AM Best Assigns Credit Ratings to Vermeer Reinsurance Ltd.

December 18 2018 - 9:25AM

Business Wire

AM Best has assigned a Financial Strength Rating of A

(Excellent) and a Long-Term Issuer Credit Rating of “a+” to Vermeer

Reinsurance Ltd. (Vermeer) (Bermuda). The outlook assigned to these

Credit Ratings (ratings) is stable.

The ratings reflect Vermeer’s balance sheet strength, which A.M.

Best categorizes as very strong, as well as its adequate operating

performance, neutral business profile and very strong enterprise

risk management (ERM).

Vermeer is a joint venture between RenaissanceRe Holdings Ltd.

(RenaissanceRe) [NYSE:RNR] and Dutch pension fund manager PGGM to

provide new capacity predominantly for risk-remote layers in the

U.S. property catastrophe market.

PGGM is a leading Dutch pension fund service provider with € 215

billion of assets under management. PGGM has been investing in

insurance and CAT bonds since 2006 and is currently one of the

largest end-investors in insurance-linked investments.

Vermeer will initially be capitalized with $600 million of

funding from PGGM, with the option for another $400 million

investment to pursue growth opportunities in 2019. Vermeer will be

managed solely by Renaissance Underwriting Managers, Ltd. (RUM) and

is expected to be consolidated into RenaissanceRe’s financial

statements. In addition to board control, RenaissanceRe owns 100%

of the voting shares, and RUM will manage Vermeer’s business

including underwriting, pricing, risk selection, reserves,

investments, claims, etc. Vermeer’s underwriting portfolio will be

aligned with RenaissanceRe’s, as RenaissanceRe participates on

every risk alongside Vermeer.

The ratings assigned to Vermeer also reflect the strength and

depth of RenaissanceRe’s management team and the ability of the

company to deliver strong long-term profitability over the course

of the (re)insurance cycle. RenaissanceRe is recognized widely for

its leadership in ERM and as a pioneer in third-party capital

management. RenaissanceRe remains a leader in the property

catastrophe market, and maintains a strong reputation in evaluating

risk and effectively deploying capital, and as a result, Vermeer

should benefit from this expertise.

Partially offsetting these strengths is Vermeer’s start-up

status, its ability to be accepted in the market and its expected

exposure to high severity losses associated with catastrophe

events. In addition, the global reinsurance market, and

specifically the property catastrophe segment, has experienced

overcapacity and pricing pressures over the past few years that in

turn has placed pressure on overall returns.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Understanding Best’s Credit Ratings. For

information on the proper media use of Best’s Credit Ratings and AM

Best press releases, please view Guide for Media - Proper

Use of Best’s Credit Ratings and AM Best Rating Action Press

Releases.

AM Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2018 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181218005501/en/

Mariza CostaSenior Financial Analyst+1 908 439

2200, ext. 5254mariza.costa@ambest.com

Robert B DeRoseSenior Director+1 908 439 2200,

ext. 5453robert.derose@ambest.com

Christopher SharkeyManager, Public Relations+1

908 439 2200, ext. 5159christopher.sharkey@ambest.com

Jim PeavyDirector, Public Relations+1 908 439

2200, ext. 5644james.peavy@ambest.com

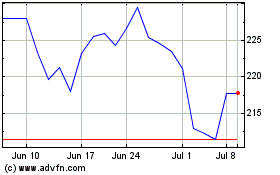

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

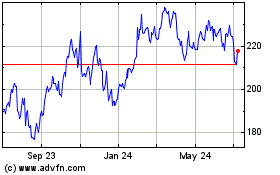

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Apr 2023 to Apr 2024