Quanex Announces Fiscal Second Quarter 2004 Results Reports Record

Second Quarter Net Sales and Earnings; Acquisitions Enhance the

Company's Earnings Outlook; Closed Its $125 Million 2.5%

Convertible Debenture Offering on May 5, 2004 HOUSTON, June 3

/PRNewswire-FirstCall/ -- Quanex Corporation (NYSE:NX) announced

fiscal second quarter results for the period ending April 30, 2004,

which included three months results from the Company's acquisitions

of MACSTEEL Monroe and TruSeal Technologies. Net sales were a

record $406.0 million in the quarter, up 60% over a year ago, with

net sales from the two acquisitions totaling $100.6 million. Demand

at the Company's Vehicular Products and Building Products segments

was very strong and backlogs for the third quarter remain at high

levels. Record net income of $11.5 million was up 22% compared to

last year's second quarter. Diluted earnings per share were $.69,

the Company's best-ever second quarter figure. MACSTEEL Monroe and

TruSeal contributed about $.21 (after interest expense) to diluted

earnings per share in the second quarter. Net sales for the second

quarter 2003 were $254.6 million. Net income and diluted earnings

per share for the second quarter 2003 were $9.4 million and $.58,

respectively. Highlights Raymond A. Jean, chairman and chief

executive officer stated, "We delivered to our investors record

second quarter earnings resulting from: (1) very strong customer

demand, (2) accretive acquisitions, (3) overhead reductions and (4)

ongoing company-wide lean initiatives. Runaway steel scrap costs

finally abated in April, when we experienced a $45 per ton drop in

MACSTEEL's overall raw material costs compared to March. Margins,

however, were significantly compressed during February and March.

North American light vehicle builds in the Company's second quarter

were up about 5% over the year ago period. Heavy duty truck builds

continued to gain momentum during our quarter, with builds up some

50% over a year ago. Both housing starts and remodeling activity

remained remarkably strong through the period, which allowed the

Building Products segment to post excellent results," Jean said.

"During the quarter, we made excellent progress with the

integration of MACSTEEL Monroe and TruSeal Technologies. Both

businesses are exceeding expectations and their long term earnings

potential remains excellent. A key metric we use in our acquisition

screen is the ability of the acquired company to exceed our

weighted average cost of capital by the end of its third year. On

an annualized basis, TruSeal already crossed that threshold, and we

expect MACSTEEL Monroe to hit that target by year-end. Our previous

2004 earnings guidance for the two acquisitions, based on 10 months

expected results, was $.40 to $.50 per diluted share. However, with

the ongoing strength we see in our two target markets, we believe a

range of $.60 to $.70 per diluted share for the two acquisitions is

now more appropriate for 2004," continued Jean. "We continue to

make excellent progress in managing our working capital. A metric

we use to track our progress is the conversion cycle, which is the

sum of inventory days, plus receivable days, less days payable, all

based on average daily sales. For the second quarter, the

conversion cycle improved to 45 days from 55 days in the year ago

quarter, an 18% improvement," said Jean. "Quanex uses the LIFO

method of accounting which requires us to revalue our inventories

at the end of each year. As we have reported for our first two

quarters this year, our scrap costs, particularly steel scrap, have

risen dramatically, impacting our inventory valuation based on the

LIFO method. Accordingly, for the second quarter, we booked a $2.0

million charge to operating income on the assumption that year-end

2004 inventories will have a higher valuation compared to year-end

2003," said Jean. Quarterly Financials ($ in millions, except per

share data) 2nd qtr 2004 2nd qtr 2003 Inc/dcr Net Sales $406.0

254.6 60% Operating Income 19.8 14.9 33% Net Income 11.5 9.4 22%

EPS: Basic $ .70 $ .58 21% EPS: Diluted .69 .58 19% Segment

Commentary VEHICULAR PRODUCTS ($ in millions) 2nd qtr 2004 2nd qtr

2003 Net Sales $225.3 $118.0 Operating Income 13.5 14.3 The

Vehicular Products segment is comprised of MACSTEEL, including the

recently acquired MACSTEEL Monroe operation, Piper Impact and

Temroc Metals. The segment's main drivers are North American light

vehicle builds and heavy duty truck builds. "North American light

vehicle builds remained at very robust levels during the quarter

and MACSTEEL's operations ran close to their rated capacity.

Backlogs in the third quarter remain healthy, although light

vehicle inventories at the retail level are a concern. Our

Vehicular Products segment also benefited from excellent heavy duty

truck production during the second quarter, which continues to

outpace year ago figures by nearly 50%. Excluding Monroe's results,

MACSTEEL's shipments were up about 14% for the quarter over the

year ago quarter, while operating income was down some 34% because

of lower operating margins. Rapidly increasing steel scrap costs

were a major issue during the second quarter as average raw

material costs were up about 25% for the January to March period

compared to December. However, several favorable developments

occurred late in our second quarter. MACSTEEL experienced a

significant drop in raw material costs in April, down some $45 per

ton from March levels. MACSTEEL also adjusted the quarterly

formula-based steel scrap surcharge, effective April 1, to more

accurately reflect the higher costs we experienced in the January

through March period. These two actions, along with productivity

gains and high value added product sales, enabled us to recover

some margin during April," Jean said. "While Piper Impact continued

to struggle with the reduction of base business during the quarter,

we did benefit from both lower manufacturing costs and new business

opportunities, which allowed us to report positive operating

earnings for the quarter. Although air bag component sales fell

again in the quarter, Piper continued to experience improvement in

other markets. Earlier this quarter, we announced both a

restructuring plan for Piper, which is now being executed, as well

as our intention to sell the business," said Jean. BUILDING

PRODUCTS ($ in millions) 2nd qtr 2004 2nd qtr 2003 Net Sales $180.7

$136.6 Operating Income 12.1 4.2 The Building Products segment is

comprised of Engineered Products, including the recent acquisition

of TruSeal Technologies, and Nichols Aluminum. The main drivers of

the segment are residential housing starts and remodeling

expenditures. "Engineered Products, excluding TruSeal's excellent

results, reported very strong sales for the quarter, in part due to

the relatively mild winter season experienced by our customers,

which in turn allowed for an early start to the Spring building

season," said Jean. "Housing starts and remodeling activity

remained higher than expected throughout the quarter and customer

demand is expected to again be strong in our third quarter."

"Nichols Aluminum continues to improve with both sales and

operating income up markedly from the year ago quarter. Shipments

remained strong to our building and construction customers and

demand in our other aluminum markets continued to pick up momentum.

The Golden facility, which supplies food packaging and container

products, also reported good customer activity in key market

niches. Nichols has an excellent backlog of business and customer

demand in the capital equipment, service center, and transportation

markets continues to improve. The division successfully pushed

through higher prices to help offset increases in material costs,

while production efficiency gains continued to benefit the bottom

line significantly," said Jean. Outlook Demand in the Company's two

target markets, vehicular products and building products, remains

strong. With an improving economy and still very favorable interest

rates, Quanex expects robust business activity in its two business

segments through the remainder of the fiscal year. In the Company's

Vehicular Products segment, overall business activity from now

through year-end appears excellent. 2004 North American light

vehicle builds are expected to remain flat to last year's 16+

million builds, and a healthy increase in heavy truck builds, now

estimated to be up 35% to 40% over last year's builds, will serve

to fill any gaps in the segment's robust demand outlook. Excluding

Monroe's results, MACSTEEL expects to deliver significantly higher

third quarter earnings compared to third quarter 2003 and second

quarter 2004 results due to lower material costs and a higher April

1 steel scrap surcharge, which remains in effect until July 1. In

the Company's Building Products segment, the market drivers remain

positive and order activity remains brisk. Housing starts for 2004

are expected to moderate slightly from last year's record 1.86

million units, while remodeling expenditures, which the Company

believes account for about one half of the segment's sales, are

also expected to remain at healthy levels. Quanex expects its

Engineered Products division to deliver excellent operating results

in the third quarter. At Nichols Aluminum, London Metal Exchange

ingot prices and scrap prices are expected to remain flat to down

slightly for the third quarter, a positive for Nichols, while

selling prices continue to improve. Taken together, Quanex's sales

and earnings outlook for the remainder of the year remains very

favorable. Accordingly, for its fiscal third quarter and fiscal

year 2004, the Company expects to report diluted earnings per share

within a range of $1.00 to $1.20 and $3.25 to $3.75 respectively.

Other The Company continues to account for stock options using the

current transition provisions of SFAS No. 123. Accordingly, Quanex

does not reflect the option expense in its income statement or

diluted earnings per share. However, the Company does disclose the

impact on net income and diluted earnings per share in the

footnotes to its SEC financial statements. Expensing stock options

in the second fiscal quarter 2004 would have reduced net income by

about $543,000 and diluted earnings per share by $.03. On March 31,

2004, Quanex announced its plans for restructuring Piper Impact and

for the sale of the business. The Company stated that while Piper

Impact continued to generate positive cash flow, it became

necessary to idle one of the division's two facilities because of

an ongoing drop in its traditional business. Piper's market focus

is no longer aligned with Quanex's strategic direction of serving

the vehicular products and building products markets, and for that

reason, will be sold. On May 11, 2004, the Company announced it

sold $125 million 2.5% convertible senior debentures. Proceeds from

the sale of debentures were used to repay a portion of the amounts

outstanding under its revolving credit agreement and for general

corporate purposes. Dividend Declared The Board of Directors

declared the Company's quarterly cash dividend of $.17 per share on

the Company's common stock, payable June 30, 2004 to shareholders

of record on June 15, 2004. Corporate Profile Quanex is a $1.4

billion industry-leading manufacturer of value-added engineered

materials and components serving the Vehicular Products and

Building Products markets. Financial Statistics as of 4/30/04 Book

value per common share: $28.28; Total debt to capitalization:

32.08%; Return on invested capital: 8.31%; Return on common equity:

10.07%; Actual number of common shares outstanding: 16,438,490

Definitions Book value per common share -- calculated as total

stockholders' equity as of balance sheet date divided by actual

number of common shares outstanding; Total debt to capitalization

-- calculated as the sum of both the current and long term portion

of debt, as of balance sheet date, divided by the sum of both the

current and long term portion of debt plus total stockholders'

equity as of balance sheet date; Return on invested capital --

calculated as the total of the prior 12 months net income plus

prior 12 months after-tax interest expense and capitalized

interest, the sum of which is divided by the trailing five quarters

average total debt (current and long term) and total stockholders'

equity; Return on common equity -- calculated as the prior 12

months net income, divided by the trailing five quarters average

common stockholders' equity. Statements that use the words

"expect," "should," "will," "might," or similar words reflecting

future expectations or beliefs are forward-looking statements. The

statements found above are based on current expectations. Actual

results or events may differ materially from this release. Factors

that could impact future results may include, without limitation,

the effect of both domestic and global economic conditions, the

impact of competitive products and pricing, and the availability

and cost of raw materials. For a more complete discussion of

factors that may affect the Company's future performance, please

refer to the Company's most recent 10-K filing (December 29, 2003)

under the Securities Exchange Act of 1934, in particular the

sections titled, "Private Securities Litigation Reform Act"

contained therein. For further information, visit the Company's

website at http://www.quanex.com/ . Financial Contact: Jeff Galow,

713/877-5327 Media Contact: Valerie Calvert, 713/877-5305 QUANEX

CORPORATION CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

per share data) (Unaudited) Three months ended Six months ended

April 30, April 30, 2004 2003 2004 2003 $405,993 $254,610 Net sales

$687,149 $484,119 354,222 213,773 Cost of sales 599,308 407,898

17,578 14,340 Selling, general and 30,686 27,595 administrative

expense 14,419 12,027 Depreciation and amortization 27,149 24,041

--- (405) Gain on sale of land (454) (405) 19,774 14,875 Operating

income 30,460 24,990 (1,831) (674) Interest expense (2,756) (1,724)

382 431 Other, net 822 1,965 18,325 14,632 Income before income

taxes 28,526 25,231 (6,781) (5,267) Income tax expense (10,555)

(9,083) $ 11,544 $ 9,365 Net income $ 17,971 $ 16,148 Weighted

average common shares outstanding: 16,423 16,064 Basic 16,370

16,238 16,690 16,286 Diluted 16,639 16,470 Earnings per common

share: $ 0.70 $ 0.58 Basic $ 1.10 $ 0.99 $ 0.69 $ 0.58 Diluted $

1.08 $ 0.98 $ 0.17 $ 0.17 Cash dividends per share $ 0.34 $ 0.34

QUANEX CORPORATION INDUSTRY SEGMENT INFORMATION (In thousands)

(Unaudited) Three months ended Six months ended April 30, April 30,

2004 2003 2004 2003 Net sales: $225,254 $118,018 Vehicular Products

$366,233 $226,950 180,739 136,592 Building Products 320,916 257,169

$405,993 $254,610 Net sales $687,149 $484,119 Operating income: $

13,506 $ 14,336 Vehicular Products $ 22,186 $ 24,223 12,071 4,218

Building Products 17,582 8,385 (5,803) (3,679) Corporate and Other

(9,308) (7,618) $ 19,774 $ 14,875 Operating Income $ 30,460 $

24,990 QUANEX CORPORATION CONSOLIDATED BALANCE SHEETS (In

thousands) (Unaudited) April 30, October 31, 2004 2003 2003 2002

Assets $ 5,290 $ 806 Cash and equivalents $ 22,108 $ 18,283 195,813

125,917 Accounts and notes 123,185 116,122 receivable, net 139,683

105,991 Inventories 79,322 90,756 13,791 12,398 Other current

assets 8,116 10,640 354,577 245,112 Total current assets 232,731

235,801 398,573 343,980 Property, plant and 335,904 353,132

equipment, net 137,756 66,436 Goodwill, net 66,436 66,436 28,718

2,813 Intangibles, net 2,755 2,870 30,990 32,113 Other assets

28,037 30,901 $950,614 $690,454 Total assets $665,863 $689,140

Liabilities and stockholders' equity $143,226 $ 83,763 Accounts

payable $ 89,435 $ 76,588 46,460 38,800 Accrued liabilities 39,209

48,973 6,400 1,311 Income taxes payable 7,381 4,839 16 1,375 Other

current liabilities 46 3,970 3,751 424 Current portion of long-term

3,877 434 debt 199,853 125,673 Total current liabilities 139,948

134,804 215,817 81,694 Long-term debt 15,893 75,131 2,299 7,048

Deferred pension credits 8,323 4,960 7,782 8,182 Deferred

postretirement welfare benefits 7,845 7,928 44,005 33,064 Deferred

income taxes 34,895 29,210 15,938 13,997 Other liabilities 13,800

15,712 485,694 269,658 Total liabilities 220,704 267,745 464,920

420,796 Total stockholders' equity 445,159 421,395 $950,614

$690,454 Total liabilities and $665,863 $689,140 stockholders'

equity QUANEX CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOW (In

thousands) (Unaudited) Three months ended Six months ended April

30, April 30, 2004 2003 2004 2003 Operating activities: $ 11,544 $

9,365 Net income $ 17,971 $ 16,148 Adjustments to reconcile net

income to cash provided by operating activities: --- (405) Gain on

sale of land (454) (405) 14,564 12,114 Depreciation and 27,402

24,221 amortization 3,059 2,601 Deferred income taxes 4,560 3,855

1,312 4,902 Deferred pension and postretirement benefits (6,087)

2,342 30,479 28,577 43,392 46,161 Changes in assets and

liabilities, net of effects from acquisitions and dispositions:

(47,802) (22,207) Increase in accounts and (49,592) (9,795) notes

receivable (14,263) (5,194) Increase in inventory (20,679) (15,235)

25,500 4,544 Increase in accounts 31,870 7,175 payable (1,180)

(712) Increase (Decrease) in 1,200 (10,173) accrued liabilities

(640) (5,869) Decrease in income (1,127) (3,528) taxes payable

2,309 (1,315) Other, net 231 (4,791) (5,597) (2,176) Cash provided

by (used for) operating activities 5,295 9,814 Investment

activities: 17,340 --- Acquisitions , net of (214,573) --- cash

acquired --- 2,832 Proceeds from sale 637 2,832 of land (4,099)

(6,292) Capital expenditures, (8,265) (14,812) net of retirements

44 (1,857) Other, net (558) (3,004) 13,285 (5,317) Cash provided by

(used for) (222,759) (14,984) investment activities Financing

activities: (10,000) 11,700 Bank revolver and 200,000 6,700 note

repayments, net --- (6,804) Purchases of Quanex --- (13,515) common

stock (2,802) (2,741) Common dividends paid (5,591) (5,379) 508 764

Issuance of common 7,223 1,574 stock, net (302) (45) Other, net

(1,011) (1,687) (12,596) 2,874 Cash provided by (used for) 200,621

(12,307) financing activities 16 Effect of exchange rate 25 changes

on cash and equivalents (4,892) (4,619) Decrease in cash (16,818)

(17,477) 10,182 5,425 Beginning of period cash 22,108 18,283 and

equivalents $ 5,290 $ 806 End of period cash $ 5,290 $ 806 and

equivalents http://www.newscom.com/cgi-bin/prnh/20010522/DATU048

http://www.newscom.com/cgi-bin/prnh/20031231/QUANEXLOGO

http://photoarchive.ap.org/ DATASOURCE: Quanex Corporation CONTACT:

financial, Jeff Galow, +1-713-877-5327, or media, Valerie Calvert,

+1-713-877-5305, both of Quanex Corporation Web site:

http://www.quanex.com/

Copyright

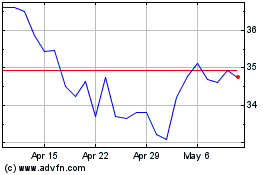

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

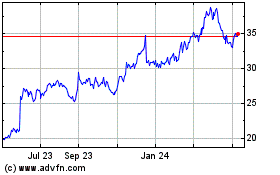

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024