UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

July 24, 2024

Commission file number:

001-14251

SAP EUROPEAN COMPANY

(Translation of registrant's name into English)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

| Form 20-F | [X] |

Form

40-F |

[ ] |

SAP SE

FORM 6-K

On July 22, 2024, SAP SE, (“SAP"),

issued a quarterly statement (the “Quarterly Statement”) announcing SAP’s financial results for the second quarter ended

June 30, 2024. The Quarterly Statement is attached as Exhibit 99.1 hereto and incorporated by reference herein.

On July 23, 2024, SAP filed a half-year

report with Deutsche Boerse AG for the first half ended June 30, 2024 (the “Half-Year Report”). The Half-Year Report

is attached as Exhibit 99.2 hereto and incorporated by reference herein.

The Quarterly Statement and the Half-Year Report disclose certain non-IFRS

measures. These measures are not prepared in accordance with IFRS and are therefore considered non-IFRS financial measures. The non-IFRS

financial measures that we report should be considered in addition to, and not as substitutes for or superior to, revenue, operating income,

cash flows, or other measures of financial performance prepared in accordance with IFRS.

Please refer to Explanations of Non-IFRS Measures online (www.sap.com/about/investor/index.epx)

for further information regarding the non-IFRS measures.

Any statements contained in this document that are not historical

facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate,"

"believe," "estimate," "expect," "forecast," "intend," "may," "plan,"

"project," "predict," "should" and "will" and similar expressions as they relate to SAP are intended

to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements.

All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from

expectations. The factors that could affect SAP's future financial results are discussed more fully in SAP's filings with the U.S. Securities

and Exchange Commission (the "SEC"), including SAP's most recent Annual Report on Form 20-F filed with the SEC. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

This filing is also intended to fulfil the NYSE rules set forth in

Sections 103.00 and 203.03.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By: | /s/ Christopher Sessar |

| | | Name: |

Dr. Christopher Sessar |

| | | Title: |

Chief Accounting Officer |

| By: | /s/ Julia Zicke |

| | | Name: |

Dr. Julia Zicke |

| | | Title: |

Head of External Reporting and Accounting Technology |

Date: July 24, 2024

EXHIBIT INDEX

Exhibit 99.1

| Quarterly

Statement Q2 2024 |

SAP

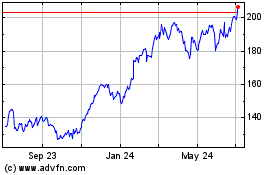

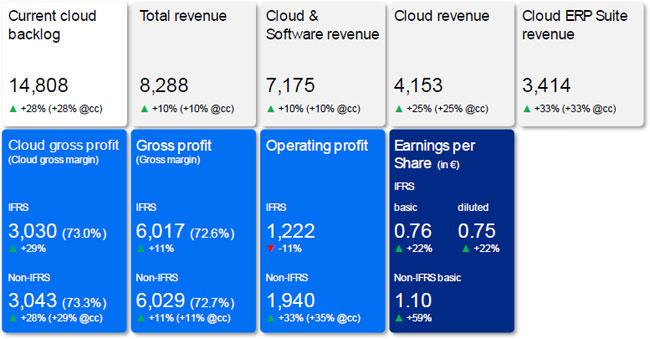

Announces Q2 2024 Results

| • | Current

cloud backlog of €14.8 billion, up 28%, both at nominal and constant currencies |

| • | Cloud

revenue up 25%, underpinned by 33% Cloud ERP Suite revenue growth, all at nominal and constant

currencies |

| • | Total

revenue up 10%, both at nominal and constant currencies |

| • | IFRS

cloud gross profit up 29%, non-IFRS cloud gross profit up 28% and up 29% at constant currencies |

| • | IFRS

operating profit down 11% due to restructuring expenses of €0.6 billion. Non-IFRS operating

profit up 33% and up 35% at constant currencies |

| • | 2024

financial outlook reiterated. 2025 operating profit ambition increased to reflect anticipated

incremental efficiency gains from expanded transformation program |

in

€ millions, unless otherwise stated; based on SAP group results from continuing operations

| Quarterly

Statement Q2 2024 |

Walldorf,

Germany – July 22, 2024

SAP SE (NYSE: SAP) announced today its financial results for the second quarter

ended June 30, 2024.

Christian

Klein, CEO:

Our

cloud growth momentum remained strong in Q2, with Business AI enabling many deals. We continue to execute on our transformation

with great discipline, leading to an increase in our operating profit ambition for 2025. At the same time, we continue to invest

into our transformation to be the leader in Business AI. Given our progress and strong pipeline, we are confident to achieve accelerating

topline growth through 2027.

Dominik

Asam, CFO:

We

are staying squarely focused on delivering our outlook for this year. Our current cloud backlog growth during the second half

of 2024, and especially in Q4 will be decisive to lay a solid foundation for our cloud revenue ambition for 2025. At the same

time, we’ll continue to execute against our transformation plan to achieve our 2025 free cash flow ambition despite a mid-triple-digit

million cash out for restructuring spilling into next year.

All

figures in this statement are based on SAP group results from continuing operations unless otherwise noted.

Financial

Performance

Group

results at a glance – Second quarter 2024

| |

IFRS |

|

Non-IFRS1 |

| |

|

|

|

| €

million, unless otherwise stated |

Q2

2024 |

Q2

2023 |

∆

in % |

|

Q2

2024 |

Q2

2023 |

∆

in % |

∆

in %

const. curr. |

| SaaS/PaaS |

4,018 |

3,130 |

28 |

|

4,018 |

3,130 |

28 |

28 |

| Thereof

Cloud ERP Suite2 |

3,414 |

2,562 |

33 |

|

3,414 |

2,562 |

33 |

33 |

| Thereof

Extension Suite3 |

604 |

568 |

6 |

|

604 |

568 |

6 |

6 |

| IaaS4 |

135 |

186 |

–27 |

|

135 |

186 |

–27 |

–27 |

| Cloud

revenue |

4,153 |

3,316 |

25 |

|

4,153 |

3,316 |

25 |

25 |

| Cloud

and software revenue |

7,175 |

6,505 |

10 |

|

7,175 |

6,505 |

10 |

10 |

| Total

revenue |

8,288 |

7,554 |

10 |

|

8,288 |

7,554 |

10 |

10 |

| Share

of more predictable revenue (in %) |

84 |

82 |

2pp |

|

84 |

82 |

2pp |

|

| Cloud

gross profit |

3,030 |

2,357 |

29 |

|

3,043 |

2,368 |

28 |

29 |

| Gross

profit |

6,017 |

5,409 |

11 |

|

6,029 |

5,432 |

11 |

11 |

| Operating

profit (loss) |

1,222 |

1,371 |

–11 |

|

1,940 |

1,457 |

33 |

35 |

| Profit

(loss) after tax from continuing operations |

918 |

724 |

27 |

|

1,278 |

799 |

60 |

|

| Profit

(loss) after tax5 |

918 |

2,982 |

–69 |

|

1,278 |

2,437 |

–48 |

|

| Earnings

per share - Basic (in €) from continuing operations |

0.76 |

0.62 |

22 |

|

1.10 |

0.69 |

59 |

|

| Earnings

per share - Basic (in €)5 |

0.76 |

2.70 |

–72 |

|

1.10 |

2.40 |

–54 |

|

| Net

cash flows from operating activities from continuing operations |

1,540 |

848 |

82 |

|

|

|

|

|

| Free

cash flow |

|

|

|

|

1,291 |

604 |

>100 |

|

1

For a breakdown of the individual adjustments see table “Non-IFRS Operating Expense Adjustments by Functional Areas”

in this Quarterly Statement.

2

Cloud ERP Suite references the portfolio of strategic Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) solutions

that are tightly integrated with our core ERP solutions and are included in key commercial packages, such as RISE with SAP. The

following offerings contribute to Cloud ERP Suite revenue: SAP S/4HANA Cloud, SAP Business Technology Platform, and core solutions

for HR and payroll, spend management, commerce, customer data solutions, business process transformation, and working capital

management. For additional information and historical data on Cloud ERP Suite, see SAP’s Reporting

Framework.

3

Extension Suite references SAP’s remaining SaaS and PaaS solutions that supplement and extend the functional coverage

of the Cloud ERP Suite.

4

Infrastructure as a service (IaaS): The major portion of IaaS comes from SAP HANA Enterprise Cloud.

5

From continuing and discontinued operations.

| Quarterly

Statement Q2 2024 |

Group

results at a glance – Six months ended June 2024

| |

IFRS |

|

Non-IFRS1 |

| €

million, unless otherwise stated |

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

|

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

∆

in %

const. curr. |

| SaaS/PaaS |

7,782 |

6,110 |

27 |

|

7,782 |

6,110 |

27 |

28 |

| Thereof

Cloud ERP Suite revenue2 |

6,581 |

4,984 |

32 |

|

6,581 |

4,984 |

32 |

33 |

| Thereof

Extension Suite revenue3 |

1,202 |

1,126 |

7 |

|

1,202 |

1,126 |

7 |

7 |

| IaaS4 |

299 |

383 |

–22 |

|

299 |

383 |

–22 |

–21 |

| Cloud

revenue |

8,082 |

6,493 |

24 |

|

8,082 |

6,493 |

24 |

25 |

| Cloud

and software revenue |

14,134 |

12,863 |

10 |

|

14,134 |

12,863 |

10 |

11 |

| Total

revenue |

16,329 |

14,995 |

9 |

|

16,329 |

14,995 |

9 |

10 |

| Share

of more predictable revenue (in %) |

84 |

82 |

2pp |

|

84 |

82 |

2pp |

|

| Cloud

gross profit |

5,867 |

4,596 |

28 |

|

5,892 |

4,617 |

28 |

29 |

| Gross

profit |

11,778 |

10,693 |

10 |

|

11,803 |

10,737 |

10 |

11 |

| Operating

profit (loss) |

434 |

2,174 |

–80 |

|

3,473 |

2,779 |

25 |

27 |

| Profit

(loss) after tax from continuing operations |

94 |

1,128 |

–92 |

|

2,223 |

1,667 |

33 |

|

| Profit

(loss) after tax5 |

94 |

3,491 |

–97 |

|

2,223 |

3,448 |

–36 |

|

| Earnings

per share - Basic (in €) from continuing operations |

0.05 |

0.97 |

–95 |

|

1.91 |

1.44 |

33 |

|

| Earnings

per share - Basic (in €)5 |

0.05 |

3.12 |

–98 |

|

1.91 |

3.23 |

–41 |

|

| Net

cash flows from operating activities from continuing operations |

4,297 |

3,160 |

36 |

|

|

|

|

|

| Free

cash flow |

|

|

|

|

3,784 |

2,559 |

48 |

|

1

For a breakdown of the individual adjustments see table “Non-IFRS Operating Expense Adjustments by Functional Areas”

in this Quarterly Statement.

2

Cloud ERP Suite references the portfolio of strategic Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) solutions

that are tightly integrated with our core ERP solutions and are included in key commercial packages, such as RISE with SAP. The

following offerings contribute to Cloud ERP Suite revenue: SAP S/4HANA Cloud, SAP Business Technology Platform, and core solutions

for HR and payroll, spend management, commerce, customer data solutions, business process transformation, and working capital

management. For additional information and historical data on Cloud ERP Suite, see SAP’s Reporting

Framework.

3

Extension Suite references SAP’s remaining SaaS and PaaS solutions that supplement and extend the functional coverage

of the Cloud ERP Suite.

4

Infrastructure as a service (IaaS): The major portion of IaaS comes from SAP HANA Enterprise Cloud.

5

From continuing and discontinued operations.

Financial

Highlights1

Second

Quarter 2024

In

the second quarter, SAP’s strong cloud momentum continued. Current cloud backlog grew by 28% to €14.81 billion and

again was up 28% at constant currencies. Cloud revenue was up 25% to €4.15 billion and up 25% at constant currencies, mainly

driven by Cloud ERP Suite revenue, which was up 33% to €3.41 billion and up 33% at constant currencies.

Software

licenses revenue decreased by 28% to €0.2 billion and was down 27% at constant currencies. Cloud and software revenue was

up 10% to €7.17 billion and up 10% at constant currencies. Services revenue was up 6% to €1.11 billion and up 6% at

constant currencies. Total revenue was up 10% to €8.29 billion and up 10% at constant currencies.

The

share of more predictable revenue increased by 2 percentage points to 84% in the second quarter.

Cloud

gross profit was up 29% (IFRS) to €3.03 billion, up 28% to €3.04 billion (non-IFRS), and up 29% (non-IFRS at constant

currencies).

IFRS

operating profit in the second quarter was down 11% to €1.22 billion. The decrease was driven by restructuring expenses of

€0.6 billion associated with the 2024 transformation program. Non-IFRS operating profit was up 33% to €1.94 billion

and was up 35% at constant currencies. Non-IFRS operating profit growth was supported by strong revenue growth as well as disciplined

execution of the 2024 transformation program.

1

The Q2 2024 results were also impacted by

other effects. For details, please refer to the disclosures on page 27 of this document.

| Quarterly

Statement Q2 2024 |

IFRS

earnings per share (basic) increased 22% to €0.76. Non-IFRS earnings per share (basic) increased 59% to €1.10. The effective

tax rate (IFRS) was 33.8% (Q2/2023: 33.8%) and the effective tax rate (non-IFRS) was 33.6% (Q2/2023: 33.0%). For non-IFRS, the

year-over-year increase mainly resulted from a temporary inability to offset withholding taxes in Germany due to tax losses in

2024 resulting from restructuring. For IFRS, the negative effects from withholding taxes were compensated mainly by changes in

tax-exempt income and valuation allowances on deferred tax assets.

Free

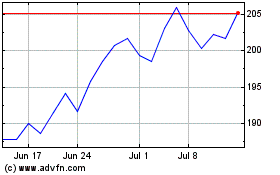

cash flow in the second quarter increased by 114% to €1.3 billion. While around €0.5 billion was paid out for restructuring,

the positive development was primarily attributable to increased profitability and enhanced working capital management. For the

first six months, free cash flow was up 48% to €3.8 billion.

Share

Repurchase Program

In

May 2023, SAP announced a share repurchase program with an aggregate volume of up to €5 billion and a term until December

31, 2025. As of June 30, 2024, SAP had repurchased 12,895,525 shares at an average price of €145.20 resulting in a purchased

volume of approximately €1.87 billion under the program.

2024

Transformation Program: Focus on scalability of operations and key strategic growth areas

In

2024, SAP is further increasing its focus on key strategic growth areas, in particular business AI. It is transforming its operational

setup to capture organizational synergies and AI-driven efficiencies, and to prepare the company for highly scalable future revenue

growth.

To

this end, as announced in January, SAP is executing a company-wide restructuring program which is anticipated to conclude in early

2025. The restructuring is intended to ensure that SAP’s skillset and resources continue to meet future business needs and

is currently expected to affect 9,000 to 10,000 positions, a majority of which will be covered by voluntary leave programs and

internal re-skilling measures. Reflecting re-investments into strategic growth areas, SAP still expects to exit 2024 at a headcount

similar to year-end 2023.

In

the second quarter, additional restructuring expenses of €0.6 billion were recorded, which mainly reflect the positive reception

of the voluntary leave programs.

While

restructuring expenses recorded in the first half of 2024 total €2.9 billion, the overall expenses associated with the program

are now estimated to be approximately €3 billion.

Restructuring

payouts in the second quarter and first half of 2024 amounted to €0.5 billion. Overall payouts associated with the program

are currently expected at approximately €3 billion, of which a mid-triple-digit million amount is expected to occur in 2025.

| Quarterly

Statement Q2 2024 |

Business

Highlights

In

the second quarter, customers around the globe continued to choose “RISE with SAP”

to drive their end-to-end business transformations. These customers included: Alpargatas,

Auckland Council, Blue Diamond Growers, Border States, Copenhagen Airports, ExxonMobil,

Navantia, PANDORA, Porsche Informatik, Powerlink Queensland, Prairie Farms Dairy, ProRail,

Prysmian, Shiseido Company, Tokio Marine & Nichido Fire Insurance, VistaPrint, Warsaw

City Hall, and Xerox.

BMI

Group Holdings, Co-op, Fiagril, Pure Storage, UBE Corporation, and Wegmans went live on SAP S/4HANA Cloud in the second quarter.

Consolidated

Hospitality Supplies, flatexDEGIRO, Fortera Corporation, La Trobe University, Stern-Wywiol Gruppe, and Trade Capital Corporation

chose “GROW with SAP”, an offering helping customers adopt cloud ERP with speed, predictability, and continuous innovation.

Key

customer wins across SAP’s solution portfolio included: Accenture, Ambipar, Arca Continental, BASF, Buderus Guss, Carl Zeiss,

DACHSER, Endress+Hauser, iHerb, Lenovo, Minor Hotels, New Look, Parle Biscuits, Refresco, U.S. Sugar, Veolia Group, and Zoomlion.

Beiersdorf,

E.ON, Gerdau, Hyundai Motor Company, Kia Corporation and SMA Solar Technology went live on SAP solutions.

In

the second quarter, SAP’s cloud revenue performance was particularly strong in APJ and EMEA and robust in the Americas region.

Brazil, Canada, Germany, India, Japan, and South Korea had outstanding performances in cloud revenue growth while China, the U.S.,

and Saudi Arabia were particularly strong.

On

April 22, SAP announced AI advancements in its supply chain solutions that we anticipate will unleash a transformative wave of

productivity, efficiency and precision in manufacturing. AI-driven insights from real-time data will help companies use their

own data to make better decisions across supply chains, streamline product development and improve manufacturing efficiency.

On

May 6, SAP announced that it had extended the contract of CEO and Member of the Executive Board Christian Klein for three years,

until April 2028.

On

May 8, SAP and IBM announced their vision for the next era of their collaboration, which includes new generative AI capabilities

and industry-specific cloud solutions that can help clients unlock business value.

On

May 13, SAP announced that Charoen Pokphand Foods Public Company Limited (“CP Foods”) had selected multiple SAP solutions

to drive further growth and competitive advantage and to ensure the sustainability of its products for the future.

On

May 15, SAP announced that the Annual General Meeting (AGM) of Shareholders of SAP SE elected Pekka Ala-Pietilä as new member

of the company’s Supervisory Board. Subsequently, Ala-Pietilä was also elected the new Chairman of the SAP Supervisory

Board, completing the handover from former Chairman of the Board, Prof. Dr. h. c. mult. Hasso Plattner. In addition, Prof. Dr.

Ralf Herbrich was elected and Aicha Evans, Gerhard Oswald and Dr. Friederike Rotsch were reelected as members of the Supervisory

Board. The AGM also approved all other proposals of the Executive Board and Supervisory Board with strong support. That includes

the adjustment of the compensation of the Chairman of the Supervisory Board. Furthermore, the dividend proposal of €2.20

per share for fiscal year 2023 was approved.

On

May 29, SAP and Amazon Web Services (AWS), an Amazon.com company, announced an expanded, strategic collaboration to transform

modern cloud enterprise resource planning (ERP) experiences and help enterprises drive new capabilities and efficiencies with

generative artificial intelligence (AI).

On

June 5, SAP and WalkMe Ltd. (Walkme) announced that the companies had entered into a definitive agreement under which SAP will

acquire 100% of WalkMe, a leader in digital adoption platforms. The Executive and Supervisory Boards of SAP SE and the board of

directors of WalkMe have approved the transaction for US $14.00 per share in an all-cash transaction, representing an equity value

of approximately US $1.5 billion. The offer price represents a 45% premium to WalkMe’s closing share price on June 4, 2024.

The acquisition is subject to customary closing conditions, including the receipt of WalkMe shareholder approval and necessary

regulatory clearances, and is expected to close in the third quarter of 2024.

On

June 5, SAP announced that it was adjusting its dividend policy effective immediately. The new policy is to pay a dividend amounting

to at least 40% of the group’s non-IFRS profit after tax from continuing operations (previously: at least 40% of the group’s

IFRS profit after tax).

| Quarterly

Statement Q2 2024 |

Financial

Outlook 2024

SAP’s

financial outlook 2024 is based on SAP’s updated non-IFRS definition of profit measures which, beginning in 2024, include

share-based compensation expenses and exclude gains and losses from equity securities, net. For more details, please refer to

the Reporting Framework section on our Investor Relations website: https://www.sap.com/investors/en/reports/reporting-framework.html.

SAP

continues to expect:

| • | €17.0

– 17.3 billion cloud revenue at constant currencies (2023: €13.66 billion),

up 24% to 27% at constant currencies. |

| • | €29.0

– 29.5 billion cloud and software revenue at constant currencies (2023: €26.92

billion), up 8% to 10% at constant currencies. |

| • | €7.6

– 7.9 billion non-IFRS operating profit at constant currencies (2023: €6.51

billion), up 17% to 21% at constant currencies. |

| • | Free

cash flow of approximately €3.5 billion (2023: €5.09 billion). |

| • | An

effective tax rate (non-IFRS) of approximately 32% (2023: 30.3%)2. |

While

SAP’s 2024 financial outlook is at constant currencies, actual currency reported figures are expected to be impacted by

currency exchange rate fluctuations as the company progresses through the year, as reflected in the table below.

Currency

Impact Assuming June 30, 2024 Rates Apply for 2024

| In

percentage points |

Q3

2024 |

FY

2024 |

| Cloud

revenue growth |

+0.5pp |

–0.5pp |

| Cloud

and software revenue growth |

+0.5pp |

–0.5pp |

| Operating

profit growth (non-IFRS) |

+0.0pp |

–1.5pp |

Non-Financial

Outlook 2024

SAP

now expects the Employee Engagement Index to be in a range of 70% to 74% in 2024 (previously: 76% to 80%).

In

2024, SAP continues to expect:

| • | A

Customer Net Promoter Score of 9 to 13. |

| • | To

steadily decrease carbon emissions across the relevant value chain, in line with our

target of achieving Net Zero carbon emissions by 2030. |

| • | To

steadily increase the number of women in executive roles in line with our end of year

2027 target to achieve 25%. |

Ambition

2025

SAP

is updating its financial ambition 2025, reflecting the anticipated incremental benefits from the transformation program.

By

2025, SAP now expects:

| • | Non-IFRS

operating profit of approximately €10.2 billion (previously: approximately €10

billion). |

SAP

continues to expect:

| • | Cloud

revenue of more than €21.5 billion. |

| • | Total

revenue of more than €37.5 billion. |

| • | Non-IFRS

cloud gross profit of approximately €16.2 billion. |

| • | Free

cash flow of approximately €8.0 billion (now including an anticipated mid-triple-digit

million Euro restructuring payout in 2025 associated with the 2024 transformation program). |

2

The effective tax rate (non-IFRS) is a non-IFRS financial measure and is presented for supplemental informational purposes

only. We do not provide an outlook for the effective tax rate (IFRS) due to the uncertainty and potential variability of gains

and losses associated with equity securities, which are reconciling items between the two effective tax rates (non-IFRS and IFRS).

These items cannot be provided without unreasonable efforts but could have a significant impact on our future effective tax rate

(IFRS).

| Quarterly

Statement Q2 2024 |

| • | A

share of more predictable revenue of approximately 86%. |

The

2025 financial ambition is based on an exchange rate of 1.10 USD per EUR.

Non-Financial

Ambition 2025

For

2025, SAP now aims to increase the Employee Engagement Index (previously: Steadily increasing the Employee Engagement Index).

SAP

continues to aim for

| • | Steadily

increasing the Customer Net Promoter Score. |

The

2025 non-financial ambitions are in addition to our medium-term targets of achieving Net Zero carbon emissions across the value

chain by 2030 and reaching 25% women in executive roles by the end of 2027.

| Quarterly

Statement Q2 2024 |

Additional

Information

This

press release and all information therein is preliminary and unaudited. Due to rounding, numbers may not add up precisely.

SAP

Performance Measures

For

more information about our key growth metrics and performance measures, their calculation, their usefulness, and their limitations,

please refer to the following document on our Investor Relations website: https://www.sap.com/investors/performance-measures

Webcast

SAP

senior management will host a financial analyst conference call on Monday, July 22nd at 11:00 PM (CEST) / 10:00 PM (BST) /

5:00 PM (EDT) / 2:00 PM (PDT). The conference will be webcast on the Company’s website at https://www.sap.com/investor

and will be available for replay. Supplementary financial information pertaining to the second quarter results can be found

at https://www.sap.com/investor

About

SAP

As a

global leader in enterprise applications and business AI, SAP (NYSE: SAP) stands at the nexus of business and

technology. For over 50 years, organizations have trusted SAP to bring out their best by uniting business-critical operations

spanning finance, procurement, HR, supply chain, and customer experience. For more information, visit www.sap.com.

For

more information, financial community only:

| Alexandra

Steiger |

+49

(6227) 7-767336 |

investor@sap.com,

CET |

Follow

SAP Investor Relations on LinkedIn at SAP Investor Relations.

For

more information, press only:

| Joellen

Perry |

+1

(650) 445-6780 |

joellen.perry@sap.com,

PT |

| Daniel

Reinhardt |

+49

(6227) 7-40201 |

daniel.reinhardt@sap.com,

CET |

For

customers interested in learning more about SAP products:

| Global

Customer Center: |

+49

180 534-34-24 |

| United

States Only: |

+1

(800) 872-1SAP (+1-800-872-1727) |

Note

to editors:

To

preview and download broadcast-standard stock footage and press photos digitally, please visit www.sap.com/photos.

On this platform, you can find high resolution material for your media channels.

This

document contains forward-looking statements, which are predictions, projections, or other statements about future events. These

statements are based on current expectations, forecasts, and assumptions that are subject to risks and uncertainties that could

cause actual results and outcomes to materially differ. Additional information regarding these risks and uncertainties may be

found in our filings with the Securities and Exchange Commission, including but not limited to the risk factors section of SAP’s

2023 Annual Report on Form 20-F.

©

2024 SAP SE. All rights reserved.

SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks

of SAP SE in Germany and other countries. Please see https://www.sap.com/copyright

for additional trademark information and notices

| Quarterly

Statement Q2 2024 |

Contents

|

Quarterly

Statement Q2 2024 |

Financial

and Non-Financial Key Facts

(IFRS and Non-IFRS)

| €

millions, unless otherwise stated |

Q1

2023 |

Q2

2023 |

Q3

2023 |

Q4

2023 |

TY

2023 |

Q1

2024 |

Q2

2024 |

| Revenues |

|

|

|

|

|

|

|

| Cloud |

3,178 |

3,316 |

3,472 |

3,699 |

13,664 |

3,928 |

4,153 |

| %

change – yoy |

24 |

19 |

16 |

20 |

20 |

24 |

25 |

| %

change constant currency – yoy |

22 |

22 |

23 |

25 |

23 |

25 |

25 |

| Cloud

ERP Suite |

2,422 |

2,562 |

2,711 |

2,931 |

10,626 |

3,167 |

3,414 |

| %

change – yoy |

35 |

30 |

26 |

28 |

29 |

31 |

33 |

| %

change constant currency – yoy |

33 |

33 |

34 |

33 |

33 |

32 |

33 |

| Software

licenses |

276 |

316 |

335 |

838 |

1,764 |

203 |

229 |

| %

change – yoy |

–13 |

–26 |

–17 |

–8 |

–14 |

–26 |

–28 |

| %

change constant currency – yoy |

–13 |

–24 |

–14 |

–6 |

–12 |

–25 |

–27 |

| Software

support |

2,905 |

2,873 |

2,872 |

2,846 |

11,496 |

2,829 |

2,792 |

| %

change – yoy |

–1 |

–3 |

–5 |

–5 |

–3 |

–3 |

–3 |

| %

change constant currency – yoy |

–1 |

–1 |

–1 |

–1 |

–1 |

–1 |

–3 |

| Software

licenses and support |

3,180 |

3,189 |

3,208 |

3,683 |

13,261 |

3,031 |

3,021 |

| %

change – yoy |

–2 |

–6 |

–6 |

–6 |

–5 |

–5 |

–5 |

| %

change constant currency – yoy |

–2 |

–4 |

–2 |

–2 |

–3 |

–4 |

–5 |

| Cloud

and software |

6,358 |

6,505 |

6,679 |

7,382 |

26,924 |

6,960 |

7,175 |

| %

change – yoy |

10 |

5 |

4 |

6 |

6 |

9 |

10 |

| %

change constant currency – yoy |

8 |

8 |

9 |

10 |

9 |

11 |

10 |

| Total

revenue |

7,441 |

7,554 |

7,744 |

8,468 |

31,207 |

8,041 |

8,288 |

| %

change – yoy |

10 |

5 |

4 |

5 |

6 |

8 |

10 |

| %

change constant currency – yoy |

9 |

8 |

9 |

9 |

9 |

9 |

10 |

| Share

of more predictable revenue (in %) |

82 |

82 |

82 |

77 |

81 |

84 |

84 |

| Profits |

|

|

|

|

|

|

|

| Operating

profit (loss) (IFRS) |

803 |

1,371 |

1,723 |

1,902 |

5,799 |

–787 |

1,222 |

| Operating

profit (loss) (non-IFRS) |

1,321 |

1,457 |

1,767 |

1,969 |

6,514 |

1,533 |

1,940 |

| %

change |

–15 |

14 |

7 |

1 |

1 |

16 |

33 |

| %

change constant currency |

–15 |

19 |

13 |

5 |

5 |

19 |

35 |

| Profit

(loss) after tax (IFRS) |

403 |

724 |

1,272 |

1,201 |

3,600 |

–824 |

918 |

| Profit

(loss) after tax (non-IFRS) |

868 |

799 |

1,352 |

1,302 |

4,321 |

944 |

1,278 |

| %

change |

–20 |

–9 |

13 |

–10 |

–6 |

9 |

60 |

| Margins |

|

|

|

|

|

|

|

| Cloud

gross margin (IFRS, in %) |

70.5 |

71.1 |

72.7 |

71.9 |

71.6 |

72.2 |

73.0 |

| Cloud

gross margin (non-IFRS, in %) |

70.8 |

71.4 |

73.0 |

72.2 |

71.9 |

72.5 |

73.3 |

| Software

license and support gross margin (IFRS, in %) |

88.6 |

89.8 |

90.0 |

89.8 |

89.6 |

89.2 |

89.7 |

| Software

license and support gross margin (non-IFRS, in %) |

88.9 |

90.2 |

90.1 |

89.8 |

89.8 |

89.2 |

89.7 |

| Cloud

and software gross margin (IFRS, in %) |

79.5 |

80.3 |

81.0 |

80.8 |

80.4 |

79.6 |

80.0 |

| Cloud

and software gross margin (non-IFRS, in %) |

79.9 |

80.6 |

81.2 |

81.0 |

80.7 |

79.8 |

80.2 |

| Gross

margin (IFRS, in %) |

71.0 |

71.6 |

72.8 |

73.3 |

72.2 |

71.7 |

72.6 |

| Gross

margin (non-IFRS, in %) |

71.3 |

71.9 |

73.0 |

73.4 |

72.4 |

71.8 |

72.7 |

| Operating

margin (IFRS, in %) |

10.8 |

18.2 |

22.2 |

22.5 |

18.6 |

–9.8 |

14.7 |

|

Quarterly

Statement Q2 2024 |

| €

millions, unless otherwise stated |

Q1

2023 |

Q2

2023 |

Q3

2023 |

Q4

2023 |

TY

2023 |

Q1

2024 |

Q2

2024 |

| Operating

margin (non-IFRS, in %) |

17.8 |

19.3 |

22.8 |

23.3 |

20.9 |

19.1 |

23.4 |

| Key

Profit Ratios |

|

|

|

|

|

|

|

| Effective

tax rate (IFRS, in %) |

40.5 |

33.8 |

27.8 |

33.6 |

32.6 |

16.0 |

33.8 |

| Effective

tax rate (non-IFRS, in %) |

29.1 |

33.0 |

27.1 |

32.5 |

30.3 |

32.4 |

33.6 |

| |

|

|

|

|

|

|

|

| Earnings

per share, basic (IFRS, in €) from continuing operations |

0.35 |

0.62 |

1.09 |

1.05 |

3.11 |

–0.71 |

0.76 |

| Earnings

per share, basic (non-IFRS, in €) from continuing operations |

0.75 |

0.69 |

1.16 |

1.12 |

3.72 |

0.81 |

1.10 |

| Earnings

per share, basic (IFRS, in €)1 |

0.41 |

2.70 |

1.09 |

1.05 |

5.26 |

–0.71 |

0.76 |

| Earnings

per share, basic (non-IFRS, in €)1 |

0.83 |

2.40 |

1.16 |

1.12 |

5.51 |

0.81 |

1.10 |

| Order

Entry and current cloud backlog |

|

|

|

|

|

|

|

| Current

cloud backlog |

11,148 |

11,537 |

12,269 |

13,745 |

13,745 |

14,179 |

14,808 |

| %

change – yoy |

25 |

21 |

19 |

25 |

25 |

27 |

28 |

| %

change constant currency – yoy |

25 |

25 |

25 |

27 |

27 |

28 |

28 |

| Share

of cloud orders greater than €5 million based on total cloud order entry volume (in %) |

45 |

46 |

49 |

62 |

55 |

52 |

52 |

| Share

of cloud orders smaller than €1 million based on total cloud order entry volume (in %) |

26 |

25 |

21 |

14 |

19 |

21 |

20 |

| Liquidity

and Cash Flow |

|

|

|

|

|

|

|

| Net

cash flows from operating activities |

2,311 |

848 |

1,124 |

1,926 |

6,210 |

2,757 |

1,540 |

| Purchase

of intangible assets and property, plant, and equipment |

–257 |

–156 |

–182 |

–190 |

–785 |

–187 |

–178 |

| Payments

of lease liabilities |

–99 |

–89 |

–78 |

–66 |

–332 |

–78 |

–70 |

| Free

cash flow |

1,955 |

604 |

865 |

1,670 |

5,093 |

2,492 |

1,291 |

| %

of total revenue |

26 |

8 |

11 |

20 |

16 |

31 |

16 |

| %

of profit after tax (IFRS) |

485 |

83 |

68 |

139 |

141 |

N/A |

141 |

| Cash

and cash equivalents |

8,766 |

14,142 |

9,378 |

8,124 |

8,124 |

9,295 |

7,870 |

| Group

liquidity |

9,700 |

14,326 |

12,122 |

11,275 |

11,275 |

13,411 |

11,449 |

| Financial

debt (–) |

–10,751 |

–10,146 |

–8,445 |

–7,755 |

–7,755 |

–7,770 |

–7,776 |

| Net

liquidity (+) / Net debt(–) |

–1,050 |

4,180 |

3,677 |

3,521 |

3,521 |

5,641 |

3,674 |

| Non-Financials |

|

|

|

|

|

|

|

| Number

of employees (quarter end)2 |

105,132 |

105,328 |

106,495 |

107,602 |

107,602 |

108,133 |

105,315 |

| Employee

retention (in %, rolling 12 months) |

93.8 |

95.1 |

96.0 |

96.4 |

96.4 |

96.6 |

96.6 |

| Women

in management (in %, quarter end) |

29.4 |

29.5 |

29.5 |

29.7 |

29.7 |

29.8 |

29.9 |

| Women

in executive roles (in %, quarter end) |

21.8 |

21.9 |

22.1 |

22.2 |

22.2 |

21.7 |

21.9 |

Gross

greenhouse gas emissions (scope 1, 2, 3 / market-based)3

(in

million tons CO2 equivalents) |

|

|

|

|

6.9 |

1.8 |

1.8 |

1 From

continuing and discontinued operations.

2 In

full-time equivalents.

3 Our

gross greenhouse gas emissions (GHG) – which cover scope 1, scope 2, and scope 3 (market based) – include the total

lifecycle emissions resulting from the use of our on-premise software. A projection over the next 12 months amounts to 5.9 million

tons CO2e. The calculation of use of sold products emissions is based on the number of active maintenance contracts

at quarter end. Therefore, the emissions for individual quarters will not add up to the total sum of GHG emissions at year end.

|

Quarterly

Statement Q2 2024 |

Primary

Financial Statements of SAP Group (IFRS)

| (A) | Consolidated

Income Statements |

| (A.1) | Consolidated

Income Statements – Quarter |

| €

millions, unless otherwise stated |

|

Q2

2024 |

Q2

2023 |

∆

in % |

| Cloud |

|

4,153 |

3,316 |

25 |

| Software

licenses |

|

229 |

316 |

–28 |

| Software

support |

|

2,792 |

2,873 |

–3 |

| Software

licenses and support |

|

3,021 |

3,189 |

–5 |

| Cloud

and software |

|

7,175 |

6,505 |

10 |

| Services |

|

1,114 |

1,050 |

6 |

| Total

revenue |

|

8,288 |

7,554 |

10 |

| |

|

|

|

|

| Cost

of cloud |

|

–1,123 |

–959 |

17 |

| Cost

of software licenses and support |

|

–311 |

–324 |

–4 |

| Cost

of cloud and software |

|

–1,434 |

–1,282 |

12 |

| Cost

of services |

|

–837 |

–863 |

–3 |

| Total

cost of revenue |

|

–2,272 |

–2,145 |

6 |

| Gross

profit |

|

6,017 |

5,409 |

11 |

| Research

and development |

|

–1,605 |

–1,565 |

3 |

| Sales

and marketing |

|

–2,217 |

–2,165 |

2 |

| General

and administration |

|

–336 |

–322 |

4 |

| Restructuring |

|

–631 |

3 |

N/A |

| Other

operating income/expense, net |

|

–5 |

11 |

N/A |

| Total

operating expenses |

|

–7,067 |

–6,183 |

14 |

| Operating

profit (loss) |

|

1,222 |

1,371 |

–11 |

| |

|

|

|

|

| Other

non-operating income/expense, net |

|

–5 |

–102 |

–95 |

| Finance

income |

|

412 |

187 |

>100 |

| Finance

costs |

|

–242 |

–363 |

–33 |

| Financial

income, net |

|

170 |

–175 |

N/A |

| Profit

(loss) before tax from continuing operations |

|

1,387 |

1,093 |

27 |

| |

|

|

|

|

| Income

tax expense |

|

–469 |

–369 |

27 |

| Profit

(loss) after tax from continuing operations |

|

918 |

724 |

27 |

| Attributable

to owners of parent |

|

888 |

728 |

22 |

| Attributable

to non-controlling interests |

|

30 |

–4 |

N/A |

| Profit

(loss) after tax from discontinued operations |

|

0 |

2,257 |

N/A |

| Profit

(loss) after tax2 |

|

918 |

2,982 |

–69 |

| Attributable

to owners of parent2 |

|

888 |

3,161 |

–72 |

| Attributable

to non-controlling interests2 |

|

30 |

–179 |

N/A |

| |

|

|

|

|

| Earnings

per share, basic (in €)1 from continuing operations |

|

0.76 |

0.62 |

22 |

| Earnings

per share, basic (in €)1, 2 |

|

0.76 |

2.70 |

–72 |

| Earnings

per share, diluted (in €)1 from continuing operations |

|

0.75 |

0.62 |

22 |

| Earnings

per share, diluted (in €)1, 2 |

|

0.75 |

2.68 |

–72 |

1

For the three months ended June 30, 2024 and 2023, the weighted average number of shares was 1,166 million (diluted 1,178 million)

and 1,169 million

(diluted: 1,180 million), respectively (treasury stock excluded).

2

From continuing and discontinued operations

|

Quarterly

Statement Q2 2024 |

(A.2) Consolidated

Income Statements – Year-to-Date

| €

millions, unless otherwise stated |

|

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

| Cloud |

|

8,082 |

6,493 |

24 |

| Software

licenses |

|

432 |

591 |

–27 |

| Software

support |

|

5,621 |

5,778 |

–3 |

| Software

licenses and support |

|

6,053 |

6,369 |

–5 |

| Cloud

and software |

|

14,134 |

12,863 |

10 |

| Services |

|

2,195 |

2,132 |

3 |

| Total

revenue |

|

16,329 |

14,995 |

9 |

| |

|

|

|

|

| Cost

of cloud |

|

–2,214 |

–1,897 |

17 |

| Cost

of software licenses and support |

|

–637 |

–687 |

–7 |

| Cost

of cloud and software |

|

–2,851 |

–2,584 |

10 |

| Cost

of services |

|

–1,699 |

–1,718 |

–1 |

| Total

cost of revenue |

|

–4,550 |

–4,301 |

6 |

| Gross

profit |

|

11,778 |

10,693 |

10 |

| Research

and development |

|

–3,270 |

–3,138 |

4 |

| Sales

and marketing |

|

–4,496 |

–4,457 |

1 |

| General

and administration |

|

–696 |

–670 |

4 |

| Restructuring |

|

–2,873 |

–257 |

>100 |

| Other

operating income/expense, net |

|

–9 |

3 |

N/A |

| Total

operating expenses |

|

–15,894 |

–12,820 |

24 |

| Operating

profit (loss) |

|

434 |

2,174 |

–80 |

| |

|

|

|

|

| Other

non-operating income/expense, net |

|

–153 |

–116 |

32 |

| Finance

income |

|

611 |

369 |

65 |

| Finance

costs |

|

–486 |

–656 |

–26 |

| Financial

income, net |

|

125 |

–287 |

N/A |

| Profit

(loss) before tax from continuing operations |

|

407 |

1,771 |

–77 |

| |

|

|

|

|

| Income

tax expense |

|

–313 |

–643 |

–51 |

| Profit

(loss) after tax from continuing operations |

|

94 |

1,128 |

–92 |

| Attributable

to owners of parent |

|

60 |

1,135 |

–95 |

| Attributable

to non-controlling interests |

|

34 |

–7 |

N/A |

| Profit

(loss) after tax from discontinued operations |

|

0 |

2,363 |

N/A |

| Profit

(loss) after tax2 |

|

94 |

3,491 |

–97 |

| Attributable

to owners of parent2 |

|

60 |

3,640 |

–98 |

| Attributable

to non-controlling interests2 |

|

34 |

–149 |

N/A |

| |

|

|

|

|

| Earnings

per share, basic (in €)1 from continuing operations |

|

0.05 |

0.97 |

–95 |

| Earnings

per share, basic (in €)1, 2 |

|

0.05 |

3.12 |

–98 |

| Earnings

per share, diluted (in €)1 from continuing operations |

|

0.05 |

0.97 |

–95 |

| Earnings

per share, diluted (in €)1, 2 |

|

0.05 |

3.09 |

–98 |

1 For

the six months ended June 30, 2024 and 2023, the weighted average number of shares was 1,167 million (diluted:

1,178 million) and 1,168 million (diluted: 1,176 million), respectively (treasury stock excluded).

2 From continuing and discontinued operations

|

Quarterly

Statement Q2 2024 |

(B) Consolidated

Statements of Financial Position

| as

at 06/30/2024 and 12/31/2023 |

| €

millions |

2024 |

2023 |

| Cash

and cash equivalents |

7,870 |

8,124 |

| Other

financial assets |

3,808 |

3,344 |

| Trade

and other receivables |

6,148 |

6,322 |

| Other

non-financial assets |

2,531 |

2,374 |

| Tax

assets |

539 |

407 |

| Total

current assets |

20,896 |

20,571 |

| Goodwill |

29,777 |

29,088 |

| Intangible

assets |

2,365 |

2,505 |

| Property,

plant, and equipment |

4,255 |

4,276 |

| Other

financial assets |

6,109 |

5,543 |

| Trade

and other receivables |

121 |

203 |

| Other

non-financial assets |

3,515 |

3,573 |

| Tax

assets |

346 |

382 |

| Deferred

tax assets |

2,993 |

2,193 |

| Total

non-current assets |

49,482 |

47,763 |

| Total

assets |

70,378 |

68,335 |

| |

| €

millions |

2024 |

2023 |

| Trade

and other payables |

1,875 |

1,783 |

| Tax

liabilities |

439 |

266 |

| Financial

liabilities |

2,271 |

1,735 |

| Other

non-financial liabilities |

4,002 |

5,648 |

| Provisions |

2,341 |

235 |

| Contract

liabilities |

7,734 |

4,975 |

| Total

current liabilities |

18,662 |

14,642 |

| Trade

and other payables |

20 |

39 |

| Tax

liabilities |

818 |

877 |

| Financial

liabilities |

7,321 |

7,941 |

| Other

non-financial liabilities |

850 |

698 |

| Provisions |

444 |

433 |

| Deferred

tax liabilities |

267 |

265 |

| Contract

liabilities |

55 |

33 |

| Total

non-current liabilities |

9,774 |

10,286 |

| Total

liabilities |

28,436 |

24,928 |

| Issued

capital |

1,229 |

1,229 |

| Share

premium |

2,263 |

1,845 |

| Retained

earnings |

39,953 |

42,457 |

| Other

components of equity |

3,519 |

2,368 |

| Treasury

shares |

–5,311 |

–4,741 |

| Equity

attributable to owners of parent |

41,652 |

43,157 |

| |

|

|

| Non-controlling

interests |

289 |

249 |

| Total

equity |

41,942 |

43,406 |

| Total

equity and liabilities |

70,378 |

68,335 |

|

Quarterly

Statement Q2 2024 |

(C) Consolidated

Statements of Cash Flows

| €

millions |

Q1–Q2

2024 |

Q1–Q2

2023 |

| Profit

(loss) after tax |

94 |

3,890 |

| Adjustments

to reconcile profit (loss) after tax to net cash flows from operating activities: |

|

|

| (Profit)

loss after tax from discontinued operations |

0 |

–2,763 |

| Depreciation

and amortization |

626 |

714 |

| Share-based

payment expense |

1,280 |

1,167 |

| Income

tax expense |

313 |

643 |

| Financial

income, net |

–125 |

287 |

| Decrease/increase

in allowances on trade receivables |

–23 |

5 |

| Other

adjustments for non-cash items |

110 |

76 |

| Increase/decrease

in trade and other receivables |

372 |

396 |

| Decrease/increase

in other assets |

–17 |

–600 |

| Increase/decrease

in trade payables, provisions, and other liabilities |

876 |

–896 |

| Increase/decrease

in contract liabilities |

2,718 |

2,109 |

| Share-based

payments |

–778 |

–697 |

| Interest

paid |

–378 |

–244 |

| Interest

received |

287 |

197 |

| Income

taxes paid, net of refunds |

–1,057 |

–1,127 |

| Net cash

flows from operating activities – continuing operations |

4,297 |

3,160 |

| Net cash

flows from operating activities – discontinued operations |

0 |

80 |

| Net

cash flows from operating activities |

4,297 |

3,240 |

| Business

combinations, net of cash and cash equivalents acquired |

–19 |

0 |

| Cash

flows from derivative financial instruments related to the sale of subsidiaries or businesses |

0 |

–91 |

| Purchase

of intangible assets and property, plant, and equipment |

–365 |

–413 |

| Proceeds

from sales of intangible assets and property, plant, and equipment |

55 |

43 |

| Purchase

of equity or debt instruments of other entities |

–7,987 |

–220 |

| Proceeds

from sales of equity or debt instruments of other entities |

7,370 |

722 |

| Net cash

flows from investing activities – continuing operations |

–947 |

41 |

| Net cash

flows from investing activities – discontinued operations |

0 |

6,323 |

| Net

cash flows from investing activities |

–947 |

6,364 |

| Dividends

paid |

–2,565 |

–2,395 |

| Dividends

paid on non-controlling interests |

–6 |

–18 |

| Purchase

of treasury shares |

–975 |

0 |

| Proceeds

from borrowings |

1 |

0 |

| Repayments

of borrowings |

–14 |

–1,724 |

| Payments

of lease liabilities |

–148 |

–188 |

| Transactions

with non-controlling interests |

0 |

43 |

| Net cash

flows from financing activities – continuing operations |

–3,708 |

–4,283 |

| Net cash

flows from financing activities – discontinued operations |

0 |

24 |

| Net

cash flows from financing activities |

–3,708 |

–4,259 |

| Effect

of foreign currency rates on cash and cash equivalents |

104 |

–212 |

| Net

decrease/increase in cash and cash equivalents |

–254 |

5,134 |

| Cash

and cash equivalents at the beginning of the period |

8,124 |

9,008 |

| Cash

and cash equivalents at the end of the period |

7,870 |

14,142 |

|

Quarterly

Statement Q2 2024 |

Non-IFRS

Numbers

| (D) | Basis

of Non-IFRS Presentation |

SAP

disclose certain financial measures such as expense (non-IFRS) and profit measures (non-IFRS) that are not prepared in accordance

with IFRS and are therefore considered non-IFRS financial measures.

For

a more detailed description of all of SAP’s non-IFRS measures and their limitations as well as SAP’s constant currency

and free cash flow figures, see Explanation of Non-IFRS Measures.

| (E) | Reconciliation

from Non-IFRS Numbers to IFRS Numbers |

| (E.1) | Reconciliation

of Non-IFRS Revenue – Quarter |

| €

millions, unless otherwise stated |

Q2

2024 |

Q2

2023 |

∆

in % |

| IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

IFRS |

Non-IFRS

Constant

Currency |

| Revenue

Numbers |

|

|

|

|

|

|

| Cloud |

4,153 |

–1 |

4,153 |

3,316 |

25 |

25 |

| Software

licenses |

229 |

1 |

230 |

316 |

–28 |

–27 |

| Software

support |

2,792 |

7 |

2,799 |

2,873 |

–3 |

–3 |

| Software

licenses and support |

3,021 |

8 |

3,029 |

3,189 |

–5 |

–5 |

| Cloud

and software |

7,175 |

7 |

7,182 |

6,505 |

10 |

10 |

| Services |

1,114 |

–2 |

1,111 |

1,050 |

6 |

6 |

| Total

revenue |

8,288 |

5 |

8,293 |

7,554 |

10 |

10 |

|

Quarterly

Statement Q2 2024 |

(E.2) Reconciliation

of Non-IFRS Operating Expenses – Quarter

| €

millions, unless otherwise stated |

Q2

2024 |

Q2

2023 |

∆

in % |

| IFRS |

Adj. |

Non-IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Operating

Expense Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Cost

of cloud |

–1,123 |

13 |

–1,110 |

|

|

–959 |

11 |

–947 |

17 |

17 |

|

| Cost

of software licenses and support |

–311 |

0 |

–311 |

|

|

–324 |

11 |

–313 |

–4 |

–1 |

|

| Cost

of cloud and software |

–1,434 |

13 |

–1,422 |

|

|

–1,282 |

22 |

–1,260 |

12 |

13 |

|

| Cost

of services |

–837 |

0 |

–837 |

|

|

–863 |

0 |

–862 |

–3 |

–3 |

|

| Total

cost of revenue |

–2,272 |

13 |

–2,259 |

|

|

–2,145 |

22 |

–2,122 |

6 |

6 |

|

| Gross

profit |

6,017 |

13 |

6,029 |

16 |

6,046 |

5,409 |

22 |

5,432 |

11 |

11 |

11 |

| Research

and development |

–1,605 |

1 |

–1,604 |

|

|

–1,565 |

2 |

–1,562 |

3 |

3 |

|

| Sales

and marketing |

–2,217 |

65 |

–2,153 |

|

|

–2,165 |

64 |

–2,102 |

2 |

2 |

|

| General

and administration |

–336 |

8 |

–328 |

|

|

–322 |

0 |

–321 |

4 |

2 |

|

| Restructuring |

–631 |

631 |

0 |

|

|

3 |

–3 |

0 |

N/A |

N/A |

|

| Other

operating income/expense, net |

–5 |

0 |

–5 |

|

|

11 |

0 |

11 |

N/A |

N/A |

|

| Total

operating expenses |

–7,067 |

718 |

–6,348 |

18 |

–6,331 |

–6,183 |

86 |

–6,097 |

14 |

4 |

4 |

(E.3) Reconciliation

of Non-IFRS Profit Figures, Income Tax, and Key Ratios – Quarter

| €

millions, unless otherwise stated |

Q2

2024 |

Q2

2023 |

∆

in % |

| IFRS |

Adj. |

Non-IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Profit

Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Operating

profit (loss) |

1,222 |

718 |

1,940 |

23 |

1,963 |

1,371 |

86 |

1,457 |

–11 |

33 |

35 |

| Other

non-operating income/expense, net |

–5 |

0 |

–5 |

|

|

–102 |

0 |

–102 |

–95 |

–95 |

|

| Finance

income |

412 |

–250 |

162 |

|

|

187 |

–81 |

106 |

>100 |

52 |

|

| Finance

costs |

–242 |

70 |

–171 |

|

|

–363 |

93 |

–270 |

–33 |

–36 |

|

| Financial

income, net |

170 |

–179 |

–9 |

|

|

–175 |

12 |

–163 |

N/A |

–94 |

|

| Profit

(loss) before tax from continuing operations |

1,387 |

539 |

1,926 |

|

|

1,093 |

98 |

1,192 |

27 |

62 |

|

| Income

tax expense |

–469 |

–178 |

–647 |

|

|

–369 |

–24 |

–393 |

27 |

65 |

|

| Profit

(loss) after tax from continuing operations |

918 |

361 |

1,278 |

|

|

724 |

75 |

799 |

27 |

60 |

|

| Attributable

to owners of parent |

888 |

395 |

1,283 |

|

|

728 |

80 |

808 |

22 |

59 |

|

| Attributable

to non-controlling interests |

30 |

–34 |

–4 |

|

|

–4 |

–5 |

–9 |

N/A |

–55 |

|

| Profit

(loss) after tax1 |

918 |

361 |

1,278 |

|

|

2,982 |

–545 |

2,437 |

–69 |

–48 |

|

| Attributable

to owners of parent1 |

888 |

395 |

1,283 |

|

|

3,161 |

–354 |

2,807 |

–72 |

–54 |

|

| Attributable

to non-controlling interests1 |

30 |

–34 |

–4 |

|

|

–179 |

–191 |

–370 |

N/A |

–99 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Operating

margin (in %) |

14.7 |

|

23.4 |

|

23.7 |

18.2 |

|

19.3 |

–3.4pp |

4.1pp |

4.4pp |

| Effective

tax rate (in %)2 |

33.8 |

|

33.6 |

|

|

33.8 |

|

33.0 |

0.1pp |

0.7pp |

|

| Earnings

per share, basic (in €) from continuing operations |

0.76 |

|

1.10 |

|

|

0.62 |

|

0.69 |

22 |

59 |

|

| Earnings

per share, basic (in €)1 |

0.76 |

|

1.10 |

|

|

2.70 |

|

2.40 |

–72 |

–54 |

|

1

From continuing and discontinued operations

2 The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS) in Q2 2024 mainly resulted

from tax effects of restructuring expenses. The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS)

in Q2 2023 mainly resulted from tax effects of acquisition-related charges.

|

Quarterly

Statement Q2 2024 |

(E.4) Reconciliation

of Non-IFRS Revenue – Year-to-Date

| €

millions, unless otherwise stated |

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

| IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

IFRS |

Non-IFRS

Constant

Currency |

| Revenue

Numbers |

|

|

|

|

|

|

| Cloud |

8,082 |

49 |

8,131 |

6,493 |

24 |

25 |

| Software

licenses |

432 |

5 |

436 |

591 |

–27 |

–26 |

| Software

support |

5,621 |

40 |

5,661 |

5,778 |

–3 |

–2 |

| Software

licenses and support |

6,053 |

44 |

6,097 |

6,369 |

–5 |

–4 |

| Cloud

and software |

14,134 |

93 |

14,228 |

12,863 |

10 |

11 |

| Services |

2,195 |

8 |

2,202 |

2,132 |

3 |

3 |

| Total

revenue |

16,329 |

101 |

16,430 |

14,995 |

9 |

10 |

(E.5) Reconciliation

of Non-IFRS Operating Expenses – Year-to-Date

| €

millions, unless otherwise stated |

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

| IFRS |

Adj. |

Non-IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Operating

Expense Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Cost

of cloud |

–2,214 |

25 |

–2,190 |

|

|

–1,897 |

21 |

–1,876 |

17 |

17 |

|

| Cost

of software licenses and support |

–637 |

0 |

–637 |

|

|

–687 |

22 |

–665 |

–7 |

–4 |

|

| Cost

of cloud and software |

–2,851 |

25 |

–2,827 |

|

|

–2,584 |

43 |

–2,541 |

10 |

11 |

|

| Cost

of services |

–1,699 |

0 |

–1,699 |

|

|

–1,718 |

0 |

–1,717 |

–1 |

–1 |

|

| Total

cost of revenue |

–4,550 |

25 |

–4,526 |

|

|

–4,301 |

44 |

–4,258 |

6 |

6 |

|

| Gross

profit |

11,778 |

25 |

11,803 |

97 |

11,900 |

10,693 |

44 |

10,737 |

10 |

10 |

11 |

| Research

and development |

–3,270 |

3 |

–3,267 |

|

|

–3,138 |

4 |

–3,134 |

4 |

4 |

|

| Sales

and marketing |

–4,496 |

129 |

–4,366 |

|

|

–4,457 |

299 |

–4,158 |

1 |

5 |

|

| General

and administration |

–696 |

9 |

–687 |

|

|

–670 |

1 |

–669 |

4 |

3 |

|

| Restructuring |

–2,873 |

2,873 |

0 |

|

|

–257 |

257 |

0 |

>100 |

N/A |

|

| Other

operating income/expense, net |

–9 |

0 |

–9 |

|

|

3 |

0 |

3 |

N/A |

N/A |

|

| Total

operating expenses |

–15,894 |

3,039 |

–12,855 |

–34 |

–12,890 |

–12,820 |

604 |

–12,216 |

24 |

5 |

6 |

|

Quarterly

Statement Q2 2024 |

(E.6) Reconciliation

of Non-IFRS Profit Figures, Income Tax, and Key Ratios – Year-to-Date

| €

millions, unless otherwise stated |

Q1–Q2

2024 |

Q1–Q2

2023 |

∆

in % |

| IFRS |

Adj. |

Non-IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Profit

Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Operating

profit (loss) |

434 |

3,039 |

3,473 |

67 |

3,540 |

2,174 |

604 |

2,779 |

–80 |

25 |

27 |

| Other

non-operating income/expense, net |

–153 |

0 |

–153 |

|

|

–116 |

0 |

–116 |

32 |

32 |

|

| Finance

income |

611 |

–282 |

328 |

|

|

369 |

–185 |

184 |

65 |

79 |

|

| Finance

costs |

–486 |

159 |

–327 |

|

|

–656 |

226 |

–430 |

–26 |

–24 |

|

| Financial

income, net |

125 |

–123 |

2 |

|

|

–287 |

41 |

–247 |

N/A |

N/A |

|

| Profit

(loss) before tax from continuing operations |

407 |

2,916 |

3,322 |

|

|

1,771 |

645 |

2,416 |

–77 |

37 |

|

| Income

tax expense |

–313 |

–787 |

–1,100 |

|

|

–643 |

–106 |

–749 |

–51 |

47 |

|

| Profit

(loss) after tax from continuing operations |

94 |

2,129 |

2,223 |

|

|

1,128 |

539 |

1,667 |

–92 |

33 |

|

| Attributable

to owners of parent |

60 |

2,163 |

2,222 |

|

|

1,135 |

543 |

1,678 |

–95 |

32 |

|

| Attributable

to non-controlling interests |

34 |

–34 |

0 |

|

|

–7 |

–4 |

–11 |

N/A |

N/A |

|

| Profit

(loss) after tax1 |

94 |

2,129 |

2,223 |

|

|

3,491 |

–43 |

3,448 |

–97 |

–36 |

|

| Attributable

to owners of parent1 |

60 |

2,163 |

2,222 |

|

|

3,640 |

136 |

3,776 |

–98 |

–41 |

|

| Attributable

to non-controlling interests1 |

34 |

–34 |

0 |

|

|

–149 |

–179 |

–327 |

N/A |

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Operating

margin (in %) |

2.7 |

|

21.3 |

|

21.5 |

14.5 |

|

18.5 |

–11.8pp |

2.7pp |

3.0pp |

| Effective

tax rate (in %)2 |

76.9 |

|

33.1 |

|

|

36.3 |

|

31.0 |

40.6pp |

2.1pp |

|

| Earnings

per share, basic (in €) from continuing operations |

0.05 |

|

1.91 |

|

|

0.97 |

|

1.44 |

–95 |

33 |

|

| Earnings

per share, basic (in €)1 |

0.05 |

|

1.91 |

|

|

3.12 |

|

3.23 |

–98 |

–41 |

|

1 From

continuing and discontinued operations

2 The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS) in the first half of

2024 and 2023 mainly resulted from restructuring expenses.

|

Quarterly

Statement Q2 2024 |

| (E.7) | Reconciliation

of Free Cash Flow |

| €

millions, unless otherwise stated |

Q1-Q2

2024 |

Q1-Q2

2023 |

| Net

cash flows from operating activities – continuing operations |

4,297 |

3,160 |

| Purchase

of intangible assets and property, plant, and equipment |

–365 |

–413 |

| Payments

of lease liabilities |

–148 |

–188 |

| Free

cash flow |

3,784 |

2,559 |

| |

|

|

| Net

cash flows from investing activities – continuing operations |

–947 |

41 |

| Net

cash flows from financing activities – continuing operations |

–3,708 |

–4,283 |

|

Quarterly

Statement Q2 2024 |

| (F) | Non-IFRS

Adjustments – Actuals and Estimates |

| €

millions, unless otherwise stated |

Estimated

Amounts for

Full

Year 2024

|

Q2

2024 |

Q1–Q2

2024 |

Q2

2023 |

Q1–Q2

2023 |

| Profit

(loss) before tax from continuing operations (IFRS) |

|

1,387 |

407 |

1,093 |

1,771 |

| Adjustment

for acquisition-related charges |

280–360 |

87 |

166 |

89 |

177 |

| Adjustment

for restructuring |

approximately

€3 B |

631 |

2,873 |

–3 |

257 |

| Adjustment

for regulatory compliance matter expenses |

0 |

0 |

0 |

0 |

170 |

| Adjustment

for gains and losses from equity securities, net |

N/A1 |

–179 |

–123 |

12 |

41 |

| Profit

(loss) before tax from continuing operations (non-IFRS) |

|

1,926 |

3,322 |

1,192 |

2,416 |

1

Due to the uncertainty and potential variability of gains and losses from equity securities, we cannot provide an estimate

for the full year without unreasonable efforts. This item could however have a material impact on our non-IFRS measures below

operating profit.

| (G) | Non-IFRS

Operating Expense Adjustments by Functional Areas |

| € millions |

Q2

2024 |

Q2

2023 |

| |

IFRS |

Acquisition-

Related |

Restruc-

turing |

RCM1 |

Non-IFRS |

IFRS |

Acquisition-

Related |

Restruc-

turing |

RCM1 |

Non-IFRS |

| Cost

of cloud |

–1,123 |

13 |

0 |

0 |

–1,110 |

–959 |

11 |

0 |

0 |

–947 |

| Cost

of software licenses and support |

–311 |

0 |

0 |

0 |

–311 |

–324 |

11 |

0 |

0 |

–313 |

| Cost

of services |

–837 |

0 |

0 |

0 |

–837 |

–863 |

0 |

0 |

0 |

–862 |

| Research

and development |

–1,605 |

1 |

0 |

0 |

–1,604 |

–1,565 |

2 |

0 |

0 |

–1,562 |

| Sales

and marketing |

–2,217 |

65 |

0 |

0 |

–2,153 |

–2,165 |

64 |

0 |

0 |

–2,102 |

| General

and administration |

–336 |

8 |

0 |

0 |

–328 |

–322 |

0 |

0 |

0 |

–321 |

| Restructuring |

–631 |

0 |

631 |

0 |

0 |

3 |

0 |

–3 |

0 |

0 |

| Other

operating income/expense, net |

–5 |

0 |

0 |

0 |

–5 |

11 |

0 |

0 |

0 |

11 |

| Total

operating expenses |

–7,067 |

87 |