P&G Posts Loss Even as Sales Surge -- WSJ

July 31 2019 - 3:02AM

Dow Jones News

Consumer company takes $8 billion charge to write down value of

Gillette razor business

By Sharon Terlep and Aisha Al-Muslim

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 31, 2019).

Procter & Gamble Co. reported its highest quarterly sales

growth in more than a decade, riding strong consumer spending on

household staples from toothpaste to laundry detergent even as the

company continued to raise prices.

The strong quarterly sales were marred by an $8 billion charge

the Cincinnati-based company took to write down the value of the

Gillette razor business it acquired 14 years ago. The charge is a

reminder of the challenges facing big brands amid shifting consumer

habits and new online entrants.

After years of trying to stoke demand by cutting prices, P&G

and most of its rivals switched course about a year ago and have

been pushing up prices across a range of products. The moves have

paid off as consumers have been willing to absorb the increases,

some of which were prompted by higher costs and have padded

profits.

The maker of Tide detergent and Pampers diapers said Tuesday

organic sales -- which strip out currency moves, acquisitions and

divestitures -- rose 7% in the quarter. About half the gains came

from higher prices. The company posted the strongest organic-sales

gains in its beauty and health-care businesses.

P&G's results for the fiscal year that ended June 30 mark

the biggest sales gain since the 2008 U.S. recession. Finance chief

Jon Moeller said the results demonstrate that P&G's turnaround

effort, from slashing brands and jobs to streamlining the

organizational structure, is working.

"We built momentum on sales, share and margin as the year

progressed," Mr. Moeller said on a call Tuesday with reporters.

P&G was buoyed by a strong overall market both in the U.S.

and in emerging markets, despite concerns about the global economy

and trade tensions. Rivals Kimberly-Clark Corp. and

Colgate-Palmolive Co. also reported solid quarterly results, though

they didn't match P&G's performance.

P&G shares were up 4.3% at $121 on Tuesday afternoon. Shares

are up about 51% in the past year.

For the fourth quarter, the company posted a net loss of $5.24

billion, or $2.12 a share, down from a profit of $1.89 billion, or

72 cents a share, a year earlier. The results were weighed down by

the Gillette charge, which reduced earnings by $3.02 a share.

Gillette started slashing prices in 2017 in hopes of stopping

defections of its U.S. customers to online startups such as Dollar

Shave Club and Harry's that sell lower-priced razors and blades.

The move helped but the brand has remained a stubborn weak spot for

P&G, which bought Gillette for $57 billion in 2005.

The company has acknowledged that it erred with a singular focus

on creating more sophisticated razors with higher and higher

prices, opening the door to lower-priced rivals.

Although competition has increased and men are shaving less, the

business "continues to be a strategic business with attractive

earnings, cash flow and growth opportunities" the company said.

During the quarter, ended June 30, P&G's net sales rose 4%

to $17.09 billion, above the consensus forecast of $16.86 billion

from analysts polled by FactSet. Unfavorable foreign exchange hurt

sales by 4%, the company said.

For fiscal 2020, the company predicted net sales growth of 3% to

4% and organic sales growth of 3% to 4%. Core earnings per share

are expected to increase 4% to 9% for fiscal 2020, compared with

$4.52 in fiscal 2019.

Write to Sharon Terlep at sharon.terlep@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

July 31, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

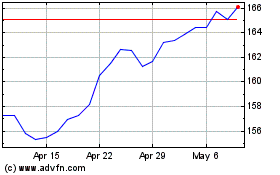

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

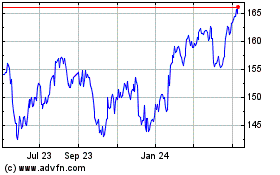

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024