UPDATE: Treasury Recognizes $2.3 Billion TARP Loss From CIT Group

February 10 2010 - 5:14PM

Dow Jones News

U.S. taxpayers' $2.3 billion stake in CIT Group Inc. (CIT) has

officially been wiped out.

The U.S. Treasury recognized the loss, which was widely

expected, in a report released Wednesday.

The Treasury provided the commercial lender with funds from the

Troubled Asset Relief Program in December 2008, but CIT Group still

ended up undergoing a bankruptcy reorganization by the end of

2009.

Despite the CIT Group loss and other likely taxpayer losses, the

Treasury expects the cost of TARP will continue to fall from the

just under $120 billion at which it now stands. The Treasury is

expecting its losses on financial sector rescue efforts to largely

stem from aid provided to domestic auto makers, American

International Group (AIG) and government sponsored enterprises

Fannie Mae (FNM) and Freddie Mac (FRE).

"If Congress joins the President in adopting a Financial Crisis

Responsibility Fee, Americans will not have to pay one cent for

TARP," Treasury Secretary Timothy Geithner said in a statement

released separately Wednesday.

Treasury is expecting to turn a profit on aid provided directly

to the banking sector and on Wednesday said it had received a $7.6

billion TARP repayment from PNC Bank (PNC). Including the PNC

transaction, banks have so far repaid $173 billion in capital

borrowed from the Treasury.

Treasury made both announcements during a government shutdown in

response to the area's second severe winter storm in a week.

-By Meena Thiruvengadam, Dow Jones Newswires; 202-862-6629;

meena.thiruvengadam@dowjones.com

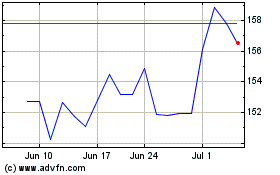

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

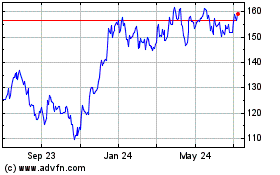

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Nov 2023 to Nov 2024