Protective Life Corporation (NYSE: PL) today reported results

for the third quarter of 2009. Net income for the third quarter of

2009 was $27.6 million, or $0.32 per average diluted share,

compared to a net loss of $100.0 million, or $1.41 per average

diluted share, in the third quarter of 2008. Operating income,

after-tax, for the third quarter of 2009 was $47.9 million, or

$0.55 per average diluted share, compared to $62.5 million, or

$0.88 per average diluted share, in the third quarter of 2008.

Net income for the nine months ended September 30, 2009 was

$140.5 million, or $1.77 per average diluted share, compared to a

net loss of $25.9 million, or $0.36 per average diluted share, in

the nine months ended September 30, 2008. Operating income, after

tax, for the nine months ended September 30, 2009 was $190.3

million, or $2.40 per average diluted share, compared to operating

income, after tax, of $183.2 million, or $2.57 per average diluted

share, in the nine months ended September 30, 2008.

Book value per share increased to $26.91 at quarter-end,

compared to $10.89 at December 31, 2008.

John D. Johns, Protective’s Chairman, President and Chief

Executive Officer commented:

“We continued to make good progress on many fronts during the

third quarter. Our book value per common share outstanding

increased to almost $27.00 per share at quarter-end, an increase of

147% from the low at year-end 2008. We continue to expand the

breadth and depth of our annuity distribution platform, and we saw

a strong increase in variable annuity sales and positive fund flows

in our major annuity product lines. We also made some good progress

in expanding our capacity to distribute universal life products.

Our universal life sales increased 33% over last year’s third

quarter in the face of some very difficult market conditions. Our

Asset Protection segment continued to perform in line with

expectations. Asset Protection sales were up about $10 million

during the quarter on a sequential basis. We also continued to

execute on our plan to grow our capital base and maintain solid

capital ratios. Just after the quarter closed, we successfully

refinanced surplus notes supporting one of our securitization

structures. We expect that the transaction will generate a

substantial increase in operating earnings in the fourth quarter

and will also further bolster our capital base and capital ratios

at year-end.

“Earnings in the quarter were negatively impacted by the

substantial amounts of excess liquidity that we continued to carry,

less favorable mortality, some consolidation and other unusual

expense items and impairments in the investment portfolio. We are

moving cautiously to deploy excess liquidity and expect earnings to

be impacted by lower yields on short term investments into next

year.”

Net income for the third quarter of 2009 included:

- Net realized investment losses,

after tax, of $20.3 million, or $0.23 per average diluted share,

compared to net realized investment losses, after tax, of $162.5

million, or $2.29 per average diluted share, in the third quarter

of 2008

- Pre-tax other-than-temporary

impairments of $31.0 million, or $0.23 per average diluted share,

are included in the $0.23 per share of net realized investment

losses in the third quarter of 2009

Operating income for the third quarter of 2009 included $4.6

million of net negative items, on a pre-tax basis:

Positive Items:

- Positive fair value changes of

$14.1 million on a portfolio of securities designated for

trading

- Positive prospective unlocking

of $10.1 million

Negative Items:

- Negative fair value changes of

$3.8 million in the Annuities segment

- Negative mortality variance to

plan in the Life Marketing and Acquisitions segments of $7.8

million

- Negative items of $17.2 million

primarily due to higher expenses and lower Corporate and Other

investment income

Business Segment Results

The table below sets forth business segment operating income

(loss) before income tax for the periods shown:

Operating Income (Loss) Before Income Tax ($ in thousands)

3Q2009

3Q2008 $ Chg

% Chg Life Marketing $ 26,544 $

52,222 $ (25,678 ) -49.2 % Acquisitions 33,061 33,021 40 0.1 %

Annuities 16,075 556 15,519 n/m Stable Value Products 14,339 28,184

(13,845 ) -49.1 % Asset Protection 5,731 8,186 (2,455 ) -30.0 %

Corporate & Other (22,826 ) (32,173 )

9,347 n/m

$ 72,924 $

89,996 $ (17,072 ) -19.0 %

In the Life Marketing and Asset Protection segments, pre-tax

operating income equals segment income before income tax for all

periods. In the Stable Value Products, Annuities, Acquisitions and

Corporate & Other segments, operating income (loss) excludes

realized investment gains (losses), periodic settlements on

derivatives, and related amortization of DAC and VOBA. A

reconciliation of operating income before income tax to income

before income tax is included below:

($ in thousands)

3Q2009 3Q2008

$ Chg

Operating income (loss) before income tax $

72,924 $ 89,996 $

(17,072

)

Realized investment gains (losses) Stable Value Products (4,949 )

4,984 (9,933

)

Annuities (482 ) (14,419 ) 13,937

Acquisitions 7,025 (40,002 ) 47,027

Corporate & Other (33,662 ) (199,289 ) 165,627

Less: Periodic settlements on derivatives Corporate & Other -

1,915 (1,915

)

Related amortization of deferred

policy acquisition costs, value of businesses acquired

Annuities 2,340 1,073 1,267

Acquisitions (3,120 ) (1,776 ) (1,344

)

Income (loss) before income

tax

$ 41,636 $ (159,942 )

$ 201,578

Income (loss) before income tax, unlike operating income (loss)

before income tax, does not exclude realized gains (losses), net of

the related amortization of DAC and VOBA, and participating income

from real estate ventures. Income before income tax for the

Acquisitions segment was $43.2 million for the third quarter of

2009 compared to a loss before income tax of $5.2 million for the

third quarter of 2008. Income before income tax for the Annuities

segment was $13.3 million for the third quarter of 2009 compared to

a loss before income tax of $14.9 million for the third quarter of

2008. Income before income tax for the Stable Value segment was

$9.4 million for the third quarter of 2009 compared to $33.2

million for the third quarter of 2008. Loss before income tax for

the Corporate & Other segment was $56.5 million for the third

quarter of 2009 compared to a loss before income tax of $233.4

million for the third quarter of 2008.

Sales

The Company uses sales statistics to measure the relative

progress of its marketing efforts. The Company derives these

statistics from various sales tracking and administrative systems

and not from its financial reporting systems or financial

statements. These statistics measure only one of many factors that

may affect future profitability of the business segments and

therefore, are not intended to be predictive of future

profitability.

The table below sets forth business segment sales for the

periods shown:

($ in millions)

3Q2009

3Q2008 $ Chg % Chg Life Marketing $ 41.9 $

35.4 $ 6.5 18.4 % Annuities 452.6 472.2 (19.6 ) -4.2 % Stable Value

Products - 685.0 (685.0 ) n/m Asset Protection 86.2 104.2 (18.0 )

-17.3 %

Review of Business Segment Results

Life Marketing

Life Marketing segment pre-tax operating income was $26.5

million in the third quarter of 2009 compared to $52.2 million in

the third quarter of 2008. The decrease was primarily due to

unfavorable mortality, lower investment income on the traditional

life block, and an elevated level of expenses. Negative traditional

life mortality of $4.9 million is included in the third quarter of

2009 results and is $7.9 million unfavorable to plan. Positive

prospective unlocking of $1.5 million was recorded in the third

quarter of 2009, compared to $8.8 million of positive prospective

unlocking recorded in the third quarter of 2008.

Sales were $41.9 million in the third quarter of 2009, an

increase of 18.5% compared to $35.4 million in the third quarter of

2008. Term insurance sales in the current quarter were $25.6

million compared to $23.0 million in the prior year’s quarter.

Universal life insurance sales (including variable universal life)

in the current quarter were $16.3 million compared to $12.3 million

in the third quarter of 2008.

Acquisitions

Acquisitions segment pre-tax operating income was $33.1 million

in the third quarter of 2009 compared to $33.0 million in the third

quarter of 2008, primarily due to lower operating expenses,

partially offset by expected runoff of the blocks of business.

Annuities

Annuities segment pre-tax operating income was $16.1 million in

the third quarter of 2009 compared to $556 thousand in the third

quarter of 2008. The current quarter included $3.8 million of

negative fair value changes, representing a positive variance of

$1.1 million compared to the prior year’s quarter. This variance

includes a $1.0 million favorable variance on embedded derivatives

associated with the variable annuity guaranteed minimum withdrawal

benefit (“GMWB”) rider and a $0.1 million favorable variance on the

equity indexed annuity product line, which is no longer marketed.

Positive prospective unlocking improved earnings by $6.9 million in

the current quarter. The segment experienced wider interest spreads

and continued growth in the single premium deferred annuity and

market value adjusted annuity lines during the third quarter.

Annuity account values were $9.9 billion as of September 30, 2009,

an increase of 20.6% over the prior year. Net cash flows for the

segment remained positive during the quarter.

Sales in the third quarter of 2009 were $452.6 million compared

to $472.2 million in the third quarter of 2008. The decrease was

primarily due to lower fixed annuity sales, partially offset by

record variable annuity sales. Variable annuity sales were $194.4

million in the third quarter of 2009, an increase of approximately

47%, compared to $132.4 million in the third quarter of 2008. Fixed

annuity sales were $258.1 million in the third quarter of 2009

compared to $339.8 million in the prior year’s quarter.

Stable Value

Products

Stable Value Products segment pre-tax operating income was $14.3

million in the third quarter of 2009 compared to $28.2 million in

the third quarter of 2008. The decrease was a result of a decline

in average account values and a decline in operating spreads.

Included in the operating income during the third quarter of 2008

was $3.0 million of other income resulting from the early

retirement of funding agreements. There were no early funding

agreement retirements in the third quarter of 2009. Excluding the

effect of this gain, the spread decreased 28 basis points to 140

basis points for the three months ended September 30, 2009,

compared to the prior year’s quarter. Deposit balances as of

September 30, 2009 were $3.9 billion.

There were no sales during the three months ended September 30,

2009 compared to $685.0 million in the previous year’s quarter.

Asset

Protection

Asset Protection segment pre-tax operating income was $5.7

million in the third quarter of 2009 compared to $8.2 million in

the third quarter of 2008. The decrease was primarily the result of

lower service contract income due to significantly lower sales

volume and modestly higher loss ratios.

Sales in the third quarter of 2009 were $86.2 million, down

$18.0 million, or 17.2%, compared to the third quarter of 2008,

driven by the negative impact in all product lines of lower volume

of automobile and marine units sold. Sales increased $10.0 million

in the third quarter of 2009, as compared to the second quarter of

2009. The segment benefitted in the current quarter from the

federal government’s “Cash for Clunkers” program.

Corporate &

Other

This segment consists primarily of net investment income on

capital, interest expense on debt, ancillary run-off lines of

business, and various items not associated with the other segments.

Corporate & Other segment pre-tax operating loss was $22.8

million in the third quarter of 2009 compared to a $32.2 million

loss in the third quarter of 2008. The improvement in the current

quarter was primarily due to mark-to-market adjustments on a

portfolio of securities designated for trading, with a market value

of approximately $322.4 million as of September 30, 2009. The

mark-to-market on this trading portfolio positively impacted income

by $14.1 million for the three months ended September 30, 2009, a

$37.6 million more favorable impact than in the prior year’s

quarter. Offsetting this positive mark-to-market change was lower

investment income resulting from reduced yields on a large balance

of cash and short-term investments and higher expenses.

Investments

- Total cash and investments were

$29.0 billion as of September 30, 2009. This includes $1.3 billion

of cash and short-term investments.

- Our net unrealized loss position

was $476.8 million, prior to tax and DAC offsets, an improvement of

$2.5 billion or approximately 83%, compared to December 31,

2008.

- During the third quarter of

2009, we recorded a $31.0 million pre-tax loss on credit related

other-than-temporary impairments.

- Problem loans and foreclosed

properties represented 0.7% of our commercial mortgage loan

portfolio as of September 30, 2009.

Net Realized Investment/Derivative Activity ($ per average

diluted share)

3Q 2009 3Q 2008

Impairments/Credit related losses $ (0.23 ) $ (1.84 ) Modco net

activity 0.05 (0.36 ) Net realized gains (excl. Modco) 0.03 (0.12 )

Interest rate related derivatives (0.06 ) (0.01 ) Credit default

swaps - (0.02 ) All other (0.02 ) 0.06

Total $ (0.23 ) $ (2.29

)

Operating income differs from the GAAP

measure, net income, in that it excludes realized investment gains

(losses) and related amortization. The tables below reconcile

operating income to net income:

Consolidated Results 3Q 2009 3Q

2008 ($ in thousands; net of income tax)

After-tax Operating Income $ 47,922 $ 62,452

Realized investment gains (losses)

and related amortization

Investments 88,002 (227,759 ) Derivatives (108,339 )

65,299

Net Income (loss)

$ 27,585 $ (100,008 )

($ per average diluted share; net of income tax)

3Q 2009 3Q 2008 After-tax Operating

Income $ 0.55 $ 0.88

Realized investment gains (losses)

and related amortization

Investments 1.01 (3.20 ) Derivatives (1.24 ) 0.91

Net Income (loss)

$ 0.32 $ (1.41 )

For information relating to non-GAAP measures (operating income,

share owners’ equity per share excluding other comprehensive income

(loss), operating return on average equity, and net income (loss)

return on average equity) in this press release, please refer to

the disclosure at the end of this press release. All per share

results used throughout this press release are presented on a

diluted basis, unless otherwise noted.

Rolling Twelve Months Ended September 30,

2009 2008 Operating Income Return on

Average Equity 9.8 % 9.9 % Net Income Return on Average

Equity 4.9 % 1.4 %

Operating income return on average equity and net

income return on average equity are measures used by management

to evaluate the Company’s performance. Operating income return on

average equity for the twelve months ended September 30, 2009 was

calculated by dividing operating income for this period by the

average ending balance of share owners’ equity (excluding

accumulated other comprehensive income (loss)) for the five most

recent quarters. Net income(loss) return on average equity for the

twelve months ended September 30, 2009, was calculated by dividing

net income (loss) for this period by the average ending balance of

share owners’ equity (excluding accumulated other comprehensive

income (loss)) for the five most recent quarters.

Reconciliation of Share Owners' Equity, Excluding Accumulated

Other Comprehensive Income (Loss) ($ in thousands)

As of

As of

September 30,

December 31,

2009 2008 Total share owners' equity $ 2,302,799 $

761,095 Less: Accumuluated other comprehensive income (loss)

(375,472 ) (1,667,056 )

Total share owners' equity

excluding accumulated other comprehensive income (loss)

$ 2,678,271 $ 2,428,151

Reconciliation of Share Owners' Equity per

Share, Excluding Accumulated Other Comprehensive Income

(Loss) per Share

($ per common share

outstanding)

As of

As of

September 30,

December 31,

2009 2008 Total share owners' equity $ 26.91 $ 10.89

Less: Accumulated other

comprehensive income (loss)

(4.39 ) (23.85 )

Total share owners' equity

excluding accumulated other comprehensive income (loss)

$ 31.30 $ 34.74

2009 Guidance

Due to current market conditions and the potential impact of

fair value accounting on reported results, Protective will not

provide 2009 earnings guidance, but will discuss the outlook for

the remainder of the year during its third quarter 2009 earnings

call as scheduled below.

Conference Call

There will be a conference call for management to discuss the

quarterly results with analysts and professional investors on

November 5, 2009 at 10:00 a.m. Eastern. Analysts and professional

investors may access this call by dialing 1-866-271-5140

(international callers 1-617-213-8893) and entering the conference

passcode: 86201587. A recording of the call will be available from

12:00 p.m. Eastern November 5, 2009 until midnight November 19,

2009. The recording may be accessed by calling 1-888-286-8010

(international callers 1-617-801-6888) and entering the passcode:

34039379.

The public may access a live webcast of the call, along with a

call presentation, on the Company’s website at

www.protective.com.

A recording of the webcast will also be available from

12:00 p.m. Eastern November 5, 2009 until midnight November

19, 2009.

Supplemental financial information is also available on the

Company’s website at www.protective.com in the Analyst/Investor

section under Financial Information/Quarterly & Other

Reports.

Information Relating to Non-GAAP Measures

Throughout this press release, GAAP refers to accounting

principles generally accepted in the United States of America.

Consolidated and segment operating income (loss) are defined as

income (loss) before income tax excluding net realized investment

gains (losses) net of the related amortization of deferred policy

acquisition costs (“DAC”),and value of businesses acquired

(“VOBA”), and participating income from real estate ventures.

Periodic settlements of derivatives associated with corporate debt

and certain investments and annuity products are included in

realized gains (losses) but are considered part of consolidated and

segment operating income because the derivatives are used to

mitigate risk in items affecting consolidated and segment operating

income (loss). Management believes that consolidated and segment

operating income (loss) provides relevant and useful information to

investors, as it represents the basis on which the performance of

the Company’s business is internally assessed. Although the items

excluded from consolidated and segment operating income (loss) may

be significant components in understanding and assessing the

Company’s overall financial performance, management believes that

consolidated and segment operating income (loss) enhances an

investor’s understanding of the Company’s results of operations by

highlighting the income (loss) attributable to the normal,

recurring operations of the Company’s business. As prescribed by

GAAP, certain investments are recorded at their market values with

the resulting unrealized gains (losses) affected by a related

adjustment to DAC and VOBA, net of income tax, reported as a

component of share owners’ equity. The market values of fixed

maturities increase or decrease as interest rates change. The

Company believes that an insurance company’s share owners’ equity

per share may be difficult to analyze without disclosing the

effects of recording accumulated other comprehensive income (loss),

including unrealized gains (losses) on investments.

Calculation of Operating Income

Return on Average Equity

Rolling Twelve Months Ended

September 30, 2009

$ in thousands

Twelve Three Months Ended Months

Ended NUMERATOR: 12/31/2008 3/31/2009

6/30/2009 9/30/2009 9/30/2009 Net

Income (Loss) $ (15,913 ) $ 22,135 $ 90,757 $ 27,585 $ 124,564

Net of:

Realized investment gains

(losses), net of income tax

Investments (60,407 ) (85,585 ) 82,439 87,495 23,942 Derivatives

(10,574 ) 47,675 (72,400 ) (108,339 ) (143,638 )

Related amortization of DAC and

VOBA, net of income tax

(632 ) (51 ) 612 507 436 Add back:

Derivative gains related to Corp.

debt and investments, net of income tax

1,020 1,455 756 -

3,231

Operating Income $ 56,720

$ 61,551 $ 80,862 $ 47,922

$

247,055 Share-Owners'

Accumulated Equity Excluding Other

Accumulated Other Share-Owners' Comprehensive

Comprehensive DENOMINATOR: Equity Income

(Loss) Income (Loss) September 30, 2008 $

1,524,655 $ (928,205 ) $ 2,452,860 December 31, 2008 761,095

(1,667,056 ) 2,428,151 March 31, 2009 783,178 (1,660,204 )

2,443,382 June 30, 2009 1,628,375 (1,031,719 ) 2,660,094 September

30, 2009 2,302,799 (375,472 ) 2,678,271 Total

$ 12,662,758 Average

$ 2,532,552

Operating Income Return on Average Equity 9.8

%

Calculation of Net Income

(Loss) Return on Average Equity

Rolling Twelve Months Ended

September 30, 2009

$ in thousands

Twelve Three Months Ended Months

Ended NUMERATOR: 12/31/2008 3/31/2009

6/30/2009 9/30/2009 9/30/2009 Net

Income (Loss) $ (15,913 ) $ 22,135 $ 90,757 $ 27,585

$ 124,564 Share-Owners'

Accumulated Equity Excluding Other

Accumulated Other Share-Owners' Comprehensive

Comprehensive DENOMINATOR: Equity Income

(Loss) Income (Loss) September 30, 2008 $

1,524,655 $ (928,205 ) $ 2,452,860 December 31, 2008 761,095

(1,667,056 ) 2,428,151 March 31, 2009 783,178 (1,660,204 )

2,443,382 June 30, 2009 1,628,375 (1,031,719 ) 2,660,094 September

30, 2009 2,298,695 (375,472 ) 2,678,271 Total

$ 12,662,758 Average

$ 2,532,552

Net Income (Loss) Return on Average Equity 4.9

%

Forward-Looking Statements

This release includes “forward-looking statements” which express

expectations of future events and/or results. All statements based

on future expectations rather than on historical facts are

forward-looking statements that involve a number of risks and

uncertainties, and the Company cannot give assurance that such

statements will prove to be correct. The factors which could affect

the Company’s future results include, but are not limited to,

general economic conditions and the following known risks and

uncertainties: the Company is exposed to the risks of natural

disasters, pandemics, malicious and terrorist acts that could

adversely affect the Company’s operations; the Company operates in

a mature, highly competitive industry, which could limit its

ability to gain or maintain its position in the industry and

negatively affect profitability; a ratings downgrade or other

negative action by a ratings organization could adversely affect

the Company; the Company’s policy claims fluctuate from period to

period resulting in earnings volatility; the Company’s results may

be negatively affected should actual experience differ from

management’s assumptions and estimates which by their nature are

imprecise and subject to changes and revision over time; the use of

reinsurance, and any change in the magnitude of reinsurance,

introduces variability in the Company’s statements of income; the

Company could be forced to sell investments at a loss to cover

policyholder withdrawals; interest rate fluctuations could

negatively affect the Company’s spread income or otherwise impact

its business, including, but not limited to, the volume of sales,

the profitability of products, investment performance, and asset

liability management; equity market volatility could negatively

impact the Company’s business, particularly with respect to the

Company’s variable products, including an increase in the rate of

amortization of DAC and estimated cost of providing minimum death

benefit and minimum withdrawal benefit guarantees relating to the

variable products; insurance companies are highly regulated and

subject to numerous legal restrictions and regulations, including,

but not limited to, restrictions relating to premium rates, reserve

requirements, marketing practices, advertising, privacy, policy

forms, reinsurance reserve requirements, acquisitions, and capital

adequacy, and the Company cannot predict whether or when regulatory

actions may be taken that could adversely affect the Company or its

operations; changes to tax law or interpretations of existing tax

law could adversely affect the Company, including, but not limited

to, the demand for and profitability of its insurance products and

the Company’s ability to compete with non-insurance products; the

Company may be required to establish a valuation allowance against

its deferred tax assets, which could materially adversely affect

the Company’s results of operations, financial condition and

capital position; financial services companies are frequently the

targets of litigation, including, but not limited to, class action

litigation, which could result in substantial judgments, and the

Company, like other financial services companies, in the ordinary

course of business is involved in litigation and arbitration;

publicly held companies in general and the financial services

industry in particular are sometimes the target of law enforcement

investigations and the focus of increased regulatory scrutiny; the

Company’s ability to maintain competitive unit costs is dependent

upon the level of new sales and persistency of existing business,

and a change in persistency may result in higher claims and/or

higher or more rapid amortization of deferred policy acquisition

costs and thus higher unit costs and lower reported earnings; the

Company’s investments, including, but not limited to, the Company’s

invested assets, derivative financial instruments and commercial

mortgage loan portfolio, are subject to market, credit, and

regulatory risks, and these risks could be heightened during

periods of extreme volatility or disruption in financial and credit

markets; the Company may not realize its anticipated financial

results from its acquisitions strategy, which is dependent on

factors such as the availability of suitable acquisitions, the

availability of capital to fund acquisitions and the realization of

assumptions relating to the acquisition; the Company is dependent

on the performance of others, including, but not limited to,

distributors, third-party administrators, fund managers, reinsurers

and other service providers, and, as with all financial services

companies, its ability to conduct business is dependent upon

consumer confidence in the industry and its products; the Company’s

reinsurers could fail to meet assumed obligations, increase rates,

or be subject to adverse developments that could affect the

Company, and the Company’s ability to compete is dependent on the

availability of reinsurance, which has become more costly and less

available in recent years, or other substitute capital market

solutions; the success of the Company’s captive reinsurance program

and related marketing efforts is dependent on a number of factors

outside the control of the Company, including, but not limited to,

continued access to capital markets, a favorable regulatory

environment, and the overall tax position of the Company; computer

viruses or network security breaches could affect the data

processing systems of the Company or its business partners, and

could damage the Company’s business and adversely affect its

financial condition and results of operations; the Company’s

ability to grow depends in large part upon the continued

availability of capital, which has been negatively impacted by

regulatory action and the volatility and disruption in the capital

and credit markets, and may be negatively impacted in the future by

an increase in guaranteed minimum death and withdrawal benefit

related policy liabilities in variable products resulting from

negative performance in the equity markets, and future marketing

plans are dependent on access to the capital markets through

securitization; new GAAP and statutory accounting rules or changes

to existing GAAP and statutory accounting rules could negatively

impact the Company; the Company’s risk management policies and

procedures may leave it exposed to unidentified or unanticipated

risk, which could negatively affect our business or result in

losses; capital and credit market volatility or disruption could

adversely impact the Company’s financial condition or results from

operations in several ways, including but not limited to the

following: causing market price and cash flow variability in the

Company’s fixed income portfolio, defaults on principal or interest

payments by issuers of the Company’s fixed income investments,

other than temporary impairments of the Company’s fixed income

investments; adversely impacting the Company’s ability to

efficiently access the capital markets to finance its reserve,

capital and liquidity needs; difficult conditions in the economy

generally, including severe or extended economic recession, could

adversely affect the Company’s business and results from

operations; there can be no assurance that the actions of the U.S.

Government or other governmental and regulatory bodies for the

purpose of stabilizing the financial markets will achieve their

intended effect; the Company may not be able to protect its

intellectual property and may be subject to infringement claims;

the Company could be adversely affected by an inability to access

its credit facility; the amount of statutory capital the Company

has and must hold to maintain its financial strength and credit

ratings and meet other requirements can vary significantly and is

sensitive to a number of factors; and the Company operates as a

holding company and depends on the ability of its subsidiaries to

transfer funds to it to meet its obligations and to pay dividends.

Please refer to Part I, Item 1A, Risk Factors and Cautionary

Factors that may Affect Future Results of the Company’s most recent

Form 10-K and Part II, Item 1A, Risk Factors, of the Company’s

subsequent quarterly reports on Form 10-Q for more

information about these factors.

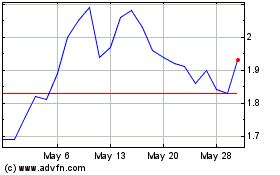

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

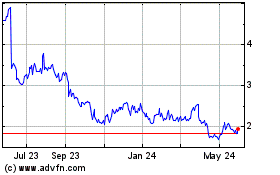

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024