- Report of Foreign Issuer (6-K)

February 23 2010 - 7:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

Date of Event Reported: February 23, 2010

Commission File Number 001-15190

Satyam Computer Services Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Satyam Infocity

Unit — 12, Plot No. 35/36

Hi-tech City layout, Survey No. 64, Madhapur

Hyderabad — 500 081

Andhra Pradesh, India

(91) 40 3063 6363

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form

20-F or Form 40-F.

Form 20-F

þ

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

o

Indicate by check mark whether the Registrant by furnishing the information contained in this Form

is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes

o

No

þ

If “Yes” is marked, indicate below the file number assigned to registrant in connection with Rule

12g3-2(b):

Not applicable.

Other Events

On February 22, 2010, Satyam Computer Services Limited (“Satyam”) filed a lawsuit against Upaid

Systems, Ltd. (“Upaid”) in state court in the State of New York, County of New York (U.S.), seeking

a declaration regarding the Settlement Agreement between Upaid and Satyam previously disclosed in a

Form 6-K furnished to the U.S. Securities and Exchange Commission on December 9, 2009. As

contemplated by the Settlement Agreement, the parties have subsequently, among other things,

entered into an Escrow Agreement dated December 10, 2009, and Satyam has deposited the entire $70

million settlement amount into the escrow account provided for under the Escrow Agreement.

In the lawsuit filed on February 22, 2010, Satyam is asking the New York Court for

A. A declaration that

(1) the Settlement Agreement is valid and enforceable; (2) the Escrow Agreement is valid and

enforceable; (3) under the terms of the Agreements, the disbursement of funds from the Escrow

Account must be made in accordance with Indian law, including any requirement to deduct taxes from

the Settlement Amounts prior to disbursement; (4) Upaid is solely responsible for any tax liability

arising from that $70 million settlement payment, including responsibility for complying with tax

deduction requirements; (5) to the extent there is any tax deduction required, it shall be deducted

from the $70 million, plus interest, currently in the escrow account that would otherwise be

payable to Upaid; (6) Satyam has discharged its obligations under the Settlement Agreement and

shall owe nothing further to Upaid; and (7) Satyam is entitled to receive from Upaid all the

benefits of the Settlement Agreement, including the release of claims, license of intellectual

property and dismissal of pending litigation.

B. Compensatory damages against Upaid in an amount to be determined at trial.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, there under duly authorized.

|

|

|

|

|

|

|

|

SATYAM COMPUTER SERVICES LIMITED

|

|

|

|

/s/ G. Jayaraman

|

|

|

|

Name:

|

G. Jayaraman

|

|

|

Date: February 23, 2010

|

|

Company Secretary

|

|

|

|

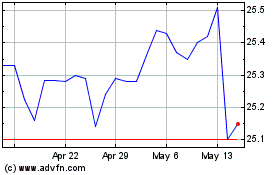

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

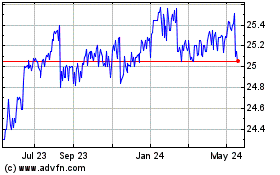

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Apr 2023 to Apr 2024