awards are issued under our equity incentive plans, or we otherwise issue additional shares of common stock in the future at prices per share below the price per share for any shares sold in this offering upon exercise of the Warrants, there will be further dilution to new investors.

6

Description of capital stock

The following is a summary of the material terms and provisions of our capital stock. You should refer to the applicable provisions of our restated certificate of incorporation, as amended, our amended and restated bylaws and the documents that we have incorporated by reference for a complete statement of the terms and rights of our capital stock.

As of December 31, 2018, our authorized capital stock was 255,000,000 shares, which includes 250,000,000 shares authorized as common stock, $0.01 par value, and 5,000,000 shares authorized as preferred stock, $0.01 par value. As of December 31, 2018, we had 125,737,565 shares of common stock outstanding. There were no shares of preferred stock outstanding as of such date.

Common Stock

Listing

. Our common stock is listed on the New York Stock Exchange under the symbol “TTI.”

Dividends

. Subject to the rights of holders of preferred stock, common stockholders may receive dividends when declared by the board of directors. Dividends may be paid in cash, stock or another form. However, our existing credit agreements contain covenants that restrict our ability to pay dividends.

Fully Paid

. All outstanding shares of common stock are, and the common stock offered by this prospectus and any prospectus supplement will be, fully paid and non-assessable upon issuance.

Voting Rights

. Common stockholders are entitled to one vote in the election of directors and other matters for each share of common stock owned. Common stockholders are not entitled to preemptive or cumulative voting rights.

Other Rights

. We will notify common stockholders of any stockholders’ meetings in accordance with applicable law. If we liquidate, dissolve or wind-up our business, either voluntarily or not, common stockholders will share equally in the assets remaining after we pay our creditors and preferred stockholders. There are no redemption or sinking fund provisions applicable to the common stock.

Transfer Agent and Registrar

. Our transfer agent and registrar is Computershare Trust Company, N.A. located in Providence, Rhode Island.

Preferred Stock

Our board of directors can, without approval of our stockholders, issue one or more series or classes of preferred stock from time to time limited by the number of shares of preferred stock then authorized. The board can also determine the number of shares of each series and the rights, preferences and limitations of each series or class, including the dividend rights, voting rights, conversion rights, redemption rights and any liquidation preferences of any series or class of preferred stock and the terms and conditions of issue.

If we offer shares of preferred stock, the specific terms will be described in a prospectus supplement, including:

|

|

•

|

the specific designation, number of shares, seniority and purchase price;

|

|

|

•

|

any liquidation preference per share;

|

|

|

•

|

any date of maturity;

|

|

|

•

|

any redemption, repayment or sinking fund provisions;

|

|

|

•

|

any dividend rate or rates and the dates on which any such dividends will be payable (or the method by which such rates or dates will be determined);

|

|

|

•

|

any voting rights;

|

|

|

•

|

if other than the currency of the United States, the currency or currencies, including composite currencies, in which such preferred stock is denominated and/or in which payments will or may be payable;

|

|

|

•

|

the method by which amounts in respect of such preferred stock may be calculated and any commodities, currencies or indices, or value, rate or price, relevant to such calculation;

|

7

|

|

•

|

whether such preferred stock is convertible or exchangeable and, if so, the securities or rights into which such preferred stock is convertible or exchangeable, and the terms and conditions upon which such conversions or exchanges will be effected, including conversion or exchange prices or rates, the conversion or exchange period and any other related provisions;

|

|

|

•

|

the place or places where dividends and other payments on the preferred stock will be payable; and

|

|

|

•

|

any additional voting, dividend, liquidation, redemption and other rights, preferences, privileges, limitations and restrictions.

|

In some cases, the issuance of preferred stock could delay a change in control of us and make it more difficult to remove present management. Under certain circumstances, preferred stock could also restrict dividend payments to common stockholders.

Certain Provisions of Our Certificate of Incorporation, Bylaws and Law

Our restated certificate of incorporation, as amended, and amended and restated bylaws contain provisions that may render more difficult possible takeover proposals to acquire control of us and make removal of our management more difficult. Below is a description of certain of these provisions in our restated certificate of incorporation, as amended, and amended and restated bylaws.

Our restated certificate of incorporation, as amended, authorizes a class of undesignated preferred stock consisting of 5,000,000 shares. Preferred stock may be issued from time to time in one or more series, and our board of directors, without further approval of the stockholders, is authorized to fix the designations, powers, preferences, and rights applicable to each series of preferred stock. The purpose of authorizing the board of directors to determine such designations, powers, preferences, and rights is to allow such determinations to be made by the board of directors instead of the stockholders and to avoid the expense of, and eliminate delays associated with, a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, adversely affect the voting power of the holders of common stock and, under some circumstances, make it more difficult for a third party to gain control of us.

Our restated certificate of incorporation, as amended, authorizes the board of directors to create and issue rights entitling the holders thereof to purchase shares of our capital stock or other securities. The times at which and the terms upon which these rights are to be issued will be determined by the board of directors and set forth in the contracts or instruments that evidence such rights. The authority of the board of directors with respect to such rights shall include, but not be limited to, determination of the following:

|

|

•

|

the initial purchase price per share of our capital stock or other securities to be purchased upon exercise of such rights;

|

|

|

•

|

provisions relating to the times at which and the circumstances under which such rights may be exercised or sold or otherwise transferred, either together with or separately from, any other of our securities;

|

|

|

•

|

provisions that adjust the number or exercise price of such rights or amount or nature of the securities or other property receivable upon exercise of such rights in the event of a combination, split or recapitalization of any capital stock, a change in ownership of our securities or a reorganization, merger, consolidation, sale of assets or other occurrence relating to us or any of our capital stock, and provisions restricting the ability of us to enter into any such transaction absent an assumption by the other party or parties thereto of our obligations under such rights;

|

|

|

•

|

provisions that deny the holder of a specified percentage of our outstanding securities the right to exercise such rights and/or cause such rights held by such holder to become void;

|

|

|

•

|

provisions that permit us to redeem such rights;

|

|

|

•

|

the appointment of rights agent with respect to such rights;

|

|

|

•

|

the issuance of such rights could, among other things, adversely affect the voting power of the holders of common stock and, under some circumstances, make it more difficult for a third party to gain control of us; and

|

8

|

|

•

|

such other provisions relating to such rights as may be determined by the board of directors.

|

Our restated certificate of incorporation, as amended, provides that, subject to the rights of holders of any preferred stock, any action required or permitted to be taken by our stockholders must be taken at an annual or special meeting of stockholders and not by written consent.

Our restated certificate of incorporation, as amended, precludes the ability of our stockholders to call meetings of stockholders. Except as may be required by law and subject to the holders of rights of preferred stock, special meetings of stockholders may be called only by our chairman of the board or by our board of directors pursuant to a resolution adopted by a majority of the members of the board of directors.

Our amended and restated bylaws contain specific procedures for stockholder nomination of directors. These provisions require advance notification that must be given in accordance with the provisions of our bylaws, as amended. The procedure for stockholder nomination of directors may have the effect of precluding a nomination for the election of directors at a particular meeting if the required procedure is not followed.

Although Section 214 of the Delaware General Corporation Law, or “DGCL,” provides that a corporation’s certificate of incorporation may provide for cumulative voting for directors, our restated certificate of incorporation, as amended, does not provide for cumulative voting. As a result, the holders of a majority of the votes of the outstanding shares of our common stock have the ability to elect all of the directors being elected at any annual meeting of stockholders.

As a Delaware corporation, we are subject to Section 203, or the business combination statute, of the DGCL. Under the business combination statute of the DGCL, a corporation is generally restricted from engaging in a business combination (as defined in Section 203 of the DGCL) with an interested stockholder (defined generally as a person owning 15% or more of the corporation’s outstanding voting stock) for a three-year period following the time the stockholder became an interested stockholder. This restriction applies unless:

|

|

•

|

prior to the time the stockholder became an interested stockholder, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

the interested stockholder owned at least 85% of the voting stock of the corporation upon completion of the transaction which resulted in the stockholder becoming an interested stockholder (excluding stock held by the corporation’s directors who are also officers and by the corporation’s employee stock plans, if any, that do not provide employees with the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer); or

|

|

|

•

|

at or subsequent to the time the stockholder became an interested stockholder, the business combination was approved by the board of directors of the corporation and authorized by the affirmative vote, at an annual or special meeting, and not by written consent, of at least 66 2/3% of the outstanding voting shares of the corporation, excluding shares held by that interested stockholder.

|

The provisions of the Delaware business combination statute do not apply to a corporation if, subject to certain requirements specified in Section 203(b) of the DGCL, the certificate of incorporation or bylaws of the corporation contain a provision expressly electing not to be governed by the provisions of the statute or the corporation does not have voting stock listed on a national securities exchange or held of record by more than 2,000 stockholders. We have not adopted any provision in our restated certificate of incorporation, as amended, or amended and restated bylaws electing not to be governed by the Delaware business combination statute. As a result, the statute is applicable to business combinations involving us.

Liability and Indemnification of Officers and Directors

Our restated certificate of incorporation, as amended, provides for indemnification of our directors and officers to the full extent permitted by applicable law. Our amended and restated bylaws also provide that directors and officers shall be indemnified against liabilities arising from their service as directors or

9

officers to the fullest extent per

mitted by law, which generally requires that the individual act in good faith and in a manner he or she reasonably believes to be in or not opposed to our best interests.

We have also entered into indemnification agreements with all of our directors and elected officers. The indemnification agreements provide that we will indemnify these officers and directors to the fullest extent permitted by our restated certificate of incorporation, as amended, amended and restated bylaws and applicable law. The indemnification agreements also provide that these officers and directors shall be entitled to the advancement of fees as permitted by applicable law and sets out the procedures required under the agreements for determining entitlement to and obtaining indemnification and expense advancement.

We also have director and officer liability insurance for the benefit of each of the above indemnitees. These policies include coverage for losses for wrongful acts and omissions. Each of the indemnitees are named as an insured under such policies and provided with the same rights and benefits as are accorded to the most favorably insured of our directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

PLAN OF DISTRIBUTION

The common stock offered under this prospectus will be offered solely by us and will be issued and sold upon the exercise of the Warrants described in this prospectus. The warrant holders must surrender payment in cash of the aggregate exercise price of the shares being acquired upon exercise of the Warrants. If, however, we are unable to offer and sell the shares underlying the Warrants pursuant to this prospectus due to the ineffectiveness of the registration statement of which this prospectus is a part, then the Warrants may only be exercised on a “net” or “cashless” basis. No fractional shares of common stock will be issued in connection with the exercise of a Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

LEGAL MATTERS

The validity of the common stock offered in this prospectus will be passed upon for us by Haynes and Boone, LLP, The Woodlands, Texas.

EXPERTS

The consolidated financial statements of TETRA Technologies, Inc. appearing in TETRA Technologies, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2018, and the effectiveness of TETRA Technologies, Inc.’s internal control over financial reporting as of December 31, 2018, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

10

TETRA Technologies, Inc.

11,155,000 Shares of Common Stock Underlying Warrants

PROSPECTUS

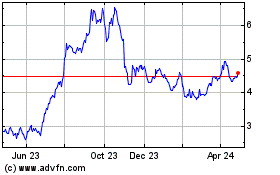

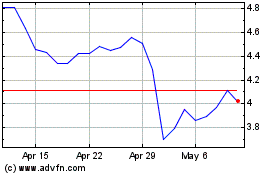

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024