Report of Foreign Issuer (6-k)

April 11 2019 - 10:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF APRIL 2019

Commission File Number:

333-04906

SK Telecom Co., Ltd.

(Translation of registrant’s name into English)

65 Euljiro,

Jung-gu

Seoul 04539, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Decision on Acquisition of Shares of Incross

On April 10, 2019, SK Telecom Co., Ltd. (the “Company”) entered into a share purchase agreement (the “Agreement”)

with NHN Corporation, the largest shareholder of Incross Co., Ltd. (“Incross”), pursuant to which the Company will acquire shares of Incross.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Details of Incross

|

|

Company Name

|

|

Incross Co., Ltd.

|

|

|

Country of Incorporation

|

|

Republic of Korea

|

|

Representative

|

|

Jaewon Lee

|

|

|

Share Capital (Won)

|

|

4,026,738,500

|

|

Relationship to Company

|

|

—

|

|

|

Total Number of Shares Issued

|

|

8,035,477

|

|

Principal Business

|

|

Advertising and advertising agency

|

|

|

|

|

|

2. Details of Acquisition

|

|

Number of Shares to be Acquired

|

|

2,786,455

|

|

|

Acquisition Amount (Won)

|

|

53,499,936,000

|

|

|

Company’s Total Shareholders’ Equity

|

|

22,349,250,355,012

|

|

|

Ratio of Acquisition Amount to the Company’s Total Shareholders’ Equity as of December 31, 2018

|

|

0.24%

|

|

|

|

|

|

3. Number of Shares to be Held by the Company and Shareholding Ratio after Acquisition

|

|

Number of Shares to be Held

|

|

2,786,455

|

|

|

Shareholding Ratio

|

|

34.60%

|

|

|

|

|

4. Acquisition Method

|

|

Cash

|

|

|

|

|

5. Purpose of Acquisition

|

|

To expand Incross’ digital advertising business through the integration of the Company’s technological capabilities.

|

|

|

|

|

6. Scheduled Acquisition Date

|

|

June 18, 2019

|

|

|

|

|

7. Date of Agreement

|

|

April 10, 2019

|

|

|

|

|

8. Put Options or Other Agreements

|

|

None

|

|

|

|

|

9. Other Important Matters Relating to Investment Decision

|

|

• The transaction will be conducted in the form of an

off-market

trade.

• The acquisition amount in Item 2 above may be subject to change depending on the results of the

Company’s due diligence after the date of the Agreement. The Agreement may be terminated if the parties fail to agree on such resulting change in the acquisition amount.

• The scheduled acquisition date in Item 6 above refers to the scheduled date of payment of the

acquisition amount.

• The

above matters and timetable may change subject to discussions with, or approvals by, relevant authorities or by agreement between the parties.

|

2

Summary Financial Information of Incross (Unit: in millions of Won)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the year ended December 31,

|

|

Total Assets

|

|

|

Total

Liabilities

|

|

|

Total

Shareholder’s

Equity

|

|

|

Share

Capital

|

|

|

Revenue

|

|

|

Profit for

the Year

|

|

|

2018

|

|

|

121,311

|

|

|

|

58,372

|

|

|

|

62,939

|

|

|

|

4,006

|

|

|

|

35,770

|

|

|

|

8,628

|

|

|

2017

|

|

|

124,860

|

|

|

|

62,960

|

|

|

|

61,900

|

|

|

|

3,943

|

|

|

|

36,750

|

|

|

|

8,293

|

|

|

2016

|

|

|

90,531

|

|

|

|

43,782

|

|

|

|

46,749

|

|

|

|

1,470

|

|

|

|

31,454

|

|

|

|

6,326

|

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SK T

ELECOM

C

O

., L

TD

.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jung Hwan Choi

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

Name:

|

|

Jung Hwan Choi

|

|

|

|

|

|

Title:

|

|

Senior Vice President

|

|

|

|

|

|

|

Date: April 11, 2019

|

|

|

|

|

|

|

4

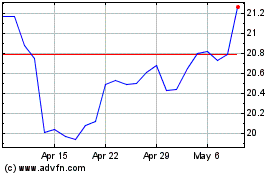

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

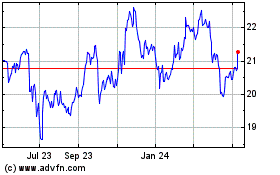

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024