SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For the month

of November, 2007

Commission File Number

1-14493

VIVO PARTICIPAÇÕES S.A.

(Exact

name of registrant as specified in its charter)

VIVO Holding Company

(Translation

of Registrant's name into English)

Av. Roque Petroni Jr., no.1464, 6

th

floor – part, "B"building

04707-000 - São Paulo, SP

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under

cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check

mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

THIRD QUARTER 2007 CONSOLIDATED RESULTS

November 05, 2007

–

VIVO Participações S.A. announces today its consolidated results for the third quarter 2007 (3Q07) and for year 2007. The Company’s operating and financial information, except as otherwise indicated, is presented in Brazilian reais in accordance with Brazilian Corporate Law, and the comparable figures refer to the third quarter 2006 (3Q06), except as otherwise mentioned.

Vivo recorded several major achievements in the third quarter of 2007, including an agreement to acquire control of Telemig Celular, which has already been approved by Anatel, and Amazônia Celular, which is still being analyzed by the agency. We also acquired frequency spectrum and licenses which will allow us to operate in areas where we do not maintain a commercial presence, especially the Northeast, and increase network capacity in our existing areas. At the same time, we have been moving ahead with our operational and financial improvement plan, as follows:

|

|

HIGHLIGHTS

-

The implementation of the GSM network and it’s commercial operation has been a great success. At the close of September, the Company had

more than 6.7 million

GSM handsets;

-

Also at the end of September, the

customer base

reached 31,320,000 clients, ensuring our leadership in our operating area, with a market share of 36.8%. Our market share for Brazil as a whole was 27.8%;

-

Vivo has the country’s biggest

handset distribution network

, with almost

8,000 points of sale

, and the largest

recharge network, with more than 347,000 points of sale

;

-

Nationwide digital coverage

and a broad portfolio of solutions in

GSM/EDGE and CDMA/EV-DO

technologies;

-

The

“Vivo Escolha”

plans have already been adopted by 63% of our postpaid customer base, contributing to customer base growth, increased customer loyalty and higher revenue. A survey by the Brazilian Consumer Rights Association (PRO TESTE) showed that Vivo had the most competitive prices in Brazil’s entire mobile communications market.

-

Service Revenue

of R$2,845.8 million, an increase of 15.3% over 3Q06 and of 7.5% over 2Q07;

-

EBITDA

grew 31.4% in 3Q07, reaching R$ 833.3 million, with

EBITDA Margin

of 25.7%, up 4.7 percentile points in relation to 2Q07;

-

The

provision for bad debt

was R$ 80.4 million in the quarter, representing 1.7% of the gross revenue, a reduction of 45.6% in relation to 3Q06 and of 20.6% in relation to 2Q07;

-

The

operating cash flow

plus the change in working capital recorded R$ 961.8 million in the year-to-date figure, materially contributing to the increase of the company’s economic value;

-

The

net debt

recorded the amount of R$2,957.7 million in 3Q07, representing a reduction of 28.7% in relation to 3Q06;

-

Net Profit

of R$ 4.4 million in the quarter, reverting the position recorded both in 3Q06 and in 2Q07.

|

MESSAGE FROM THE CHIEF EXECUTIVE OFFICER

Towards National Coverage

August and September 2007 will be remembered as a landmark in Vivo’s history. It was in these months that the Company took several important steps towards increasing its competitiveness and service capacity, within part of a wider plan, which includes the elimination of fraud and cloning, the restructuring and simplification of its corporate structure, the consolidation of its operating and IT systems, the constant expansion of its network coverage and the implantation of a GSM/EDGE overlay in record time.

On August 2, Vivo reached an agreement to acquire control of Telemig Celular, which was approved by Anatel on October 23, and Amazônia Celular, which is still awaiting approval by the regulatory body. On September 25, Vivo acquired the 1.9 GHz frequency bands in all the regions where it was not already authorized to operate, especially the Northeast states of Pernambuco, Alagoas, Ceará, Piauí, Rio Grande do Norte and Paraíba. At the same time, it bought additional spectrum to reinforce its network, which already has the best quality indicators, according to Anatel and client-satisfaction surveys.

Vivo has aspired to nationwide operational and commercial coverage ever since it began and that aspiration has now become a reality thanks to a concerted and effective initiative.

The clients added by the two acquisitions will strengthen Vivo’s leadership in terms of user and revenue market share, avoiding losses from regions where it was not permitted to operate, particularly the state of Minas Gerais.

In addition, Vivo has maintained commercial operations that are both responsible and aligned with its strategy of attracting and retaining high-value clients while, at the same time, not neglecting those with lower incomes, who are equally in need of high-quality communications services.

In the space of a single year, Vivo fell from first to sixth place in the number of complaints per thousand customers registered with Anatel, an achievement that was underlined by client-satisfaction surveys. Thanks to a concerted focus on service quality, Vivo has one of the lowest churn rate in the Brazilian market.

The recent heating up of the market, with the sale of Sim Cards (chips) whose credits are much higher than the price of the card itself, so that an activation is worth the same as a recharge, is being closely monitored by Vivo in an attempt to avoid the future impact of this practice on such important sector indicators as ARPU and churn.

Vivo’s primary objective is growth with quality, mainly measured by net revenue. In October, the Brazilian Consumer Rights Association (PRO TESTE) released a survey of mobile telephony prices, which received widespread publicity, showing that Vivo had the best, cheapest and most adequate price plans from the consumer’s point of view.

For Vivo and its management team, client recognition is the most important element in confirming that the Company’s strategy is on the right track, accompanied by the requisite operational quality standards. At the same time, its improved operating and financial results and healthy balance sheet are proof of its ability to progressively satisfy its shareholders and investors.

Finally, it is worth noting that all these initiatitives marking the continuous progress of our business are undertaken in an environment of growing satisfaction on the part of our direct and indirect employees.

We would like to take this opportunity of expressing our thanks to all our stakeholders

ROBERTO LIMA

CEO

Basis for presentation of results

Figures disclosed are subject to differences, due to rounding-up procedures. Some information disclosed for 2Q07 and 3Q06 was re-classified, always as applicable. Vivo’s accounting criteria kept stable.

|

HIGHLIGHTS

|

|

|

|

|

|

|

|

|

Accum

|

|

R$ million

|

3 Q 07

|

2 Q 07

|

Δ%

|

3 Q 06

|

Δ%

|

|

2007

|

2006

|

Δ%

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating revenue

|

3,248.5

|

3,021.0

|

7.5%

|

2,824.9

|

15.0%

|

|

9,120.3

|

8,000.2

|

14.0%

|

|

Net service revenues

|

2,845.8

|

2,647.8

|

7.5%

|

2,467.7

|

15.3%

|

|

8,102.9

|

6,913.5

|

17.2%

|

|

Net handset revenues

|

402.7

|

373.2

|

7.9%

|

357.2

|

12.7%

|

|

1,017.4

|

1,086.7

|

-6.4%

|

|

Total operating costs

|

(2,415.2)

|

(2,386.8)

|

1.2%

|

(2,109.3)

|

14.5%

|

|

(6,895.8)

|

(6,261.2)

|

10.1%

|

|

EBITDA

|

833.3

|

634.2

|

31.4%

|

715.6

|

16.4%

|

|

2,224.5

|

1,739.0

|

27.9%

|

|

EBITDA Margin (%)

|

25.7%

|

21.0%

|

4.7 p.p.

|

25.3%

|

0.3 p.p.

|

|

24.4%

|

21.7%

|

2.7 p.p.

|

|

Depreciation and amortization

|

(591.1)

|

(602.2)

|

-1.8%

|

(636.3)

|

-7.1%

|

|

(1,764.3)

|

(1,834.2)

|

-3.8%

|

|

EBIT

|

242.2

|

32.0

|

656.9%

|

79.3

|

205.4%

|

|

460.2

|

(95.2)

|

n.a.

|

|

Net income

|

4.4

|

(112.8)

|

n.a.

|

(196.9)

|

n.a.

|

|

(127.7)

|

(869.3)

|

-85.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

Capex

|

369.2

|

337.3

|

9.5%

|

444.8

|

-17.0%

|

|

941.9

|

1,064.0

|

-11.5%

|

|

Capex over net revenues

|

11.4%

|

11.2%

|

0.2 p.p.

|

15.7%

|

-4.5 p.p.

|

|

10.3%

|

13.3%

|

-3.0 p.p.

|

|

Operating cash flow

|

464.1

|

296.9

|

56.3%

|

270.8

|

71.4%

|

|

1,282.6

|

675.0

|

90.0%

|

|

Change in working capital

|

63.4

|

(159.3)

|

n.a.

|

69.9

|

-9.3%

|

|

(320.8)

|

(230.4)

|

39.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

Customers (thousand)

|

31,320

|

30,240

|

3.6%

|

28,726

|

9.0%

|

|

31,320

|

28,726

|

9.0%

|

|

Net additions (thousand)

|

1,079

|

1,210

|

-10.8%

|

201

|

436.8%

|

|

2,266

|

(1,079)

|

n.a.

|

Operating cash flow

|

Excellent cash generation,

increasing

Vivo’s economic

value

|

Operating cash flow (EBITDA-CAPEX) of R$ 464.1 million in the quarter, with a growth of 71.4% in relation to 3Q06, when compared to 2Q07 it recorded an increase of 56.3% which, added to the change in working capital, generated R$ 527.5 million in the quarter, which is 54.8% higher than the figure recorded for the same period of the previous year, which was R$ 340.7 million. The year-to-date operating cash flow plus the change in current assets recorded R$ 961.8 million, an increase of 116.3% when compared to the same period of the previous year. This flow, which is the result of a simple and reasonable structure, allied to the constant search for better efficiency and, mainly, higher revenue, has significantly increased Vivo’s economic value.

|

Capital Expenditures (CAPEX)

|

GSM/EDGE

Network already

covers 2,303

municipalities.

|

The necessary activities for the GSM/EDGE overlay were almost concluded in this quarter, with more than 90% of the total CapEx estimated in the initial project having been invested up to the moment. A total of R$ 369.2 million were invested in 3Q07, which were intended for maintenance of networks and systems quality and capacity, expansion of coverage and terminals into the corporate segment, among other things. The 3Q07 CapEx represented 11.4% over the net revenue. The year-to-date invested total was R$ 941.9 million, represented 10.3% the net revenue.

|

|

CAPEX - VIVO

|

|

R$ million

|

|

|

|

|

Accum

|

|

|

3 Q 07

|

2 Q 07

|

3 Q 06

|

|

2007

|

2006

|

|

|

|

|

|

|

|

|

|

Network

|

206.7

|

190.3

|

202.6

|

|

495.1

|

434.3

|

|

Technology / Information System

|

48.1

|

46.3

|

107.1

|

|

138.2

|

280.6

|

|

Other

|

114.4

|

100.7

|

135.1

|

|

308.6

|

349.1

|

|

Total

|

369.2

|

337.3

|

444.8

|

|

941.9

|

1,064.0

|

|

|

|

|

|

|

|

|

|

% Net Revenues

|

11.4%

|

11.2%

|

15.7%

|

|

10.3%

|

13.3%

|

|

CONSOLIDATED OPERATING PERFORMANCE - VIVO

|

|

|

3 Q 07

|

2 Q 07

|

Δ%

|

3 Q 06

|

Δ%

|

|

|

|

|

|

|

|

|

Total number of customers (thousand)

|

31,320

|

30,240

|

3.6%

|

28,726

|

9.0%

|

|

Market Share (*)

|

36.8%

|

37.3%

|

-0.5 p.p.

|

39.3%

|

-2.5 p.p.

|

|

Net additions (thousand)

|

1,079

|

1,210

|

-10.8%

|

201

|

436.8%

|

|

Market Share of net additions (*)

|

26.4%

|

34.7%

|

-8.3 p.p.

|

7.6%

|

18.8 p.p.

|

|

Market penetration

|

59.3%

|

56.3%

|

3.0 p.p.

|

53.3%

|

6.0 p.p.

|

|

|

|

|

|

|

|

|

SAC (R$)

|

115

|

107

|

7.5%

|

105

|

9.5%

|

|

|

|

|

|

|

|

|

Monthly Churn

|

2.2%

|

2.3%

|

-0.1 p.p.

|

2.6%

|

-0.4 p.p.

|

|

ARPU (in R$/month)

|

30.8

|

29.9

|

3.0%

|

28.7

|

7.3%

|

|

ARPU Outgoing

|

83.3

|

83.7

|

1.5%

|

70.9

|

3.7%

|

|

ARPU Inbound

|

16.7

|

16.8

|

4.3%

|

12.8

|

10.5%

|

|

Total MOU (minutes)

|

77

|

77

|

0.0%

|

78

|

-1.3%

|

|

MOU Outgoing

|

43

|

42

|

0.0%

|

34

|

-7.9%

|

|

MOU Inbound

|

214

|

209

|

0.0%

|

199

|

7.7%

|

|

|

|

|

|

|

|

|

Employees

|

5,418

|

5,494

|

-1.4%

|

6,017

|

-10.0%

|

(*) source: Anatel

OPERATING HIGHLIGHTS

|

Quality, variety of offers, service plans and GSM/EDGE contributed to the growth of products offered.

Customer base quality enables ARPU growth in

the quarter

|

-

Continued leadership with an increase in the customer base by 9.0% in relation to 3Q06 and 3.6% in relation to 2Q07, reaching 31,320 thousand customers. The varied range of offers and service plans made available by Vivo, together with the recognized quality in the rendering of services contributed to such growth. Vivo continued with its strategy to keep a strict control over its customer base, without, however, disregarding assistance quality and coverage maintenance. Worthy of mention, further, is the progressive increase in sales of GSM handsets, which have already exceeded 6.7 million handsets.

-

Net additions

in 3Q07 totaled 1,079 thousand new customers, with a market share of net additions of 26.4% in its coverage area, keeping its market leadership both in its operational area and in the national market. Once again the activations of GSM technology, which represent 77% of total activations, contributed to the steady and consistent growth.

-

Vivo has now available 12 exclusive handsets, which contributed to differentiated offers.

-

In the same manner, the growth in the ARPU, which recorded R$ 30.8 evidences the quality of Vivo’s present customer base even though in a period of intense growth of the customer base.

-

The company has continued to place its focus on capturing and keeping high and medium value customers, maintaining rationality and searching for positive results in each campaign and commercial action.

|

|

|

-

SAC

in the quarter, of R$ 115, is a result of enhanced selling efforts and “entry barriers” implemented in the period, partially diluted by lower advertising expenses. The growth in the quarter is also a result of the strategy to capture high-value customers, especially in medium and high value handsets.

|

|

Quality of services rendered and

reward programs contributed to

Churn reduction

|

-

Churn

of 2.2% in the quarter, with a reduction of 0.4 percentile points in relation to 3Q06 and a slight drop when compared to 2Q07. The value segment, the mostly targeted by competition, represented by “premium” customers, was maintained under strict control with specific actions aiming at retaining and capturing customers. This result shows the drop trend of

churn

and validates the actions implemented with a view to maintain and keep customer base quality. In the loyalty campaign, the use of the recognized reward program contributed to the renewal of customer handsets and to the increased satisfaction with services rendered.

|

|

ON-NET traffic increase through specific campaigns.

Sustained growth of the outgoing traffic.

Customer base quality improvement increased the ARPU by R$31

Vivo Escolha, the most competitive plans in the Brazilian mobile communications market

|

-

The

blended MOU

remained stable in the quarter. The 7.7% increase in the outgoing MOU contributed to dilute the slight drop in the Blended MOU in relation to 3Q06, which was due to the campaigns for stimulating use for the prepaid segment, adoption of new service plans and segmented campaigns. The inbound traffic, which in several markets records a decreasing trend, in the case of Vivo has recorded an increase in relation to the compared periods.

-

The

total traffic

recorded a 5.2% growth in 3Q07 in relation to 2Q07, emphasizing the 5.6% growth in the outgoing traffic. In the comparison between 3Q07 and 3Q06, the total traffic increased by 7.5% and considering only the outgoing traffic the increase is 14.8%. The inbound traffic stability arises mainly from the increase in the off-net mobile-mobile and long-distance traffic, showing each time more the increase in mobile access as a means of personal communication, offsetting the trend of decrease in the fixed-mobile traffic market.

-

The

blended

ARPU

recorded the amount of R$ 30.8 in 3Q07, the highest figure recorded since the conclusion of the corporate reorganization in February 2006, a 3.0% increase in relation to 2Q07 and 7.3% in relation to the same period of the previous year. Following the trend mentioned for the MOU, the outgoing ARPU increased by 10.5% over 3Q06. By eliminating the effects of termination of the partial Bill&Keep system, the blended ARPU in 3Q07 even though would record 2.4% increase in relation to 3Q06.

-

The highly successful “Vivo Escolha” plans played a vital role in increasing the competitiveness of the Company’s services. The Brazilian Consumer Rights Association (Proteste) has just published an independent survey which confirmed that Vivo’s plans are the most economical for different usage profiles in all the regions in which it operates, being the only ones that permit customization with free add-ons, which is most important for the client.

|

|

NET OPERATING REVENUES - VIVO

|

|

|

According to Corporate Law

|

|

|

|

|

|

|

|

|

Accum

|

|

R$ million

|

3 Q 07

|

2 Q 07

|

Δ

%

|

3 Q 06

|

Δ

%

|

|

2007

|

2006

|

Δ

%

|

|

Subscription and Usage

|

1,373.0

|

1,260.1

|

9.0%

|

1,167.3

|

17.6%

|

|

3,856.6

|

3,490.6

|

10.5%

|

|

Network usage

|

1,251.9

|

1,186.8

|

5.5%

|

1,149.5

|

8.9%

|

|

3,623.3

|

2,947.3

|

22.9%

|

|

Other services

|

220.9

|

200.9

|

10.0%

|

150.9

|

46.4%

|

|

623.0

|

475.6

|

31.0%

|

|

Net service revenues

|

2,845.8

|

2,647.8

|

7.5%

|

2,467.7

|

15.3%

|

|

8,102.9

|

6,913.5

|

17.2%

|

|

Net handset revenues

|

402.7

|

373.2

|

7.9%

|

357.2

|

12.7%

|

|

1,017.4

|

1,086.7

|

-6.4%

|

|

Net Revenues

|

3,248.5

|

3,021.0

|

7.5%

|

2,824.9

|

15.0%

|

|

9,120.3

|

8,000.2

|

14.0%

|

OPERATING REVENUE

|

Consistent growth in the revenue from the outgoing traffic.

Growth of data revenue and VAS.

|

Service revenue

grew 15.3%, increasing the

total net revenue

by 15.0% in relation to 3Q06, recording R$ 3,248.5 million in the quarter. In relation to 2Q07, the total net revenue grew by of 7.5%, especially due to the increase in the revenue from subscription and usage. By eliminating the effects of the partial Bill&Keep in the 3Q07, the net service revenue would still record an increase of 12.7% in 3Q07 over 3Q06.

The increase of 17.6% in “

subscription and usage revenue

”, when compared to 3Q06, is mainly due to the increase in the total outgoing revenue, which was due to the growth in the total outgoing traffic, by the incentive to usage and promotions and, especially, by the success of the “

Vivo Escolha

” plans, which plans, besides stimulating usage and loyalty, also increase profitability and customer satisfaction. When compared to 2Q07, there was 9.0% increase in the subscription and usage revenue, as result of customer base increase and incentive to usage with segmented campaigns.

Data revenue

plus

VAS

accounted for 8.3% of the service revenue in 3Q07, a 33.8% increase over 3Q06. In the comparison between 3Q07 and 2Q07, it recorded an increase of 12.5%. Data Revenue plus VAS have had a sustained growth due to actions that stimulate usage of the present services (such as SMS, VIVO AVISA, Voice Mail and Voice Portal), with the continuous increase of our offer in the WAP, in contents and game downloads (inclusion of new and relevant partners), with VIVO ZAP solutions (EV-DO PMCIA and USB boards) and with the launching of innovative products and services, such as complete song downloading in VIVO PLAY. Vivo continues to be Brazil’s leading music sales portal (complete music downloads), having formed partnerships with SonyBMG and Sonora (Terra’s music site).

|

|

OPERATING COSTS - VIVO

|

|

|

According to Corporate Law

|

|

|

|

|

|

|

|

|

Accum

|

|

R$ million

|

3 Q 07

|

2 Q 07

|

Δ

%

|

3 Q 06

|

Δ

%

|

|

2007

|

2006

|

Δ

%

|

|

Personnel

|

(151.3)

|

(165.0)

|

-8.3%

|

(150.9)

|

0.3%

|

|

(490.0)

|

(461.9)

|

6.1%

|

|

Cost of services rendered

|

(780.0)

|

(758.6)

|

2.8%

|

(664.3)

|

17.4%

|

|

(2,255.0)

|

(1,516.5)

|

48.7%

|

|

Leased lines

|

(56.7)

|

(58.3)

|

-2.7%

|

(59.0)

|

-3.9%

|

|

(168.7)

|

(175.4)

|

-3.8%

|

|

Interconnection

|

(412.2)

|

(388.1)

|

6.2%

|

(322.5)

|

27.8%

|

|

(1,165.3)

|

(399.5)

|

191.7%

|

|

Rent/Insurance/Condominium fees

|

(60.7)

|

(54.9)

|

10.6%

|

(53.1)

|

14.3%

|

|

(164.9)

|

(154.7)

|

6.6%

|

|

Fistel and other taxes and contributions

|

(124.3)

|

(120.0)

|

3.6%

|

(125.7)

|

-1.1%

|

|

(371.2)

|

(393.9)

|

-5.8%

|

|

Third-party services

|

(108.9)

|

(116.3)

|

-6.4%

|

(96.4)

|

13.0%

|

|

(322.5)

|

(279.3)

|

15.5%

|

|

Others

|

(17.2)

|

(21.0)

|

-18.1%

|

(7.6)

|

126.3%

|

|

(62.4)

|

(113.7)

|

-45.1%

|

|

Cost of goods sold

|

(585.0)

|

(548.5)

|

6.7%

|

(511.9)

|

14.3%

|

|

(1,485.0)

|

(1,491.3)

|

-0.4%

|

|

Selling expenses

|

(728.8)

|

(728.3)

|

0.1%

|

(697.4)

|

4.5%

|

|

(2,076.4)

|

(2,411.1)

|

-13.9%

|

|

Provision for bad debt

|

(80.4)

|

(101.2)

|

-20.6%

|

(147.8)

|

-45.6%

|

|

(289.0)

|

(647.5)

|

-55.4%

|

|

Third-party services

|

(614.4)

|

(596.7)

|

3.0%

|

(520.3)

|

18.1%

|

|

(1,689.3)

|

(1,659.7)

|

1.8%

|

|

Others

|

(34.0)

|

(30.4)

|

11.8%

|

(29.3)

|

16.0%

|

|

(98.1)

|

(103.9)

|

-5.6%

|

|

General & administrative expenses

|

(159.3)

|

(161.6)

|

-1.4%

|

(112.7)

|

41.3%

|

|

(466.7)

|

(387.2)

|

20.5%

|

|

Third-party services

|

(131.3)

|

(137.9)

|

-4.8%

|

(86.6)

|

51.6%

|

|

(388.8)

|

(303.7)

|

28.0%

|

|

Others

|

(28.0)

|

(23.7)

|

18.1%

|

(26.1)

|

7.3%

|

|

(77.9)

|

(83.5)

|

-6.7%

|

|

Other operating revenue (expenses)

|

(10.8)

|

(24.8)

|

-56.5%

|

27.9

|

n.a.

|

|

(122.7)

|

6.8

|

n.a.

|

|

Operating revenue

|

105.6

|

80.0

|

32.0%

|

155.6

|

-32.1%

|

|

250.1

|

286.2

|

-12.6%

|

|

Operating expenses

|

(116.7)

|

(105.1)

|

11.0%

|

(131.3)

|

-11.1%

|

|

(365.6)

|

(274.4)

|

33.2%

|

|

Other operating revenue (expenses)

|

0.3

|

0.3

|

0.0%

|

3.6

|

-91.7%

|

|

(7.2)

|

(5.0)

|

44.0%

|

|

Total costs before depreciation / amortization

|

(2,415.2)

|

(2,386.8)

|

1.2%

|

(2,109.3)

|

14.5%

|

|

(6,895.8)

|

(6,261.2)

|

10.1%

|

|

Depreciation and amortization

|

(591.1)

|

(602.2)

|

-1.8%

|

(636.3)

|

-7.1%

|

|

(1,764.3)

|

(1,834.2)

|

-3.8%

|

|

Total operating costs

|

(3,006.3)

|

(2,989.0)

|

0.6%

|

(2,745.6)

|

9.5%

|

|

(8,660.1)

|

(8,095.4)

|

7.0%

|

OPERATING EXPENSES

|

Strict control over manageable costs.

|

The growth of 0.3% in

Human Resources

in 3Q07 over 3Q06 is due to the adjustment provided for the Collective Union Agreement in November 2006, attenuated by a reduction in the labor count occurred in previous quarters. The same cost, when compared to 2Q07, recorded 8.3% reduction arising out of the result of the same reduction in the labor count and the reduction in severance payments.

|

|

By eliminating

the effects of termination of

the B&K program, the services costs would be reduced

by 4.4% in relation to 3Q06.

|

The increase of 17.4% in the

cost of services rendered

in 3Q07, when compared to 3Q06, is due to the 27.8% increase in interconnection costs arising out of the termination of the partial Bill&Keep system, the increase in expenses with third-party services, in addition to an increase resulting from the provision for losses from roaming services. When compared to 2Q07, it recorded an increase of 2.8% also due to the increase in interconnection costs, besides the variation in expenses with property rental, partially offset by a reduction in the expenses with third-party services, especially public utilities and plant maintenance.

|

|

The

cost of

goods sold

increased by 14.3% in 3Q07 over 3Q06, especially due to an increased number of gross activations which accounted for 29.5% growth. In relation to 2Q07, even with less commercial activity, the additions and exchanges in GSM technology, in both segments, recorded in an increase higher than the 6.7% recorded in the cost of goods sold.

In 3Q07,

selling expenses

increased by 4.5% in relation to 3Q06, as a result of the increase in third-party expenses (publicity and advertising, in addition to agency and commissions), due to the larger number of activations, being offset by a constant reduction in expenses with the provision for bad debt. When compared to 2Q07, it remained stable, especially due to the reduction in the provision for bad debt.

|

|

45.6% reduction in the PDD in relation to the same period of the previous year.

|

The

Provision for Bad Debt – PDD

in 3Q07 was of R$ 80.4 million, representing 1.7% of the total gross revenue, a 45.6% reduction in relation to the same period of the previous year, which was R$ 147.8 million, representing 3.7% of the gross revenue. When compared to 2Q07, which recorded R$ 101.2 million, the reduction was of 20.6%. This result evidences the strict control exercised over new customers and on debt collection.

|

|

|

General and administrative expenses

increased by 41.3% in 3Q07 in relation to 3Q06, due, mainly, to the increase in expenses with third-party services, especially technical assistance, partially offset by a reduction in expenses with consulting and regular services due to efficiency gains. When compared to 2Q07, it represents a reduction of 1.4% arising out of the reduction in third-party services, especially data processing and plant maintenance.

|

|

Other Operating Revenue / Expenses

recorded an expense of R$ 10.8 million. The variation in relation to 3Q06 arises from the increase in the expenses with taxes, duties and contributions, in addition to a reduction in the revenue from recovered expenses, partially diluted by the increase in the revenue from commercial incentives. When compared to 2Q07, the 56.5% is due to an increase in revenues from recovered expenses and commercial incentives, partially impacted by the increase in taxes, duties and contributions and a reduction in revenues from penalties.

|

EBITDA

|

EBITDA margin

of 25.7% in the quarter, 4.7 percentile points higher.

|

The

EBITDA

(earnings before interests, taxes, depreciation and amortization) in 3Q07 was R$ 833.3 million, an increase of 16.4% in relation to 3Q06, resulting in an EBITDA Margin of 25.7%. When compared to 2Q07, the EBITDA recorded a 31.4% increase, with an EBITDA Margin of 4.7 percentile points higher. Such result recorded in 3Q07 was mainly due to the increase in the revenue due to the increase in the customer base and to the strict control of expenses, even though considering the number of additions and the sustainable growth. The stability in the cost of goods sold also contributed to such increase, explained by the sales of GSM handsets at lower acquisition cost.

|

DEPRECIATION AND AMORTIZATION

|

|

Depreciation and amortization

expenses recorded reductions of 7.1% and 1.8% when compared to 3Q06 and 2Q07, respectively, due to the end of the useful life of the assets along the periods.

|

|

FINANCIAL REVENUES (EXPENSES) - VIVO

|

|

|

According to Corporate Law

|

|

|

|

|

|

|

|

|

Accum

|

|

R$ million

|

3 Q 07

|

2 Q 07

|

Δ

%

|

3 Q 06

|

Δ

%

|

|

2007

|

2006

|

Δ

%

|

|

Financial Revenues

|

50.8

|

38.8

|

30.9%

|

40.5

|

25.4%

|

|

147.8

|

218.0

|

-32.2%

|

|

Other financial revenues

|

50.8

|

38.8

|

30.9%

|

40.5

|

25.4%

|

|

147.8

|

218.0

|

-32.2%

|

|

(-) Pis/Cofins taxes on financial revenues

|

0.0

|

0.0

|

n.a.

|

0.0

|

n.a.

|

|

0.0

|

0.0

|

n.a.

|

|

Financial Expenses

|

(160.8)

|

(162.4)

|

-1.0%

|

(234.5)

|

-31.4%

|

|

(508.6)

|

(805.8)

|

-36.9%

|

|

Other financial expenses

|

(120.0)

|

(101.9)

|

17.8%

|

(141.4)

|

-15.1%

|

|

(331.7)

|

(461.5)

|

-28.1%

|

|

Gains (Losses) with derivatives transactions

|

(40.8)

|

(60.5)

|

-32.6%

|

(93.1)

|

-56.2%

|

|

(176.9)

|

(344.3)

|

-48.6%

|

|

Exchange rate variation / Monetary variation

|

(3.8)

|

(0.8)

|

375.0%

|

(7.6)

|

-50.0%

|

|

3.9

|

(13.6)

|

n.a.

|

|

Net Financial Income

|

(113.8)

|

(124.4)

|

-8.5%

|

(201.6)

|

-43.6%

|

|

(356.9)

|

(601.4)

|

-40.7%

|

|

Reduction in financial expenses

by 43.6% in 3Q07 over 3Q06.

|

VIVO’s

net financial expense

in 3Q07 was reduced in relation to 2Q07. The R$ 10.6 million reduction was due to lower net debt in the period. In the comparison of 3Q07 over 3Q06, there was a reduction of R$ 87.8 million in the net financial expense due to decrease in net debt, occasioned by increase in operating cash flow generation and restructuring of financial liabilities, besides a reduction in interest rates in the period (3.51% in 3Q06 and 2.78% in 3Q07).

|

|

LOANS AND FINANCING - VIVO

|

|

|

CURRENCY

|

|

|

Lenders (R$ million)

|

R$

|

URTJLP *

|

UMBND **

|

US$

|

Yen

|

Total

|

|

|

|

|

|

|

|

|

|

Financial institutions

|

1,852.5

|

693.1

|

12.6

|

652.9

|

805.1

|

4,016.2

|

|

Fixcel – TCO’s Acquisition

|

22.2

|

-

|

-

|

-

|

-

|

22.2

|

|

Total

|

1,874.7

|

693.1

|

12.6

|

652.9

|

805.1

|

4,038.4

|

|

Exchange rate used

|

0.0

|

1.965734

|

0.03542

|

1.8389

|

0.016021

|

|

|

|

|

|

|

|

|

|

|

Payment Schedule - Long Term

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008

|

6.4

|

4.7

|

0.7

|

16.9

|

158.8

|

187.5

|

|

as from 2008

|

1,280.7

|

652.7

|

7.3

|

-

|

95.2

|

2,035.9

|

|

Total

|

1,287.1

|

657.4

|

8.0

|

16.9

|

254.0

|

2,223.4

|

|

NET DEBT - VIVO

|

|

|

Sep 30.07

|

Jun 30.07

|

Sep 30.06

|

|

Short Term

|

1,815.0

|

1,226.9

|

1,524.1

|

|

Long Term

|

2,223.4

|

2,478.8

|

3,175.5

|

|

Total debt

|

4,038.4

|

3,705.7

|

4,699.6

|

|

Cash and cash equivalents

|

(1,588.3)

|

(955.2)

|

(966.9)

|

|

Derivatives

|

507.6

|

585.8

|

414.9

|

|

Net Debt

|

2,957.7

|

3,336.3

|

4,147.6

|

(*) BNDES long term interest rate unit

(**) UMBND - prepared by the BNDES, it is a basket of foreign currencies unit, US dollar predominan

|

Reduction in net debt by 28.70% in the year-to-year comparison and by 14.1% in gross debt.

|

On September 30, 2007, VIVO’s debts related to loans and financing amounted to R$ 4,038.4 million (R$ 3,705.7 million at June 30, 2007), 36% of which is denominated in foreign currency. The Company has executed (swaps and hedging) contracts thus protecting 100% of its financial debt against foreign exchange volatility, so that the final cost (debt and swap) is Reais-referenced. Additionally, the Company has entered into swap transactions – CDI Post x Pre fixed, in order to partially protect it against fluctuations in domestic interest rates. Covered transactions totaled R$ 1,704.4 million. (R$ 2,274.0 million at June 30, 2007). This debt was offset by the Company’s available cash and financial investments (R$ 1,588.3 million) and by derivative assets and liabilities (R$ 507.6 million payable) resulting in a net debt of R$ 2,957.7 million.

|

|

|

The 14.1% reduction in VIVO’s gross debt in relation to 3Q06, amounting to R$ 661.2 million, is due to the generation of cash, financial flexibility and rationality.

|

|

Debt reduction

due to cash generation

|

The reduction in Net Debt is due to a better generation of operating cash, arising mainly from the growth in Operating Revenue, the net Revenue in 3Q07 was R$ 3,248.5 million, against R$ 3,021.0 in 2Q07.

Net Profit of R$ 4.4 million in the quarter, reverting the position recorded both in 3Q06 and in 2Q07. In the year-to-date, a reduction of 85.3% in its loss was recorded.

|

|

Capital Market

|

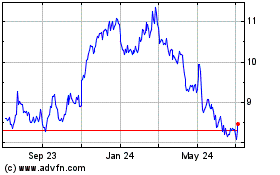

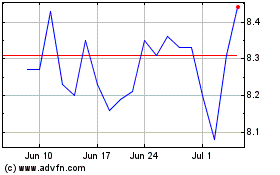

The shares of Vivo Participações were traded in 100% of the trading floor sessions of the São Paulo Stock Exchange in this quarter, with the common shares having devaluated by 3.3% while the preferred shares devaluated by 7.8%. Vivo’s shares recorded 1.2% appreciation in the year-to-date figures for ON shares and 1.6% for PN shares.

|

Shareholding Structure and Capital Stock Composition

|

CAPITAL STOCK OF VIVO PARTICIPAÇÕES S.A. on September 30, 2007

|

|

Shareholders

|

Common Shares

|

Preferred Shares

|

TOTAL

|

|

Portelcom Participações S.A.

|

67,349,733

|

12.8%

|

1,843

|

0.0%

|

67,351,576

|

4.7%

|

|

BRASILCEL, N.V.

|

222,877,507

|

42.5%

|

364,350,055

|

39.7%

|

587,227,562

|

40.7%

|

|

SUDESTECEL Participações LTDA

|

88,255,178

|

16.8%

|

1,224,498

|

0.1%

|

89,479,676

|

6.2%

|

|

AVISTA Participações LTDA

|

9,630,458

|

1.8%

|

46,613,811

|

5.1%

|

56,244,269

|

3.9%

|

|

TBS Celular Participações LTDA

|

68,818,554

|

13.1%

|

1,165,797

|

0.1%

|

69,984,351

|

4.9%

|

|

TAGILO Participações LTDA

|

12,061,046

|

2.3%

|

22,625,728

|

2.5%

|

34,686,774

|

2.4%

|

|

Controlling Shareholder Group

|

468,992,476

|

89.3%

|

435,981,732

|

47.5%

|

904,974,208

|

62.8%

|

|

Treasury shares

|

0

|

0.0%

|

4,494,900

|

0.5%

|

4,494,900

|

0.3%

|

|

Others shareholders

|

55,939,189

|

10.7%

|

476,709,448

|

52.0%

|

532,648,637

|

36.9%

|

|

TOTAL

|

524,931,665

|

100.0%

|

917,186,080

|

100.0%

|

1,442,117,745

|

100.0%

|

|

Acquisition of

Telemig

Participações

and of Tele Norte Participações.

|

On August 2nd, VIVO entered into a stock purchase and sale agreement with Telpart Participações S.A. (“Telpart”) aiming at the acquisition of the share control of Telemig Celular Participações S.A. (“Telemig Participações”) and of Tele Norte Celular Participações S.A. (“Tele Norte Participações”), corresponding to 22.72% and 19.34% of their respective total capital stock, for an aggregate total of R$ 1.2 billion, subject to certain adjustments set forth in the stock purchase agreement. Additionally, Vivo will purchase from Telpart stock subscription rights for R$ 87 million. The agreement was approved at the general meetings of shareholders of Vivo and Telpart, among other conditions precedent, and its closing is subject to approval by ANATEL.

The Board of Directors of Anatel, on October 23, unanimously approved the acquisition of Telemig by Vivo. Thus, we will be able to extend our quality signal to the now Vivo customers in Minas Gerais.

As for the Amazon region, we are currently awaiting the approval by the regulatory agency in order to acquire the share control of the Company.

Further information about the transaction, the public offerings of common shares and the voluntary public offerings of preferred shares are available from Vivo’s web site – Investor Relations (

www.vivo.com.br/ir

).

|

Quality and coverage improvement program

|

Better connection

and coverage

quality

|

VIVO has continued significantly expanding its coverage, increasing the number of municipalities served, in addition to enlarging and optimizing the 1xRTT coverage and installing the new GSM/EDGE network convertible into W-CDMA. Vivo Participações, through its wholly-owned subsidiary, Vivo S/A, the largest operator in Brazil, provides mobile telephone services in the states of São Paulo, Paraná, Santa Catarina, Rio de Janeiro, Espírito Santo, Bahia, Sergipe, Rio Grande do Sul, Acre, Amazonas, Amapá, Goiás, Maranhão, Mato Grosso, Mato Grosso do Sul, Pará, Rondônia, Roraima and Tocantins and in the Federal District. Digital coverage is provided in 100% of the municipalities comprised in its service area, with more than 2,000 municipalities having 1xRTT coverage, of which 27 municipalities are provided with EV-DO service. The GSM/EDGE network is already present in 2,303 municipalities. Some states as São Paulo, Rio de Janeiro and Espírito Santo are already served by Vivo in 100% of their municipalities.

|

|

Nationwide

coverage has now become a reality

|

With the 1.9 GHz frequencies won in the Anatel auction, Vivo achieved one of its major goals: nationwide operation, being able to reach the Northeast states in which it did not operate, and further reinforce its quality signal in the regions where it already operated, as a result of the acquisition of further spectrum.

|

|

Main Prizes,

Awards and

Events

|

For the third consecutive year,

Vivo

is chosen as the

most valuable brand

in cellular phone in Brazil, having recorded the value of R$ 2.25 billion, according to the ranking prepared by Brand Finance, an English consulting firm. With an increase of 28.6% in relation to the 2006 study, Vivo is ahead of strongly positioned brands of companies from other market segments.

Another recent achievement was the

Reliable Brands

prize awarded by Seleções magazine, based on an Ibope Institute research. Vivo was considered the most reliable brand in cellular phone, which is an evidence of its successful repositioning strategy, focused on quality and customer satisfaction.

Vivo

has

sponsored for the 9th year the Gramado Movie Festival, main event in this industry in Latin América, which attracts the industry professionals and millions of tourists to the Rio de Grande do Sul state mountains. Vivo has also sponsored the Troféu Oscarito, which was awarded this year to actress Zezé Motta. Finally, it developed inclusive actions, with a special session of “Basic Sanitation” movie for visually and hearing disabled people.

|

|

Social

Responsibility

|

With new services turned to visually disabled people, production of Braille materials and audiobooks, Vivo has progressed in its inclusive practices. During the event called “Eu Vivo Cinema Pan-Americano” (I live Pan-American Movie”), held in Ipanema Beach (RJ), during the Pan-American games, Vivo promoted the Inclusive Evening, with the exhibition of “The Year My Parents Traveled in Vacations” with audio description for visually disabled people made by volunteers trained inside the company itself. The movie also displayed captions in Portuguese for hearing disabled people.

In the end of July, taking advantage of the season of performances by ballet dancer Mikail Baryshnikov in Brazil, also sponsored by the Company, Vivo renewed its sponsorship to the Fernanda Bianchini Blind People Ballet Association, an entity engaged in the professional formation of visually disabled ballet dancers in Brazil.

In September, Vivo achieved the second place in the first edition of the 2007 Feelings Award, in the category of Honorable Mention – Companies. The prize was awarded for the Company’s case of actions related to social inclusion of visually disable people, developed by Vivo Institute together with Vivo’s Voluntary Program. The Feelings Award I is developed by the Association for Valuation and Promotion of Exceptional People (AVAPE), Feelings magazine and Record Radio and Television Network, with HSBC support.

Delivery of “Carta da Terra” in Braille and audiobook to the State Departments of Environment of 17 Brazilian states and the Federal District. There were 43 meetings held for promoting the relationship between Vivo and vice-governors, mayors, state and local government environment departments, representatives from the IBAMA, other state departments, the Brazilian Army, House of Representatives and the House of Councilors, in addition to 6 environment-related non-government entities.

Worthy of mention in the Waste Management Program is “Vivo’s Handset Recycling” Project, which is responsible for collecting handsets, accessories and cellular batteries in its owned stores, having been expanded to Vivo’s regional offices in ES, PR, SC and RS states, in the stores where it is already available in RJ, SP and DF, as well as the continuance and expansion of the Overlay Project in the regional stores of CO/N and RS.

|

|

CONSOLIDATED BALANCE SHEET - VIVO

|

|

R$ million

|

|

|

ASSETS

|

Sep 30. 07

|

|

Jun 30. 07

|

Δ

%

|

|

Current Assets

|

6,041.9

|

|

5,323.3

|

13.5%

|

|

Cash and banks

|

57.5

|

|

57.3

|

0.3%

|

|

Temporary cash investments

|

1,504.3

|

|

872.9

|

72.3%

|

|

Net accounts receivable

|

2,029.5

|

|

1,911.5

|

6.2%

|

|

Inventory

|

412.1

|

|

316.8

|

30.1%

|

|

Prepayment to Suppliers

|

1.3

|

|

12.3

|

-89.4%

|

|

Deferred and recoverable taxes

|

1,673.9

|

|

1,641.7

|

2.0%

|

|

Derivatives transactions

|

0.4

|

|

2.5

|

-84.0%

|

|

Prepaid Expenses

|

227.7

|

|

351.7

|

-35.3%

|

|

Other current assets

|

135.2

|

|

156.6

|

-13.7%

|

|

|

|

|

|

|

|

Non- Current Assets

|

10,882.0

|

|

11,181.4

|

-2.7%

|

|

Long Term Assets:

|

|

|

|

|

|

Temporary cash investments

|

25.0

|

|

6.5

|

6.0%

|

|

Deferred and recoverable taxes

|

2,420.2

|

|

2,494.5

|

-3.0%

|

|

Derivatives transactions

|

2.5

|

|

1.7

|

47.1%

|

|

Prepaid Expenses

|

43.8

|

|

37.6

|

16.5%

|

|

Other long term assets

|

21.3

|

|

30.8

|

-30.8%

|

|

Investment

|

745.4

|

|

823.3

|

-9.5%

|

|

Plant, property and equipment

|

5,999.3

|

|

6,103.0

|

-1.7%

|

|

Net intangible assets

|

1,523.2

|

|

1,554.3

|

-2.0%

|

|

Deferred assets

|

99.8

|

|

111.2

|

-10.3%

|

|

|

|

|

|

|

|

Total Assets

|

16,923.9

|

|

16,504.7

|

2.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

5,884.8

|

|

5,085.2

|

15.7%

|

|

Personnel, tax and benefits

|

156.8

|

|

136.8

|

14.6%

|

|

Suppliers and Consignment

|

2,406.8

|

|

2,373.2

|

1.4%

|

|

Taxes, fees and contributions

|

487.2

|

|

466.6

|

4.4%

|

|

Loans and financing

|

1,815.0

|

|

1,226.9

|

47.9%

|

|

Interest on own capital and dividends

|

50.5

|

|

51.3

|

-1.6%

|

|

Contingencies provision

|

65.4

|

|

79.3

|

-17.5%

|

|

Derivatives transactions

|

446.9

|

|

387.9

|

15.2%

|

|

Other current liabilities

|

456.2

|

|

363.2

|

25.6%

|

|

|

|

|

|

|

|

Non-Current Liabilities

|

2,784.2

|

|

3,171.6

|

-12.2%

|

|

Long Term Liabilities:

|

|

|

|

|

|

Taxes, fees and contributions

|

225.6

|

|

221.9

|

1.7%

|

|

Loans and financing

|

2,223.4

|

|

2,478.8

|

-10.3%

|

|

Contingencies provision

|

130.2

|

|

130.6

|

-0.3%

|

|

Derivatives transactions

|

63.6

|

|

202.0

|

-68.5%

|

|

Other long term liabilities

|

141.4

|

|

138.3

|

2.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder's Equity

|

8,254.5

|

|

8,247.5

|

0.1%

|

|

|

|

|

|

|

|

Funds for capitalization

|

0.4

|

|

0.4

|

0.0%

|

|

|

|

|

|

|

|

Total Liabilities and Shareholder's Equity

|

16,923.9

|

|

16,504.7

|

2.5%

|

|

CONSOLIDATED INCOME STATEMENTS - VIVO

|

|

|

According to Corporate Law

|

|

|

|

|

|

|

|

|

Accum

|

|

R$ million

|

3 Q 07

|

2 Q 07

|

Δ

%

|

3 Q 06

|

Δ

%

|

|

2007

|

2006

|

Δ

%

|

|

Gross Revenues

|

4,622.0

|

4,310.1

|

7.2%

|

3,961.2

|

16.7%

|

|

12,896.4

|

11,343.2

|

13.7%

|

|

Gross service revenues

|

3,724.0

|

3,471.9

|

7.3%

|

3,268.7

|

13.9%

|

|

10,615.0

|

9,241.4

|

14.9%

|

|

Deductions – Taxes and others

|

(878.2)

|

(824.1)

|

6.6%

|

(801.0)

|

9.6%

|

|

(2,512.1)

|

(2,327.9)

|

7.9%

|

|

Gross handset revenues

|

898.0

|

838.2

|

7.1%

|

692.5

|

29.7%

|

|

2,281.4

|

2,101.8

|

8.5%

|

|

Deductions – Taxes and others

|

(495.3)

|

(465.0)

|

6.5%

|

(335.3)

|

47.7%

|

|

(1,264.0)

|

(1,015.1)

|

24.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues

|

3,248.5

|

3,021.0

|

7.5%

|

2,824.9

|

15.0%

|

|

9,120.3

|

8,000.2

|

14.0%

|

|

Net service revenues

|

2,845.8

|

2,647.8

|

7.5%

|

2,467.7

|

15.3%

|

|

8,102.9

|

6,913.5

|

17.2%

|

|

Subscription and Usage

|

1,373.0

|

1,260.1

|

9.0%

|

1,167.3

|

17.6%

|

|

3,856.6

|

3,490.6

|

10.5%

|

|

Network usage

|

1,251.9

|

1,186.8

|

5.5%

|

1,149.5

|

8.9%

|

|

3,623.3

|

2,947.3

|

22.9%

|

|

Other services

|

220.9

|

200.9

|

10.0%

|

150.9

|

46.4%

|

|

623.0

|

475.6

|

31.0%

|

|

Net handset revenues

|

402.7

|

373.2

|

7.9%

|

357.2

|

12.7%

|

|

1,017.4

|

1,086.7

|

-6.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Costs

|

(2,415.2)

|

(2,386.8)

|

1.2%

|

(2,109.3)

|

14.5%

|

|

(6,895.8)

|

(6,261.2)

|

10.1%

|

|

Personnel

|

(151.3)

|

(165.0)

|

-8.3%

|

(150.9)

|

0.3%

|

|

(490.0)

|

(461.9)

|

6.1%

|

|

Cost of services rendered

|

(780.0)

|

(758.6)

|

2.8%

|

(664.3)

|

17.4%

|

|

(2,255.0)

|

(1,516.5)

|

48.7%

|

|

Leased lines

|

(56.7)

|

(58.3)

|

-2.7%

|

(59.0)

|

-3.9%

|

|

(168.7)

|

(175.4)

|

-3.8%

|

|

Interconnection

|

(412.2)

|

(388.1)

|

6.2%

|

(322.5)

|

27.8%

|

|

(1,165.3)

|

(399.5)

|

191.7%

|

|

Rent/Insurance/Condominium fees

|

(60.7)

|

(54.9)

|

10.6%

|

(53.1)

|

14.3%

|

|

(164.9)

|

(154.7)

|

6.6%

|

|

Fistel and other taxes and contributions

|

(124.3)

|

(120.0)

|

3.6%

|

(125.7)

|

-1.1%

|

|

(371.2)

|

(393.9)

|

-5.8%

|

|

Third-party services

|

(108.9)

|

(116.3)

|

-6.4%

|

(96.4)

|

13.0%

|

|

(322.5)

|

(279.3)

|

15.5%

|

|

Others

|

(17.2)

|

(21.0)

|

-18.1%

|

(7.6)

|

126.3%

|

|

(62.4)

|

(113.7)

|

-45.1%

|

|

Cost of handsets

|

(585.0)

|

(548.5)

|

6.7%

|

(511.9)

|

14.3%

|

|

(1,485.0)

|

(1,491.3)

|

-0.4%

|

|

Selling expenses

|

(728.8)

|

(728.3)

|

0.1%

|

(697.4)

|

4.5%

|

|

(2,076.4)

|

(2,411.1)

|

-13.9%

|

|

Provision for bad debt

|

(80.4)

|

(101.2)

|

-20.6%

|

(147.8)

|

-45.6%

|

|

(289.0)

|

(647.5)

|

-55.4%

|

|

Third-party services

|

(614.4)

|

(596.7)

|

3.0%

|

(520.3)

|

18.1%

|

|

(1,689.3)

|

(1,659.7)

|

1.8%

|

|

Others

|

(34.0)

|

(30.4)

|

11.8%

|

(29.3)

|

16.0%

|

|

(98.1)

|

(103.9)

|

-5.6%

|

|

General & administrative expenses

|

(159.3)

|

(161.6)

|

-1.4%

|

(112.7)

|

41.3%

|

|

(466.7)

|

(387.2)

|

20.5%

|

|

Third-party services

|

(131.3)

|

(137.9)

|

-4.8%

|

(86.6)

|

51.6%

|

|

(388.8)

|

(303.7)

|

28.0%

|

|

Others

|

(28.0)

|

(23.7)

|

18.1%

|

(26.1)

|

7.3%

|

|

(77.9)

|

(83.5)

|

-6.7%

|

|

Other operating revenue (expenses)

|

(10.8)

|

(24.8)

|

-56.5%

|

27.9

|

n.a.

|

|

(122.7)

|

6.8

|

n.a.

|

|

Operating revenue

|

105.6

|

80.0

|

32.0%

|

155.6

|

-32.1%

|

|

250.1

|

286.2

|

-12.6%

|

|

Operating expenses

|

(116.7)

|

(105.1)

|

11.0%

|

(131.3)

|

-11.1%

|

|

(365.6)

|

(274.4)

|

33.2%

|

|

Other operating revenue (expenses)

|

0.3

|

0.3

|

0.0%

|

3.6

|

-91.7%

|

|

(7.2)

|

(5.0)

|

44.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

833.3

|

634.2

|

31.4%

|

715.6

|

16.4%

|

|

2,224.5

|

1,739.0

|

27.9%

|

|

Margin %

|

25.7%

|

21.0%

|

4.7 p.p.

|

25.3%

|

0.3 p.p.

|

|

24.4%

|

21.7%

|

2.7 p.p.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and Amortization

|

(591.1)

|

(602.2)

|

-1.8%

|

(636.3)

|

-7.1%

|

|

(1,764.3)

|

(1,834.2)

|

-3.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

242.2

|

32.0

|

656.9%

|

79.3

|

205.4%

|

|

460.2

|

(95.2)

|

n.a.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Financial Income

|

(113.8)

|

(124.4)

|

-8.5%

|

(201.6)

|

-43.6%

|

|

(356.9)

|

(601.4)

|

-40.7%

|

|

Financial Revenues

|

50.8

|

38.8

|

30.9%

|

40.5

|

25.4%

|

|

147.8

|

218.0

|

-32.2%

|

|

Other financial revenues

|

50.8

|

38.8

|

30.9%

|

40.5

|

25.4%

|

|

147.8

|

218.0

|

-32.2%

|

|

(-) Pis/Cofins taxes on financial revenues

|

0.0

|

0.0

|

n.a.

|

0.0

|

n.a.

|

|

0.0

|

0.0

|

n.a.

|

|

Financial Expenses

|

(160.8)

|

(162.4)

|

-1.0%

|

(234.5)

|

-31.4%

|

|

(508.6)

|

(805.8)

|

-36.9%

|

|

Other financial expenses

|

(120.0)

|

(101.9)

|

17.8%

|

(141.4)

|

-15.1%

|

|

(331.7)

|

(461.5)

|

-28.1%

|

|

Gains (Losses) with derivatives transactions

|

(40.8)

|

(60.5)

|

-32.6%

|

(93.1)

|

-56.2%

|

|

(176.9)

|

(344.3)

|

-48.6%

|

|

Exchange rate variation / Monetary variation

|

(3.8)

|

(0.8)

|

375.0%

|

(7.6)

|

-50.0%

|

|

3.9

|

(13.6)

|

n.a.

|

|

Non-operating revenue/expenses

|

(0.2)

|

(6.3)

|

n.a.

|

(4.7)

|

-95.7%

|

|

(7.4)

|

(10.8)

|

-31.5%

|

|

Taxes

|

(123.8)

|

(14.1)

|

778.0%

|

(69.9)

|

77.1%

|

|

(223.6)

|

(153.9)

|

45.3%

|

|

Minority Interest

|

0.0

|

0.0

|

n.a.

|

0.0

|

n.a.

|

|

0.0

|

(8.0)

|

n.a.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

4.4

|

(112.8)

|

n.a.

|

(196.9)

|

n.a.

|

|

(127.7)

|

(869.3)

|

-85.3%

|

CONFERENCE CALL – 3Q07

In Portuguese

Date:

November 06, 2007 (Tuesday)

Time:

09:30 a.m. (Brasília time) and 06:30 a.m. (New York time)

Telephone number

:

(+55 11) 2188-0188

Conference Call Code

:

VIVO

Webcast

:

www.vivo.com.br/ri

The conference call audio replay will be available at telephone number (+55 11) 2188-0188

code: VIVO or in our website.

CONFERENCE CALL – 3Q07

In English

Date:

November 06, 2007 (Tuesday)

Time:

12:00 p.m. (Brasília time) and 09:00 a.m. (New York time)

Telephone number

:

(+1 973) 935-8893

Conference Call Code

:

VIVO

or 9343497

Webcast

:

www.vivo.com.br/ir

The conference call audio replay will be available at telephone number (+1 973) 341-3080 code: 9343497 or in our website.

|

VIVO – Investor Relations

|

|

Ernesto Gardelliano

Carlos Raimar Schoeninger

Janaina São Felicio

|

Av Chucri Zaidan, 860 – Morumbi – SP – 04583-110

Telefone: +55 11 7420-1172

Email:

ir@vivo.com.br

Information available in the website:

http://www.vivo.com.br/ir

|

|

This press release contains forecasts of future events. Such statements are not statements of historical fact, and merely reflect the expectations of the company's management. The terms "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects", "aims" and similar terms are intended to identify these statements, which obviously involve risks or uncertainties which may or may not be foreseen by the company. Accordingly, the future results of operations of the Company may differ from its current expectations, and the reader should not rely exclusively on the positions taken herein. These forecasts speak only of the date they are made, and the company does not undertake any obligation to update them in light of new information or future developments.

|

|

Financial Terms:

CAPEX

– Capital Expenditure.

Current Capital (Short-term capital)

= Current assets – Current liabilities.

Working capital

= Current Capital – Net Debt.

Net debt

= Gross debt – cash – financial investments – securities – asset from derivative transactions + liability from derivative transactions.

Net Debt / EBITDA

– Index which evaluates the Company’s ability to pay its debt with the generation of operating cash within a one-year period.

EBIT

– Earnings before interest and taxes.

EBITDA

– Earnings result before interest. taxes. depreciation and amortization.

Indebtedness

= Net Debt / (Net Debt + NE) – Index which measures the Company’s financial leverage.

Operating Cash Flow

= EBITDA – CAPEX.

EBITDA Margin

= EBITDA / Net Operating Revenue.

PDD

– Provision for bad debt. A concept in accounting that measures the provision made for accounts receivable overdue for more than 90 days.

NE –

Shareholders’ Equity.

Subsidy

= (net revenue from goods – cost of goods sold + discounts given by suppliers) / gross additions.

Technology and Services

1xRTT

– (1x Radio Transmission Technology) – It is the CDMA 2000 1x technology which, pursuant to the ITU (International Telecommunication Union). and in accordance with the IMT-2000 rules is considered 3G (third generation) Technology.

CDMA

– (C

ode Division Multiple Access

) – Wireless interface technology for cellular networks based on spectral spreading of the radio signal and channel division by code domain.

CDMA 2000 1xEV-DO

– 3rd Generation access technology with data transmission speed of up to 2.4 Megabits per second.

CSP

– Carrier Selection Code.

SMP

– Personal Mobile Services.

SMS

– Short Message Service

–

Short text message service for cellular handsets. allowing customers to send and receive alphanumerical messages.

WAP

–

Wireless Application Protocol

is an open and standardized protocol started in 1997 which allows access to Internet servers through specific equipment. a WAP Gateway at the carrier. and WAP browsers in customers’ handsets. WAP supports a specific language (WML) and specific applications (WML

script

).

ZAP

– A service which allows quick wireless access to the Internet through a computer, notebook or palmtop, using the CDMA 1xRTT technology.

GSM – (Global System for Mobile) – an open digital cellular technology used for transmitting mobile voice and data services. It is a circuit witched system that divides each channel into time-slots.

|

Operating indicators:

Gross additions

– Total of customers acquired in the period.

Net additions

= Gross Additions – number of customers disconnected.

ARPU

(Average Revenue per User) – net revenue from services per month / monthly average of customers in the period.

Postpaid ARPU

– ARPU of postpaid service users.

Prepaid ARPU

– ARPU of prepaid service users.

Blended ARPU

– ARPU of the total customer base (contract + prepaid).

Entry Barrier

– Value of the least expensive phone offered.

Customers

– Number of wireless lines in service.

Churn rate

= percentage of the disconnections from customer base during the period or the number of customers disconnected in the period / ((customers at the beginning of the period + customers at the end of the period) / 2).

Market share

= Company’s total number of customers / number of customers in its operating area.

Market share of net additions

: participation of estimated net additions in the operating area.

MOU

(minutes of use) – monthly average. in minutes. of traffic per customer = (Total number of outbound minutes + incoming minutes) / monthly average of customers in the period.

Postpaid MOU –

MOU of postpaid service users.

Prepaid MOU

– MOU of prepaid service users.

Market penetration

= Company’s total number of customers + estimated number of customers of competitors) / each 100 inhabitants in the Company’s operating area.

Productivity

= number of customers / permanent employees.

Right planning programs

– Customer profile adequacy plans

SAC

– cost of acquisition per customer = (70% marketing expenses + costs of the distribution network + handset subsidies) / gross additions.

VC

– Communication values per minute.

VC1

– Communication values for calls in the same area of the subscriber.

VC2

– Communication values for Calls posted for the same primary area code.

VC3

– Communication values for Calls outside the primary area code.

VU