By Patrick Thomas

The makers of Tommy Bahama shirts, Hollister brand clothes and

Play-Doh are moving production out of China to different corners of

the globe as more consumer goods are potentially subject to the

Trump administration's proposed 25% tariff on nearly all Chinese

imports.

Companies have become more vocal in reassuring investors and

Wall Street analysts that they are diversifying their supply chains

away from China amid growing trade tensions. Firms are moving

production to countries like India, Malaysia, South Korea, Taiwan,

Vietnam and Mexico.

Manufacturers of clothing, footwear and other low-margin

consumer items have been moving out of China in recent years due to

rising costs, but tariffs that have been implemented and threatened

have accelerated that trend.

In the first quarter of this year, imports of furniture,

vacuums, refrigerators, lamps and various other consumer goods in

China has declined anywhere from 13% to 40% from a year earlier,

according to data from global trade intelligence firm Panjiva.

"We think U.S. companies will continue to optimize their supply

chains and divert away from China," analysts at S&P Global

Ratings said in a research note. "However, this strategy is not

costless. It's limited by near-term capacity constraints and will

be more challenging for sectors that require skilled labor and

high-value manufacturing."

Oxford Industries Inc. (OXM) Chief Executive Thomas Chubb said

about 54% of its production was in China last year and that it

would be "materially less than it was last year" in 2019. "Beyond

the first half of next year, we'd expect to be operating really as

normal again to basically fully mitigating the impact of the

tariffs," Mr. Chubb said earlier this month.

Oxford, which owns brands like Tommy Bahama, Lilly Pulitzer and

Southern Tide, is moving production to countries such as Vietnam,

Thailand, India and Peru, Financial Chief Scott Grassmyer said on a

call with analysts earlier this month.

Ralph Lauren Corp. (RL), which sources about a third of its

products from China, according to its latest annual filing, said

last month that tariffs on Chinese imports enacted thus far have

had a limited impact on its business. However, the apparel and

accessories maker said that the trade spat has accelerated efforts

to diversify where it sources items to mitigate the long-term

impact of any potential tariffs.

Tailored Brands Inc. (TLRD), the Houston-based parent of

clothing retailers Men's Wearhouse and Jos. A. Bank, plans to cut

the amount of product it receives from China to between 18% and 20%

this year, Financial Chief Jack Calandra said during the company's

quarterly conference call earlier this month. The company has

already lowered the percentage of goods it receives from China to

23% from a year ago and from 30% in 2017.

"We believe we can absorb new tariffs as high as 25% within our

existing product cost structure with minimal impact to our bottom

line," Mr. Calandra said. "This outlook is thanks to the hard work

of our supply chain team, which moved quickly last year to

diversify our sourcing."

It can be costly and time consuming to uproot production from

one country and replicate supply chains elsewhere. Columbia

Sportswear Co. (COLM) said in testimony to federal trade officials

that the products it imports from China are highly specialized and

tied to significant investments made in tooling, machinery and

training personnel.

If it were to move its remaining production operations out of

China, Columbia said it would have to spend at least $3 million to

buy new machinery and train a new workforce, a process that would

take about a year. Vietnam and China accounted for about 61% of

Columbia's 2018 apparel, accessories and equipment production,

according to its latest annual securities filing.

In a letter to U.S. Trade Representative Robert Lighthizer,

Brunswick Billiards, which was recently sold by Brunswick Co. (BC)

to KPS Capital Partners, said it sources its air hockey, foosball

and table-tennis products from China and that it is difficult to

find suitable replacement suppliers. Company general manager John

Kazik said in an interview the company is in wait-and-see mode and

if it were to move the production of those products, which make up

15% of its total business, out of China it would take about six

months to a year.

"Chinese manufacturers have dominated this industry for years,

limiting the availability of alternative suppliers outside of

China," the company said in its letter. "For this segment, the

types of foosball, air hockey, and table tennis tables are almost

all exclusively built in China."

Hasbro Inc. (HAS) said it brings in about two-thirds of its

products from China, down from more than 80% in 2012. The company

has brought production of certain products, such as Magic: The

Gathering cards, board games like Monopoly and Play-Doh, back to

the U.S., Chief Executive Brian Goldner said last month. Over the

next five years, Hasbro could lower its total imports from China to

less than a third, he said.

"We've also moved our strategic sourcing footprint to places

like India and to Vietnam and other places--Mexico and other places

and as I said in the U.S.," Mr. Goldner said at a conference at

Bernstein in May.

A Hasbro spokeswoman said the company now sources 20% of the

toys and games it sells in the U.S. from U.S. suppliers, and that

it intends to increase that figure year-over-year. "Hasbro's

current goal is to achieve 64% global sourcing from China by the

end of 2019 and 60% or less by the end of 2020," she said.

Write to Patrick Thomas at patrick.thomas@wsj.com

(END) Dow Jones Newswires

June 28, 2019 14:54 ET (18:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

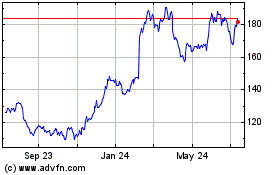

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Mar 2024 to Apr 2024

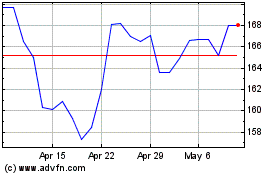

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Apr 2023 to Apr 2024