Vivo Participacoes S.A. - Report of Foreign Issuer (6-K)

May 02 2008 - 3:00PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For the month

of May, 2008

Commission File Number

1-14493

VIVO PARTICIPAÇÕES S.A.

(Exact

name of registrant as specified in its charter)

VIVO Holding Company

(Translation

of Registrant's name into English)

Av. Roque Petroni Jr., no.1464, 6

th

floor – part, "B"building

04707-000 - São Paulo, SP

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under

cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check

mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

FIRST QUARTER 2008 CONSOLIDATED RESULTS

April 30, 2008

–

VIVO Participações S.A. announces today its consolidated results for the first quarter 2008 (1Q08). The Company’s operating and financial information, except as otherwise indicated, is presented in Brazilian reais in accordance with Brazilian Corporate Law, and the comparable figures refer to the first quarter 2007 (1Q07), except as otherwise mentioned.

In the first quarter 2008, Vivo continued to keep its leadership position on the Brazilian market in number of customers, which will be further increased after the conclusion of the purchase of Telemig Celular Participações on April 03, 2008. From now on, Vivo will definitely operate in one of the largest Brazilian states and broaden its coverage with the best connection quality in Brazil. Around 4 million customers of Telemig Celular will be added to Vivo’s customer base, making up a community of 38 million customers, which places Vivo among the 15 largest world operators. With the slogan “

What is good can become even better

”, Vivo marks its arrival to Minas Gerais state.

|

Prices as of

04/29/2008

Per share

ON - VIVO3 - R$ 12.50

PN - VIVO4 - R$ 11.10

ADR – VIV – US$ 6.53

Free Float- ON Shares 10.7%

Free Float- PN Shares 52.0%

Free Float- Total 36.9%

Treasury Shares 0.3%

Controlling Group 62.8%

Total ON Shares 524,931,665

Total PN Shares 917,186,080

Market Cap R$ 15,944 million as of 03/31/2008

|

HIGHLIGHTS

-

In March, the

customer base

reached 34,323 thousand customers, ensuring its leadership with a 27.3% market share.

-

The

GSM

operation

reached more than 14.6 million

accesses in this technology, representing more than 42% of the total customer base, a 30.4% growth over 4Q07;

-

Vivo has the biggest handset distribution network, with more than

8,800 points of sale

, and more than

412 thousand recharge points

in March 2008, thus contributing to keep its leadership in its whole operational area;

-

Service Revenue

of R$3,022.6 million, an increase of 15.8% over 1Q07 and of 1.2% over 4Q07;

-

Self-supported data and VAS revenue, which grew 47.7% in relation to 1Q07, representing 10.4% of the net service revenue in 1Q08;

-

BITDA margin

in the quarter of 28.8% growing 2.3 percentage points over 1Q07.

EBITDA

reaching R$ 961.2 million, the highest recorded in the last five quarters, representing a growth of 27.0%. In the comparison over 4Q07, the

EBITDA

grew 5.8%;

-

The

operating cash flow

recorded R$ 704.6 million, a growth of 35.1% in relation to 1Q07, evidencing the growth and capacity to generate resources to finance the development of the company;

-

The

net debt

recorded the amount of

R$2,907.7

million in 1Q08, representing a reduction of 12.0% in relation to 1Q07, as a result of the increase in available resources. The FISTEL fee was paid in this quarter, while in 2007 it was paid in the second quarter;

-

For the third consecutive quarter the company recorded

Net Profit

, which reached

R$ 89.6 million

in the quarter, reversing the negative result recorded in 1Q07 and an increase of 216.6% in relation to 4Q07.

|

MESSAGE FROM THE CHIEF EXECUTIVE OFFICER

The continuous good results achieved led us to our best performance in the last 5 quarters, confirming our strategy to be the best quality option for the services provided, anchored on three basic pillars: network quality, billing and recharge and customer service.

This made it possible to improve our relationship with costumers and made Vivo the company with the lowest number of complaints filed with Anatel. In addition, we were awarded a quality prize for the services provided, increased our employees' satisfaction and the confidence of our shareholders and investors.

All this has placed Vivo in a privileged condition to face the growth and stimulation of competition with the arrival of the number portability.

The indicators reported here today are little demonstrations of trust, established on a daily basis by all the agents of a social network of which Vivo is a member. We would like to thank all these publics for their most varied contributions given to help us build what we are: a Quality Signal company.

ROBERTO LIMA

CEO

Basis for presentation of results

Figures disclosed are subject to differences, due to rounding-up procedures. Some information disclosed for 4Q07 and 1Q07 were re-classified, always as applicable. Vivo’s accounting criteria kept stable.

|

HIGHLIGHTS

|

|

|

|

|

|

|

|

|

R$ million

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

|

|

|

|

|

|

|

Net operating revenue

|

3,332.0

|

3,372.2

|

-1.2%

|

2,850.8

|

16.9%

|

|

Net service revenues

|

3,022.6

|

2,986.4

|

1.2%

|

2,609.3

|

15.8%

|

|

Net handset revenues

|

309.4

|

385.8

|

-19.8%

|

241.5

|

28.1%

|

|

Total operating costs

|

(2,370.8)

|

(2,463.9)

|

-3.8%

|

(2,093.8)

|

13.2%

|

|

EBITDA

|

961.2

|

908.3

|

5.8%

|

757.0

|

27.0%

|

|

EBITDA Margin (%)

|

28.8%

|

26.9%

|

1.9 p.p.

|

26.6%

|

2.3 p.p.

|

|

Depreciation and amortization

|

(663.5)

|

(721.7)

|

-8.1%

|

(571.0)

|

16.2%

|

|

EBIT

|

297.7

|

186.6

|

59.5%

|

186.0

|

60.1%

|

|

Net income

|

89.6

|

28.3

|

216.6%

|

(19.3)

|

n.a.

|

|

|

|

|

|

|

|

|

Capex

|

256.6

|

977.1

|

-73.7%

|

235.4

|

9.0%

|

|

Capex over net revenues

|

7.7%

|

29.0%

|

-21.3 p.p.

|

8.3%

|

-0.7 p.p.

|

|

Operating cash flow

|

704.6

|

(68.8)

|

n.a.

|

521.6

|

35.1%

|

|

Change in working capital

|

(1,001.0)

|

723.3

|

n.a.

|

(125.2)

|

699.5%

|

|

|

|

|

|

|

|

|

Customers (thousand)

|

34,323

|

33,484

|

2.5%

|

29,030

|

18.2%

|

|

Net additions (thousand)

|

839

|

2,164

|

-61.2%

|

(23)

|

n.a.

|

Operating Cash Flow

|

Operating cash generation 35.1% higher than in 1Q07.

|

Operating cash flow (EBITDA-CAPEX) of R$ 704.6 million in the quarter, representing a growth of 35.1% in relation to 1Q07 and reverting the negative result recorded in 4Q07, evidences the generation of resources from operations. The operating cash flow plus the change in working capital recorded an expense of R$ 296.4 million in 1Q08 as a result of cash consumption for payment of the Fistel Fee in March, in the amount of R$ 463.8 million.

|

Capital Expenditures (CAPEX)

|

Investments were concentrated in enhancing the Network capacity and quality

|

Vivo has continued to expand its coverage in order to meet the increase in the customer base and expansion of the GSM network, covering 2,324 municipalities, already exceeding the number of municipalities served by CDMA network. For achieving this goal, it invested R$ 256.6 million in 1Q08, which represents 7.7% of its net revenue. This investment made it possible for Vivo to keep its coverage leadership and achieve Anatel’s quality goals.

|

|

CAPEX - VIVO

|

|

|

|

|

R$ million

|

|

|

|

|

|

1 Q 07

|

4 Q 07

|

1 Q 07

|

|

|

|

|

|

|

Network

|

135.6

|

662.4

|

98.1

|

|

Technology / Information System

|

36.6

|

129.0

|

43.8

|

|

Products and Services, Channels, Administrative and others

|

84.4

|

185.7

|

93.5

|

|

Total

|

256.6

|

977.1

|

235.4

|

|

|

|

|

|

|

% Net Revenues

|

7.7%

|

29.0%

|

8.3%

|

|

CONSOLIDATED OPERATING PERFORMANCE - VIVO

|

|

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

|

|

|

|

|

|

|

Total number of customers (thousand)

|

34,323

|

33,484

|

2.5%

|

29,030

|

18.2%

|

|

Contract

|

6,473

|

6,247

|

3.6%

|

5,653

|

14.5%

|

|

Prepaid

|

27,850

|

27,237

|

2.3%

|

23,377

|

19.1%

|

|

Market Share (*)

|

36.2%

|

36.7%

|

-0.5 p.p.

|

37.4%

|

-1.2 p.p.

|

|

Net additions (thousand)

|

839

|

2,164

|

-61.2%

|

(23)

|

n.a.

|

|

Market Share of net additions (*)

|

22.2%

|

34.2%

|

-12.0 p.p.

|

-1.8%

|

24.0 p.p.

|

|

Market penetration

|

68.0%

|

65.6%

|

2.4 p.p.

|

56.0%

|

12.0 p.p.

|

|

|

|

|

|

|

|

|

SAC (R$)

|

95

|

103

|

-7.8%

|

100

|

-5.0%

|

|

|

|

|

|

|

|

|

Monthly Churn

|

2.6%

|

2.1%

|

0.5 p.p.

|

2.6%

|

0.0 p.p.

|

|

ARPU (in R$/month)

|

29.8

|

31.1

|

-4.2%

|

30.0

|

-0.7%

|

|

ARPU Inbound

|

13.3

|

13.7

|

-2.9%

|

13.9

|

-4.3%

|

|

ARPU Outgoing

|

16.5

|

17.4

|

-5.2%

|

16.1

|

2.5%

|

|

Total MOU (minutes)

|

75

|

80

|

-6.3%

|

75

|

0.0%

|

|

MOU Inbound

|

33

|

36

|

-8.3%

|

36

|

-8.3%

|

|

MOU Outgoing

|

42

|

44

|

-4.5%

|

39

|

7.7%

|

|

|

|

|

|

|

|

|

Employees

|

5,582

|

5,600

|

-0.3%

|

5,735

|

-2.7%

|

(*) source: Anatel

OPERATING HIGHLIGHS

|

Signal and coverage quality, besides leadership and pioneering activity, contributed to the growth of the customer base.

VIVO launched the first handset with exclusive software for visually disabled people.

|

-

The customer base at the end of the 1Q08 reached 34,323 thousand customers, of which more than 14.6 million in GSM/EDGE technology, representing an increase of 18.2% in relation to 1Q07 and 2.5% in relation to the previous quarter. The competitive positioning, quality leadership and the portfolio of plans and handsets contributed to such growth.

-

Net additions in 1Q08 totaled 839 thousand new customers, with a market share of net additions of 22.2% in its operational area, keeping its market leadership, reverting the scenario in 1Q07 when Vivo started its GSM operations. Once again the activations of GSM/EDGE technology, which represents 83% of the total, contributed to the steady and consistent growth.

-

In an innovating action on the Brazilian market, Vivo launched in March a handset accessible for visually disabled people – Nokia E65 Talks model, which is provided with Talks (vocalizer) software already installed in the cell phone. Being available to consumers in the whole operational area of the company, the handset is offered on a free-of-charge license basis for use of the referred software. This initiative strengthens Vivo’s commitment to making its products and services accessible to visually disabled people.

|

|

SAC reduction of 7.8% in relation to 4Q07.

|

-

SAC

of R$ 95 in the 1Q08 decreased by 5.0% in relation to 1Q07 and by 7.8% in relation to 4Q07 as a result of lower expenses with customer acquisition subsidies and a greater participation of handsets and SIM CARDS in the GSM technology, which have a lower cost. There was also a reduction in advertising and commission expenses due to the period's seasonality and since no relevant campaign was launched.

|

|

Churn remained stable in relation to 1Q07.

Quality of the customer base increased the outgoing ARPU

|

-

Churn

of 2.6% in the quarter, stable in relation to the same period of last year, showing that actions implemented with focus on customer loyalty and activation of the customer base were efficient, despite the intense commercial activity recorded between the two periods. In relation to 4Q07, the variation recorded was due to seasonality. The reward program has continued to contribute to customer loyalty, renewal of customer handsets and increased satisfaction with services rendered.

-

The

ARPU

of R$ 29.8 in the quarter was practically stable in relation to 1Q07, despite the 5.3 million customers increase in the period. As it can be seen, the outgoing ARPU increased by 2.5%, which is an evidence of better customer mix. The reduction recorded in relation to 4Q07 reflects particularly the seasonality in the quarter as well as the existence of less working days. The increase in the outgoing revenue is due mainly to higher adoption of data and voice services.

|

|

ON-NET traffic increase through specific campaigns.

Sustained growth of the outgoing traffic

.

|

-

The

Blended

MOU

remained stable in 1Q08 in relation to 1Q07. However, the outgoing MOU increased by 7.7%, a growth that resulted from higher outgoing traffic through usage incentive campaigns. In comparison with 4Q07 results, there was a 6.3% reduction because of the period seasonality.

-

The

total traffic

recorded a 15.9% growth in 1Q08

in relation to 1Q07, emphasizing the 24.0% growth in the outgoing traffic. In the comparison between 1Q08 and 4Q07, the total traffic was reduced by 1.1% due to the drop in the inbound traffic as a result of the period seasonality. The consistent evolution of the outgoing traffic since the first quarter of 2007 has contributed to keep use at the current levels.

|

|

NET OPERATING REVENUES - VIVO

|

|

|

According to Corporate Law

|

|

R$ million

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

Subscription and Usage

|

1,367.3

|

1,390.0

|

-1.6%

|

1,192.4

|

14.7%

|

|

Data revenue plus VAS

|

315.4

|

285.7

|

10.4%

|

213.6

|

47.7%

|

|

Network usage

|

1,312.4

|

1,286.6

|

2.0%

|

1,184.6

|

10.8%

|

|

Other services

|

27.5

|

24.1

|

14.1%

|

18.7

|

47.1%

|

|

Net service revenues

|

3,022.6

|

2,986.4

|

1.2%

|

2,609.3

|

15.8%

|

|

Net handset revenues

|

309.4

|

385.8

|

-19.8%

|

241.5

|

28.1%

|

|

Net Revenues

|

3,332.0

|

3,372.2

|

-1.2%

|

2,850.8

|

16.9%

|

OPERATING REVENUE

|

Consistent growth in the revenue from the outgoing traffic.

Growth of data revenue and VAS.

|

Total net revenue

grew 16.9% over 1Q07, due to the growth of 15.8% in the

service revenue,

which represents growth in all components. In relation to 4Q07, the total net revenue was reduced by 1.2%, especially due to the drop in the revenue from sales of handsets and for a lower commercial activity, slightly offset by the increase in the service revenue.

The increase of 14.7% in "

franchising and usage revenue

", when compared to 1Q07, is mainly due to the increase in the total outgoing revenue, which was due to the growth in the total outgoing traffic, by the incentive to usage and promotions, segmented campaigns and, especially, to the increase in the average recharge value per customer of 6.5%. When compared to 4Q07, there was 1.6% reduction due to seasonality.

Data revenue

plus

VAS

accounted for 10.4% of the service revenue in 1Q08, a 47.7% nominal increase over 1Q07. In the comparison between 1Q08 and 4Q07, it recorded an increase of 10.4%. The main reasons for this growth were: strong increase in the service revenue from Play, Java, SMS, as well as an increase in the base of Zap, Flash/Desk Modem, Black Berry and Smart Mail customers; increase in the use of person-to-person SMS, as a consequence of the increase of recharges with services and activations of post-paid plans with data advantages; incentive promotion for the usage of SMS Contents (interactivity actions on the TV and other media), and new partnerships with contents providers.

|

|

OPERATING COSTS - VIVO

|

|

|

According to Corporate Law

|

|

R$ million

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

Personnel

|

(159.8)

|

(181.7)

|

-12.1%

|

(173.7)

|

-8.0%

|

|

Cost of services rendered

|

(840.4)

|

(789.6)

|

6.4%

|

(716.4)

|

17.3%

|

|

Leased lines

|

(50.4)

|

(57.5)

|

-12.3%

|

(53.7)

|

-6.1%

|

|

Interconnection

|

(449.7)

|

(452.9)

|

-0.7%

|

(365.0)

|

23.2%

|

|

Rent/Insurance/Condominium fees

|

(52.0)

|

(45.0)

|

15.6%

|

(49.3)

|

5.5%

|

|

Fistel and other taxes and contributions

|

(145.0)

|

(127.6)

|

13.6%

|

(126.9)

|

14.3%

|

|

Third-party services

|

(125.7)

|

(103.2)

|

21.8%

|

(97.3)

|

29.2%

|

|

Others

|

(17.6)

|

(3.4)

|

417.6%

|

(24.2)

|

-27.3%

|

|

Cost of goods sold

|

(502.2)

|

(611.8)

|

-17.9%

|

(351.5)

|

42.9%

|

|

Selling expenses

|

(680.4)

|

(755.9)

|

-10.0%

|

(604.3)

|

12.6%

|

|

Provision for bad debt

|

(81.7)

|

(76.7)

|

6.5%

|

(107.4)

|

-23.9%

|

|

Third-party services

|

(465.3)

|

(555.6)

|

-16.3%

|

(399.9)

|

16.4%

|

|

Customer loyalty and donatios

|

(99.9)

|

(84.6)

|

18.1%

|

(63.3)

|

57.8%

|

|

Others

|

(33.5)

|

(39.0)

|

-14.1%

|

(33.7)

|

-0.6%

|

|

General & administrative expenses

|

(156.3)

|

(165.5)

|

-5.6%

|

(145.8)

|

7.2%

|

|

Third-party services

|

(130.5)

|

(140.3)

|

-7.0%

|

(119.6)

|

9.1%

|

|

Others

|

(25.8)

|

(25.2)

|

2.4%

|

(26.2)

|

-1.5%

|

|

Other operating revenue (expenses)

|

(31.7)

|

40.6

|

n.a.

|

(102.1)

|

-69.0%

|

|

Operating revenue

|

64.5

|

109.9

|

-41.3%

|

49.5

|

30.3%

|

|

Operating expenses

|

(89.1)

|

(55.4)

|

60.8%

|

(143.8)

|

-38.0%

|

|

Other operating revenue (expenses)

|

(7.1)

|

(13.9)

|

-48.9%

|

(7.8)

|

-9.0%

|

|

Total costs before depreciation / amortization

|

(2,370.8)

|

(2,463.9)

|

-3.8%

|

(2,093.8)

|

13.2%

|

|

Depreciation and amortization

|

(663.5)

|

(721.7)

|

-8.1%

|

(571.0)

|

16.2%

|

|

Total operating costs

|

(3,034.3)

|

(3,185.6)

|

-4.7%

|

(2,664.8)

|

13.9%

|

OPERATING COSTS

|

Structural costs stability.

|

The 17.3% increase in the

cost of the services rendered

in 1Q08, in comparison with 1Q07, is the result of a 23.2% increase in the interconnection costs caused by an increase in the total outgoing traffic, higher third party's service expenses, particularly for the plant maintenance, besides an increase in the Fistel fee. In comparison with 4Q07, the 6.4% increase was due mainly to the increase in third party's service costs, such as those related to plant maintenance and public services, besides the Fistel fee, rents, insurance and condominiums, partially offset by a reduction in the leased lines and interconnection costs.

|

|

Better commercial and operational efficiency

|

The

cost of goods sold

shows a 42.9% increase in 1Q08 in relation to the 1Q07 figures, which is partially due to the higher number of gross activations which represents a 55.9% growth. When compared to the 4Q07 it shows a reduction of 17.9%, due to greater business activities during the Christmas season. This variation is directly proportional to that of the revenue of goods sold.

|

|

|

In the 1Q08, the

selling expenses

showed a 12.6% increase over 1Q07, reflecting the increase in third parties’ service expenses, such as: advertising, publicity, donations, commissions, outsourced labor, besides the increased customer loyalty costs, partially offset by the provision for bad debt reduction. In a comparison with the 4Q07 figures, the commercial expenses showed a 10.0% reduction, particularly because of a decrease in third parties' service expenses, especially those related to sales support, which were partially affected by an increase in the provision for bad debt and customer loyalty.

|

|

Provision for bad debt control.

|

The

Provision for Bad Debt

in 1Q08 showed a reduction of 23.9%, an amount of R$ 81.7 million, representing 1.8% of the total gross revenue, a drop of 0.9 percentage points in relation to the 1Q07, which recorded 2.7% of the total gross revenue. When compared to 4Q07, which recorded R$ 76.7 million, there was a slight increase of 6.5%, remaining almost stable in relation to the percentage of the gross revenue, which was 1.6% in 4Q07. This result evidences the strict control exercised over new customers, improvement of the credit policy and on debt collection.

|

|

|

The

general and administrative expenses

showed a 7.2% increase in 1Q08 in relation to the 1Q07 figures, particularly because of an increase in third parties' service expenses, especially those related to technical assistance. In a comparison with 4Q07, there was a 5.6% reduction which resulted from a decrease in the expenses incurred with third parties' services, particularly outsourced labor, which were partially affected by an increase in the data processing and technical assistance expenses.

|

|

|

Other Operating Revenue / Expenses

recorded expenses of R$ 31.7 million. The drop of 69.0% in relation to 1Q07 arises from the reduction in the provision for contingencies, the reduction in the expenses with taxes, charges and contributions, in addition to the increase in the revenue from recovered expenses. The variation in comparison with 4Q07 which recorded a revenue of R$ 40.6 million was due to the increase in the revenue from recovered expenses, as a result of the reversal of PIS and COFINS due to the final and non-appeallable judgment (Law 9718/98), which recorded R$ 49 million.

|

EBITDA

|

EBITDA recorded an increase of 27.0% in the 1Q08.

|

The

EBITDA

(earnings before interests, taxes, depreciation and amortization) in the 1Q08 was R$ 961.2 million, an increase of 27.0% in relation to 1Q07, resulting in an EBITDA Margin of 28.8%. When compared to 4Q07, the EBITDA recorded a 5.8% increase, with an EBITDA Margin 1.9 percentage points higher. Such result recorded in 1Q08, the highest result in the last five quarters, reflects the revenue growth due to the increase in the customer base and to the strict cost control. This result was also achieved due to the cost of goods sold, which is explained by the sales of GSM handsets at lower acquisition cost.

|

DEPRECIATION AND AMORTIZATION

|

|

Depreciation and amortization

expenses recorded an increase of 16.2% when compared to 1Q07, in line with investments made in the period. In the comparison with the previous quarter, it recorded an 8.1% reduction, since the 4Q07 is impacted by accelerated depreciation in the TDMA technology.

|

|

FINANCIAL REVENUES (EXPENSES) - VIVO

|

|

|

According to Corporate Law

|

|

R$ million

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

Financial Revenues

|

75.3

|

38.1

|

97.6%

|

58.2

|

29.4%

|

|

Other financial revenues

|

75.3

|

60.9

|

23.6%

|

58.2

|

29.4%

|

|

(-) Pis/Cofins taxes on financial revenues

|

0.0

|

(22.8)

|

n.a.

|

0.0

|

n.a.

|

|

Financial Expenses

|

(122.2)

|

(156.1)

|

-21.7%

|

(185.4)

|

-34.1%

|

|

Other financial expenses

|

(96.6)

|

(110.6)

|

-12.7%

|

(109.8)

|

-12.0%

|

|

Gains (Losses) with derivatives transactions

|

(25.6)

|

(45.5)

|

-43.7%

|

(75.6)

|

-66.1%

|

|

Exchange rate variation / Monetary variation

|

(23.6)

|

6.6

|

n.a.

|

8.5

|

n.a.

|

|

Net Financial Income

|

(70.5)

|

(111.4)

|

-36.7%

|

(118.7)

|

-40.6%

|

|

Reduction of 40.6% in financial expenses in the 1Q08 over the 1Q07

|

VIVO Participações’

net financial expenses

in the 1Q08 was reduced by R$ 40.9 million in relation to 4Q07. This variation is mainly explained by the extraordinary effect of the assessment of PIS/COFINS (R$ 22.8 million in the 4Q07) on the allocation of Interest on Own Capital, the extinguishment of the CPMF tax assessment (R$ 15.2 million in the 4Q07), besides a reduction in interest rates effective in the period (2.53% in the 1Q08 and 2.58% in the 4Q07).

In comparison with the 1Q07, there was also a reduction of R$ 48.2 million in the net financial expense, due to the drop in the net debt, benefited by generation of operational cash by the Company, as well as lower interest rate effective in the period (2.53% in 1Q08 and 3.03% in 1Q07), in addition to extinguishment of CPMF assessment in 2008 (R$ 14.3 million in 1Q07).

|

|

LOANS AND FINANCING - VIVO

|

|

|

CURRENCY

|

|

|

Lenders (R$ million)

|

R$

|

URTJLP *

|

UMBND **

|

US$

|

Yen

|

Total

|

|

|

|

|

|

|

|

|

|

Financial institutions

|

1,943.4

|

675.6

|

9.1

|

1,083.3

|

1,068.5

|

4,779.9

|

|

Fixcel – TCO’s Acquisition

|

23.5

|

0.0

|

0.0

|

0.0

|

0.0

|

23.5

|

|

Total

|

1,966.9

|

675.6

|

9.1

|

1,083.3

|

1,068.5

|

4,803.4

|

|

Exchange rate used

|

|

1.968139

|

0.033942

|

1.749100

|

0.017547

|

|

|

|

|

|

|

|

|

|

|

Payment Schedule - Long Term

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

228.5

|

54.7

|

2.0

|

0.0

|

51.6

|

336.9

|

|

as from 2008

|

1,134.1

|

594.1

|

4.3

|

638.7

|

23.6

|

2,394.8

|

|

Total

|

1,362.6

|

648.8

|

6.3

|

638.7

|

75.2

|

2,731.7

|

|

NET DEBT - VIVO

|

|

|

Mar 31.08

|

Dec 31.07

|

Mar 31.07

|

|

Short Term

|

2,071.7

|

1,984.0

|

1,283.4

|

|

Long Term

|

2,731.7

|

2,397.4

|

2,773.8

|

|

Total debt

|

4,803.4

|

4,381.4

|

4,057.2

|

|

Cash and cash equivalents

|

(2,236.0)

|

(2,250.5)

|

(1,241.6)

|

|

Derivatives

|

340.3

|

448.4

|

489.5

|

|

Net Debt

|

2,907.7

|

2,579.3

|

3,305.1

|

(*) BNDES long term interest rate unit

(**) UMBND - prepared by the BNDES, it is a basket of foreign currencies unit, US dollar predominant

|

Reduction in net debt by 12.0% in the comparison between 1Q08 and 1Q07

|

On March 31, 2008, VIVO’s loans and financing amounted R$ 4,803.4 million (R$ 4,057.2 million at March 31, 2007), 45.0% of which is denominated in foreign currency. The Company has executed hedge contracts thus protecting 100% of its financial debt against foreign exchange volatility, so that the final cost (debt and swap) is Reais-referenced. This debt was offset by the Company’s available cash and financial investments, R$ 2,236.0 million (R$1,241.6 million at March 31, 2007), as well as by derivative assets and liabilities of R$ 340.3 million (R$ 489.5 million at March 31, 2007) payable, finally resulting in a net debt of R$ 2,907.7 million. Additionally, the Company has entered into “swap“ transactions – CDI Post x Pre fixed, in order to partially protect it against fluctuations in domestic interest rates. Covered transactions totaled R$ 109.5 million. (R$ 871.0 million at March 31, 2007).

|

|

|

The 12.0% reduction in the Net Debt in the comparison between the 1Q08 and the 1Q07 was due to the generation of operating cash by the Company in the period. Considering that the TFF (Fistel Operation Fee), the annual fee assessed on the customer base and active radiobase stations at the end of the previous year 2007 (R$ 419.7 million) was paid in April because 03/31/2007 was a Saturday; therefore, equalizing the comparison basis, the reduction in the Net Debt would have been 21.9%.

|

|

Fistel Fee increases net debt.

|

The increase of VIVO’s net debt in 1Q08 over 4Q07 is mainly due to the payment of R$ 463.8 million on the last day of March referring to TFF.

|

|

|

Net Profit of R$ 89.6 million in the quarter, reverting the negative result recorded in 1Q07 and an increase of 216.6% in relation to 4Q07. Likewise, the operating profit (EBIT), recorded an increase of 60.1% and 59.5% when compared to 1Q07 and 4Q07, respectively, recording R$ 297.7 million in the quarter.

|

|

Capital Market.

|

The shares of Vivo Participações were traded in 100% of the trading floor sessions of the São Paulo Stock Exchange and of the New York Stock Exchange in this quarter, with the common shares having devaluated by 7.7% while the preferred shares appreciated by 8.7%, always in comparison with the last trading day in the quarter.

|

|

CAPITAL STOCK OF VIVO PARTICIPAÇÕES S.A. on March 31, 2008

|

|

Shareholders

|

Common Shares

|

Preferred Shares

|

TOTAL

|

|

Portelcom Participações S.A.

|

67,349,733

|

12.8%

|

1,843

|

0.0%

|

67,351,576

|

4.7%

|

|

Brasilcel, N.V.

|

222,877,507

|

42.5%

|

364,350,055

|

39.7%

|

587,227,562

|

40.7%

|

|

Sudestecel Participações LTDA

|

88,255,178

|

16.8%

|

1,224,498

|

0.1%

|

89,479,676

|

6.2%

|

|

Avista Participações LTDA

|

9,630,458

|

1.8%

|

46,613,811

|

5.1%

|

56,244,269

|

3.9%

|

|

TBS Celular Participações LTDA

|

68,818,554

|

13.1%

|

1,165,797

|

0.1%

|

69,984,351

|

4.9%

|

|

Tagilo Participações LTDA

|

12,061,046

|

2.3%

|

22,625,728

|

2.5%

|

34,686,774

|

2.4%

|

|

Controlling Shareholder Group

|

468,992,476

|

89.3%

|

435,981,732

|

47.5%

|

904,974,208

|

62.8%

|

|

Treasury shares

|

0

|

0.0%

|

4,494,900

|

0.5%

|

4,494,900

|

0.3%

|

|

Others shareholders

|

55,939,189

|

10.7%

|

476,709,448

|

52.0%

|

532,648,637

|

36.9%

|

|

TOTAL

|

524,931,665

|

100.0%

|

917,186,080

|

100.0%

|

1,442,117,745

|

100.0%

|

|

Subsequent events

|

On April 03, Vivo communicated that all conditions and formalities required for the acquisition of shares in Telemig Celular Participações and, indirectly, of its controlled company Telemig Celular, as set forth in the stock purchase agreement entered into August 02, 2007 with Telpart Participações S.A., were satisfied, with the payment of the total amount of R$1.23 billion being effected on that date, whereby it undertook the direct share control in Telemig Celular Participações.

On April 08, Vivo published an Invitation to Bid for the Voluntary Public Offering (VTO) for acquisition of up to 1/3 of the outstanding preferred shares of Telemig Celular Participações and of Telemig Celular and in the case of Telemig Celular Participações the offering will be made to holders of ADS’s in the US market. The price, which corresponds to a premium of approximately twenty-five per cent (25%) on the weighted average of the prices of Preferred Shares of the respective companies, recorded in the last thirty (30) floor sessions of the BOVESPA prior to and including August 01, 2007, will be six hundred and fifty-four reais and seventy-two cents (R$ 654.72) per preferred share of Telemig Celular and sixty-three reais and ninety cents (R$ 63.90) per preferred share of Telemig Celular Participações.

On April 11, the application for registration of the MTO (Mandatory Tender Offer) by Sale of the Share Control was file, for purchase of all the outstanding common shares of Telemig Celular Participações and of Telemig Celular, containg a draft invitation to bid. The actual launching of the Offering is subject to registration with and authorization by the CVM and BOVESPA, under the terms of CVM Instruction no. 361/02. As soon as the registration of such offering is granted by CVM, Vivo Part will cause a full invitation to bid to be published in the relevant newspapers, containing the final information.

On April 14, Vivo Part executed a stock purchase agreement with Vivo S.A. for acquisition of 100% of the capital stock of TCO IP S.A., with the latter becoming a wholly-owned subsidiary of Vivo Part. The acquisition was effected based on the shareholders’ equity recorded in the balance sheet as of March 31, 2008, in the total amount of R$ 146,067.11, with cash payment within up to five business days from the execution of the agreement.

More information about the transactions, public offerings of common shares and voluntary public offerings of preferred shares is available in Vivo’s web site – Investor Relations (

www.vivo.com.br/ri

).

|

|

CONSOLIDATED BALANCE SHEET - VIVO

|

|

R$ million

|

|

|

ASSETS

|

Mar 31. 08

|

|

Dec 31. 07

|

Δ%

|

|

|

|

|

|

|

|

Current Assets

|

7,087.5

|

|

6,821.3

|

3.9%

|

|

Cash and banks

|

24.8

|

|

328.3

|

-92.4%

|

|

Temporary cash investments

|

2,158.1

|

|

1,862.7

|

15.9%

|

|

Temporary cash investments (collateral)

|

33.4

|

|

32.4

|

3.1%

|

|

Net accounts receivable

|

2,027.7

|

|

2,178.7

|

-6.9%

|

|

Inventory

|

384.9

|

|

376.6

|

2.2%

|

|

Prepayment to Suppliers

|

1.7

|

|

0.8

|

112.5%

|

|

Deferred and recoverable taxes

|

1,704.6

|

|

1,614.4

|

5.6%

|

|

Derivatives transactions

|

14.9

|

|

0.9

|

n.a

|

|

Prepaid Expenses

|

566.6

|

|

228.9

|

147.5%

|

|

Other current assets

|

170.8

|

|

197.6

|

-13.6%

|

|

|

|

|

|

|

|

Non- Current Assets

|

10,738.4

|

|

11,269.9

|

-4.7%

|

|

Long Term Assets:

|

|

|

|

|

|

Temporary cash investments (as collateral)

|

19.7

|

|

27.1

|

-27.3%

|

|

Deferred and recoverable taxes

|

2,291.6

|

|

2,433.9

|

-5.8%

|

|

Derivatives transactions

|

28.1

|

|

3.8

|

639.5%

|

|

Prepaid Expenses

|

56.2

|

|

59.9

|

-6.2%

|

|

Other long term assets

|

32.4

|

|

26.5

|

22.3%

|

|

Investment

|

589.6

|

|

667.5

|

-11.7%

|

|

Plant, property and equipment

|

6,044.0

|

|

6,301.4

|

-4.1%

|

|

Net intangible assets

|

1,596.9

|

|

1,660.3

|

-3.8%

|

|

Deferred assets

|

79.9

|

|

89.5

|

-10.7%

|

|

|

|

|

|

|

|

Total Assets

|

17,825.9

|

|

18,091.2

|

-1.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

6,163.9

|

|

6,877.2

|

-10.4%

|

|

Personnel, tax and benefits

|

111.3

|

|

173.5

|

-35.9%

|

|

Suppliers and Consignment

|

2,426.3

|

|

3,069.3

|

-20.9%

|

|

Taxes, fees and contributions

|

534.5

|

|

571.0

|

-6.4%

|

|

Loans and financing

|

2,071.7

|

|

1,984.0

|

4.4%

|

|

Interest on own capital and dividends

|

20.2

|

|

22.2

|

-9.0%

|

|

Contingencies provision

|

89.6

|

|

81.4

|

10.1%

|

|

Derivatives transactions

|

370.4

|

|

429.7

|

-13.8%

|

|

Other current liabilities

|

539.9

|

|

546.1

|

-1.1%

|

|

|

|

|

|

|

|

Non-Current Liabilities

|

3,273.5

|

|

2,916.4

|

12.2%

|

|

Long Term Liabilities:

|

|

|

|

|

|

Taxes, fees and contributions

|

191.4

|

|

181.4

|

5.5%

|

|

Loans and financing

|

2,731.7

|

|

2,397.4

|

13.9%

|

|

Contingencies provision

|

128.3

|

|

118.0

|

8.7%

|

|

Derivatives transactions

|

12.9

|

|

23.5

|

-45.1%

|

|

Other long term liabilities

|

209.2

|

|

196.1

|

6.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder's Equity

|

8,388.5

|

|

8,297.6

|

1.1%

|

|

|

|

|

|

|

|

Total Liabilities and Shareholder's Equity

|

17,825.9

|

|

18,091.2

|

-1.5%

|

|

CONSOLIDATED INCOME STATEMENTS - VIVO

|

|

|

According to Corporate Law

|

|

R$ million

|

1 Q 08

|

4 Q 07

|

Δ%

|

1 Q 07

|

Δ%

|

|

Gross Revenues

|

4,607.3

|

4,747.9

|

-3.0%

|

3,964.3

|

16.2%

|

|

Gross service revenues

|

3,952.9

|

3,923.6

|

0.7%

|

3,419.1

|

15.6%

|

|

Deductions – Taxes and others

|

(930.3)

|

(937.2)

|

-0.7%

|

(809.8)

|

14.9%

|

|

Gross handset revenues

|

654.4

|

824.3

|

-20.6%

|

545.2

|

20.0%

|

|

Deductions – Taxes and others

|

(345.0)

|

(438.5)

|

-21.3%

|

(303.7)

|

13.6%

|

|

|

|

|

|

|

|

|

Net Revenues

|

3,332.0

|

3,372.2

|

-1.2%

|

2,850.8

|

16.9%

|

|

Net service revenues

|

3,022.6

|

2,986.4

|

1.2%

|

2,609.3

|

15.8%

|

|

Franchise and Usage

|

1,367.3

|

1,390.0

|

-1.6%

|

1,192.4

|

14.7%

|

|

Data revenue plus VAS

|

315.4

|

285.7

|

10.4%

|

213.6

|

47.7%

|

|

Network usage

|

1,312.4

|

1,286.6

|

2.0%

|

1,184.6

|

10.8%

|

|

Other services

|

27.5

|

24.1

|

14.1%

|

18.7

|

47.1%

|

|

Net handset revenues

|

309.4

|

385.8

|

-19.8%

|

241.5

|

28.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Costs

|

(2,370.8)

|

(2,463.9)

|

-3.8%

|

(2,093.8)

|

13.2%

|

|

Personnel

|

(159.8)

|

(181.7)

|

-12.1%

|

(173.7)

|

-8.0%

|

|

Cost of services rendered

|

(840.4)

|

(789.6)

|

6.4%

|

(716.4)

|

17.3%

|

|

Leased lines

|

(50.4)

|

(57.5)

|

-12.3%

|

(53.7)

|

-6.1%

|

|

Interconnection

|

(449.7)

|

(452.9)

|

-0.7%

|

(365.0)

|

23.2%

|

|

Rent/Insurance/Condominium fees

|

(52.0)

|

(45.0)

|

15.6%

|

(49.3)

|

5.5%

|

|

Fistel and other taxes and contributions

|

(145.0)

|

(127.6)

|

13.6%

|

(126.9)

|

14.3%

|

|

Third-party services

|

(125.7)

|

(103.2)

|

21.8%

|

(97.3)

|

29.2%

|

|

Others

|

(17.6)

|

(3.4)

|

417.6%

|

(24.2)

|

-27.3%

|

|

Cost of handsets

|

(502.2)

|

(611.8)

|

-17.9%

|

(351.5)

|

42.9%

|

|

Selling expenses

|

(680.4)

|

(755.9)

|

-10.0%

|

(604.3)

|

12.6%

|

|

Provision for bad debt

|

(81.7)

|

(76.7)

|

6.5%

|

(107.4)

|

-23.9%

|

|

Third-party services

|

(465.3)

|

(555.6)

|

-16.3%

|

(399.9)

|

16.4%

|

|

Costumer loyalty and donations

|

(99.9)

|

(84.6)

|

18.1%

|

(63.3)

|

57.8%

|

|

Others

|

(33.5)

|

(39.0)

|

-14.1%

|

(33.7)

|

-0.6%

|

|

General & administrative expenses

|

(156.3)

|

(165.5)

|

-5.6%

|

(145.8)

|

7.2%

|

|

Third-party services

|

(130.5)

|

(140.3)

|

-7.0%

|

(119.6)

|

9.1%

|

|

Others

|

(25.8)

|

(25.2)

|

2.4%

|

(26.2)

|

-1.5%

|

|

Other operating revenue (expenses)

|

(31.7)

|

40.6

|

n.a.

|

(102.1)

|

-69.0%

|

|

Operating revenue

|

64.5

|

109.9

|

-41.3%

|

49.5

|

30.3%

|

|

Operating expenses

|

(89.1)

|

(55.4)

|

60.8%

|

(143.8)

|

-38.0%

|

|

Other operating revenue (expenses)

|

(7.1)

|

(13.9)

|

-48.9%

|

(7.8)

|

-9.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

961.2

|

908.3

|

5.8%

|

757.0

|

27.0%

|

|

Margin %

|

28.8%

|

26.9%

|

1.9 p.p.

|

26.6%

|

2.3 p.p.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and Amortization

|

(663.5)

|

(721.7)

|

-8.1%

|

(571.0)

|

16.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

297.7

|

186.6

|

59.5%

|

186.0

|

60.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Financial Income

|

(70.5)

|

(111.4)

|

-36.7%

|

(118.7)

|

-40.6%

|

|

Financial Revenues

|

75.3

|

38.1

|

97.6%

|

58.2

|

29.4%

|

|

Other financial revenues

|

75.3

|

60.9

|

23.6%

|

58.2

|

29.4%

|

|

(-) Pis/Cofins taxes on financial revenues

|

0.0

|

(22.8)

|

n.a.

|

0.0

|

n.a.

|

|

Financial Expenses

|

(122.2)

|

(156.1)

|

-21.7%

|

(185.4)

|

-34.1%

|

|

Other financial expenses

|

(96.6)

|

(110.6)

|

-12.7%

|

(109.8)

|

-12.0%

|

|

Gains (Losses) with derivatives transactions

|

(25.6)

|

(45.5)

|

-43.7%

|

(75.6)

|

-66.1%

|

|

Exchange rate variation / Monetary variation

|

(23.6)

|

6.6

|

n.a.

|

8.5

|

n.a.

|

|

Non-operating revenue/expenses

|

0.3

|

(13.4)

|

n.a.

|

(0.9)

|

n.a.

|

|

Taxes

|

(137.9)

|

(33.5)

|

311.6%

|

(85.7)

|

60.9%

|

|

Minority Interest

|

0.0

|

0.0

|

n.a.

|

0.0

|

n.a.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

89.6

|

28.3

|

216.6%

|

(19.3)

|

n.a.

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(In thousands of Brazilian reais)

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

1Q 08

|

|

4Q 07

|

|

1Q 07

|

|

Net income (loss)

|

89,609

|

|

28,354

|

|

(19,334)

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income (loss) to cash

|

|

|

|

|

|

|

provided by operating activities:

|

|

|

|

|

|

|

Depreciation and amortization

|

663,779

|

|

610,925

|

|

571,338

|

|

(Gain) loss on property, plant and equipment disposals

|

(407)

|

|

13,284

|

|

835

|

|

Loss in forward, swap and option contracts

|

(75,324)

|

|

71,363

|

|

163,079

|

|

Monetary and exchange variation

|

118,311

|

|

(32,085)

|

|

(89,293)

|

|

Allowance for doubtful accounts receivable

|

81,714

|

|

76,775

|

|

107,401

|

|

Reserve for pension and other post-retirementbenefit plans

|

101

|

|

959

|

|

402

|

|

|

|

|

|

|

|

|

(Increase) decrease in operational assets:

|

|

|

|

|

|

|

Trade accounts receivable

|

69,360

|

|

(225,963)

|

|

(20,686)

|

|

Inventories

|

(8,251)

|

|

35,497

|

|

19,530

|

|

Deferred and recoverable taxes

|

52,112

|

|

45,830

|

|

123,243

|

|

Other current and noncurrent assets

|

(307,751)

|

|

(89,562)

|

|

(296,454)

|

|

|

|

|

|

|

|

|

(Increase) decrease in operational liabilities:

|

|

|

|

|

|

|

Payroll and related accruals

|

(62,166)

|

|

16,660

|

|

(13,569)

|

|

Trade accounts payable

|

(643,024)

|

|

662,564

|

|

(25,955)

|

|

Interest payable

|

25,344

|

|

(9,613)

|

|

9,225

|

|

Taxes payable

|

(26,449)

|

|

39,495

|

|

15,430

|

|

Reserve for contingencies

|

18,544

|

|

3,851

|

|

51,253

|

|

Other current and noncurrent liabilities

|

4,853

|

|

143,315

|

|

(39,100)

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

355

|

|

1,391,649

|

|

557,345

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

Additions to property, plant and equipment and intangible

|

(253,161)

|

|

(973,000)

|

|

(232,848)

|

|

Additions to deferred assets

|

(2,113)

|

|

(1,324)

|

|

(41)

|

|

Cash received on sale of property, plant and equipment

|

1,601

|

|

2,050

|

|

610

|

|

Net cash provided by investing activities

|

(253,673)

|

|

(972,274)

|

|

(232,279)

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

New loans and debentures obtained

|

547,862

|

|

804,156

|

|

47,249

|

|

Loans paid

|

(269,606)

|

|

(419,437)

|

|

(410,366)

|

|

Net settlement on derivative contracts

|

(32,799)

|

|

(130,558)

|

|

(174,143)

|

|

Interest on shareholders’ equity and dividends paid to minorities

|

(181)

|

|

(16,388)

|

|

(415)

|

|

Net cash from (used in) financing activities

|

245,276

|

|

237,773

|

|

(537,675)

|

|

|

|

|

|

|

|

|

INCREASE IN CASH AND CASH EQUIVALENTS

|

(8,042)

|

|

657,148

|

|

(212,609)

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS

|

|

|

|

|

|

|

At the beginning of the year

|

2,190,990

|

|

1,533,842

|

|

1,401,996

|

|

At the end of the year

|

2,182,948

|

|

2,190,990

|

|

1,189,387

|

|

|

(8,042)

|

|

657,148

|

|

(212,609)

|

CONFERENCE CALL – 1Q08

In Portuguese

Date:

April 30, 2008 (Wednesday)

Time:

09:00 a.m. (Brasília time) and 08:00 a.m. (New York time)

Telephone number

:

(11) 2188-0188

Conference Call Code

:

VIVO

Webcast

:

www.vivo.com.br/ir

The conference call audio replay will be available at telephone number (11) 2188-0188

code: VIVO or in our website.

CONFERENCE CALL – 1Q08

In English

Date:

April 30, 2008 (Wednesday)

Time:

09:00 a.m. (Brasília time) and 08:00 a.m. (New York time)

Telephone number

:

(+1 973) 935-8893

Conference Call Code

:

VIVO

or 44508423

Webcast

:

www.vivo.com.br/ir

The conference call audio replay will be available at telephone number (+1 706) 645-9291

code: 44508423 or in our website

|

VIVO – Investor Relations

|

|

Ernesto Gardelliano

Carlos Raimar Schoeninger

Janaina São Felicio

|

Av Chucri Zaidan, 860 – Morumbi – SP – 04583-110

|

Telefone: +55 11 7420-1172

e-mail:

ir@vivo.com.br

Information avaialable in the website:

http://www.vivo.com.br/ir

|

|

This press release contains forecasts of future events. Such statements are not statements of historical fact, and merely reflect the expectations of the company's management. The terms "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects", "aims" and similar terms are intended to identify these statements, which obviously involve risks or uncertainties which may or may not be foreseen by the company. Accordingly, the future results of operations of the Company may differ from its current expectations, and the reader should not rely exclusively on the positions taken herein. These forecasts speak only of the date they are made, and the company does not undertake any obligation to update them in light of new information or future developments.

|

GLOSSARY

|

Financial Terms:

CAPEX

– Capital Expenditure.

Working capital

= Operational Current assets – Operational Current liabilities.

Net debt

= Gross debt – cash – financial investments – securities – asset from derivative transactions + liability from derivative transactions.

Net Debt / EBITDA

– Index which evaluates the Company’s ability to pay its debt with the generation of operating cash within a one-year period.

EBIT

– Earnings before interest and taxes.

EBITDA

– Earnings result before interest. taxes. depreciation and amortization.

Indebtedness

= Net Debt / (Net Debt + NE) – Index which measures the Company’s financial leverage.

Operating Cash Flow

= EBITDA – CAPEX.

IST =

Telecommunications Services Index.

EBITDA Margin

= EBITDA / Net Operating Revenue.

PDD

– Provision for bad debt. A concept in accounting that measures the provision made for accounts receivable overdue for more than 90 days, includes part of clients under negotiation.

NE –

Shareholders’ Equity.

Subsidy

= (net revenue from goods – cost of goods sold + discounts given by suppliers) / gross additions.

Technology and Services

1xRTT

– (1x Radio Transmission Technology) – It is the CDMA 2000 1x technology which, pursuant to the ITU (International Telecommunication Union). and in accordance with the IMT-2000 rules is considered 3G (third generation) Technology.

CDMA

– (C

ode Division Multiple Access

) – Wireless interface technology for cellular networks based on spectral spreading of the radio signal and channel division by code domain.

CDMA 2000 1xEV-DO

– 3rd Generation access technology with data transmission speed of up to 2.4 Megabits per second.

CSP

– Carrier Selection Code.

SMP

– Personal Mobile Services.

SMS

– Short Message Service

–

Short text message service for cellular handsets. allowing customers to send and receive alphanumerical messages.

WAP

–

Wireless Application Protocol

is an open and standardized protocol started in 1997 which allows access to Internet servers through specific equipment. a WAP Gateway at the carrier. and WAP browsers in customers’ handsets. WAP supports a specific language (WML) and specific applications (WML

script

).

ZAP

– A service which allows quick wireless access to the Internet through a computer, notebook or palmtop, using the CDMA 1xRTT technology.

GSM

– (Global System for Mobile) – an open digital cellular technology used for transmitting mobile voice and data services. It is a circuit witched system that divides each channel into time-slots.

|

Operating indicators:

Gross additions

– Total of customers acquired in the period.

Net additions

= Gross Additions – number of customers disconnected.

ARPU

(Average Revenue per User) – net revenue from services per month / monthly average of customers in the period.

Postpaid ARPU

– ARPU of postpaid service users.

Prepaid ARPU

– ARPU of prepaid service users.

Blended ARPU

– ARPU of the total customer base (contract + prepaid).

Entry Barrier

– Value of the least expensive phone offered.

Customers

– Number of wireless lines in service.

Churn rate

= percentage of the disconnections from customer base during the period or the number of customers disconnected in the period / ((customers at the beginning of the period + customers at the end of the period) / 2).

Market share

= Company’s total number of customers / number of customers in its operating area.

Market share of net additions

: participation of estimated net additions in the operating area.

MOU

(minutes of use) – monthly average. in minutes. of traffic per customer = (Total number of outbound minutes + incoming minutes) / monthly average of customers in the period.

Postpaid MOU –

MOU of postpaid service users.

Prepaid MOU

– MOU of prepaid service users.

Market penetration

= Company’s total number of customers + estimated number of customers of competitors) / each 100 inhabitants in the Company’s operating area.

Productivity

= number of customers / permanent employees.

Right planning programs

– Customer profile adequacy plans

SAC

– cost of acquisition per customer = (70% marketing expenses + costs of the distribution network + handset subsidies) / gross additions.

VC

– Communication values per minute.

VC1

– Communication values for calls in the same area of the subscriber.

VC2

– Communication values for Calls posted for the same primary area code.

VC3

– Communication values for Calls outside the primary area code.

VU

-M – Value of mobile use of the Cellular Operator network which the Fixed Telephone Operator pays for a call from a Fixed Phone to a Mobile Phone (interconnection fee).

Partial Bill & Keep

– system of collection for use of local network between SMP operators which occurs only when traffic between them exceeds 55%, which impacts over revenue and interconnection cost, which ceased to be charged as from July 2006.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

VIVO PARTICIPAÇÕES S.A.

|

|

|

|

By:

|

/

S

/ Ernesto Gardelliano

|

|

|

Ernesto Gardelliano

Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

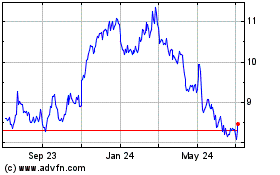

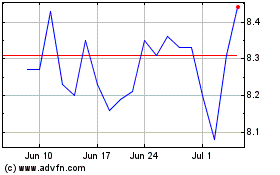

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2024 to May 2024

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From May 2023 to May 2024