Current Report Filing (8-k)

October 28 2020 - 4:51PM

Edgar (US Regulatory)

0001108426false 0001108426 2020-10-26 2020-10-26 0001108426 pnm:TexasNewMexicoPowerCompanyMember 2020-10-26 2020-10-26

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Registrants, State of Incorporation,

Address Of Principal Executive Offices and Telephone Number

|

|

|

|

|

|

|

|

|

|

|

|

(A New Mexico Corporation)

|

|

|

|

|

|

|

|

|

|

|

|

Albuquerque, New Mexico 87102-3289

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas-New Mexico Power Company

|

|

|

|

|

|

|

|

|

|

|

|

577 N. Garden Ridge Blvd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

40.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4

(c) under the Exchange Act (17 CFR

40.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, no par value

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Entry into a Material Definitive Agreement.

|

Amendments to PNMR Credit Agreements

On October 26, 2020, PNM Resources, Inc., a New Mexico corporation (“PNMR”) entered into the Eighth Amendment to Credit Agreement (“PNMR Revolver Amendment”) amending its $300.0 million revolving credit agreement (“PNMR Revolver”), among PNMR, the lenders party thereto, and Wells Fargo Bank, National Association, as administrative agent. The PNMR Revolver Amendment is effective October 26, 2020 and amends (i) the definition of “Change of Control” in the PNMR Revolver such that the entry by PNMR into the Agreement and Plan of Merger dated October 20, 2020, among Avangrid, Inc., NM Green Holdings, Inc. and PNMR (the “Merger Agreement”) will not be a Change of Control for purposes of the PNMR Revolver, and (ii) the merger negative covenant to replace “enter into any transaction of merger” with “merge with or into any other person.” The PNMR Revolver Amendment also waives the Change of Control and any other event of default arising from PNMR’s entry into the Merger Agreement. Entering into the PNMR Revolver Amendment resulted in the acceleration of the maturity date under the $300 million 364-day revolving credit facility among PNMR, the lenders party thereto, and MUFG Bank, Ltd., as administrative agent, which was filed as Exhibit 10.1 to PNMR’s Current Report on Form 8-K filed on October 21, 2020, and such facility is terminated as a result thereof.

On October 26, 2020, PNMR entered into the Second Amendment to Term Loan Agreement (“PNMR $150 Million Term Loan Amendment”) amending its $150.0 million term loan agreement (the “PNMR $150 Million Term Loan”) among PNMR, the lenders party thereto, and MUFG Bank, Ltd., as administrative agent. The PNMR $150 Million Term Loan Amendment is effective October 26, 2020 and amends (i) the definition of “Change of Control” in the PNMR $150 Million Term Loan such that the entry by PNMR into the Merger Agreement will not be a Change of Control for purposes of the PNMR $150 Million Term Loan, and (ii) the merger negative covenant to replace “enter into any transaction of merger” with “merge with or into any other person.” The PNMR $150 Million Term Loan Amendment also waives the Change of Control and any other event of default arising from PNMR’s entry into the Merger Agreement.

On October 26, 2020, PNMR entered into the First Amendment to Term Loan Agreement (“PNMR $50 Million Term Loan Amendment”) amending its $50.0 million term loan agreement (“PNMR $50 Million Term Loan”) between PNMR and Bank of America, N.A., as sole lender. The PNMR $50 Million Term Loan Amendment is effective October 26, 2020 and amends (i) the definition of “Change of Control” in the PNMR $50 Million Term Loan such that the entry by PNMR into the Merger Agreement will not be a Change of Control for purposes of the PNMR $50 Million Term Loan, and (ii) the merger negative covenant to replace “enter into any transaction of merger” with “merge with or into any other person.” The PNMR $50 Million Term Loan Amendment also waives the Change of Control and any other event of default arising from PNMR’s entry into the Merger Agreement.

On October 26, 2020, PNMR entered into a Waiver Agreement (the “PNMR LOC Waiver”) with respect to its $30.3 million standby letter of credit facility with Wells Fargo Bank National Association. The PNMR LOC Waiver is effective as of October 26, 2020 and waives the change of control event of default arising from PNMR’s entry into the Merger Agreement.

On October 21, 2020, the $30.3 million letter of credit facility between PNMR and JPMorgan Chase Bank N.A., expired in accordance with its terms.

The above descriptions of the PNMR Revolver Amendment, the PNMR $150 Million Term Loan Amendment, the PNMR $50 Million Term Loan Amendment and the PNMR LOC Waiver are not complete and are qualified in their entirety by reference to the entire PNMR Revolver Amendment, PNMR $150 Million Term Loan Amendment, PNMR $50 Million Term Loan Amendment and PNMR LOC Waiver, copies of which are attached hereto as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively, and incorporated herein by reference.

Amendment to TNMP Credit Agreement and No Bond Repurchase Event

On October 26, 2020,

Texas-New

Mexico Power Company (“TNMP”) entered into the Second Amendment to Third Amended and Restated Credit Agreement (“TNMP Revolver Amendment”) amending its $75 million revolving credit agreement (the “TNMP Revolver”), among TNMP, the lenders identified therein and KeyBank National Association, as administrative agent. The TNMP Revolver Amendment is effective October 26, 2020 and amends (i) the definition of “Change of Control” in the TNMP Revolver such that the entry by PNMR into the Merger Agreement will not be a Change of Control for purposes of the TNMP Revolver, and (ii) the merger negative covenant to replace “enter into any transaction of merger” with “merge with or into any other person.” The TNMP Revolver also waives the Change of Control and any other event of default arising from PNMR’s entry into the Merger Agreement.

In addition, as previously disclosed in the Current Report on Form

8-K,

dated as of October 20, 2020, filed by PNMR and TNMP, TNMP has $750 million of outstanding First Mortgage Bonds (“TNMP FMBs”) that include a “Bond Repurchase Event” provision. The execution of the TNMP Revolver Amendment means that no Bond Repurchase Event will occur with respect to the TNMP FMBs.

The above description of the TNMP Revolver Amendment is not complete and is qualified in its entirety by reference to the entire TNMP Revolver Amendment, a copy of which is attached hereto as Exhibit 10.5 and incorporated herein by reference.

Amendments to PNMR Development Credit Agreements

On October 26, 2020, PNMR Development and Management Company (“PNMR Development”) entered into a Waiver Agreement (“PNMR Development Revolver Waiver”) with respect to its $40 million revolving credit agreement, as amended (“PNMR Development Revolver”), among PNMR Development and Wells Fargo Bank National Association, as lender. The PNMR Development Revolver Waiver is effective as of October 26, 2020 and waives the cross-default event of default arising from PNMR’s entry into the Merger Agreement and the resulting event of default under the PNMR Revolver.

Also on October 26, 2020, PNMR Development entered into the First Amendment to Term Loan Credit Agreement (“PNMR Development Term Loan Amendment”) amending its $90 million term loan agreement (“PNMR Development Term Loan”) among PNMR Development and KeyBank, N.A., as administrative agent and sole lender. The PNMR Development Term Loan Amendment is effective October 26, 2020 and amends (i) the definition of “Change of Control” in the PNMR Development Term Loan such that the entry by PNMR into the Merger Agreement will not be a Change of Control for purposes of the PNMR Development Term Loan, and (ii) the merger negative covenant to replace “enter into any transaction of merger” with “merge with or into any other person.” The PNMR Development Term Loan Amendment also waives the Change of Control and any other event of default arising from PNMR’s entry into the Merger Agreement.

The above descriptions of the PNMR Development Revolver Waiver and the PNMR Development Term Loan Amendment are not complete and are qualified in their entirety by reference to the entire PNMR Development Revolver Waiver and PNMR Development Term Loan Amendment, copies of which are attached hereto as Exhibits 10.6 and 10.7, respectively, and incorporated herein by reference.

|

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information required by this item is included in Item 1.01 and incorporated herein by reference.

|

|

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement.

|

The information required by this item is included in Item 1.01 and incorporated herein by reference.

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

10.1

|

|

Eighth Amendment to Credit Agreement, dated as of October 26, 2020, among PNM Resources, Inc., the lenders party thereto, and Wells Fargo Bank, National Association, as administrative agent.

|

|

|

|

|

10.2

|

|

Second Amendment to Term Loan Agreement, dated as of October 26, 2020, among PNM Resources, Inc., the lenders party thereto, and MUFG Bank, Ltd., as administrative agent.

|

|

|

|

|

10.3

|

|

First Amendment to Term Loan Agreement, dated as of October 26, 2020, between PNM Resources, Inc. and Bank of America, N.A., as sole lender.

|

|

|

|

|

10.4

|

|

Waiver Agreement, dated as of October 26, 2020, between PNM Resources, Inc. and Wells Fargo Bank National Association.

|

|

|

|

|

|

10.5

|

|

Second Amendment to Third Amended and Restated Credit Agreement, dated as of October 26, 2020, among Texas-New Mexico Power Company, the lenders identified therein and KeyBank National Association, as administrative agent.

|

|

|

|

|

10.6

|

|

Waiver Agreement, dated as of October 26, 2020, among PNMR Development and Management Corporation and Wells Fargo Bank National Association.

|

|

|

|

|

10.7

|

|

First Amendment to Term Loan Credit Agreement, dated as of October 26, 2020, among PNMR Development and Management Corporation and KeyBank, N.A., as administrative agent and sole lender.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

TEXAS-NEW

MEXICO POWER COMPANY

|

|

|

|

|

|

|

Date: October 28, 2020

|

|

|

|

By:

|

|

|

|

|

|

|

|

Name:

|

|

Henry E. Monroy

|

|

|

|

|

|

Title:

|

|

Vice President and Corporate Controller

|

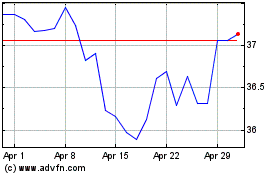

PNM Resources (NYSE:PNM)

Historical Stock Chart

From Mar 2024 to Apr 2024

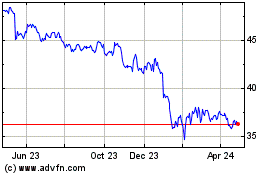

PNM Resources (NYSE:PNM)

Historical Stock Chart

From Apr 2023 to Apr 2024