Tenet Optimistic on 2012 Earnings - Analyst Blog

January 10 2012 - 9:52AM

Zacks

Yesterday, Tenet Healthcare Corp. (THC)

announced its projection of adjusted earnings before interest,

taxes, depreciation and amortization (EBITDA) to be within $1.2–1.3

billion.

Meanwhile, the adjusted EBITDA includes the deductions from

accounting changes to affect some deferred income recognized out of

certain Medicare Healthcare Information Technology (HIT) incentive

payments, which is expected to be about $31 million in 2012.

In November last year, management had reiterated its adjusted

EBITDA projection to be between $1.175 billion and $1.275 billion.

The company expects the upside to appear from cost reduction

through its ongoing Medicare Performance Initiative and an increase

its physicians. The outlook also reflects a growth projection in

Tenet’s Conifer service business.

The growth strategies discussed above are further expected to

negate the adverse effects of government reimbursements and macro

economic volatility. However, Tenet’s adjusted EBITDA dipped 3.9%

year over year to $195 million in the third quarter of 2011.

Adjusted EBITDA is expected to weaken again in the fourth

quarter of 2011, given the deferred recognition of revenues related

to HIT incentive payments worth $12 million, which resulted from a

change in the accounting method. Even an adverse affect of decline

in interest rate is expected to hurt adjusted EBITDA by about $7

million.

However, these will be partially offset by a year-over-year hike

in admissions and a flat growth in outpatient visits. Additionally,

a net favorable impact of $28 million related to the California

Provider Fee Six-Month program is also expected in the fourth

quarter of 2011.

Earnings Review

In November last year, Tenet reported its third-quarter

operating earnings of $16 million or 4 cents per share, beating the

Zacks

Consensus Estimate of 1 cent and operating loss of $14 million or 1

cent per share in the prior-year quarter.

The improved results were due to a growth in admissions,

outpatient visits and surgeries, which were partly offset by the

rise in bad debt and operating expenses.

The Zacks Consensus Estimate for fourth-quarter earnings is

pegged at 14 cents per share, up about 41% from the year-ago

quarter. For 2011, Tenet’s earnings are expected to be 42 cents per

share, growing about 3% from 2010.

Management expects to announce its detailed growth guidance for

2012 on February 28, 2012, when the company is scheduled to release

the results for its fourth quarter and full year 2011.

Tenet competes with HCA Inc. (HCA) and

Community Health Systems Inc. (CYH). The company

carries a Zacks #2 Rank, which implies a short-term Buy rating and

a long term Outperform stance.

On Monday, the shares of Tenet closed at $5.10, up 2.2%, on the

New York Stock Exchange.

COMMNTY HLTH SY (CYH): Free Stock Analysis Report

HCA HOLDINGS (HCA): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

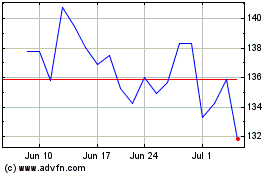

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Sep 2024 to Oct 2024

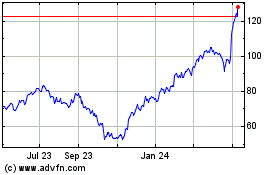

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Oct 2023 to Oct 2024