Bear of the Day: Quanex Building Products (NX) - Bear of the Day

March 28 2013 - 2:00AM

Zacks

Earnings estimates have fallen sharply for

Quanex Building

Products Corporation (NX) following disappointing first quarter

results on March 7. It is a Zacks Rank #5 (Strong Sell) stock.

Although shares have sold off since the Q1 report,

the stock still doesn't look cheap at 34x forward earnings.

Investors may want to hold off on this stock until earnings

momentum improves.

Quanex Building Products manufactures engineered

materials, components and systems primarily for window and door

original equipment manufacturers (OEMs). It reports is operations

in two segments:

- Engineered Products, which makes window and door components and

other residential building products for OEMs, that primarily serve

the residential construction and remodeling markets.

- Aluminum Sheet Products, which are used in exterior housing

trim, fascias, roof edgings, soffits, downspouts and gutters.

Q1 Earnings Miss

Quanex delivered disappointing results for the

first quarter of its fiscal 2013 on March 7. The company reported

an adjusted loss of 17 cents per share, which was below the Zacks

Consensus Estimate calling for a loss of 6 cents. It was also the

company's third straight earnings miss.

Net sales increased 15% to $185.7 million, driven

by 7% growth in Engineered Products and 29% growth in Aluminum

Sheet Products. Operating profits in the Engineered Products

segment improved to $2.8 million, but this wasn't enough to offset

a $4.2 million operating loss in the Aluminum Sheet Products

division.

Estimates Falling

Despite a rebound in the housing market, management

stated in the Q1 press release that its expects U.S. window

shipments will only improve by approximately 5% this year. This

prompted analysts to revise their estimates significantly lower for

both 2013 and 2014, sending the stock to a Zacks Rank #5 (Strong

Sell).

The Zacks Consensus Estimate for 2013 is now $0.35,

down from $0.58 ninety days ago. The 2014 consensus has fallen from

$1.02 to $0.65 over the same period.

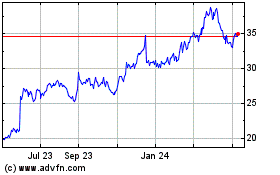

You can see the big decline in earnings estimates

over the last several months in the company's 'Price &

Consensus' chart:

Premium Valuation

Shares of NX are down more than 20% since the Q1

earnings release, but shares still a look a bit pricey here. The

stock currently trades at 34x 12-month forward earnings, which is a

significant premium to its 10-year historical median of 14x and the

industry median of 20x.

Quanex Building Products also carries a long-term

'Underperform' Zacks Recommendation.

The Bottom Line

With declining consensus estimates and premium

valuation, investors may want to avoid Quanex Building Products

until its earnings momentum turns around. There are other stocks

within the Building & Construction - Miscellaneous industry,

however, that investors might want to consider based on their

positive earnings momentum. Masco (MAS) and Trex

Company (TREX), for instance, both carry a Zacks Rank of 2

(Buy).

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Editor of the Income

Plus Investor service.

MASCO (MAS): Free Stock Analysis Report

QUANEX BLDG PRD (NX): Free Stock Analysis Report

TREX COMPANY (TREX): Free Stock Analysis Report

To read this article on Zacks.com click here.

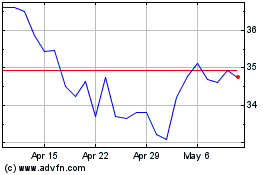

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024