UPDATE: Tech Mahindra 1Q Net Profit Up 9.1%, But Misses Forecast

July 26 2010 - 10:33AM

Dow Jones News

Tech Mahindra Ltd.'s (532755.BY) first-quarter net profit Monday

rose 9.1% from a year earlier because of lower interest expenses,

but the software exporter's results missed market expectations due

to slow order growth from Europe and volatile currency

movements.

Consolidated net profit at Pune, western India-based Tech

Mahindra rose to INR1.44 billion in the April-June period from

INR1.32 billion a year earlier, while revenue gained 1.9% to

INR11.34 billion from INR11.13 billion.

The market was expecting the joint venture of India's Mahindra

& Mahindra Ltd. (500520.BY) and U.K.-based BT Group PLC (BT) to

post a net profit of INR1.96 billion on revenue of INR12.61

billion, according to the average of estimates in a Dow Jones

Newswires poll of 12 analysts.

While top Indian software exporters such as Tata Consultancy

Services Ltd. and Infosys Technologies Ltd. are reporting strong

order growth as they shrug off the effects of the economic

slowdown, smaller companies are still finding their customers

cautious in awarding contracts.

Also, uncertainties over the European economy is a concern for

the software industry, especially for Tech Mahindra as it has a

higher exposure to Europe than most of its local rivals--the

company gets 55% of its total revenue from Europe and 32% from

North America.

"In the previous quarter, we saw prolonged decision-making

cycles at key customers," Chairman Anand Mahindra said in a

statement.

The latest-quarter results included INR501.2 million received

from BT--its largest client accounting for about 45% of revenue--as

part of a INR9.68 billion fee for restructuring some long-term

contracts.

Tech Mahindra had recorded INR2.00 billion of this restructuring

fee as revenue in the last fiscal year, while the remaining amount

will be carried forward as deferred revenue in the balance

sheet.

Interest cost fell to INR263.7 million from INR571.0 million a

year earlier, the company statement said without elaborating.

Tech Mahindra had taken huge debt to fund its acquisition of a

controlling stake in Satyam Computer Services Ltd. (SAY) last year

and the cost of the funds had hurt its profit in the past few

quarters.

Its results included a non-operating income of INR252.8 million

in the past quarter, compared with an year-earlier expense of

INR261.1 million.

Tech Mahindra, which bills up to 65% of its revenue in the

British pound and most of the rest in dollars, said volatile

currencies were a major worry.

"It's been a quarter where our performance has been impacted

among others by adverse currency movements," Vice Chairman Vineet

Nayyar said.

The Indian rupee has risen about 5% against the pound and nearly

1% to the dollar in the past quarter. Any gains for the rupee will

hurt the company as it converts revenue in foreign currencies into

the local unit.

Operating margin fell to 18.5% from 23.6% in the previous

quarter and 25.2% in the year-earlier period.

"There is definitely some negative surprise" on the margin

front, analyst Shashi Bhushan of Prabhudas Lilladher said. "But,

after seeing seven or eight companies reporting over the last few

weeks, a lot has been factored in largely in terms of expectations

also."

Tech Mahindra plans to offer salary hikes in the current quarter

and that it will hurt its margins, Chief Financial Officer Sonjoy

Anand said. He didn't elaborate on the salary hike.

Tech Mahindra said it added four clients in the quarter, taking

the total number of clients to 117. It also took 1,743 employees

during April-June, taking its total headcount to 35,267.

-By Dhanya Ann Thoppil, Dow Jones Newswires; +91-9886929464;

dhanya.thoppil@dowjones.com

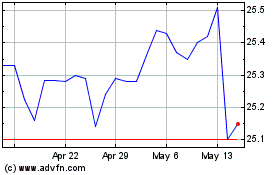

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

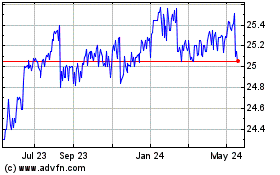

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Apr 2023 to Apr 2024