UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

[Rule 13d-101]

Under the Securities Exchange Act of 1934

(Amendment No. 2)

SATYAM COMPUTER SERVICES LIMITED

Common Stock, par value Rs. 2.0 per share

|

|

|

(Title of Class of Securities)

|

CUSIP Number for Equity Shares: Y7530Q141;

CUSIP Number for American Depositary Shares:

804098101

Milind Kulkarni

Vice President Finance

Tech Mahindra Limited

Sharda Centre,

Off Karve Road

Erandwane

Pune, 411 004, India

+91 20 6601 8100

|

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

with a copy to:

Gina K. Gunning, Esq.

Peter E. Izanec, Esq.

Jones Day

901 Lakeside,

Cleveland, Ohio 44114

216-586-3939

July 10, 2009

|

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the

subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box.

¨

Note.

Schedules filed in paper format shall include a signed original and five copies of the Schedule including all exhibits.

See

Section 240.13d-7 for other parties to whom copies are to be

sent.

(Continued on following pages)

|

|

|

|

|

|

|

CUSIP No.

Y7530Q141

|

|

13D

|

|

Page 2 of 8 Pages

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSONS

Venturbay Consultants

Private Limited

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

¨

(b)

¨

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

OO (See Item 3)

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

India

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

SOLE VOTING POWER

-0-

|

|

|

8

SHARED VOTING POWER

501,843,740

|

|

|

9

SOLE DISPOSITIVE POWER

-0-

|

|

|

10

SHARED DISPOSITIVE POWER

501,843,740

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

501,843,740

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

42.7

1

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (see instructions)

OO

|

|

|

|

1

|

This calculation is based on 1,175,455,935 shares of common stock, par value Rs. 2.0 per share, of Satyam Computer Services Limited outstanding immediately after

the Subsequent Allotment (as defined herein).

|

|

|

|

|

|

|

|

CUSIP No.

Y7530Q141

|

|

13D

|

|

Page 3 of 8 Pages

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSONS

Tech Mahindra

Limited

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

¨

(b)

¨

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

4

|

|

SOURCE OF FUNDS (see instructions)

OO (See Item 3)

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

¨

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

India

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

SOLE VOTING POWER

-0-

|

|

|

8

SHARED VOTING POWER

501,843,740

|

|

|

9

SOLE DISPOSITIVE POWER

-0-

|

|

|

10

SHARED DISPOSITIVE POWER

501,843,740

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

501,843,740

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

¨

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

42.7

2

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (see instructions)

HC

|

|

|

|

2

|

This calculation is based on 1,175,455,935

shares of common stock, par value Rs. 2.0 per share, of Satyam Computer Services Limited outstanding immediately

after the Subsequent Allotment.

|

This Amendment No. 2 to Schedule 13D amends the information set forth in the Schedule 13D filed by

Venturbay Consultants Private Limited (“

Venturbay

”) and Tech Mahindra Limited (“

Tech Mahindra

”) with the Securities and Exchange Commission (the “

Commission

”) on May 15 2009 and Amendment

No. 1 filed on June 6, 2009 (as amended, the “

Schedule 13D

”), relating to the to common stock, par value Rs. 2.0 per share (“

Shares

”), of Satyam Computer Services Limited, a corporation organized

under the laws of India (the “

Issuer

”). The Issuer has its principal executive offices at Satyam Infocity, Unit — 12, Plot No. 35/36, Hi-tech City layout, Survey No. 64, Madhapur Hyderabad — 500 081, Andhra

Pradesh, India. Venturbay is a wholly owned subsidiary of Tech Mahindra. Capitalized terms used herein without definition shall have the meanings assigned to such terms in the Schedule 13D filed with the Commission on May 15, 2009. Except as

expressly set forth herein, there have been no changes to the information set forth in the Schedule 13D.

|

Item 2.

|

Identity and Background

|

Item 2 of the

Schedule 13D is hereby amended and supplemented by adding the following text thereto:

On June 23, 2009, the Issuer and Tech Mahindra

announced that Mr. Vineet Nayyar was appointed as Executive Vice-Chairman of the Issuer and Tech Mahindra, Mr. Sanjay Kalra was appointed as Chief Executive Officer of Tech Mahindra and Mr. C.P. Gurnani was appointed as Chief

Executive Officer of the Issuer. The principal business address of Mr. Vineet Nayyar and Mr. Sanjay Kalra is c/o Tech Mahindra Limited, Sharda Centre, Off Karve Road, Erandwane, Pune, 411 004, India, telephone +91 20 6601 8100. The

principal business address of Mr. C.P. Gurnani is c/o Satyam Computer Services Limited 1-8-303/36, Mayfair Centre, 1st Floor, S P Road, Secunderabad — 500 003, India, telephone: + 91 40 3065 4343.

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

Item 3 of the Schedule 13D is hereby amended and restated in its entirety as set forth below:

The source of funds used to

acquire Shares by Venturbay (including the funds used to acquire Shares in the Initial Allotment, Open Public Offer and the Subsequent Allotment (in each case as defined in Item 4 below)) was from internal resources, optionally convertible

domestic debt, equity by Tech Mahindra in Venturbay and debt extended by Tech Mahindra to Venturbay. The total consideration used to purchase the Shares in the Initial Allotment was Rs. 17,560,330,966 (approximately US$351 million based on an

exchange rate of Rs. 50 to US$1), the Open Public Offer was Rs. 24,413,070 (approximately US$0.5 million based on an exchange rate of Rs. 50 to US$1), and the Subsequent Allotment was Rs. 11,522,192,884 (approximately US$230 million based on an

exchange rate of Rs. 50 to US$1). In connection with Venturbay’s acquisition of Shares in the Initial Allotment, Open Public Offer and Subsequent Allotment, (1) Tech Mahindra has infused funds in Venturbay by using cash on hand, which

includes funds that Tech Mahindra previously had available to it for general corporate purposes such as capital expenditures and working capital needs, and (2) Venturbay raised capital through the issuance of optionally convertible debentures

(as described in more detail in the next sentence). In connection with its acquisition of the Shares, Venturbay has issued optionally convertible debentures to various institutional investors for an aggregate consideration of Rs. 550 Crores

(approximately US$110 million based on the above-stated exchange rate) in the aggregate, at an effective interest rate of approximately 15%, which indebtedness matures over a period of three years or may be converted into equity at the end of three

years. It is anticipated that this indebtedness will be paid from proceeds from operations and/or future capital raising transactions.

Separately, Tech Mahindra has borrowed Rs. 1450 Crores (approximately US$290 million based on the above-stated exchange rate) from various banks, mutual funds, institutions & non banking financial institutions at an effective

interest rate of approximately 10%, which indebtedness matures over a period of one to five years. This indebtedness has been incurred in connection with Tech Mahindra’s anticipated need for increased working capital & capital

expenditures in the coming years. It is anticipated that this indebtedness also will be paid from proceeds from operations and/or future capital raising transactions.

|

Item 4.

|

Purpose of the Transaction

|

Item 4 of the

Schedule 13D is hereby amended and restated in its entirety as follows:

The Reporting Persons are acquiring the Shares as part of a

strategic investment in the information technology, consulting and business outsourcing businesses of the Issuer.

The Issuer undertook a

competitive bidding process (the

“Competitive Bidding Process”

) for the purpose of selecting a strategic investor for the Issuer. The Issuer commenced the Competitive Bidding Process on March 9, 2009 and selected the Reporting

Persons as the highest bidder on April 13, 2009. On that date, the Issuer and the Reporting Persons entered into a share subscription agreement (the

“Share Subscription Agreement”

), which provides for the following

transactions:

|

|

•

|

|

Under the Share Subscription Agreement, subject to the terms and conditions thereof, the Issuer issued new Shares to the Reporting Persons (the

“Initial

Allotment”

) in an amount equal to 31% of the Enhanced Share Capital

3

at 58

Indian Rupees per Share (the

“Purchase Price”

). The Reporting Persons deposited the funds necessary to consummate the Initial Allotment and the Open Public Offer (as defined herein) in separate escrow accounts on April 20, 2009

and the Initial Allotment was completed on May 5, 2009;

|

|

|

•

|

|

Subject to the terms and conditions of the Share Subscription Agreement, the Reporting Persons shall make a cash tender offer (the

“Open Public

Offer”

) to the holders of the Shares to acquire, at the Purchase Price or a price higher than the Purchase Price, a minimum of 20% of the Enhanced Share Capital. The Open Public Offer commenced on June 12, 2009 and expired on

July 1, 2009; and

|

|

|

•

|

|

If, upon the closing of the Open Public Offer, the Reporting Persons have acquired less than 51% of the Enhanced Share Capital through the Initial Allotment and the

Open Public Offer, then following the Open Public Offer, the Reporting Persons may elect, at their option, to subscribe for additional Shares at the Purchase Price (the

“Subsequent Allotment”

) in accordance with the Share

Subscription Agreement. The Subsequent Allotment was completed on July 10, 2009.

|

As part of the Competitive Bidding

Process, the Reporting Persons entered into separate standstill agreements with the Issuer, each dated March 24, 2009 (collectively, the

“Standstill Agreements”

), with respect to future acquisition, disposition or transfer of

securities of the Issuer. Pursuant to the Standstill Agreements, the Reporting Persons were prohibited from tendering their Shares in the Open Public Offer. The Standstill Agreements terminate six months from the date of Public Announcement (as

defined below).

Pursuant to the terms of the Share Subscription Agreement, Venturbay agreed to use its reasonable best efforts to

(i) maintain the listing of the American Depositary Shares (

“ADSs”

) on the New York Stock Exchange, (ii) maintain the registration of the Shares and ADSs pursuant to Section 12(b) or 12(g) of the Securities Exchange

Act of 1934, as amended (the

“Exchange Act”

) and ensure that the Shares and ADSs will not become eligible for termination of registration under the Exchange Act and (iii) not take any action in respect of the Shares and ADSs

that would result in the applicability of the “going private transaction” rules of the Section 13(e) of the Exchange

|

3

|

The term “

Enhanced Share Capital

” as used in this Schedule 13D means, with respect to the Initial Allotment, the Issuer’s share capital

(excluding any instruments convertible into Issuers’ share capital), after giving effect to the Shares issued in such Initial Allotment. With respect to the Open Public Offer (as defined herein), the term “Enhanced Share Capital”

includes the Shares (including any instruments convertible into the Issuer’s share capital as provided by the Securities Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997) issued in the Initial

Allotment. With respect to the Subsequent Allotment (as defined herein), if any, the term “Enhanced Share Capital” includes the Shares (including any instruments convertible into the Issuer’s share capital, on a fully diluted basis)

issued in such Subsequent Allotment.

|

Act, in each case, for a period of one year after the closing of the Open Public Offer. Under the Share Subscription

Agreement, Venturbay agreed that the Shares acquired in the Initial Allotment, the Open Public Offer or the Subsequent Allotment would be locked in for a period of three years from the date of acquisition of such Shares in the manner provided in the

Securities Exchange Board of India DIP Guidelines. Under the Share Subscription Agreement, Venturbay agreed not to sell or dispose of any material assets or undertaking of the Issuer for a period of two years from the date of completion of the Open

Public Offer without the required consent specified in the Share Subscription Agreement. Under the Share Subscription Agreement, Venturbay agreed not to discontinue the main business of the Issuer or cause the Issuer to undertake any new business

which is unrelated or not complementary to the existing business of the Issuer without the prior approval of the shareholders of the Issuer for so long as the Company Petition of 2009 remains pending.

The foregoing summary of the Share Subscription Agreement and the transactions contemplated thereby, including the Initial Allotment, the Open Public

Offer, and the Subsequent Allotment is not complete and is subject in its entirety to the Share Subscription Agreement, which is filed as Exhibit 99.1 hereto and incorporated herein by reference, and the Public Announcement to the Shareholders of

Satyam Computer Services Limited, dated April 22, 2009 (the

“Public Announcement”

), which is filed as Exhibit 99.2 hereto and incorporated by reference.

On May 22, 2009, Venturbay nominated four individuals to join the board of directors of the Issuer (the

“Board”

):

Mr. Vineet Nayyar, Mr. C.P. Gurnani, Mr. Sanjay Kalra, and Mr. Ulhas Yargop. Such appointments to the Board became effective on May 27, 2009, bringing the total number of directors on the Board to ten.

On June 8, 2009, the Reporting Persons filed with the Commission a tender offer statement on Schedule TO relating to the making of the Open Public

Offer. Also on June 8, the Reporting Persons began mailing the Letter of Offer in connection with the Open Public Offer.

On

June 23, 2009, the Issuer and Tech Mahindra announced the executive appointments of Mr. C.P. Gurnani as CEO of the Issuer, Mr. S. Durgashankar as CFO of the Issuer, and Mr. Nayyar as Executive Vice-Chairman of the Issuer.

On June 12, 2009, the offering period for the Open Public Offer commenced. The offering period for the Open Public Offer expired on

July 1, 2009. On July 6, 2009, the Reporting Persons filed Amendment No. 4 to the Schedule TO to report the final results of the Open Public Offer. Specifically, a total of 420,915 Shares (including 268,656 Shares underlying ADSs)

were validly tendered and not withdrawn upon the expiration of the Open Public Offer. The Reporting Persons have accepted for payment all Shares validly tendered and not validly withdrawn in the Open Public Offer. Payment for Shares accepted in the

Open Public Offer was made on July 7, 2009. Pursuant to the terms and conditions of the Share Subscription Agreement, on July 6, 2009, the Reporting Persons advised Issuer that they intended to acquire Shares in the Subsequent Allotment

pursuant to the Share Subscription Agreement. On July 10, 2009, the Subsequent Allotment was completed with the Reporting Persons acquiring 198,658,498 Shares. The balance of the funds remaining in the escrow account established for purposes of

funding the Open Public Offer was used to purchase the Shares in the Subsequent Allotment.

|

Item 5.

|

Interest in Securities of Issuer.

|

Item 5 of

Schedule 13D is hereby amended and restated in its entirety and set forth below:

(a) The aggregate number and percentage of Shares of the

Issuer deemed to be beneficially owned by the Reporting Persons is 501,843,740 Shares (the

“Owned Shares”

), which represents 42.7% of the outstanding Shares of the Issuer. All of the Owned Shares are directly owned by Venturbay and

beneficially owned by Tech Mahindra. The calculation of this percentage is based upon 1,175,455,935 Shares outstanding immediately after the Subsequent Allotment. Venturbay and Tech Mahindra have shared voting and dispositive power of all of the

Owned Shares.

To the knowledge of the Reporting Persons, none of the persons set forth on Schedule A to the Schedule 13D filed with

the Commission on May 15, 2009, has any interest in the Shares of the Issuer other than Mr. Ulhas N. Yargop, who owns 2 Shares.

(b) The Reporting Persons have shared power to vote or direct the vote and to dispose or to direct the

disposition of the Owned Shares.

(c) Except for the Initial Allotment, the Open Public Offer and the Subsequent Allotment, during the past

60 days, the Reporting Persons have not effected any transactions in Shares.

(d) Not applicable.

(e) Not applicable.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Date: July 10, 2009

|

|

|

|

VENTURBAY CONSULTANTS PRIVATE LIMITED

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Milind Kulkarni

|

|

|

|

|

|

|

|

Milind Kulkarni

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

TECH MAHINDRA LIMITED

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Milind Kulkarni

|

|

|

|

|

|

|

|

Milind Kulkarni

|

|

|

|

|

|

|

|

Vice President Finance

|

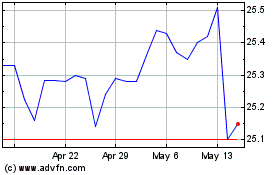

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

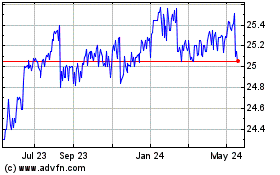

Saratoga Investment (NYSE:SAY)

Historical Stock Chart

From Apr 2023 to Apr 2024