Statement of Changes in Beneficial Ownership (4)

August 31 2020 - 5:17PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Gulf Hungary Holding Korlatolt Felelossegu Tarsasag |

2. Issuer Name and Ticker or Trading Symbol

QUAKER CHEMICAL CORP

[

KWR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

BAH CENTER, 2 FURJ STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/27/2020 |

|

(Street)

BUDAPEST, K5 1124

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 8/27/2020 | | S(1) | | 150131 | D | (1) | 219367 | D | |

| Common Stock | 8/27/2020 | | P(1) | | 150131 | A | (1) | 4054584 | I | By QH Hungary Holdings Limited |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Prepaid Variable Forward Sale Contract | (2)(4) | 8/27/2020 | | J/K (2)(4) | | 140000 | | (2)(4) | (2)(4) | Common Stock | 140000 | (2)(4) | 140000 | I | By QH Hungary Holdings Limited |

| Prepaid Variable Forward Sale Contract | (3)(4) | 8/27/2020 | | J/K (3)(4) | | 60000 | | (3)(4) | (3)(4) | Common Stock | 60000 | (3)(4) | 60000 | I | By QH Hungary Holdings Limited |

| Explanation of Responses: |

| (1) | Transfer by the reporting person to QH Hungary Holdings Limited, a wholly owned subsidiary of the reporting person ("QH Hungary"). |

| (2) | On August 27, 2020, QH Hungary entered into a prepaid variable share forward transaction with JPMorgan Chase Bank, National Association ("JPMorgan"). See Footnote 4 and Remarks for details of the transaction. |

| (3) | On August 27, 2020, QH Hungary entered into a prepaid variable share forward transaction with Citibank, N.A. ("Citibank"). See Footnote 4 and Remarks for details of the transaction. |

| (4) | The prepaid forward transactions with JPMorgan and Citibank are each divided into 14 components (each a "Component"). For each Component, QH Hungary is obligated to, on the settlement date (the "Settlement Date") determined based on the specified scheduled valuation date within the period from August 18, 2022 to September 7, 2022, either, at QH Hungary's option, (i) up to 10,000 Shares to JPMorgan and up to 4,286 Shares (or 4,282 Shares for the last Settlement Date) to Citi (such Share number, "Subject Number") based on the average market price of the Shares determined as described below in Remarks or (ii) an amount of cash equivalent to the value of such Shares. In exchange for assuming the obligation under each contract, QH Hungary received an upfront cash prepayment of $9,481,130.00 and $22,122,636.00 from Citibank and JPMorgan, respectively. |

Remarks:

The number of Shares (or, at QH Hungary's option, the cash equivalent) to be delivered to the applicable bank on each Settlement Date is to be determined as follows: (a) if the volume-weighted average price per Share on the relevant valuation date, as reasonably determined by such bank by reference to the Bloomberg Page "KWR <equity> AQR <Go>" (or any successor page thereto) (provided that, if such price is not so reported for any reason or is, in the applicable bank's reasonable discretion, erroneous, a price determined by the applicable bank in good faith and a commercially reasonable manner) (the "Settlement Price") is equal to or less than $178.60 per Share (the "Forward Floor Price"), QH Hungary will deliver to the applicable bank the Subject Number of Shares; (b) if the Settlement Price is between the Forward Floor Price and $216.20 per Share (the "Forward Cap Price"), QH Hungary will deliver to the applicable bank a number of Shares equal to the Subject Number multiplied by a fraction, the numerator of which is the Forward Floor Price and the denominator of which is the Settlement Price; and (c) if the Settlement Price is greater than the Forward Cap Price, QH Hungary will deliver to the applicable bank a number of Shares equal to the product of (i) the Subject Number and (ii) a fraction (A) the numerator of which is the sum of (x) the Forward Floor Price and (y) the Settlement Price minus the Forward Cap Price, and (B) the denominator of which is the Settlement Price. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Gulf Hungary Holding Korlatolt Felelossegu Tarsasag

BAH CENTER, 2 FURJ STREET

BUDAPEST, K5 1124 |

| X |

|

|

Signatures

|

| /s/ Judit Rozsa, Managing Director, on behalf of Gulf Hungary Holding Korlatolt Felelossegu Tarsasag | | 8/31/2020 |

| **Signature of Reporting Person | Date |

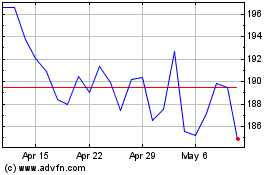

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

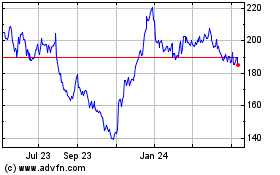

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Apr 2023 to Apr 2024