false000000733212/3100000073322021-09-012021-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 1, 2021

________________________________________________________________

SOUTHWESTERN ENERGY COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-08246

|

|

71-0205415

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

10000 Energy Drive

Spring, TX 77389

(Address of principal executive offices)(Zip Code)

(832) 796-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $0.01

|

|

SWN

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

On September 1, 2021, pursuant to the Agreement and Plan of Merger, dated as of June 1, 2021 (the “Merger Agreement”), by and among Southwestern Energy Company (“Southwestern”), Ikon Acquisition Company, LLC (“Merger Sub”), Indigo Natural Resources LLC (“Indigo”), and Ibis Unitholder Representative, LLC solely in its capacity as the Unitholder Representative, Southwestern completed its previously announced acquisition of Indigo.

Item 1.01 Entry into a Material Definitive Agreement.

Registration Rights Agreements

In connection with the closing of the Merger (as defined in Item 2.01 below), Southwestern entered into a registration rights agreement (the “Registration Rights Agreement”) with certain holders of Indigo Membership Interests (as defined in Item 2.01 below) (the “RRA Holders”) that will receive a portion of the consideration in connection with the Merger. Pursuant to the Registration Rights Agreement, among other things, Southwestern (a) is required to file with the Securities and Exchange Commission a registration statement on Form S-3 registering for resale the shares of Southwestern common stock received by the RRA Holders as part of the Merger (the “Shelf Registration Statement”), and (b) will grant certain RRA Holders certain demand and piggyback registration rights.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the form of Registration Rights Agreement, a copy of which is included as Exhibit 2.2 to this Current Report on Form 8-K, and incorporated herein by reference.

Lock-Up Agreements

In connection with entering into the Registration Rights Agreement, Southwestern also entered into lock-up agreements with certain RRA Holders who, in the aggregate, own approximately 95% of the outstanding interests in Indigo (the “Lock-Up Agreements”), pursuant to which, among other things, each such RRA Holder will agree to transfer only up to a certain specified portion of the Southwestern stock consideration received in the Merger as follows: the RRA Holders subject to the Lock-Up Agreements may (i) not transfer any Registrable Securities (as defined in the Registration Rights Agreement) on or before the date that is 30 days following the closing of the Merger and (ii) transfer up to an aggregate of 25% of the Registrable Securities beginning on the 31st day after closing pursuant to the Shelf Registration Statement, including pursuant to non-underwritten resales pursuant to the Shelf Registration Statement, subject to certain delay and suspension rights, and up to (a) one shelf underwritten offering on or before the date that is six months following closing and (b) two shelf underwritten offerings on or after the date that is six months following the closing.

The foregoing description of the Lock-Up Agreements is qualified in its entirety by reference to the full text of the form of Lock-Up Agreement, a copy of which is included as Exhibit 2.3 to this Current Report on Form 8-K, and incorporated herein by reference.

Indigo First Supplemental Indenture

On August 26, 2021, Indigo entered into the First Supplemental Indenture to the Indenture, dated as of February 2, 2021, among Indigo, the guarantors party thereto and Wells Fargo, National Association, the trustee, to effect the proposed amendments to the Indenture in connection with the previously announced exchange offer and consent solicitation by Southwestern with respect to Indigo's 5.375% Senior Notes due 2029. The proposed amendments eliminated substantially all of the restrictive covenants and events of default in the Indenture.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information set forth in the “Introductory Note” of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

In accordance with the Merger Agreement, at the effective time of the Merger (the “Effective Time”), Southwestern acquired all of the outstanding membership interests of Indigo (the “Indigo Membership Interests”) in exchange for the consideration described below. Upon the terms and subject to the conditions of the Merger Agreement, Merger Sub

merged with and into Indigo, with Indigo continuing as the surviving company (the “Merger”) and a wholly-owned subsidiary of Southwestern.

Under the terms and conditions of the Merger Agreement, the aggregate consideration paid to the holders of Indigo Membership Interests in the transaction consisted of $400 million in cash and 339,270,568 shares of Southwestern common stock, as adjusted pursuant to the Merger Agreement.

The description of the Merger Agreement and related transactions (including, without limitation, the Merger) in this Current Report on Form 8-K does not purport to be complete and is subject, and qualified in its entirety by reference, to the full text of the Merger Agreement, which is attached as Exhibit 2.1 to Southwestern’s Current Report on Form 8-K filed with the Commission on June 2, 2021 and incorporated herein by reference.

Item 3.03 Material Modification of Rights of Security Holders.

As reported in our Current Report on Form 8-K filed on August 27, 2021, at a special meeting of our stockholders held on August 27, 2021, our stockholders approved, among other proposals, an amendment to Southwestern’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 1,250,000,000 shares to 2,500,000,000 shares (the “Authorized Share Increase”).

On September 1, 2021, we filed an amendment to our Amended and Restated Certificate of Incorporation (the “Amendment Certificate”) with the Secretary of State of the State of Delaware to effect the Authorized Share Increase. The newly authorized shares of common stock were identical to the shares of common stock previously authorized and outstanding. The Authorized Share Increase did not alter the voting powers or relative rights of the common stock.

The foregoing description of the Amendment Certificate does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amendment Certificate, which is filed herewith as Exhibit 3.1 and incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in Item 3.03 of this report with respect to the Authorized Share Increase is incorporated by reference into this Item 5.03.

Item 8.01 Other Events.

On September 1, 2021, Southwestern issued a press release announcing the completion of the Merger, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired

The audited consolidated balance sheets of Indigo, as of December 31, 2020 and 2019, and the audited consolidated statements of operations, statements of cash flows and statements of members’ common equity of Indigo for the years ended December 31, 2020 and 2019, and the notes related thereto, were filed on Southwestern’s Current Report on Form 8-K on July 2, 2021 as Exhibit 99.2 and are incorporated in this Item 9.01(a) by reference.

The unaudited condensed consolidated balance sheet of Indigo as of June 30, 2021 and the unaudited condensed consolidated statements of operations, statements of cash flows and statements of members’ common equity of Indigo for the six-month periods ended June 30, 2021 and 2020 were filed on Southwestern’s Current Report on Form 8-K on August 10, 2021 as Exhibit 99.3 and are incorporated in this Item 9.01(a) by reference.

(b) Unaudited Pro Forma Financial Information

The unaudited pro forma condensed combined balance sheet as of June 30, 2021 and the unaudited pro forma condensed combined statements of operations for the year ended December 31, 2020 and the six-month period ended June 30, 2021 were filed on Southwestern’s Current Report on Form 8-K on August 10, 2021 as Exhibit 99.4 and are incorporated in this Item 9.01(b) by reference.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Descriptions

|

|

2.1

|

|

|

|

2.2*

|

|

|

|

2.3*

|

|

|

|

3.1*

|

|

|

|

99.1*

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

*Filed herewith

**Annexes, schedules and certain exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Southwestern Energy Company hereby undertakes to furnish supplemental copies of any of the omitted annexes, schedules and exhibits upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOUTHWESTERN ENERGY COMPANY

|

|

|

Registrant

|

|

|

|

|

Dated: September 1, 2021

|

By:

|

/s/ CHRIS LACY

|

|

|

|

Name:

|

Chris Lacy

|

|

|

|

Title:

|

Vice President, General Counsel and Corporate Secretary

|

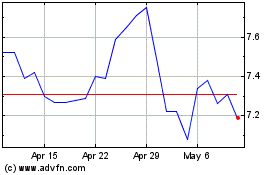

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

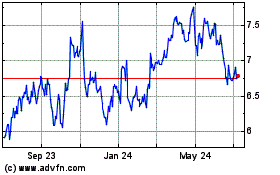

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024