A.M. Best Revises Outlook to Negative for Lyndon Property Insurance Company

April 13 2009 - 4:09PM

Business Wire

A.M. Best Co. has revised the outlook to negative from

stable and affirmed the financial strength rating (FSR) of A-

(Excellent) and issuer credit rating of �a-� of Lyndon Property

Insurance Company (Lyndon Property) (St. Louis, MO).

The ratings of Lyndon Property reflect its adequate

capitalization, favorable operating performance in its core

business of vehicle service contracts and the benefits derived from

being part of Protective Life Corporation (Protective)

(Birmingham, AL) [NYSE: PL].

The ratings recognize the $28 million capital contribution made

by its immediate parent, Protective Life Insurance Company

(PLIC) (Brentwood, TN) in 2006 (PLIC has a FSR of A+ (Superior)

with a negative outlook), and the risk management support provided

to Lyndon Property by Protective.

These positive rating factors are offset by Lyndon Property�s

challenges in its discontinued lines of business, now in run off.

The negative outlook reflects the weakened capitalization and

limitations on financial flexibility at PLIC.

For Best�s Ratings, an overview of the rating process and rating

methodologies, please visit www.ambest.com/ratings.

The principal methodologies used in determining these ratings,

including any additional methodologies and factors that may have

been considered, can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is a global full-service

credit rating organization dedicated to serving the financial and

health care service industries, including insurance companies,

banks, hospitals and health care system providers. For more

information, visit www.ambest.com.

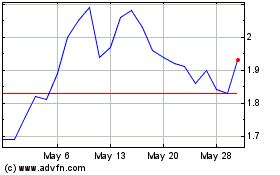

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

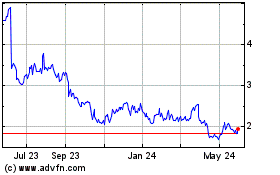

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024