AMBO Shares Could Climb Sharply

Driven by Novel Solutions for $2.5 Trillion Loss of Business in

U.S. and China from Semiconductor and Tech Labor

Shortages

Atlanta, GA --

February 25th,

2019 -- InvestorsHub

NewsWire --

Emerging MicroCaps

-

Deloitte

estimates the growing shortage of skilled workers in U.S. projected

to cost $2.5 trillion in lost business over next ten years and

China suffers the same problem.

-

Ambow

owns patented HR

job training technology that can provide large numbers of skilled

workers for integrated circuit makers and tech industries in U.S.

and China that is new area of strong interest to

investors.

-

Founded in

Silicon Valley, Ambow Education Group has built an

impeccable reputation for excellence in China and owns U.S.

patented AI and hologram HR learning technology to train large

numbers of skilled workers for chipmakers and tech

jobs.

-

Ambow

Education reports

over $62 million cash plus other assets over $300 million available

for sales-increasing acquisitions, and

9-month 2018 sales of US $52.8 million pointing to over $100

million for 2019.

-

Ambow's

strong growth is being fueled by record HR needs from over 4,000

corporate and 200 university partners.

-

Market comps

demonstrate Ambow share price of $6.35 should

be $22.00, plus very strong growth potential.

Overview

Deloitte estimates the

U.S. and global labor shortage is

reaching a critical point and is restricting what could be much

higher growth for Integrated Circuit manufacturers and tech

companies. For the

first time, there are now more job openings than there are eligible

workers to fill them. The key word here is "eligible", meaning

skilled. Private payrolls are growing less than expected owing to a

shortage of skilled labor to fill the demand for high tech jobs in

integrated circuit manufacturing and tech companies where strong

economic growth has been expected to continue,

but is

disappointing. Deloitte estimates that the U.S. alone could suffer

$2.5 trillion in lost business over the next ten years if skilled

labor supply continues to fall short.

Ambow

Education

Group (NYSE:

AMBO) is a leading national

provider of educational and career enhancement services in China

and is now entering the U.S. market. Ambow's business addresses two

critical demands in China's education market; the desire for

students to be admitted into top secondary and post-secondary

schools, and the desire for graduates of those schools to obtain

more attractive jobs. Founded in Silicon Valley

and relocated to China in

2000, Ambow built its core technology

innovation system and currently holds a competitive advantage in

technology innovation among China's education services

industry.

Ambow

was awarded a

patent from the United States Patent and Trademark Office for its

innovative Adaptive Computer-Assisted Learning System and Method

platform for enhancing learning outcomes, which makes it the first

China-based education company to receive a U.S. patent in the

adaptive learning methods field.

With its

extensive network of regional service hubs complemented by a

dynamic, proprietary learning platform, Ambow now services students in 30

of the 31 provinces and autonomous regions within China. In

2017, Ambow acquired Bay State College in

Boston, Massachusetts to serve as a model for Ambow's unique Cross-Border College

program that offers Chinese students both a China diploma and a

U.S. baccalaureate degree. The Cross-Border College program is

expected to provide strong growth because it offers substantial new

and needed revenue to many U.S. colleges, it appeals to millions of

aspiring Chinese citizens, and it plans to provide large numbers of

valuable skilled workers for integrated circuit makers and tech

companies.

By creating

tech-focused curricula aligned with dynamic industry demand and

coupled with the Company's enormous educational resources and

expertise; Ambow has assumed a major role in

helping Chinese career colleges and schools address five key

industry challenges: curriculum development, qualified faculty,

practical training, job placement and international cooperation. As

an example, Ambow recently established the

first college big data laboratory in China for one of their college

partners to educate students in all aspects of advanced fields,

thus preparing them for highly-skilled jobs in emerging and

fast-growing IT industries.

Another exciting

development in 2018 was the initiation of field testing for

Ambow's

holographic

virtual learning environment. The technology was implemented with

some of our college partners who, in turn, were inspired by

Ambow's

innovative

approach and have asked to set up additional programs.

Ambow

management is

confident that more colleges and institutions will be engaging

with Ambow to help improve their

competitiveness and presence in industry.

With a market cap

of only $135 million and a share price of $6.35,

Ambow

shares are

significantly undervalued and offer substantial unrealized value

coupled with solid growth prospects for 2019 and beyond.

Ambow

has strong

financials, is undergoing a major expansion in China, breaking into

the U.S. market with a model that is attractive to U.S.

Universities and students, and is expected to generate over $100

million in sales in 2019. Ambow's strong educational programs

targeting high-tech jobs are particularly attractive now that there

is a growing awareness of the critical shortage of skilled workers

for technical jobs.

Although

Ambow

has no plans to

sell them, their K-12 schools are now valued at $300 million which

is in excess of the current market cap for the entire company. With

their unique education model that is demonstrating impressive sales

gains, and with their new models for expansion, combined with a

large number of corporate and college partnerships expected to

provide large numbers of highly skilled workers in high demand, the

market is likely to soon discover Ambow and revalue shares at well

over $500 million, or closer to $22 per share based only on current

metrics and comps.

Ambow

Entering

U.S. with First Acquisition of Bay State College

Ambow

highlighted their

progress in a recent

Letter to Shareholders. "Following

the acquisition of Boston-based Bay

State College in November

2017,

Ambow

started to

implement significant operational improvements, which continued

throughout 2018, as part of our near- and long-term strategic

goals, including the restructuring of Bay

State's management

team, and optimizing the college's operations, financial efficiency

and student enrollment."

"Starting

with Bay

State College, we moved

quickly to initiate the launch of the first Cross-Border College

Program (between China and U.S. colleges) in the fourth quarter of

2018. This program is designed to fulfill demand from Chinese

students wanting to earn a bachelor's degree in a popular major,

serving as the basic

foundation to the

start of a career in China or

in the

United States. The

program will allow thousands of Chinese students who now receive

three-year diplomas from Chinese colleges - the equivalent of an

associate degree from a U.S. college - to continue their education

with a two-year advanced education program and earn a bachelor's

degree from Bay

State College or

another U.S. college."

"The

Cross-Border Program has been very well-received among our Chinese

college partners, and certain cooperation agreements and

integration plans have already been implemented. This program

further validates our mission to provide "Better Schools, Better

Jobs, Better Lives" to our students by leveraging Ambow's

established

expertise, vast resources and diversified channels in the education

space. Ambow's

unique

industry-leading position continues to benefit our core business

while we explore additional growth opportunities, including the

entry into new verticals."

"As a

recognized and highly respected educational services provider, we

are excited about the year ahead and our ability to expand

Ambow's

brand and

market position in both the

United States and

China through continued delivery of our powerful learning platform,

the initiatives of entry into new verticals, and a deepening of

cross-border relationships with other educational

providers."

Ambow

is highly

undervalued:

Considering

Ambow's

current

sales, Ambow's Price to Sales ratio of 1.9

is well below the industry average of 6.85. Based on

Ambow's

current run rate

of $70 million per year, the average Price to Sales ratio of 6.85,

commands closer to $22 per share from its current price of $6.16

per share. And this valuation does not factor in the projected

sales of $100 million for 2019.

Ambow's

unique education

model is growing rapidly with the potential to generate very large

revenues as they continue to grow in China. With the addition of

their strategy to enter the U.S. market, and to provide large

numbers of skilled workers, sales growth can become quite

impressive.

One of many

big unmet education needs is shortage in Integrated Circuit

sector

According to

a

Whitepaper, China's integrated circuit

sector is facing the potential of a severe talent shortage as the

talent pool in the industry at the end of 2017 was about 400,000,

while China is expected to need approximately 720,000 IC-related

workers by the year 2020. Considering the rapid growth of the

sector, vocational training and overseas recruitment are playing

more important roles in filling the expanding requirement to

provide 100,000 integrated circuit workers, on average, per year to

capture this ever-growing demand.

The findings of

this latest Whitepaper make it clear that traditional colleges and

universities will be challenged to meet the demand for IC

professionals for years to come. Through Ambow's continuing development of

courses and programs, the company is working hard to reduce this

anticipated shortage by preparing students to meet the requirements

of IC enterprises. Ambow's reach is strengthened greatly

by partnerships with more than 200 colleges and 4,000 corporations

throughout China," commented Dr. Jin Huang, Ambow's President and Chief Executive

Officer.

Dr. Huang

added, "The IC

sector plays a significant role in China's technology-driven

economy, and further technological development is strongly

supported by the government. We are honored to continue our

contribution to the preparation and release of this highly

anticipated Whitepaper, and we are pleased to do our part to

prepare and train professionals for the integrated circuit

industry."

Financials

Strong financial

results were

reported during the first nine months

of 2018. Net revenues and gross profit reached US$52.8

million and US$19.8

million,

respectively, representing growths of 17.3% and 7.0%, compared to

the same period in 2017. Operating expenses as a percentage

of net

revenues decreased by 10.0% throughout the first nine months of

2018, compared to the first nine months of 2017. As

of September 30,

2018, Ambow had cash resources

of US$62.1

million.

With a strengthened capital and operating structure, the company is

working diligently toward balancing growth, profitability and

cost-saving measures. A

full accounting can be seen on SEC Edgar

site. Another significant financial metric is that

Ambow

delivered

an

ROE of 27.7% over the past 12 months, which is an impressive feat

relative to its industry average of 12.5% during the same

period.

Market

Comps

Following are

current market comparisons of Ambow to companies in the same

space:

Ambow

Education

Group (NYSE:

AMBO)

$6.16

Market Cap $135

million

PE

23.16

Price to Sales

1.9

New

Oriental Education & Technology Group (NYSE:

EDU)

provides

private educational services under the New Oriental brand in the

People's Republic of China. It operates through Language Training

and Test Preparation Courses, and Others

segments.

The company offers test preparation courses to students taking

language and entrance exams used by educational institutions in the

United States, the People's Republic of China, and the Commonwealth

countries; and after-school tutoring courses for middle and high

school students to achieve better scores on entrance exams for

admission into high schools or higher education institutions, as

well as for children to teach English. It also provides language

training courses, including English, as well as other foreign

languages, such as German, Japanese, French, Korean, Italian, and

Spanish; operates a full-time private primary and secondary school

in Yangzhou seeking a full curriculum taught in Chinese and

English; develops and edits educational materials for language

training and test preparation comprising books, software, CD-ROMs,

magazines, and other periodicals; and offers online education

programs that include college, K-12, and pre-school education. In

addition, the company offers overseas studies consulting;

pre-school education; and a pilot program that permits third

parties in small cities to provide its English and kindergarten

programs, as well as overseas study tour services. As of May 31,

2018, it offered educational programs, services, and products to

students through a network of 87 schools, 994 learning centers, and

18 bookstores. The company was founded in 1993 and is headquartered

in Beijing, the People's Republic of China. Sales growth has been

consistent.

Share price

$78.58

Market Cap $12.47

billion

PE 54 to

1

Price to Sales

4.5 to 1

TAL

Education Group (NYSE:

TAL) through

its subsidiaries, provides K-12 after-school tutoring services in

the People's Republic of China. It offers tutoring services to K-12

students covering various academic subjects, including mathematics,

physics, chemistry, biology, history, geography, political science,

English, and Chinese. The company also provides tutoring services

primarily through small classes under the Xueersi,

Mobby,

and Firstleap

brand

names; personalized premium services under Izhikang

name;

and online courses. In addition, it operates jzb.com, an online

education platform that serves as a gateway for online courses

offered through xueersi.com; and other Websites for specific topics

and offerings, such as college entrance examinations, high school

entrance examinations, graduate school entrance examinations,

preschool education, and raising infants and toddlers, as well as

mathematics, English, and Chinese composition. Further, the company

provides educational content through mobile applications; operates

mmbang.com and the Mama Bang app, an online platform focusing on

children, baby, and maternity market; and provides consulting

services for overseas studies under the Shunshun

Liuxue

name.

Additionally, it offers tutoring services for students aged two

through twelve under the Mobby

brand;

provides education and management consulting, and investment

management and consulting services; and develops and sells software

and networks, as well as offers related consulting services. The

company also provides online advertising services; and engages in

the sale of educational materials. As of February 28, 2018, the

company's educational network included 594 learning centers and 465

service centers in 42 cities. TAL Education Group was founded in

2003 and is headquartered in Beijing, the People's Republic of

China. Sales growth has been impressive.

$31.73

Market Cap $18

billion

PE 55 to

1

Price to Sales

7.69 to 1

Chegg, Inc.

(NYSE:

CHGG) operates

direct-to-student learning platform that supports students on their

journey from high school to college and into their career with

tools designed to help them pass their test, pass their class, and

save money on required materials. The company offers Chegg

Services, which include digital products and services; and required

materials that comprise its print textbooks and eTextbooks.

Its digital products and services include Chegg Study, which helps

students master challenging concepts on their own; Chegg Writing

that enables

automatically generate sources in the required formats, when

students need to cite their sources in written work; Chegg Tutors

that allow students find human help on its learning platform

through a network of live tutors; Chegg Math, an adaptive math

technology and developer of the math application; Brand

Partnership, which offers various ways for student-relevant brands

to reach and engage high school and college students; Test Prep

that provides students with an online adaptive test preparation

services; and internships services. The company rents and sells

print textbooks and eTextbooks;

and offers supplemental materials and textbook buyback services.

The company has a strategic alliance with Ingram Content Group.

Chegg, Inc. was founded in 2003 and is headquartered in Santa

Clara, California. Sales growth has been relatively disappointing

although there is still a huge market opportunity for Chegg to

pursue.

$35.62

Market Cap $4.1

billion

PE N/A

Price to Sales

13.71 to 1

Bright Horizons

Family Solution

$116.76

Market Cap $6.78

billion

PE 43 to

1

Price to Sales

3.64 to 1

Grand Canyon

Education, Inc.

$92.42

Market Cap $4.45

billion

PE 20 to

1

Price to Sales

4.73 to 1

Risk

factors

Ambow

Education shares

many commonly encountered risk factors such as the inability to

raise capital, unexpected lawsuits, unfavorable international

political or economic events, and most likely the typical lengthy

CYA laundry list expected from any prudent company.

Conclusion

Based on multiple

current industry standard market comps, Ambow Education shares are

substantially undervalued at $6.30 per share and if they were

trading at industry average comps, they would be closer to $22.00

per share. Even more compelling is that Ambow growth is strongly positioned for

further dramatic gains as the company continues increasing growth

in China and is now entering the large U.S. education market with

an emphasis on providing skilled labor for the integrated circuit

and tech sectors. Ambow has good access to capital

since they were ushered into the U.S. financial markets through

an

IPO funded by Goldman Sachs, JP Morgan and others.

Higher

Ambow

share prices are

forecast in the near term as shares currently meets institutional

buying requirements and qualify for purchase by many institutional

investors. Small retail investors and small institutions currently

have an opportunity to accumulate Ambow shares at undervalued prices

before larger institutional buyers discover and drive up

price.

AMBO is

rated "Strong Buy" with 12-month target of $22.00

About

Emerging MicroCaps

Traditional

methods for valuation no longer work as well as in the past.

Technology and business are moving so quickly that many factors

must be considered for successful investment screening. Risks go

far beyond the typical risks associated with capital. The

underlying technology itself must be carefully analyzed to assess

its merits, how it will reach the market and how the market will

react to it, as well as how well management is capable of

execution. Intense research is required for every consideration and

Emerging Microcaps has almost 50 years of valuable experience in

the marketplace to help our clients achieve success. There is no

reward without risk. Our job is to analyze the risk and the rewards

and then determine worthy investment candidates.

Contact/Source:

Emerging

MicroCaps

MicroCapMonsters

Racavalli@yahoo.com

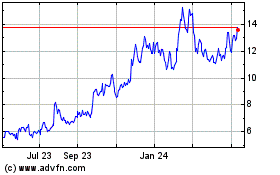

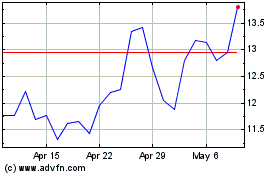

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024